Updated Jan 24th, 2022

If you want to get the best whole life insurance rates, you will have to research. But, the good news is we have done all the research for you.

As a consumer, you know that a lot goes into comparing policies and companies. But, you also know that one detail is more important than most: The Cost.

If you were asking yourself: how much does whole life insurance cost? You came to the right place.

Whole Life Insurance Rates

While most people are familiar with term insurance, not everyone knows whole life insurance. However, whole life insurance has been around for much longer.

Whole life is a type of permanent insurance that, in most cases, you pay for your entire life, and when you die, your beneficiaries get the death benefit. It is an attractive choice because you know you will get something for the money you are paying in the end.

Also, whole life insurance has a component called cash value. Cash value is similar to a savings account that you can access if needed. The cash value account of whole life makes for a smart way to save safe money.

Different types of life insurance have different costs. Therefore, you should know the type of insurance you pick, which will significantly impact your rates.

In general, whole life insurance is much more expensive than term life insurance. The difference can be anywhere from 5 to 7 times more premium.

However, the reason for this drastic difference is that you know you will get a payout eventually, no matter what.

If all you want is a quote, you can get one here: Whole Life Quick Quote.

Regardless of your situation and future needs, you're likely to be faced with these two questions:

- How much does whole life insurance cost?

- How much coverage do I need?

In many ways, these two questions go together hand in hand. In other words, your cost is dictated mainly by how much coverage you require. But of course, there is more to it than that.

Cost depends on many different factors like health, how long you pay for, cash value growth, and more. Most of these factors we will address in this article.

Quick Links

The following are some of the topics you can expect to find in the article, and quick links so you can jump to what's important to you:

- What is Whole Life?

- Who Should Consider Whole Life?

- Why Price Is Not Everything

- Whole Life Insurance Rates By Age Chart

- Factors That Impact Your Cost

- Average Whole Life Insurance Cost With Cash Value

- Whole Life 10 Pay Cost

- Whole Life Insurance Non-Medical Cost

- Burial Insurance

- Permanent Life Insurance Cost (Cheapest)

This should give you a complete understanding of how much whole life insurance will cost you.

I Would Like To Get A Quote Now

Best Whole Life For Cash Value

What is whole life insurance?

Basically, whole life insurance is a type of life insurance that never expires. In reality, it's the only policy that as long as you pay your premiums you will have your policy for the rest of your life.

Whole Life Insurance is true permanent life insurance.

It has the basic features of any life insurance. However, it also has many additional features that make it very attractive, like:

- Cash Value

- Permanent Death Benefit

- Guaranteed Growth

- Guaranteed Premiums

Who Should Consider Whole Life Insurance?

Before you keep going further, you should ask yourself:

Do I really need whole life insurance?

Whole life insurance offers great benefits, but the premiums are much higher than Term Life insurance. Before you consider whole life insurance, you should always protect your income and family with the right amount of coverage.

If something happens to you, your family will not ask what type of life insurance it was. They will only ask how much they are going to get.

In reality, most people shouldn't get whole life insurance. It's costly compared to a budget they can allocate to life insurance.

We are not trying to dissuade you from getting a quote, but we want you to understand other options you need to consider.

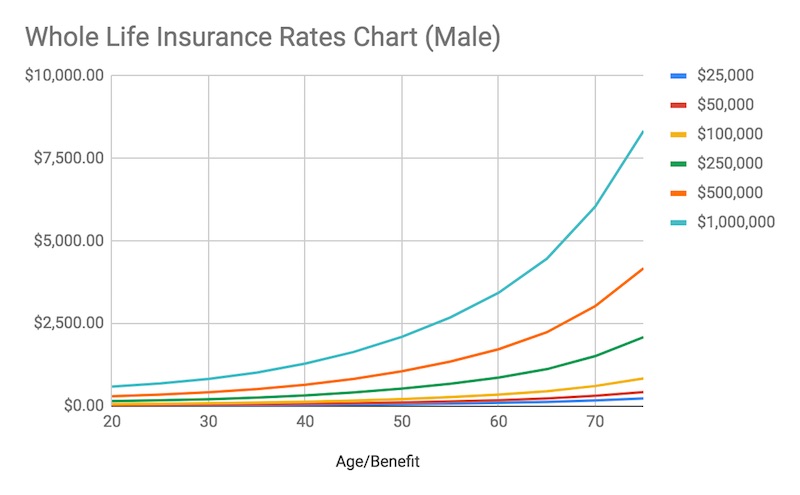

Whole Life Insurance Rates Chart

The following is a list of many whole life insurance rate charts.

