LEGAL: We do not represent represent any of the companies on the list. This is a third-party review.

Comparison of Top 7 Whole Life Insurance Companies For Cash Value

First, this is a deep dive into whole life cash value, but we don't want you to waste your time.

You can skip ahead or read all the details in our review. Here are our ratings for the best whole life insurance companies for cash value in 2022:

- #1 MassMutual

- #2 Penn Mutual

- #3 New York Life

- #4 Guardian Life

- #5 Foresters

- #6 Northwestern Mutual

- #7 One America

Each of the companies from the previous list has an explanation as to why we picked them, so make sure you read all of the company reviews.

However, if all you would like to get is a quote, click: we will get you the best whole life.

In this article, we will not go over the costs and prices of whole life. But if you want to get an idea of cost and prices, check out: Whole Life Insurance Rates.

All of the companies we picked are Dividend Paying Participating Whole Life Insurance Policies. We will go over why we picked participating policies. But first, we need to make sure you understand some of the basics.

Also, in our article, we will go over:

- What Is Whole Life Cash Value?

- What Builds Cash Value?

- How Can I Access Cash Value?

- Always Chose A Participating Policy

- More Companies With Whole Life That Didn't Make It

Introduction

Let's first look at some of the basics to understand the building blocks of a good whole life insurance policy.

What Is Whole Life Cash Value?

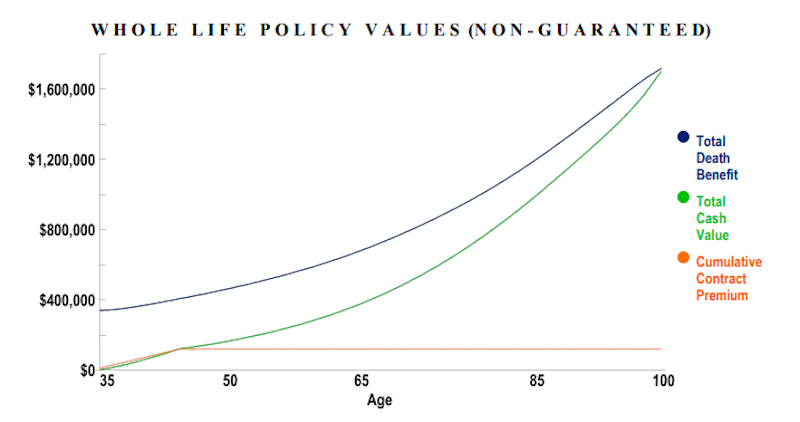

Whole Life Insurance is permanent insurance with strong guarantees. It has a guaranteed death benefit, guaranteed premiums, and guaranteed cash value growth.Cash Value builds inside of whole life insurance policies. Imagine this cash value portion like a savings account you can access anytime. We say it is a savings account because the cash value will only go up. It never fluctuates up and down.

Cash value is what makes every whole life insurance a desirable asset for many people.

Related: Whole Life Insurance For Dummies

What Builds Cash Value?

There are two aspects of most whole life insurance policies that build cash value:- The guaranteed rate of return

- Non-guaranteed rate of return (or dividends)

The non-guaranteed rate of return is added on top of the guaranteed rate. And it is also known as dividends. You get a dividend when the company does well. Companies pay these dividends to participate in policies.

Example:

Let's suppose the company has a guaranteed rate of 4%, and its dividend is 2.0%.This gives them a total dividend of 6.0%.

Also, this dividend helps the cash value inside of policy grow tax-deferred.

Get More Cash Value

Also, there are ways of getting more cash value out of every whole life insurance. This concept has been illustrated in-depth in books like Infinite Banking and Bank on Yourself.You can get extra cash value by getting more paid-up additions on your policy.

All of the companies from our top 7 list have this paid-up additions feature. Some companies call it "Paid-Up Additions" Rider or PUAR (see paid-up additions rider). Other companies call it ALIR (additional life insurance rider).

Adding more cash value to a policy is called "overfunding" a policy. You will need to determine if getting an overfunded whole life insurance is the right fit for you. We go over overfunding and give samples here: Overfunded Whole Life Insurance.

Without overfunding a policy, there are whole life products that are designed to grow cash value faster.

