Updated July 13th, 2022

Get Me A Quote

Since being founded in 1860, the Guardian Life Insurance Company of America has provided millions upon millions of people with the life insurance coverage they need. In 2015, the company generated its highest-earning year ever, with $7.3 billion in capital.

While the company focuses primarily on its life insurance products, it doesn't stop there. Other products include disability income insurance, investments, annuities, vision, dental, and retirement plans.

In this review, we will cover the following topics: So let's get started.

Here is a shortlist of some of its ratings:

When you buy a Guardian whole life insurance, you become a policyholder. Your whole life insurance policy is guaranteed to provide you protection for your loved ones. Also, you are eligible to receive a dividend from the company's profits at the end of each year. The amount of the dividend that you would potentially receive is determined by how the company performed in three key areas.

The key areas of performance are

Check out more information about dividends rates from Guardian and others here.

You can also see the review of Guardians Whole Life 2022 below.

Check out: Comparison of the Best Whole Life Insurance For Cash Value.

The Guardian Life Insurance Company of America is growing by leaps and bounds, which has helped its dividend rate hold relatively steady over the years.

Here is the history of the dividend since 2012:

Although Guardian is still paying out dividends to policyholders, which is a great thing. The dividend has been decreasing slowly since 2002. This decreasing dividend interest rate is important because whole life performance is linked strongly to dividend performance. It is not a good sign to see the dividend dropping constantly.

However, if history is any indication, things will turn around in the years to come.

Guardian announced that they approved their 2022 dividend payout. The dividend payout for 2022 is $1.13B in dividends to eligible whole life policyholders. Also, Guardian's dividend interest rate for 2022 will be 5.65%

Check our Whole Life Dividend History to compare the dividend to other companies.

The agent count isn't a huge downside, but we still wanted to compare it to the competition.

Even though there are roughly 3,000 financial representatives in 70 offices nationwide, you may not be able to find somebody close to your home.

Fortunately, you don't have to meet with an agent in person to make a purchase. However, if you are the type who wants this security, you will need to see if there is an office in your local area.

Also, Guardian Life is among the largest companies in the United States. The company ranked #247 on Fortune magazine's annual Fortune 500 list. Guardian has made the list 27 times.

These are the primary reasons to consider whole life insurance. Looking more in-depth, the two main whole life products are:

Index Participation Features: This allows you to allocate the cash value of the policy's paid-up additions to the performance of the S&P 500. It does have a cap and a floor, but this rider can turn a whole life into an IUL.

Discover DuoGuard: This is an exciting rider that guarantees a beneficiary the right to purchase a new life insurance policy when the original insured dies.

Disability Waiver of Premiums Benefit: If you become totally disabled for six months, you will not have to pay premiums on the policy but keep the policy in force.

Simplified Insurability Option: It allows you to get more coverage with simplified underwriting.

Enhanced Accelerated Benefits Rider: This allows you to accelerate benefits if you are terminally ill or have certain chronic illnesses.

Guaranteed Insurability Rider: You will have the ability to buy whole life insurance without having to do another medical. This rider can be great if you get whole life insurance on kids.

Not all these riders are essential, but we still wanted you to be aware of your options.

The dividend payout for 2022 is $1.13B in dividends to eligible whole life policyholders. The Guardian dividend interest rate for 2022 will be 5.65%

While the dividend has decreased, it is very similar to what other companies have experienced. If you want to see a full comparison of dividends, check out our analysis: Whole Life Dividends.

The current dividend and cash value performance are lower than some of the top whole lives in the industry, making their whole life underperform. However, it is still a fantastic option for anyone looking for a strong company.

Check out other great reviews: Prudential Whole Life Review, Gerber Whole Life Review, Foresters Whole Life Review, AIG Whole Life Review.

Compared to the competition, Guardian Life Insurance Company of America used to be among the top five whole life insurance companies.

For a more detailed breakdown of the competition, you can see it in our Top 7 Whole Life For Cash.

Guardian Whole Life Insurance Review

In this article, you will find our Guardian Whole Life Insurance Review, but if all you are looking for a is a Guardian whole life quote click bellow:Get Me A Quote

Guardian Overview

Based in New York City, the Guardian Life Insurance Company of America is known for being one of the world's largest mutual life insurance companies. Not only does the company have more than 8,000 employees, but it also has approximately 3,000 financial representatives at more than 70 agencies throughout the United States.