However, we do want you to get an understanding of pricing. We used a top rated life insurance company with great cash value accumulation; this way, you can get an idea of whole life insurance rates.

The following charts are for whole life insurance that is paid until age 100. There are other whole life policies that you pay for less time, they are called limited pay whole life.

Next, you will find male and female rates. All the charts premiums are monthly payments. We quoted from age 20 to age 75.

Also, please note these premiums can vary based on health.

Whole Life Insurance Rates Chart $25,000

| Age | Male | Female |

|---|---|---|

| 20 | $23.51 | $20.90 |

| 25 | $26.43 | $23.77 |

| 30 | $30.15 | $27.19 |

| 35 | $34.69 | $30.73 |

| 40 | $41.26 | $36.02 |

| 45 | $51.18 | $41.78 |

| 50 | $64.92 | $52.31 |

| 55 | $80.32 | $64.79 |

| 60 | $101.51 | $82.11 |

| 65 | $129.89 | $106.62 |

| 70 | $174.13 | $143.14 |

| 75 | $236.77 | $199.23 |

Whole Life Insurance Rates Chart $50,000

| Age | Male | Female |

| 20 | $40.24 | $34.19 |

| 25 | $44.85 | $39.28 |

| 30 | $51.68 | $45.11 |

| 35 | $60.07 | $53.29 |

| 40 | $72.95 | $62.60 |

| 45 | $90.74 | $72.91 |

| 50 | $115.71 | $91.70 |

| 55 | $143.94 | $116.80 |

| 60 | $181.92 | $149.25 |

| 65 | $234.03 | $195.68 |

| 70 | $314.37 | $263.91 |

| 75 | $429.30 | $369.79 |

Whole Life Insurance Rates Chart $100,000

| Age | Male | Female |

|---|---|---|

| 20 | $65.86 | $55.16 |

| 25 | $75.52 | $66.73 |

| 30 | $89.44 | $80.40 |

| 35 | $108.66 | $91.87 |

| 40 | $135.63 | $109.88 |

| 45 | $170.78 | $135.98 |

| 50 | $216.80 | $172.78 |

| 55 | $275.53 | $222.02 |

| 60 | $350.35 | $286.58 |

| 65 | $453.53 | $378.36 |

| 70 | $611.44 | $514.08 |

| 75 | $840.42 | $725.06 |

Whole Life Insurance Rates Chart $250,000

| Age | Male | Female |

|---|---|---|

| 20 | $153.56 | $126.80 |

| 25 | $177.70 | $155.73 |

| 30 | $212.50 | $189.01 |

| 35 | $260.57 | $218.59 |

| 40 | $327.99 | $263.61 |

| 45 | $415.86 | $328.86 |

| 50 | $530.92 | $420.86 |

| 55 | $677.73 | $543.97 |

| 60 | $864.78 | $705.35 |

| 65 | $1,122.74 | $934.82 |

| 70 | $1,517.50 | $1,274.12 |

| 75 | $2,089.96 | $1,801.55 |

Whole Life Insurance Rates Chart $500,000

| Age | Male | Female |

|---|---|---|

| 20 | $302.76 | $249.26 |

| 25 | $351.05 | $307.11 |

| 30 | $420.65 | $373.67 |

| 35 | $516.78 | $432.83 |

| 40 | $651.63 | $522.87 |

| 45 | $827.37 | $653.37 |

| 50 | $1,057.49 | $837.38 |

| 55 | $1,351.11 | $1,083.59 |

| 60 | $1,725.21 | $1,406.36 |

| 65 | $2,241.12 | $1,865.28 |

| 70 | $3,030.65 | $2,543.88 |

| 75 | $4,175.57 | $3,598.76 |

Whole Life Insurance Rates Chart $1,000,000

| Age | Male | Female |

|---|---|---|

| 20 | $591 | $484.59 |

| 25 | $688 | $600.30 |

| 30 | $827 | $733.41 |

| 35 | $1,019 | $851.73 |

| 40 | $1,289 | $1,031.82 |

| 45 | $1,640 | $1,292.82 |

| 50 | $2,101 | $1,660.83 |

| 55 | $2,688 | $2,153.25 |

| 60 | $3,436 | $2,798.79 |

| 65 | $4,468 | $3,716.64 |

| 70 | $6,047 | $5,073.84 |

| 75 | $8,337 | $7,183.59 |