10 and 20 Pay Products

10 pay and 20 pay whole life policies are great for building cash value quickly. When we say "10 pay," we mean the amount of time you need to pay for the policy. So a 10 pay would be done in 10 years, and a 20 pay in 20 years.This works because a whole life insurance policy can be paid up.

This means that you do not have to make more premiums after a certain period, but you keep the life insurance and cash value forever.

Some of the best whole life insurance products out there for cash value accumulation are 10 pay or 20 pay. This means you pay for 10 years, and you are done.

These products are also known as Limited Pay Whole Life Insurance

How Can I Access Cash Value?

One of the important things that you need to understand is how you can access your cash value. The cash value in whole life insurance can be accessed in many ways:- Loans

- Distributions

- Take out dividends as cash

These loans do not have to be paid back. Because the whole life has a permanent death benefit, your loan will be subtracted from your death benefit if you die.

Taking money out in loans is the preferred method because when you take a loan out of a policy, you do not have to pay taxes on that loan.

Now that we understand some of the basics, let's see how we created our top 7 list.

How We Compare Cash Values & Pick The Winning Whole Life Insurance?

To find which company has the best high cash value whole life insurance, we must compare cash values properly.We have run hundreds of illustrations to find out which company was the best. That's how we build our top 7 list.

However, we cannot only compare the total cash value of a policy. There are many variables we need to consider to get the best whole life for cash value.

In our top 7 ratings, we compared all of the following variables:

- Company Strength

- Cash Value Performance

- Current Dividend Rate

- Income Performance

- Direct vs. Non-Direct Recognition

- Always Chose A Mutual

- Historical Dividend Rate

- Underwriting Standards

Income Performance

In reality, you always need to see how much income your policy can generate.Taking money out of the policy is one of the most important aspects to consider. The reason is that not all companies perform the same when you receive income out of the plan.

Using income as well, you truly see how a policy performs. So let's look at something that can affect your income.

Non-Direct vs. Direct Recognition

There are two types of whole life insurance contracts:- Direct Recognition

- Non-Direct Recognition

This determines how loans in a contract affect a whole life policy. And as we mentioned before, taking income out of whole life is one of the best ways to test the performance.

Without getting overly complicated, Non-Direct recognition will pay the same dividend even if you take money out of a policy as loans.

This is why Non-Direct recognition will illustrate more cash (income) coming out of a policy.

So you shouldn't compare whole life insurance cash values alone because even if a direct recognition company has more cash value, you will be able to take out less cash.

Here is a list of direct recognition and non-direct recognition companies.