Since being founded in 1860, the Guardian Life Insurance Company of America has provided millions upon millions of people with the life insurance coverage they need. In 2015, the company generated its highest-earning year ever, with $7.3 billion in capital.

While the company focuses primarily on its life insurance products, it doesn't stop there. Other products include disability income insurance, investments, annuities, vision, dental, and retirement plans.

In this review, we will cover the following topics: So let's get started.

The Good

When you decide to shop for life insurance through Guardian Life Insurance Company of America, you will soon realize that there are many products to consider. When it comes to whole life insurance, this company is historically among the best.Many Options

In addition to many options, Guardian Life Insurance Company of America explains why its whole life policies are the cream of the crop:- Permanent guaranteed life insurance.

- Cash value accumulation.

- Dividend payments.

- Tax benefits.

- Tax-sensible asset for loans.

Top Rated

Some life insurance companies are rated higher than others. However, with Guardian Life Insurance Company of America, you are doing business with a company with a long-standing reputation for top-of-the-line service.Here is a shortlist of some of its ratings:

- A.M. Best Rating: A++ (Superior)

- Standard & Poor's Rating: AA+ (Very Strong)

- Moody's Rating: Aa2 (Excellent)

- Fitch: AA+ (Very Strong)

- Comdex: 98 (out of 100)

2021 Rating Highlights

- DALBAR ranked Guardian #2 on its list of companies with the most efficient and user-friendly plan administration portals as part of its 2022 group benefits employer website study.

- Fortune magazine ranked Guardian Life #247 on its annual Fortune 500 list. Guardian has made the list 27 times.

Mutuality

As noted above, Guardian Life Insurance Company of America is a mutual life insurance company. Some consumers don't know what this means, but it's an important feature to consider when buying a policy.When you buy a Guardian whole life insurance, you become a policyholder. Your whole life insurance policy is guaranteed to provide you protection for your loved ones. Also, you are eligible to receive a dividend from the company's profits at the end of each year. The amount of the dividend that you would potentially receive is determined by how the company performed in three key areas.

The key areas of performance are

- Investments

- Death Claims

- Expenses

Check out more information about dividends rates from Guardian and others here.

You can also see the review of Guardians Whole Life 2022 below.

Check out: Comparison of the Best Whole Life Insurance For Cash Value.

The Bad

Dividend Rate

Let me begin by saying that it is very hard to find something bad about Guardian. However, we have to find something to write about.The Guardian Life Insurance Company of America is growing by leaps and bounds, which has helped its dividend rate hold relatively steady over the years.

Here is the history of the dividend since 2012:

| 2022 | 5.65 |

| 2021 | 5.65 |

| 2020 | 5.65 |

| 2019 | 5.85 |

| 2018 | 5.85 |

| 2017 | 5.85 |

| 2016 | 6.05 |

| 2015 | 6.05 |

| 2014 | 6.25 |

| 2013 | 6.65 |

| 2012 | 6.95 |

Although Guardian is still paying out dividends to policyholders, which is a great thing. The dividend has been decreasing slowly since 2002. This decreasing dividend interest rate is important because whole life performance is linked strongly to dividend performance. It is not a good sign to see the dividend dropping constantly.

However, if history is any indication, things will turn around in the years to come.

Guardian announced that they approved their 2022 dividend payout. The dividend payout for 2022 is $1.13B in dividends to eligible whole life policyholders. Also, Guardian's dividend interest rate for 2022 will be 5.65%

Check our Whole Life Dividend History to compare the dividend to other companies.

Agent Network

Another potential downside of working with the Guardian Life Insurance Company of America is a small agent network than their immediate competitors (MassMutual 7,000, New York Life 12,000).The agent count isn't a huge downside, but we still wanted to compare it to the competition.

Even though there are roughly 3,000 financial representatives in 70 offices nationwide, you may not be able to find somebody close to your home.

Fortunately, you don't have to meet with an agent in person to make a purchase. However, if you are the type who wants this security, you will need to see if there is an office in your local area.

