Updated January 5, 2025

Whole Life Insurance Dividend Rate History Chart

Whole life insurance historical performance and charts with expert analysis. We have an updated list of Whole Life Insurance Dividend History.

We also go back to give you average rates for the past 5, 10, 15, and 20 years. This can help you understand where each company ranks historically. We use all this data to get our seven best whole life companies every year.

The next table is only relevant for participating policies. Participating policies pay a dividend, and it is a huge part of the performance of the cash value.

Get A High Dividend Paying Whole Life

We will get you the best dividend

Get A Quick QuoteWhat is participating policy?

A participating policy is one that pays dividends to the policyholder. The most competitive participating policies are from mutual companies.The reason mutual companies pay dividends is that they do not have stockholders. So the only dividend they pay is to policyholders.

Why is the history of whole life dividends important?

We can take the highest dividend companies from today and pick the best one. However, we prefer to use today's rates and historical rates because it will give us a better idea of how the dividend will perform in the future.Even though past performance doesn't indicate future performance.

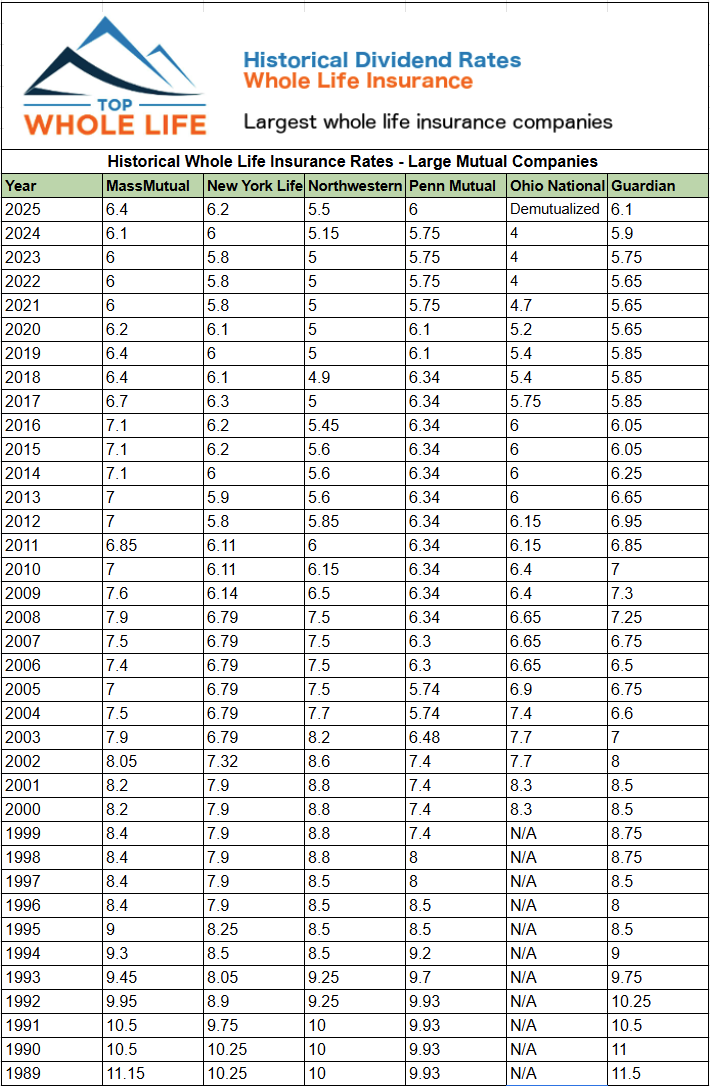

We took the following Historical Whole Life Table that has incredible data, and updated the numbers:

We will keep updating it, and feel free to contact us, so we add a company.