| Direct Recognition | Non-Direct Recognition |

| Ameritas | Ohio National |

| Country Financial | New York Life |

| Massmutual* | MassMutual* |

| Minnesota Life | MetLife |

| Mutual Trust Life | Lafayette Life |

| Northwestern Mutual | Foresters |

| Penn Mutual | |

| Savings Bank Life of Massachusetts | |

| Security Mutual | |

| The Guardian | |

| Thrivent |

Non-Direct vs. Direct Example

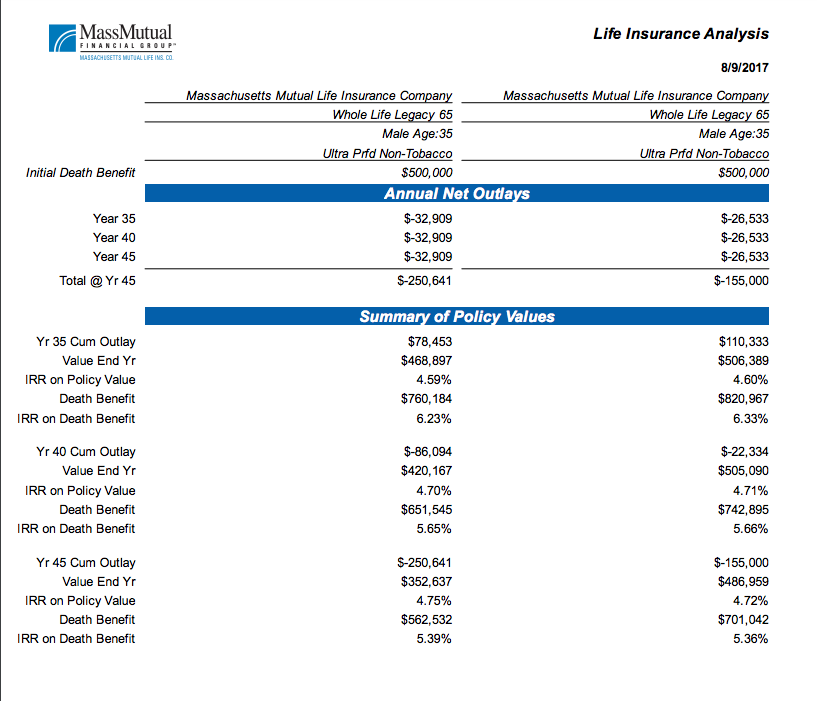

Let's use MassMutual, which (as far as we know) is the only company that can offer both direct and non-direct recognition contracts. This will help us understand how the whole life insurance cash value can change drastically when you pull money out of a policy.The following picture is a sample illustration. We used the following variables in the illustration:

- Male

- Age 35

- $500,000

- Ultra Preferred (Best Rating Possible)

- Paid Up At Age 65 (No More Premiums)

If you look at the previous image, you will see the numbers of a whole life after 45 years in the last rows.

If you look at the previous image, you will see the numbers of a whole life after 45 years in the last rows.You need to notice that there is more than a $95,000 difference between taking money out of a non-direct recognition vs. direct recognition.

Non-direct recognition is what generated more money in the long run, even though the whole life insurance cash values were the same before taking income out.

Always Chose A Mutual

In reality, the most valuable whole life insurance is sold by Mutual companies. Mutual companies will outperform the competition because the policyholders are part owners of the company.Stock companies pay dividends to stockholders, and then the rest will go into the policies.

But mutual companies pay dividends directly to policyholders. These policies that get dividends are called participating policies.

So we always advise to chose mutual companies vs. stock companies.

From our top 7 list, all companies are mutual companies.

I Would Like To Get A Quote Now

Best Whole Life For Cash Value

Get Me A QuoteWhole Life Insurance Dividend Rates

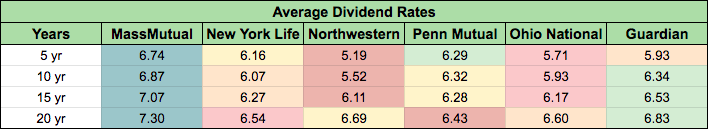

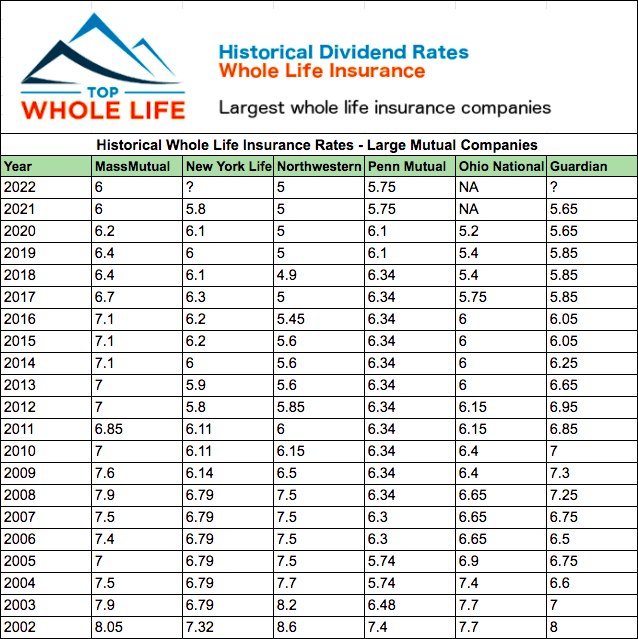

Whole life insurance dividends played a big part in our rating. Dividends vary each year tremendously from company to company. The reason this happens is that each company's dividend is based on their performance and the investments they made. This is the data we used to back up our ratings.Also, check out all the whole life historical dividend data.