Rates Chats

Next are visual representations of the previous data. As you can see, rates increase as you age. Also, your prices will increase depending on the amount of coverage you want.

As you can see, rates increase as you age. Also, your prices will increase depending on the amount of coverage you want.

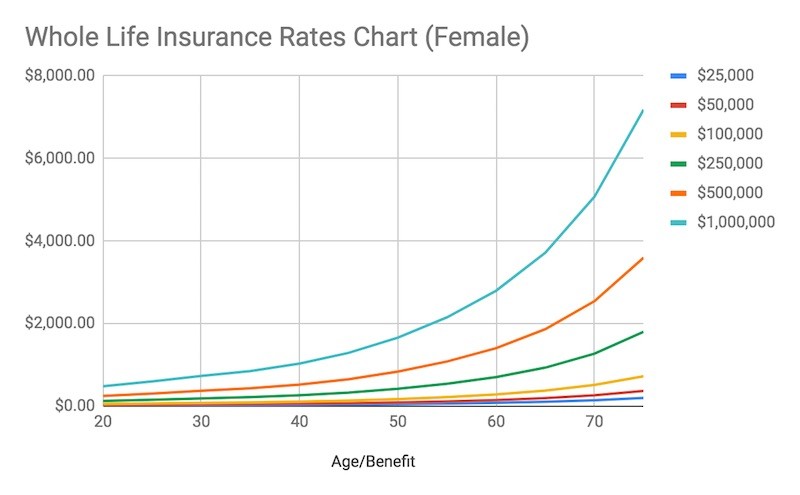

However, it gets to a point where the cost might be prohibitive if you want a large enough whole life. That's why most people decide to purchase smaller whole life policies later in life. Or they may go with term life insurance.  For females, whole life insurance prices increase by age as well. This isn't new; all life insurance works the same way. But females, in general, have much lower whole life premium rates than males.

For females, whole life insurance prices increase by age as well. This isn't new; all life insurance works the same way. But females, in general, have much lower whole life premium rates than males.

Locking in your whole life insurance rates when you are young can be an excellent strategy for both males and females.

However, unlike term insurance, whole life insurance is an asset. So getting the cheapest may not be the best for you long term. On the other hand, sometimes paying a bit more will get you significant cash value growth over the long run.

Check out our article: Best Whole Life For Cash Value to compare cash value.

Just like price increases, the longer you wait, the slower your cash value will grow.

Why Price Is Not Everything

But let's assume you already did the research and you think your whole life is for you. We have many charts with prices for every age, but please understand before you only look at the price.

Price is not everything in whole life insurance.

Imagine only buying a house based on price. It wouldn't make much sense, would it?

When buying a house, you would need to consider things like:

- Location (location, location)

- Age of the home

- School district

- Repairs needed

And many more variables. The same is true in whole life insurance.

There are manly variables to consider when buying a whole life:

- Cost

- Cash Value Growth

- Guaranteed Death Benefit

- Dividends

- Company Financial Strength

But in this article, we will mainly focus on the cost while not forgetting about the other variables.

That's A High Price

Get A Cheaper Term Quote

Factors That Impact Your Cost

In reality, whole life insurance can be pricey. So we want to give you some ideas on managing the cost. But before we go any further, remember this:

no two companies take the same approach when providing whole life insurance quotes.

For this reason, the price offered by one company may not be identical to the next.

In a perfect world, you'll be young and healthy when purchasing life insurance. Being young and healthy gives you the best opportunity to secure a policy at an affordable price. Maybe this is why many people buy whole life insurance for their kids, knowing that this will be a great gift to them in the future.