| Year | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ameritas | TBD | 5.0 | 4.60 | 4.60 | 4.75 | 5.0 | 5.0 | 5.0 | 5.0 | 5.15 | 5.25 | 5.25 |

| Guardian | 6.10 | 5.9 | 5.75 | 5.65 | 5.65 | 5.65 | 5.85 | 5.85 | 5.85 | 6.05 | 6.05 | 6.25 |

| John Hancock | NA | NA | 4.25 | 4.25 | 4.25 | 4.75 | 5.0 | 5.0 | 5.15 | 5.15 | 5.3 | 5.55 |

| MassMutual | 6.40 | 6.1 | 6.0 | 6.0 | 6.0 | 6.2 | 6.4 | 6.4 | 6.7 | 7.1 | 7.1 | 7.1 |

| MetLife | NA | NA | NA | NA | NA | 4.7 | 4.7 | 4.7 | 4.7 | 5 | 5.1 | 5.1 |

| New England Financial (Brighthouse Financial) | NA | NA | NA | NA | 4.65 | 4.65 | 4.65 | 4.65 | 5 | 5 | 5 | |

| New York Life | 6.20 | 6.0 | 5.8 | 5.8 | 5.80 | 6.1 | 6.0 | 6.1 | 6.3 | 6.2 | 6.2 | 6 |

| Northwestern Mutual | 5.50 | 5.15 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 4.9 | 5 | 5.45 | 5.6 | 5.6 |

| Penn Mutual | 6.00 | 5.75 | 5.75 | 5.75 | 5.75 | 6.1 | 6.1 | 6.34 | 6.34 | 6.34 | 6.34 | 6.34 |

| Ohio National | NA | 4.0 | 4.0 | 4.0 | 4.7 | 5.2 | 5.4 | 5.4 | 5.75 | 6 | 6 | 6 |

| Foresters | NA | NA | NA | NA | NA | 5.8 | 6.23 | 6.23 | 6.58 | 6.83 | 6.65 | 6.42 |

Whole Life Insurance Dividend Rates for 2025

2025 announcements for whole life dividend rates across the insurance industry have been released. To keep up with high yield savings account rates and the high Fed interest rate, the industry has had to increase dividends to continue to be attractive. The result is that dividend rates across the major whole life insurance firms are up between 20 basis points and 35 basis points. This increase in dividend yield while savings account rates are dropping should result in a positive year for Whole Life insurance, in general.| MassMutual | 6.40 |

| New York Life | 6.20 |

| Penn Mutual | 6.00 |

| Guardian | 6.10 |

| Northwestern Mutual | 5.50 |

| Foresters | NA |

Whole Life Insurance Dividend Rates for 2024

2024 rates versus high yields savings accounts in early 2024 were just not attractive. Interest in whole life insurance for yield was challenged by risk free 5%+ money markets making whole life dividends look less attractive (Of course that is short term thinking on the part of the consumer).| MassMutual | 6.10 |

| New York Life | 6.00 |

| Penn Mutual | 5.75 |

| Guardian | 5.90 |

| Northwestern Mutual | 5.15 |

| Foresters | NA |

Whole Life Insurance Dividend Rates for 2023

We are starting to get results on the 2023 announcements for dividends. All the dividends from the large mutual companies seem to have remained steady. As they come in we will update the list.| MassMutual | 6.0 |

| New York Life | 5.8 |

| Penn Mutual | 5.75 |

| Guardian | 5.75 |

| Northwestern Mutual | 5.0 |

| Foresters | NA |

Whole Life Insurance Dividend Rates for 2022

Following are the dividend for participating policies in 2022.| MassMutual | 6.0 |

| Foresters | 5.8 |

| New York Life | 5.8 |

| Penn Mutual | 5.75 |

| Guardian | 5.65 |

| Northwestern Mutual | 5.0 |

Whole Life Insurance Dividend Rates for 2021

We are starting to get results on the 2021 announcements for dividends. As they come in we will update the list.| MassMutual | 6.0 |

| Foresters* | 5.8 |

| New York Life | 5.8 |

| Penn Mutual | 5.75 |

| Guardian | 5.65 |

| Northwestern Mutual | 5.0 |

| Ohio National | 4.7 |

*Foresters always announced dividend for the previous year. So their schedule is behind all other companies.

Whole Life Insurance Dividend Rates for 2020

At the end of the year, most companies start announcing their dividend rates for next year. Here are the whole life dividend rates for 2020 ahead of time. As we become aware of more, we will list them out.| MassMutual | 6.2 |

| Penn Mutual | 6.1 |

| New York Life | 6.1 |

| Foresters* | 5.8 |

| Guardian | 5.65 |

| Ohio National | 5.2 |

| Northwestern Mutual | 5.0 |

*Foresters always announced dividend for the previous year. So their schedule is behind all other companies.