Dividends for 2022

| Foresters | NA |

| MassMutual | 6.0 |

| Penn Mutual | 5.75 |

| New York Life | 5.80 |

| Guardian | 5.65 |

| Ohio National | 4.7 |

| Northwestern Mutual | 5.0 |

Historical Whole Life Dividend Averages

The following is a table that shows the average dividend payout over the past 5, 10, 15 and 20 years. It is important to take into consideration not only todays dividend rate, but how stable that dividend is.

In addition, here you have a table with whole life dividend rates over the past years. This will help you see how the dividends fluctuate over time.

Top 7 Whole Life Insurance Companies For Cash Value

We want to help you pick the best whole life insurance for cash value growth and accumulation. So we created this list to help you narrow down the field to a few of the best.The battle for the top spot was very hard to pick, but someone had to win. Please note that this list changes every year, and even more often, as we gather or new data is released from the companies.

Our ratings are not only based on all the variables we described, but also on what company our clients pick as the best choice more often.

So here are our in depth reviews for whole life insurance for cash value accumulation:

#1 MassMutual

MassMutual regains our #1 spot.

We made our choice based on:

- Cash Value Growth

- #1 Participating Dividend

- Very Strong Company

- Amazing Ratings

MassMutual is a progressive insurance company and has embraced the changing landscape as the internet and a pandemic has become factors in how to do business. The company continues to grow very rapidly, which can only help their performance. They are committed to a small product base, and in particular, to their best selling whole life insurance.

Even more important than the company's progressive culture is that MassMutual has the highest participating dividend in the industry and the highest average whole life dividend over the past 15 and 25 years.

Their whole life participating products benefit from having a non-direct recognition and direct recognition. When purchasing a whole life policy, you can decide what option you prefer. As far as we can tell, they are the only company that has both options available.

For more information, you can read our MassMutual Whole Life Review.

Rating

- A.M. Best Company: A++ (Superior)

- Fitch Ratings: AA+ (Very Strong)

- Moody's Investors Service: Aa3 (High Quality)

- Standard & Poor's: AA+ (Very Strong)

- Comdex 98

Dividend History

The dividend history since 2000 is very impressive. It ranks as one of the strongest dividends of the past 20 years, and it's currently the highest dividend in 2022.| 2000 | 8.20 |

| 2001 | 8.20 |

| 2002 | 8.05 |

| 2003 | 7.90 |

| 2004 | 7.50 |

| 2005 | 7.00 |

| 2006 | 7.40 |

| 2007 | 7.50 |

| 2008 | 7.90 |

| 2009 | 7.60 |

| 2010 | 7.00 |

| 2011 | 6.85 |

| 2012 | 7.00 |

| 2013 | 7.10 |

| 2014 | 7.10 |

| 2015 | 7.10 |

| 2016 | 7.10 |

| 2017 | 6.70 |

| 2018 | 6.40 |

| 2019 | 6.40 |

| 2020 | 6.20 |

| 2021 | 6.00 |

| 2022 | 6.00 |

Best Products For Cash Value

Legacy 10

This whole life product you only have to pay for 10 years. After 10 years, the policy is paid up. This means you keep the policy, and you do not have to pay premiums anymore.Also, you keep the whole life insurance cash value, death benefit, and they both keep growing.

This product has the least amount of death benefit, and it is very cash-rich. One of the main main reasons it grows so quickly is due to Paid-Up Additions.

- Loan rate of 3.25%

- High Cash Value Early

Legacy 15

MassMutual's newest addition is the 15 pay whole life product. This policy is similar to the 10 and 20 pay options. What separates this product is that the loan rate on the policy is lower than all the others. For example, the Legacy 15 has a 4% loan rate vs. 5% with all other products.- Loan rate of 4%

- High Cash Value Early

Legacy 20

Just like Legacy 10, it is a cash-rich product. However, premiums last for 20 years. This can be a great product if you want to get whole life insurance for kids. Also, it is a great product for people in their 30's considering whole life.HECV (High Early Cash Value)

This is a product that is designed to have significant cash value early in the whole life insurance policy. This may play a vital role if you are using your whole life for business planning.Also, it reduces the agent commission significantly, so most agents will not want to show you this policy.

Read more on High Early Cash Value.

Our #1 Pick

If you are looking for a company with a long history of success and great dividend payouts, we suggest MassMutual.With the benefits of non-direct recognition whole life, excellent track history, and a dividend-paying 6.0%.

