Foresters Financial is one of the top names in the life insurance industry, due in large part to its long history of success.Foresters are part of The Independent Order of Foresters (IOF), a fraternal organization that looks to serve all of their policyholders with amazing benefits.For more than 140 years, the company has been providing life insurance coverage to working families throughout the country. It's also known for its selection of retirement and savings solutions, all of which are an excellent addition to a whole life insurance policy.[caption id="attachment_8310" align="alignnone" width="300"] Foresters Logo[/caption]Before we get into the finer details of this review, let's examine an excerpt about the company as shared on our "Top 7 Whole Life Insurance Companies For Cash Value" webpage:

Foresters Logo[/caption]Before we get into the finer details of this review, let's examine an excerpt about the company as shared on our "Top 7 Whole Life Insurance Companies For Cash Value" webpage:

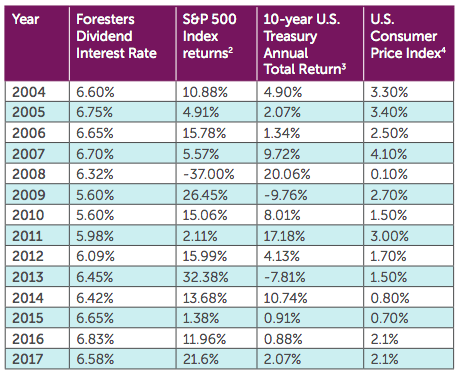

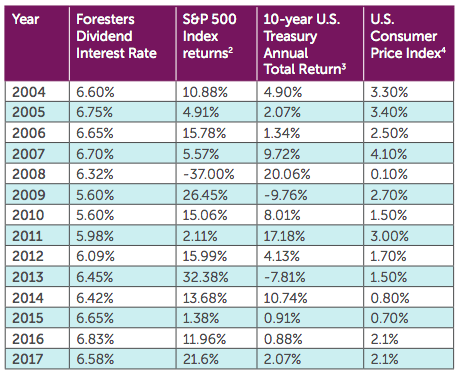

Forsters's dividend is one the highest whole life dividend average over the last few years, and it's definitely in the top tier of participating whole life policies.

Forsters's dividend is one the highest whole life dividend average over the last few years, and it's definitely in the top tier of participating whole life policies.

Foresters Logo[/caption]Before we get into the finer details of this review, let's examine an excerpt about the company as shared on our "Top 7 Whole Life Insurance Companies For Cash Value" webpage:

Foresters Logo[/caption]Before we get into the finer details of this review, let's examine an excerpt about the company as shared on our "Top 7 Whole Life Insurance Companies For Cash Value" webpage:"Foresters is a fraternal insurer that is growing in popularity. They have a fantastic list of products and benefits in their policies. However for cash value accumulation, their whole life insurance is not a good choice. ... the living benefits that come with their whole life are second to none."Like most companies, there is a lot to like about Foresters, as well as some things you'll need to think about before making a purchase.

The Good

Financials

Foresters are rated as "A" for Excellent by A.M. Best (source). An A rate by A.M. should give anyone considering them as a choice peace of mind.Also, they have significant assets under management of $44 billion (CDN):"Foresters has shared its financial strength with its members3 and their communities for over 140 years and is today in a strong financial position with total funds under management of $44 billion (CDN) and total assets of $13.4 billion (CDN) as of December 31, 2016."

Cash Value Accumulation

Foresters whole life ranks as one of the best in the market in a properly overfunded whole life insurance policy. These policies are great to build cash value quickly and are one of the main reasons why people chose to buy whole life insurance as an investment.Member Benefits

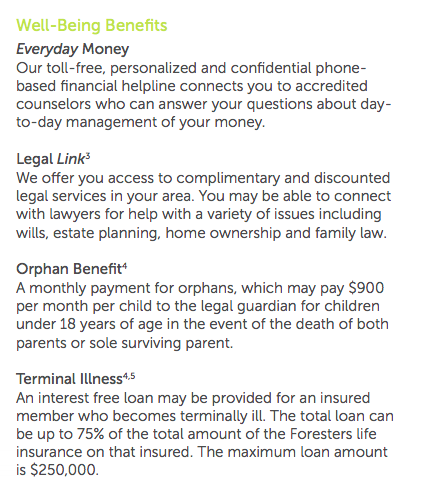

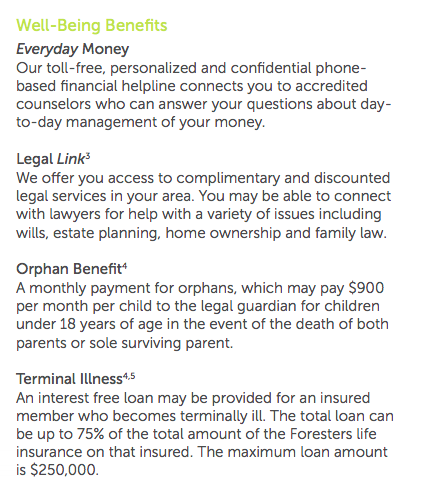

When it comes to selection and benefits, Foresters is second to none. It doesn't matter what you're looking for in a whole life insurance policy, there's a good chance you'll find it with this company.With a devotion to enhancing family well-being, Foresters gives you the feeling that you're the only customer that matters - and that's a good thing.By purchasing a whole life, or any other policy, you will gain access to their member benefits.These benefits include things like:

Competitive Whole Life Dividend Average

With a 6.36% whole life dividend average over the past 10 years, policyholders can feel good about their ability to get something extra in return for their investment. Foresters reported a 6.23% dividend in 2018. Forsters's dividend is one the highest whole life dividend average over the last few years, and it's definitely in the top tier of participating whole life policies.

Forsters's dividend is one the highest whole life dividend average over the last few years, and it's definitely in the top tier of participating whole life policies.Amazing Accelerated Benefits Rider

Riders are features that can be added to a policy. Accelerated Benefits Rider will give you the ability to access your death benefit before you die. Most companies have this rider. However, not many have it like Foresters. Most companies only accelerate on a terminal illness. But Foresters can "accelerate" the death benefit in all of the following circumstances:Chronic Illness

A physician diagnoses a chronic illness as permanent, unable to perform at least 2 of the 6 activities of daily living for at least 90 days. It is also defined as severe cognitive impairment.Critical Illness

Critical illness covers many illnesses like:- Life-threatening cancer

- Myocardial infarction (heart attack)

- Stroke

- Advanced Alzheimer's Disease (before age 75)

- End-stage renal failure

- Major organ failure

- ALS

Terminal Illness

Non-correctable illness or physical condition which is reasonably expected to result in death within 12 months of diagnosis.Non-Medical Whole Life

Foresters offers a non-medical whole life insurance option. If you do not want to go through the hassle or the pain of doing blood work, then you can get a non-medical whole life. It is as simple as completing a questionnaire. The approval process also takes less.It should take less than four weeks to get a result.Great Customer Service

Some life insurance companies care about nothing more than selling you a policy. Foresters take a different approach, ensuring that the customer always comes first.Here's an excerpt from the company's website:"Today, more than three million customers and members in the United States, Canada and the United Kingdom benefit from the foundation of experience, expertise and reliability we have built over two centuries. During this time, we have remained steadfast in our commitment to help improve family well-being and, each year, we invest millions to support causes that enrich the lives of families and communities."Experience, expertise, and reliability. That's what you get with Foresters. And that's what most consumers are looking for.