Finances

Financially Guardian is an extremely strong company. As you can see next in the financial highlights for Guardian Life:- Assets under Management: $90.2 Billion

- Life Insurance Inforce: $776 Billion

- Premiums: $12.3 Billion

- Capital: $10.7 Billion

- Benefits Paid to Policy Holders: $7.4 Billion

- Operating Income: $1.9 Billion

- Policy Dividend Declared: $1.1 Billion

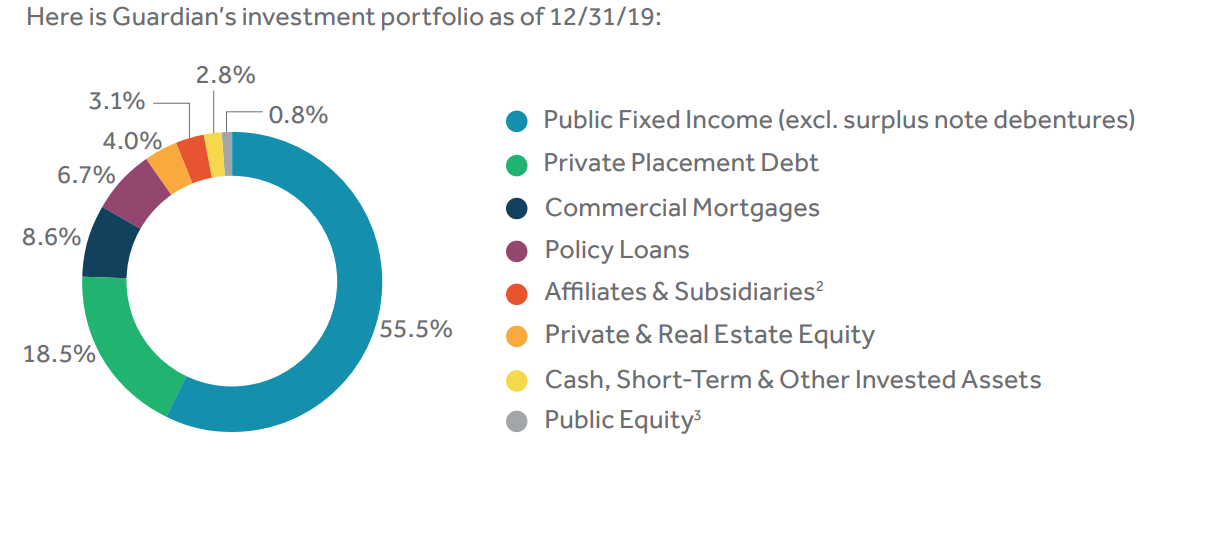

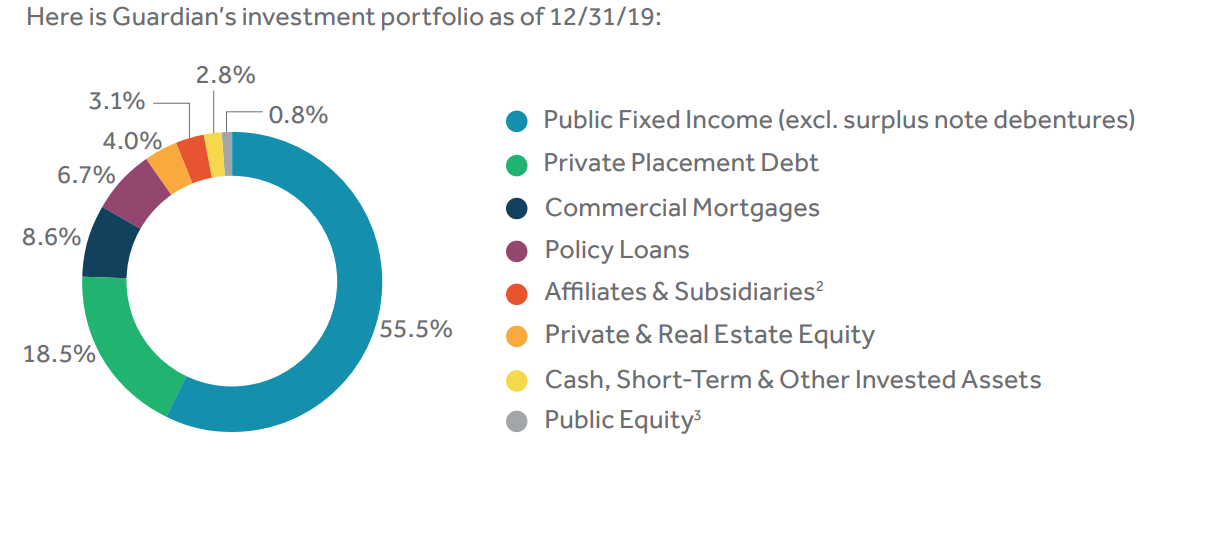

Investment Allocation

Also, Guardian Life is among the largest companies in the United States. The company ranked #247 on Fortune magazine's annual Fortune 500 list. Guardian has made the list 27 times.

Ratings

As we already mentioned, Guardian Life has impressive ratings, and they have had for many years. Third-party companies establish ratings to determine how strong a company is.- A.M. Best Rating: A++ (Highest of 15 ratings)

- Standard & Poor's Rating: AA+ (2nd highest of 22 ratings)

- Moody's Rating: Aa2 (3rd highest of 21 ratings)

- Comdex: 98

Products

While the company has some unique products, all of Guardian's whole life insurance products have the same basic features that any mutual whole life has:- Death Benefit that is guaranteed

- Guaranteed Cash Value

- Premiums that never increase in price

- Dividends to help grow cash and death benefit

These are the primary reasons to consider whole life insurance. Looking more in-depth, the two main whole life products are:

Level Premium Whole Life

This product can be designed to have premiums until age 120, 99, or 95. This whole life is better if you are looking to get a higher death benefit. Do you want maximum death benefit? Then make sure to pay premiums until age 120.Limited Payment Whole Life

This type of whole life can be designed to be paid up in a short period. Let's say you would like to pay for your whole life for only 20 years; then this is the product that you could choose:- 10 Pay

- 20 Pay

EstateGuard® Whole Life

EstateGuard is a second-to-die whole life policy. EstateGuard insures two people, and it pays when the second person dies. A second-to-die policy is a great strategy when you want to leave a legacy or for estate planning.Riders

Riders are features that you can add to a life insurance policy. Guardian not only has the regular riders:- Waiver of Premium

- Guaranteed Insurability Option

- Paid-Up Additions Rider

- Renewable Term Rider

- Accidental Death Benefit

Interesting Riders

As you will see Guardian offers some attractive life insurance riders for your policy:Index Participation Features: This allows you to allocate the cash value of the policy's paid-up additions to the performance of the S&P 500. It does have a cap and a floor, but this rider can turn a whole life into an IUL.

Discover DuoGuard: This is an exciting rider that guarantees a beneficiary the right to purchase a new life insurance policy when the original insured dies.

Disability Waiver of Premiums Benefit: If you become totally disabled for six months, you will not have to pay premiums on the policy but keep the policy in force.

Simplified Insurability Option: It allows you to get more coverage with simplified underwriting.

Enhanced Accelerated Benefits Rider: This allows you to accelerate benefits if you are terminally ill or have certain chronic illnesses.

Guaranteed Insurability Rider: You will have the ability to buy whole life insurance without having to do another medical. This rider can be great if you get whole life insurance on kids.

Not all these riders are essential, but we still wanted you to be aware of your options.

Dividend Rate

As we already mentioned, Guardian's dividend hasn't been that strong over the past few years. Here is a table that will show how the dividend has decreased:| 2022 | 5.65 |

| 2021 | 5.65 |

| 2020 | 5.65 |

| 2019 | 5.85 |

| 2018 | 5.85 |

| 2017 | 5.85 |

| 2016 | 6.05 |

| 2015 | 6.05 |

| 2014 | 6.25 |

| 2013 | 6.65 |

| 2012 | 6.95 |

The dividend payout for 2022 is $1.13B in dividends to eligible whole life policyholders. The Guardian dividend interest rate for 2022 will be 5.65%

While the dividend has decreased, it is very similar to what other companies have experienced. If you want to see a full comparison of dividends, check out our analysis: Whole Life Dividends.

Final Word

In summary, Guardian Life Insurance Company of America has a lot going for it. Guardian has a long history, strong dividend payments, strong finances, and various life insurance options.The current dividend and cash value performance are lower than some of the top whole lives in the industry, making their whole life underperform. However, it is still a fantastic option for anyone looking for a strong company.

Check out other great reviews: Prudential Whole Life Review, Gerber Whole Life Review, Foresters Whole Life Review, AIG Whole Life Review.

Compared to the competition, Guardian Life Insurance Company of America used to be among the top five whole life insurance companies.

For a more detailed breakdown of the competition, you can see it in our Top 7 Whole Life For Cash.