Search no further for the best whole life policy for cash value. You can't go wrong with a MassMutual whole life policy.

Get The #1 Best Whole Life For Cash!

Free Quote#2 Penn Mutual

Penn Mutual could have been our number 1 pick very easily. But we had to have a winner. Penn Mutual has one of the highest dividends in the industry and one of the most stable dividends over the last 10 years. However, they did have a little bit of a decrease in their dividend.

One of the main reasons we couldn't give them #1 was because their whole life is a direct recognition. This means that when you pull money out of the whole life, you could withdraw less than it if it was a non-direct recognition company.

Check out our Penn Mutual Whole Life Review.

Ratings

Penn Mutual has fantastic ratings:- A.M. Best: A+ (Superior)

- Moody's Investors Service: Aa3 (Excellent)

- Standard & Poor's: A+ (Strong)

- KBRA: AA (Very High Quality)

- Comdex: 93

Financials

Also, Penn Mutual has solid financials that can rival any company.- Over $44 billion in assets

- Total Revenue of $4.5 billion for 2021.

- Paid a total of $2.1 billion to policy holders in 2021.

Source: Penn Mutual

Dividend

Penn Mutual has a very stable dividend. It currently ranks among the best dividends in 2022 with a rate of 5.75%.| Year | Dividend Rate |

| 2000 | 7.4 |

| 2001 | 7.4 |

| 2002 | 7.4 |

| 2003 | 6.48 |

| 2004 | 5.74 |

| 2005 | 5.74 |

| 2006 | 6.3 |

| 2007 | 6.3 |

| 2008 | 6.34 |

| 2009 | 6.34 |

| 2010 | 6.34 |

| 2011 | 6.34 |

| 2012 | 6.34 |

| 2013 | 6.34 |

| 2014 | 6.34 |

| 2015 | 6.34 |

| 2016 | 6.34 |

| 2017 | 6.34 |

| 2018 | 6.34 |

| 2019 | 6.1 |

| 2020 | 6.1 |

| 2021 | 5.75 |

| 2022 | 5.75 |

Best Product for Cash Value

Guaranteed Choice Whole Life:

This product offers many flexible options, from limited pay 10 and 20-year products to longer pay products that are paid up at age 65 or 100. To maximize the Penn Mutual whole life's insurance cash value performance, you will want to request overfunding the policy.Key Benefit: Penn Mutual has a critical care rider included on all whole life policies above a table D rating. If you qualify, you can receive a tax-free income benefit in the form of an accelerated death benefit payout. This can be useful to help with future nursing home-type expenses.

Get The #2 Best Whole Life For Cash!

Free Quote#3 New York Life

New York Life is a fantastic company with great whole life products, and a long history of amazing performance. We have moved NYL up to number 3 on the list for cash value whole life insurance.

The dividend for 2021 is 5.80%, which is very strong.

However, New York Life is a captive company, so only their agents can sell this product on premiums under $25,000. This could be an issue as it may limit your ability to compare whole life insurance cash value quotes.

That being said, their whole life's performance is fantastic, and they are in a position to be one of the industry leaders for some time.

For more information, you can read our New York Life Whole Life Review.

Financials

It's hard to find a company in any industry with better financials than NYL.- For 2020, New York Life declared $1.9 billion in dividends to policyholders. This is the largest payout in company history.

- New York Life has increased its dividend payout for the last five years.

- New York Life now has 1 Trillion of individual life insurance in force.

Ratings

- A.M. Best Rating: A++

- Standard & Poor's Rating: AA+

- Moody's Rating: Aaa

- Fitch Ratings: AAA

Dividend History

Next is a history of New York Life's dividend.| Year | Dividend Rate |

| 2001 | 7.9 |

| 2002 | 7.32 |

| 2003 | 6.79 |

| 2004 | 6.79 |

| 2005 | 6.79 |

| 2006 | 6.79 |

| 2007 | 6.79 |

| 2008 | 6.79 |

| 2009 | 6.14 |

| 2010 | 6.11 |

| 2011 | 6.11 |

| 2012 | 5.8 |

| 2013 | 5.9 |

| 2014 | 6 |

| 2015 | 6.2 |

| 2016 | 6.2 |

| 2017 | 6.3 |

| 2018 | 6.1 |

| 2019 | 6 |

| 2020 | 6.1 |

| 2021 | 5.80 |

Get The Best Whole Life For Cash!

