Updated May 22nd, 2020

Northwestern Mutual Whole Life Insurance Review

DISCLAIMER: We are not Northwestern Mutual. This is an independent review.Founded in 1857, Northwestern Mutual is one of the oldest financial security companies in the world. The company offers a variety of products and services, including its popular whole life insurance policies.

Northwestern Mutual is one of the large mutual insurance companies. It is ranked as #104 in the Fortune 500 list. Get Me A Quote

The Good

Industry Leader

When shopping for whole life insurance, peace of mind is extremely important. As a consumer, a focus on industry ratings can help you make an informed and confident decision.[caption id="attachment_11125" align="alignnone" width="800"]

Great Ratings For Northwestern Mutual[/caption]

Great Ratings For Northwestern Mutual[/caption] Financial Ratings

Northwestern Mutual is an industry leader in regards to its financial ratings. All the top rating agencies consider the company a top performer, including the following:- A.M. Best Rating: A++

- Fitch Ratings: AAA

- Standard & Poor's Rating: AA+

- Moody's Rating: Aaa

Northwestern Mutual Financial Info

There are other companies that perform this well, but not many have higher ratings than Northwestern Mutual.

Variety of Coverage Options

It's easier to find and buy whole life insurance when you have access to a variety of coverage options.Here are some details to consider:

- There is no whole life minimum age.

- Whole life maximum age is 85.

- The minimum whole life death benefit is $25,000.

- There are guarantees on cash, death benefit, and premium.

- Dividend-paying whole life insurance.

Full of Features

One of the primary benefits of Northwestern Mutual whole life insurance is its standard policy features. You get the best of the best with your monthly premium, without being asked to pay any extra.Some of these features include:

- Cash value access and partial surrenders.

- Interest rate guarantee.

- Waivers on deductions and premium payments in emergency situations, such as an injury that leaves you out of work.

- Expiration and lapse guarantees.

- No-exam conversions.

- Flexible death benefits.

The Not So Good

Low and Decreasing Dividend

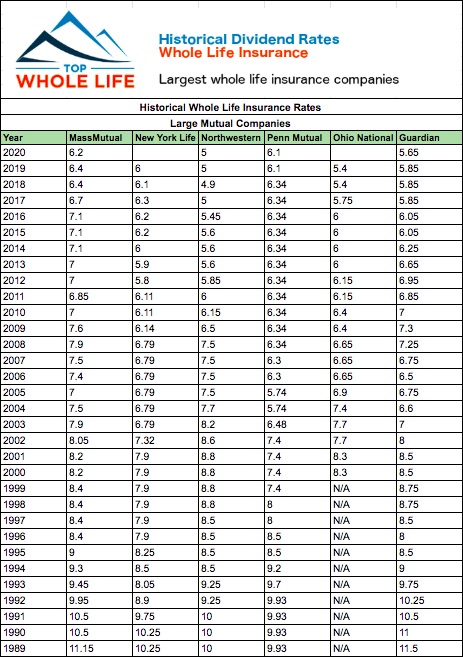

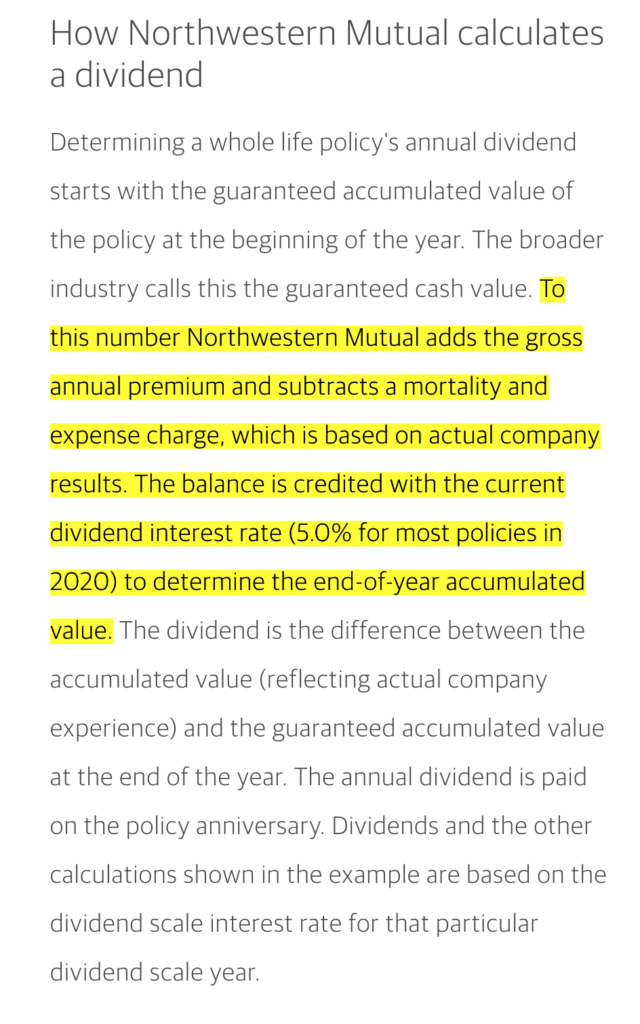

Northwestern Mutual's dividend has been decreasing over the past years. The dividend when from being the highest in the industry to being average. This dividend is what drives the performance of the whole life insurance cash and death benefit growth.The dividend has decreased from 8.8% in 2000 to 5.45% for 2016 and all the way down to 4.8% in 2018.