The main factors that determine whole life insurance costs are:

- Age

- Health

- The Company

While some people are young and healthy, others don't fall into this category.

[caption id="attachment_11073" align="alignnone" width="300"] Age & Health Are Important Factors On Prices[/caption]

Age & Health Are Important Factors On Prices[/caption]Age, Health and Company

Generally speaking, here are the factors that affect your whole life insurance premium:

- Life insurance rates are cheaper when you are young. The older you get, the more you will pay

- Are you 100 percent healthy? Or have you run into some health concerns in the past?

- Medical conditions can increment your rates.

- On average, women live longer. Subsequently, they pay less for life insurance coverage.

- Drinker or smoker? If you drink alcohol or use tobacco, you should expect your life insurance rate to be higher.

- Many consumers overlook this detail, but it comes into play. For example, there's a big difference between someone who works as a secretary and someone who works as a sky diving instructor.

- Some companies offer no exam whole life insurance, but you will pay more for coverage if you go down this path.

- Different companies have different products, some offer better rates than others, so you always have to compare.

- The riders you chose to add to the policy. Riders are features you can add to any plan.

Since so many factors impact your cost, including the company and your overall personal and health profile, you won't know how much you'll be asked to pay until you receive quotes from multiple providers.

Health & Age Impact On Cost

The following chart can give you an idea of how much health and age impacts whole life insurance costs.

We used three different ratings (Standard, Preferred, Ultra) from a large life insurance company. Of course, these rates vary company by company, but at least you can get an idea of how much it changes.

The following is a quote for $250,000 whole life paid till age 100, with monthly rates:

| Age | Standard | Preferred | Ultra |

| 35 | 279.49 | 260.57 | 260.57 |

| 40 | 348.87 | 327.99 | 327.99 |

| 45 | 451.53 | 415.86 | 415.86 |

| 50 | 576.81 | 530.92 | 530.92 |

| 55 | 738.41 | 677.73 | 677.73 |

| 60 | 947.43 | 864.78 | 864.78 |

Next are the rates for a MALE SMOKER $250,000 whole life paid till age 100, with monthly rates:

| Age | Preferred Tabacco | Standard Tabacco |

| 35 | 321.68 | 338.65 |

| 40 | 396.72 | 414.99 |

| 45 | 521.13 | 548.10 |

| 50 | 642.06 | 678.38 |

| 55 | 868.91 | 912.41 |

| 60 | 1,112.51 | 1,169.50 |

Here are the rates for a FEMALE $250,000 whole life paid till age 100, with monthly rates:

| Age | Standard | Preferred | Ultra |

| 35 | 226.20 | 218.59 | 218.59 |

| 40 | 281.88 | 263.61 | 263.61 |

| 45 | 354.96 | 328.86 | 328.86 |

| 50 | 469.15 | 420.86 | 420.86 |

| 55 | 586.60 | 543.97 | 543.97 |

| 60 | 757.55 | 705.35 | 705.35 |

Here are the rates for a FEMALE SMOKER $250,000 whole life paid till age 100, with monthly rates:

| Age | Preferred Tabaco | Standard Tabacco |

| 35 | 254.91 | 268.40 |

| 40 | 323.21 | 341.26 |

| 45 | 403.25 | 424.13 |

| 50 | 511.78 | 550.28 |

| 55 | 658.59 | 691.87 |

| 60 | 847.82 | 890.88 |

As you can see, costs by rating change, but incredibly they do not vary that much. The whole life insurance price is not significantly impacted by health.

As we already said, prices will change from company to company, but now you have a better understanding.

The main factor that changes price is age, not health. So if you are considering a whole life, then get it as soon as possible.

Besides, even though the price doesn't change much with age, what does change is cash value accumulation. So the longer you wait, the less time you have for the cash value to grow inside of your policy.

So again, don't wait if you are looking for a whole life.

Average Whole Life Insurance Rates With Cash Value

Many companies out there say they provide whole life insurance, and they only show you the prices. But, as we said in the beginning, price is not everything in whole life. You want to get good assets, not cheap assets.

We will give you some average whole life insurance rates for different ages next. The charts' purpose is to give you an idea of the price ranges and Cash Value Accumulation.