Free Quote#4 Guardian Life

Guardian Life Insurance Company of America has a lot going for it, including a long history, strong dividend payments, and various life insurance products. The current dividend and cash value performance are lower than some of the top whole life's in the industry, so this makes their whole life underperform. For more information, you can read our Guardian Whole Life Review.

Financials

- Ended the year with $8 billion in capital

- $71.5 billion in assets under management

- Operating income before tax and dividends was $1.6 billion

Ratings

- A.M. Best Rating: A++ (Superior)

- Standard & Poor's Rating: AA+ (Very Strong)

- Moody's Rating: Aa2 (Excellent)

- Fitch Ratings: AA+(Very Strong)

- Comdex: 98 out of 100

Dividend History

Guardian has a long history of a strong dividend. Also, in recent years its dividend has been more stable than most of their competition.| 2001 | 8.5 |

| 2002 | 8 |

| 2003 | 7 |

| 2004 | 6.6 |

| 2005 | 6.7 |

| 2006 | 6.5 |

| 2007 | 6.75 |

| 2008 | 7.25 |

| 2009 | 7.3 |

| 2010 | 7 |

| 2011 | 6.85 |

| 2012 | 6.95 |

| 2013 | 6.65 |

| 2014 | 6.25 |

| 2015 | 6.05 |

| 2016 | 6.05 |

| 2017 | 5.85 |

| 2018 | 5.85 |

| 2019 | 5.85 |

| 2020 | 5.65 |

| 2021 | 5.65 |

| 2022 | 5.65 |

#5 Foresters

Foresters rank falls to #6 whole life insurance. The company has one of the highest participating dividends in the industry; however, it is not a well-known option. Forester's is expanding rapidly in the U.S. and becoming a significant player in the life insurance industry. They are a fraternal organization, and this has many benefits to policyholders.

Here is a snippet from Investopedia's definition of a fraternal:

In order to do so, the organization must have a fraternal purpose, meaning the intent of membership is based on a common bond and have a substantial program of activities. The group must operate under the lodge system, which requires a minimum of two active entities, which include the parent organization and a subordinate branch. The branch must both be self-governing and chartered by the parent organization. The fraternal organization must also provide the payment of benefits to members and their dependents in the event of injury, accident, or other calamity.For more information, you can read our Foresters Whole Life Review.

Rating

- A.M. Best Company: A

Dividend History

Forester's dividend wasn't the most competitive a few years back; however, now their dividend has been maintained while other companies keep dropping their dividend significantly. This is a key indicator that the company is a strong pick when considering a whole life policy.Here is Forester's dividend history since 2009:

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| 5.60 | 5.60 | 5.98 | 6.09 | 6.45 | 6.42 | 6.65 | 6.83 | 6.58 | 6.23 | 6.23 |

This ranks Forester's dividend rate as the highest in the industry, which cannot be ignored.

Best Products For Cash Value

Advantage Plus

This whole life product is a participating whole life insurance product. It offers lifetime death benefit protection (to age 121), guaranteed cash values, and lifetime guaranteed premium.However, to get the best out of this product, you need to know how to "overfund it."

This is a concept that is discussed in depth in books like "Bank On Yourself."

This product shines when correctly designed and overfunded with Paid-Up Additions Rider.

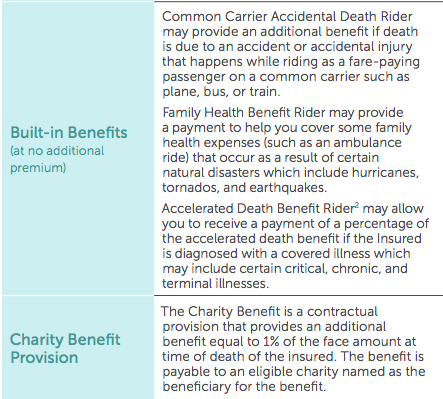

Also, there are some other great riders and benefits that the Advantage Plus has:

- Accelerated death benefit riders ("ABR")

- Children's Term Rider: Provide term life insurance coverage for your children, which can be converted to permanent coverage without evidence of insurability.