Whole Life Insurance Dividend Rates for 2019

Here is the full 2019 whole life dividend list from the largest and most important carriers.| MassMutual | 6.4 |

| Foresters | 6.23 |

| Penn Mutual | 6.1 |

| New York Life | 6.0 |

| Guardian | 5.85 |

| Ohio National | 5.4 |

| Northwestern Mutual | 5.0 |

Whole Life Insurance Dividend Rankings for 2018

Here is a quick summary of the dividend rate from some of the largest/best companies that offer whole life insurance.| Forester | 6.58 |

| MassMutual | 6.4 |

| Penn Mutual | 6.34 |

| New York Life | 6.2 |

| Guardian | 5.85 |

| Ohio National | 5.4 |

| Northwestern Mutual | 4.9 |

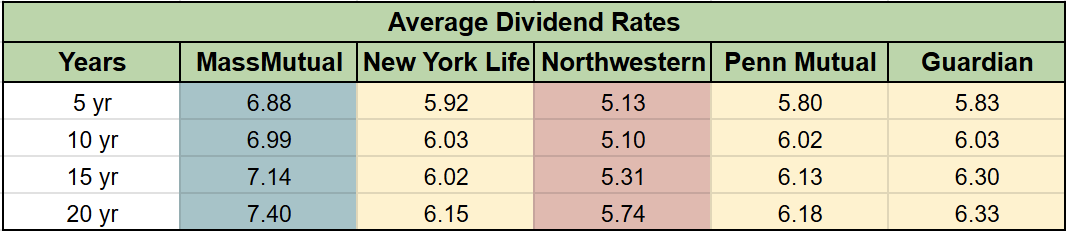

Whole Life Insurance Dividend Rates Historical Averages

It can be hard to understand all the data, so we created a simpler way for you to look at the information. We have the 10 year and the 15 year averages for the whole life dividends.

| Company Name | 10 yr average (2025) | 15 Yr Average (2025) |

|---|---|---|

| General American | N/A | N/A |

| Guardian | 5.83 | 6.07 |

| Manulife | N/A | N/A |

| Mass Mutual | 6.99 | 7.14 |

| MetLife | N/A | N/A |

| New England Financial | N/A | N/A |

| New York Life | 6.03 | 6.02 |

| Northwestern Mutual | 5.10 | 5.31 |

| Penn Mutual | 6.02 | 6.13 |

| Phoenix | N/A | N/A |

| Sun Life | N/A | N/A |

| Ohio National | N/A | N/A |

| Foresters | N/A | N/A |

Final Opinion

We used the previous tables, and in addition, we used the dividend analysis found at InsuranceProBlog to add more validation to our results (their report).Our rating for current whole life dividend strength:

#1 MassMutual

MassMutual has increased their dividend rate for 2025 to 6.4%. Also, we ran a historical analysis and found:

- Mass Mutual 15 year average dividend rate of 7.14% which also ranks at #1

- Mass Mutual 10 year average dividend rate of 6.99% which also ranks at #1

#2 Penn Mutual

Penn Mutual has a current dividend of 6.00% (a nice increase from 2024), which ranks #4 for 2025. Also, Penn has always had a very stable dividend, even in a decreasing interest rate environment. They use direct recognition on their whole life contracts and their policies when illustrated are very attractive for long term cash value growth.

- Penn Mutual 15 year average dividend rate of 6.13% which ranks it #2

- Penn Mutual 10 year average dividend rate of 6.02% which ranks it #3

New York Life is one of the best mutual companies out there. They have a fantastic track record and their dividend is stellar. In addition, their ratings are second to none. With a 2025 dividend rate of 6.2% New York Life is a great option.

- New York Live Whole Life 15 year average dividend rate of 6.02% which ranks it #4

- New York Live Whole Life 10 year average dividend rate of 6.03% which ranks it #2

Do you have a dividend-paying whole life that you would like us to add?

The dividend rate is not everything. However, it helps grow cash value in whole life.

To learn a little bit more about whole life insurance you should read:

Whole Life Insurance For Dummies

Overfunding Whole Life Insurance

How Much Does Whole Life Cost?

Comparing Insurers: The Mutual and Stock Difference?