However, in 2020, it bounces back to 5.0%. So it's not all bad news.

Still, one of the main reasons to buy whole life insurance is because of the participating dividend. If the performance of the dividend keeps decreasing, so does the performance of their whole life policy.

Stability Of Your Agent

In reality, Northwestern Mutual had 5,900 employees in 2016. But the employee count went down to a little over 5400 in 2018 (source Forbes 500).What this means to you is that finding an agent that will stay longer with Northwestern Mutual may be more difficult in the future.

This is a product of the significant competition that Northwestern Mutual has faced, and that other companies keep growing past them. See the revenue from the large Mutual Companies (Fortune 500 Source):

[caption id="attachment_11127" align="alignnone" width="800"]

Northwestern Is Not The Top Dog In The Mutual Insurers Any More[/caption]

Northwestern Is Not The Top Dog In The Mutual Insurers Any More[/caption] The Quotes

In the past Northwestern Mutual had one of the best performing whole life insurance in the market.Today, Northwestern Mutual's lower dividend will not help when comparing Northwestern Mutual whole life insurance with the competition.

The cash value and the death benefit will grow slower than some of the top 7 whole life insurances in the marketplace.

Total Dividend

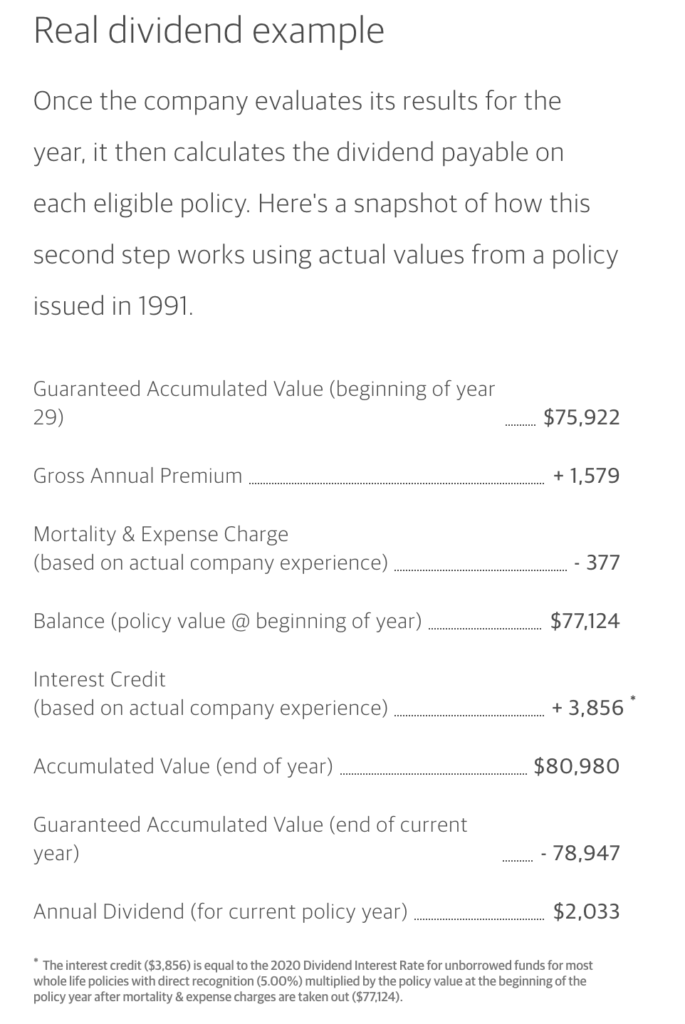

In 2020, the company will pay an estimated $6 billion to policy-owners through its dividend payout. This is an industry-leading dividend but bear in mind that Northwestern is a large company. They have many policyholders, so this gets split by all the current policyholders. The policy dividend interest payout will be 5% for 2020.

Real Example

Final Word

In conclusion, Northwestern Mutual has long been one of the top providers of whole life insurance. With high ratings across the board and a record amount paid in dividends to policy-owners, the company seems to be in a strong position.However, a rapidly decreasing dividend could be a concern for new whole life insurance products and participating policies.

If you are looking for a new policy there are many better options out there like:

MassMutual, Ohio National, New York Life or Penn Mutual.

Top Whole Life's - Northwestern Mutual Whole Life Insurance Review:

3 out of 5