- Waiver of Premium Rider: Waives your premium if you are totally disabled and unable to work for at least 6 months.

- Accidental Death Rider: Add additional coverage in case of death due to accidental bodily injury.

Advantage Plus (20 pay)

It is the same product as Advantage Plus, but you only pay for 20 years. It has great cash value accumulation, and it is a simple policy to choose from. You can't go wrong with this one.BrightFuture Children's Whole Life€‹

This is a whole life insurance contract designed specifically for those currently under the age of 18. Below are some of the many benefits of the BrighrFuture Product:- You can guarantee future insurability by locking in coverage at an early age.

- The product has a built-in Guaranteed Insurability Rider. This permits to increase the death benefit amount at certain ages without any underwriting.

- The premiums, death benefit amount, and cash values are guaranteed for life.

- The owner can decide to transfer ownership of the policy when the minor is ready.

BrightFuture isn't just buying life insurance. The child will have access to member benefits when they turn 16.

BrighFuture also has additional built-in coverage that is automatically included with no additional premium:

- Accelerated Death Benefit Rider: Provides an option to accelerate a portion of the death benefit if needed.

- Common Carrier Accidental Death Rider: Automatically included to provide an additional death benefit if you die of accidental injuries that occur while riding as a fare-paying passenger on a common carrier, such as a bus or a train.

- Family Health Benefit Rider: Automatically included to pay a benefit you can use to help pay some certain family health expenses that may occur as a result of some natural disasters, such as earthquakes, hurricanes, and tornadoes.

Amazing Benefits

Some of the features that come with a standard whole life insurance policy are not that impressive. However, Foresters is very different in this respect. You get many free benefits just by owning a policy like:These member benefits include legal advice, scholarships, disaster relief, and much more.

This is straight from their brochure:

Non-Medical Whole Life

Forester's gives you the option to get whole life insurance without having to do a medical exam. This can be a great choice for many clients. For one, you can avoid the hassle of doing a blood test and a urine test. Also, you can speed up the process of getting whole life insurance.If your health is standard and you need less than $400,000 of coverage, then you a non-medical can be a great option for you.

Our #2 Pick

Forester has a non-direct recognition whole life with an industry-leading dividend-paying of 6.23%.In addition, this whole life insurance product is designed for cash value accumulation and growth. However, it needs to be properly designed by an expert agent that knows how to overfund policies.

#6 Northwestern Mutual

We have moved Northwestern off of the honorable mention list and into the running for the best whole life insurance for cash value. If you do any research on whole life insurance you will hear about Northwester Mutual. As they are #91 on Forbes 500 Company list.

Northwestern Mutual is one of the original mutual companies and used to be the leader for many years in whole life insurance.

Ratings

- A.M. Best Company: A++ (Superior)

- Fitch Ratings: AAA

- Moody's Investors Service: Aaa

- Standard & Poor's: AA+ (Very Strong)

- Comdex 100

Over the past several years, we have seen a downturn in their dividend rate, making them less competitive. Although many insurance company's dividends are lower than they were back in 2001, here is some perspective:

Northwester's dividend back in 2001 was 8.80%. This was back when they were the leader of dividend performance. Their rival and current dividend leader, MassMutual, was sitting at 8.20%.

Today Northwestern's current dividend is 5.0%. However, many insurance companies had a large decrease in dividends.

One of the drawbacks is that Northwestern Mutual agents cannot sell to other insurance carriers. So if you are speaking to an NML agent, you will not be provided with your best options. Additionally, their whole life policy has direct recognition.

It is still one of the giants in the industry with excellent ratings.

Here is our full Northwestern Mutual Whole Life Review.

#7 OneAmerica

American United Life Insurance Company, which is part of the OneAmerica organization, offers consumers a variety of whole life insurance policies. The company is in its 140th year of business. OneAmerica is all about getting better with age. Overall, OneAmerica has good whole life insurance. However, the company is often overlooked as its brand is not as well known as many competitors.

Financials

- Founded in 1877 and is currently headquartered in Indianapolis, Indiana.