This chart is not intended to be a quote.

Pro Tip: Do Not Trust Whole Life Insurance Rates Without Cash Value Growth... You Could Get A Bad Whole Life

Please remember all of the prices can change based on health and company.

That being said, on the following char we used one of the most solid companies.

Whole Life Insurance Rates for $250,000, Good Health & Non-smoker

Female Quote

| Age | Monthly Price | Cash Value @ 65 | Death Benefit @ 65 |

| 25 | $155.73 | $197,962 | $448,229 |

| 30 | $189.01 | $174,093 | $408,742 |

| 35 | $218.59 | $160,158 | $392,254 |

| 40 | $263.61 | $129,863 | $345,516 |

| 45 | $328.86 | $103,677 | $311,939 |

| 50 | $420.86 | $81,418 | $292,492 |

| 55 | $543.97 | $58,136 | $283,201 |

| 60 | $705.35 | $24,230 | $262,321 |

Male Quote

| Age | Monthly Price | Cash Value @ 65 | Death Benefit @ 65 |

| 25 | $177.70 | $225,927 | $452,517 |

| 30 | $212.50 | $224,859 | $459,121 |

| 35 | $260.57 | $191,210 | $408,734 |

| 40 | $327.99 | $162,496 | $370,916 |

| 45 | $415.86 | $132,839 | $335,865 |

| 50 | $530.92 | $104,912 | $310,216 |

| 55 | $677.73 | $70,849 | $287,318 |

| 60 | $864.78 | $29,754 | $264,222 |

As you can see, there is a significant difference as you age in price, cash value, and death benefit growth. So if you are considering a whole life, now is the time to take action.

Whole Life Insurance Rates Payable For 10 Years

There are many variations to whole life life insurance, but few are as interesting as a 10 pay.

When you are looking for a whole life that builds cash value, one of the best products to consider is a whole life 10 pay.

A 10 pay is a type of limited-pay whole life insurance where you only need to pay premiums for ten years. Then, after ten years, you keep your policy and all the cash in it, but you don't have to keep paying.

10 Pay whole life is excellent to maximize cash value growth, but you should consider other products if you want a substantial death benefit.

Here are the whole life insurance rates for a 10 pay:

Male $250,000 Excellent Health

| Age | Cost | Cash @ 65 |

| 25 | 521.78 | 326,700 |

| 30 | 617.05 | 295,214 |

| 35 | 733.19 | 267,052 |

| 40 | 873.48 | 241,420 |

| 45 | 1,038.56 | 217,402 |

| 50 | 1,227.57 | 147,707 |

| 55 | 1,451.38 | 174,093 |

| 60 | 1,705.42 | 76,267 |

As you can see, this product builds significant cash value if you start early. However, when you are older, it becomes much more expensive. Therefore, this is the type of product someone looking for whole life in their 30's or 20's should consider.

Now You Know Average Rates

Get Your Personal Whole Life Prices

Get Me A Quote It's common to ask, "how much does whole life insurance cost," but there's no simple answer. Instead, you have to dig up the answer by requesting quotes from multiple companies. However, now you have a better idea of prices.

Check out this article for whole life insurance cost for $1,000,000.

Whole Life Insurance Non Medical Cost

Many people do not like to go through the hassle of doing a medical exam. We get many clients that are scared of needles. You can opt for a medical exam, and non-medical whole life insurance may be a good option for you.

Pros

It's a much simpler process, and you will not have to do blood and urine test. So you will not uncover any new health conditions as the health rating is based on your current health.

Cons

Your health rating will be close to a standard rating. Standard rate means you may have to pay a little more than your average (medical) full underwriting whole life.

Who Should Do It?

If your health is average, and you are not in excellent shape, it may be a good option for you. In addition, if you haven't been to the doctor in a while, it may be better just to go the non-medical route.

Cost Of Non Medical Whole Life

Here is a table from a participating whole life insurance company that offers a great non-medical whole life:

Male $250,000 Non Medical Whole Life Cost

| Age | Monthly Premium | Cash Value @ 65 | Death Benefit @ 65 |

| 25 | $222.86 | $205,965.19 | $427,059.02 |

| 30 | $253.05 | $187,496.37 | $401,162.50 |

| 35 | $295.49 | $166,111.52 | $371,911.09 |

| 40 | $344.05 | $143,980.43 | $344,438.65 |

| 45 | $424.77 | $121,078.61 | $321,472.21 |

| 50 | $526.93 | $96,216.66 | $299,930.59 |

| 55 | $666.71 | $66,599.53 | $278,409.70 |

Female $250,000 Non-Medical Whole Life Cost

| Age | Monthly Premium | Cash Value @ 65 | Death Benefit @ 65 |

| 25 | $215.64 | $184,128.40 | $432,056.29 |

| 30 | $247.80 | $166,916.34 | $405,145.92 |

| 35 | $287.61 | $148,837.26 | $379,003.01 |

| 40 | $331.36 | $129,578.01 | $353,662.83 |

| 45 | $389.33 | $108,497.04 | $328,882.22 |

| 50 | $468.30 | $85,014.47 | $304,082.69 |

| 55 | $604.80 | $58,033.15 | $280,612.76 |

If you would like a quote for a non-medical whole life reach out to us and our experts are ready to help.

I Would Like To Get A Quote Now

Non-Medical Whole Life Cost

Burial Insurance

Small whole life policies $2,000 to $10,000 can also be known as burial insurance. These are simple, very affordable whole life policies that are easy to purchase. You will not have to go through a complicated underwriting process.

All you will need is to answer a few questions, and either you are accepted or rejected.

Here are sample rates for $10,000 whole life policy, or burial policy:

| Age | Premium |

| 20 | $13.70 |

| 25 | $14.75 |

| 30 | $16.18 |

| 35 | $17.97 |

| 40 | $19.98 |

| 45 | $22.59 |

| 50 | $25.99 |

| 55 | $31.39 |

| 60 | $36.77 |

| 65 | $46.68 |

| 70 | $60.99 |

| 75 | $80.72 |

| 80 | $106.96 |

| 85 | $161.31 |

Most rejections are based on severe health conditions, so don't be afraid to apply. Check out this article for more info on burial insurance: 12 Questions About Final Expense Policies

Permanent Life Insurance Cost

The word "permanent" can be applied to many different kinds of life insurance.

- Guaranteed Universal Life

- Whole Life Insurance

- Indexed Universal Life Insurance

All of the previous are called permanent because of how long the policies will last. So while you pay the premium, your policy will be there until you die.

We wanted to show you other rates because there are many different types of permanent insurance. So we decided to add other types of permanent insurance for your information.

Many times people that thought they wanted whole life were looking for the cheapest permanent coverage. If you don't care about cash value, you should consider a Guaranteed Universal Life (GUL) policy instead.

The simplest way for people to understand a GUL is to think of it as term insurance that lasts much longer. Usually until age 100 or more.

Guaranteed Universal Life Cost

For more on GUL's, you can read our article: Top 7 Guaranteed Universal Life Policies.

The following are rates for Guaranteed Universal Life policy with the following features:

- 100,000 of a guaranteed death benefit

- Guaranteed until age 100

- Excellent Health

- Level Premiums

| GUL 100k To Age 100 | ||

| Age | Premium (Male) | Premium (Female) |

| 30 | $42.00 | $36.00 |

| 35 | $49.00 | $43.00 |

| 40 | $58.00 | $51.00 |

| 45 | $72.00 | $63.00 |

| 50 | $92.00 | $78.00 |

| 55 | $111.37 | $97.08 |

| 60 | $133.73 | $106.52 |

| 65 | $168.99 | $138.78 |

| 70 | $238.95 | $193.96 |

As you can see, these rates are even cheaper than whole life insurance.

The main difference is that you will not have much cash value. But if you are looking for a permanent death benefit, these are great policies.

Final Note

Now, you have a great idea of pricing and rates. Remember that whole life insurance costs can change drastically with age and health.

So start as soon as possible, and lock in your insurance for life.

Other reads:

Whole Life Insurance Dividend Rate History

Indexed Universal Life Insurance Costs

Best Whole Life For Cash Value

An Introduction to Our Life Insurance Cost Calculator