High Early Cash Value - One Of Our Favorites

When it comes to whole life insurance there is no shortage of companies and products.

On the plus side, a large selection makes it easy to find the policy that best suits your budget and personal requirements.

Conversely, the more selections you have the more difficult it becomes to make a confident decision. With this in mind, it makes good sense to consider some of the more unique products on the market.

This is where Whole Life Legacy High Early Cash Value by Massachusetts Mutual Life Insurance Company (MassMutual) comes into play.

What's it All About?

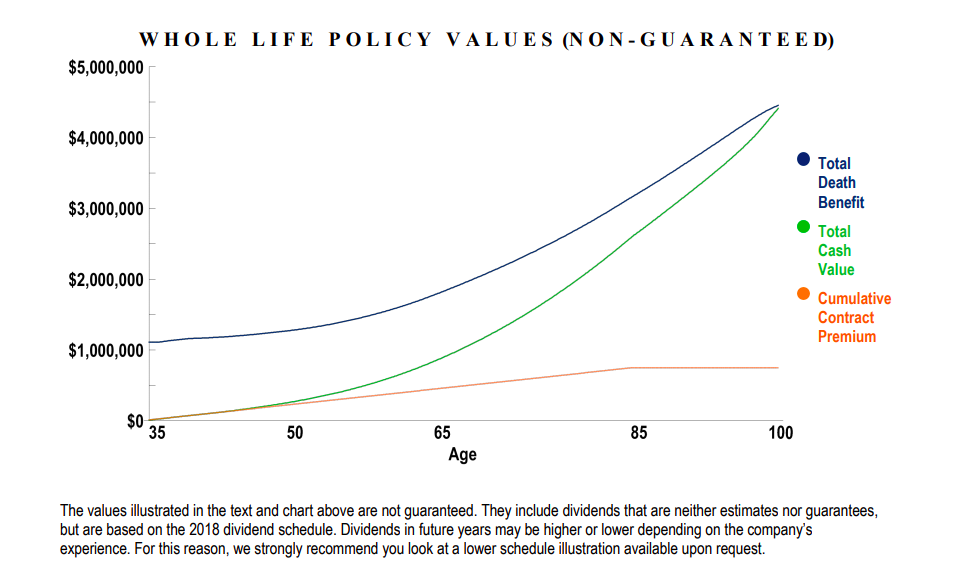

[caption id="attachment_9806" align="alignnone" width="956"] Growth Of High Early Cash Value[/caption]

Growth Of High Early Cash Value[/caption]Every life insurance company has its own set of policies, all of which have a unique selling proposition.

However, as you learn more about Whole Life Legacy High Early Cash Value, you'll come to find that it's above and beyond anything else on the market.

With this, you get permanent life insurance protection with guaranteed cash values. As if that's not good enough, there's one other detail that allows this policy to stand out:

The cash value of the policy is higher in the early years than those associated with more conventional whole life policies. If you are looking for cash value growth this a great product for you.

The Many Benefits

The best way to learn more about Whole Life Legacy High Early Cash Value is to let us show you how it works. Before you do this, you may want to learn more about the many benefits, as this will give you a better idea of if it's right for you.

- 90% of your premium in year one as cash

- Lifetime coverage

- Cash value that is guaranteed to increase every year

- Cash value that is guaranteed to never decrease as a result of market conditions

- Tax deferred cash value accumulation

- Eligibility to receive annual dividend payouts (although these are not guaranteed)

- Opportunity to use dividends to increase your protection or reduce your out of pocket premium cost

- A variety of optional benefits available through policy riders

- Guaranteed level premiums all the way up to age 85

And you will have many more benefits in our favorite whole life product. Also, it is great for people looking to do a "Bank On Your Self" or "Infinite Banking" concept.

Perfect for Individuals and Business Owners

Flexibility is the name of the game when shopping for and buying a whole life insurance policy. This is one of the things that makes Whole Life Legacy High Early Cash Value such a popular product.

Not only is it a good choice for individual consumers, but the same holds true for business owners.

With this type of policy, businesses that purchase life insurance for employees can reduce the impact on the balance sheet during the first few policy years.

Furthermore, with the right strategy in place, you can use Whole Life Legacy High Early Cash Value to provide coverage to your key employees. In other words, it's a win-win for both the company and employees.

A Quick Sample

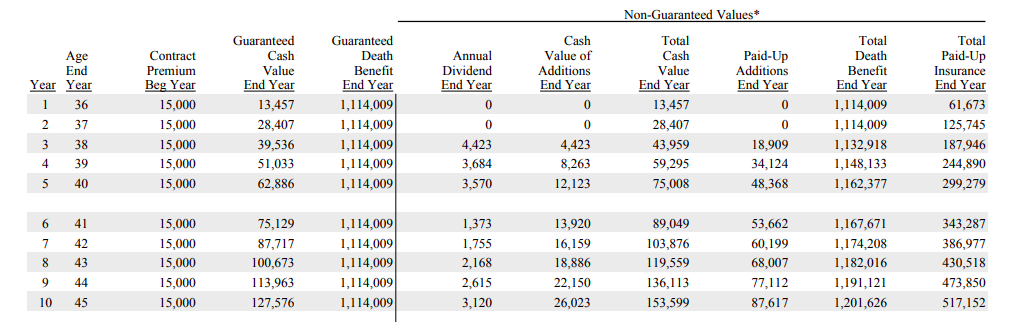

So let see the numbers for a healthy 35 year old male that wants to have cash value at the beginning of the policy:

- 35 Year Old

- Excellent Health

- Cash Value Early

- $15,000/yr Contribution

What we find is that this product is great as in the first 3 years you have almost all of your cash.

[caption id="attachment_9804" align="alignnone" width="1014"] High Early Cash Value Tabular Values[/caption]

High Early Cash Value Tabular Values[/caption]An Interesting Idea

A great alternative to term insurance if you have the cash flow. From our table above you will see that compared to a 10 year term, the cost of HECV is 0 after 9 years.

So if you are considering term insurance and cash flow is not an issue for you, you should look into HECV as an alternative.

Contact us to compare your current term policy to HECV.

Final Thoughts

Since 1851, Massachusetts Mutual Life Insurance Company has been providing consumers throughout the United States with life insurance coverage.

Although the company sells many types of policies, its Whole Life Legacy High Early Cash Value remains one of the best. From the benefits to the flexibility, there is a lot to like both now and in the future. It is one of our favorite whole life insurance products in the market right now.

News Flash!

MassMutual just released a completely new online application experience. No more paper application!

One more reason we like them

Check out the all new: Coverpath by MassMutual Review

Contact us to get a quote for HECV!