- OneAmerica had revenue of approximately $1.5 billion in 2014.

- OneAmerica has total assets of $45.6 billion as of 2014.

- The company has approximately 1,900 employees.

Ratings

- A.M. Best: A+ (Superior)

- Standard & Poor's: AA- (Stable outlook)

Whole Life Companies That Didn't Make The List

It is important for us to list other companies that whole life as well. Because we get questions about comparing companies very often.So we give you a quick analysis and comparison of other whole life insurance companies for cash value that didn't make our top 7 list.

Ohio National

2022 Update Ohio National has decided to demutualize, so we can no longer recommend them as a top 7 pick. Source

Ohio National had one of the best performing whole life policies in the market. For more than 100 years, the company has been one of the highest-rated in the industry. In addition, Ohio National has paid dividends consistently each year since 1924.

However, in 2021 they decided to DeMutualize. This means that they value the company's stockholders more than the policyholders. It's sad to see companies going that route for profit. Due to this, they have been excluded from our list.

For more information, you can read our Ohio National Whole Life Review.

Financials

- Total GAAP revenue (excluding realized gains and losses) increased 6.2 percent to $2.0 billion.

- Core earnings were $176.7 million. The planned decrease from 2015 represented strategic investments in business and corporate technology assets.

- For the 93rd consecutive year, Ohio National paid dividends to participate in whole life policies. A total of $80.6 million was paid or credited to participating policyholders.

Ratings:

- Standard & Poor's: A+

- A.M. Best: A

- Moody's: A3

- Fitch: A-

Dividend History

| 2000 | 8.30% |

| 2001 | 8.30% |

| 2002 | 7.70% |

| 2003 | 7.70% |

| 2004 | 7.40% |

| 2005 | 6.90% |

| 2006 | 6.65% |

| 2007 | 6.65% |

| 2008 | 6.65% |

| 2009 | 6.40% |

| 2010 | 6.40% |

| 2011 | 6.15% |

| 2012 | 6.15% |

| 2013 | 6.00% |

| 2014 | 6.00% |

| 2015 | 6.00% |

| 2016 | 6.00% |

| 2017 | 5.75% |

| 2018 | 5.40% |

| 2019 | 5.40% |

| 2020 | 5.40% |

| 2021 | 4.7 |

Best Products For Cash Value

- Prestige 10 Pay is a 10-year whole life, meaning after paying a level premium for 10 years, no additional premiums are required. It's cash-rich and insurance-poor. Fantastic for cash value accumulation.

- Prestige 100 is a foundational whole life insurance policy. Premiums are paid to age 100; however, they can be customized to accumulate significant cash value.

- Prestige Max II is a "paid-up" at age 65 or 10 years after purchase. This whole life insurance policy maximizes its cash value and dividends to generate high cash value. However, it requires a larger premium.

MetLife

MetLife's Promise whole life was one of the best whole life's in the market. However, you cannot purchase this product anymore, as they rebranded it to Brighthouse Financial.If you already have term insurance, then you can still convert term insurance into a whole life. For more information, you can read our MetLife Whole Life Review.

Dividend History

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| 7.6 | 7.6 | 7.35 | 7.1 | 6.6 | 6.6 | 6.25 | 6.25 | 6.25 |

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| 6.25 | 5.75 | 5.5 | 5.5 | 5.25 | 5.1 | 5.1 | 5 | 5 | 5 |

Liberty Mutual

Liberty mutual's whole life is not a competitive product in the market.Read our full review: Liberty Mutual Whole Life Review

Another great company with a weak whole life insurance product.

Here is our full StateFarm review.

Final Word

Finally, you can see we put a lot of thought into our ratings, and we will be happy to change these as dividends, performance, or company strength changes.However, we want to stress that to get the best whole life insurance company for you, you should speak to an expert that will customize it for your own needs. You may value more company strength than the current dividend rate or cash value growth more than death benefit growth.

So always remember to customize your whole life insurance for your needs.

Good Reads:

- How Much Does Whole Life Insurance Cost?

- Whole Life Insurance For Dummies

- Whole Life Insurance $1,000,000 Cost

In addition, if you are considering an Index Universal Life instead of a whole life you should read the following: