Infinite Banking Review for 2019

In this updated article, we dive deep into the Infinite Banking Concept. We will review what Infinite Banking is and if this concept still works in 2019's economic environment.Becoming Your Own Banker by Nelson Nash is the book where he teaches about the Infinite Banking Concept. Nash's book educated us on strategies and tactics to create your own "banking system." Nash's book will help you can take 100% control of your money and stop paying it to other banks or institutions.

What You Will Discover In This Article?

This article will provide summaries and review Nelson Nash's book - Becoming Your Own Banker "How to unlock the infinite banking concepts." Becoming Your Own Banker was a copy written in 2000, and the fifth edition published in 2008.This updated article aims to review the validity of Nash's book in today's times. We will review Nashe's clams that you can use dividend-paying whole life insurance as an alternative banking system.

The concept seems to have worked years ago in a much different economic environment, but should we still be interested in whole life insurance today?

One could argue that today's economic climate is very similar to what they were back when this book was republished in 2008? We will make sure that you have the most relevant and up to date review on this concept.

This article will give you an excellent overview of Nash's book; however, it does not cover every detail that Nash's communicates.

If this concept interests you, we would recommend continuing your research and review the full book. We link to this book and many other related books you may find useful in your research.

Becoming Your Own Banker

The idea of "becoming your own banker" is one that intrigues many people.The approach that you take doesn't have to be precisely the same as the next person. You shouldn't expect this to be the case.

However, you do need a strategy that is proven to work. After all, this is your money we're talking about. You don't want to make uninformed decisions that could lead you down the wrong path.

If you want to take control of your money, this is where the Infinite Banking Concept comes into play.

Here's the tagline from the company's official website: "The Nelson Nash Institute exists to educate and inspire individuals to take control of their financial lives by reclaiming the banking function from outsiders."

On the surface, this sounds easy enough. But once again, if you genuinely want to make progress, you need to dig deeper and know what steps you must take (and when to take them).

Most of the concepts in, Become Your Own Banker book outline the exact step you need.

Also, other books recommend the same strategy like Bank On Yourself.

Related Article: Bank On Yourself Review.

Reclaiming the Banking Function from Outsiders

Reclaiming the Banking process from strangers is what the Infinite Banking Concept is about.So how do you accomplish this? This answer lies in understanding banking, a business the author Nash says most know next to nothing about.

Nash explains in his book that "Banking is the most important business in the world!" Without banking, everything would shut down.

So why would everything shut down?

Everything would shut down because money must be held somewhere so it can be traded between people to create value and meet needs. The crucial part of the banking system that Nash explains is that after the money has transferred hands and created value at some point that money ends up back in the banking system.

Money parked in an account is the foundation of the Infinite Banking Concept.

Nash digs deep into how a bank is not your only option for parking your money and how you can take control of this process. You must be open to the imagination of something different than the normal.

Think like a Business (The Grocery Store Example)

To understand the Infinite Banking Concept, you will want to place your mindset as a business owner where you are both CONSUMER and SELLER of your products.Nash uses an example of opening up your own grocery store...

He explained that we all need groceries. As an owner of a grocery store, you are both the consumer of your products and also a seller. Many complexities arise when you are both the seller looking to make a profit and also a consumer of a product you own.

But as a business owner, your objective is to be profitable right?

Well, to be profitable, it will require a few key things:

- Extensive Funding to capitalize on the business.

- Excellent management skills

- Not stealing from yourself.

You Finance Everything (The Problem)

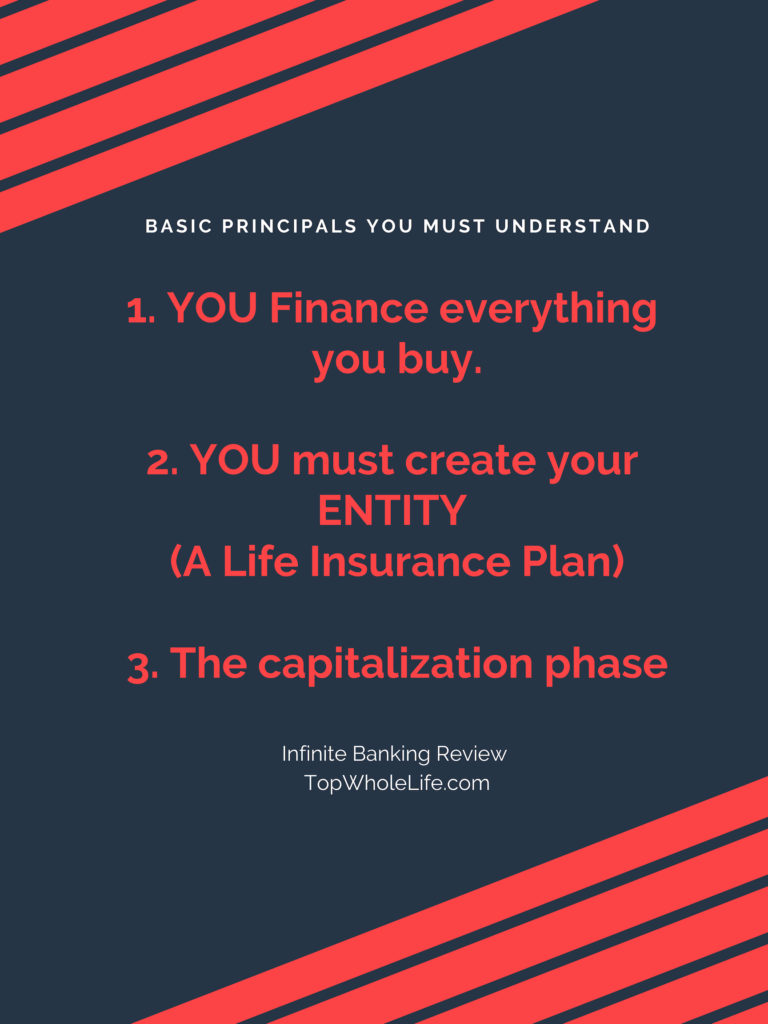

A significant problem that Nash highlights is that an average person will spend a large portion of their after-tax dollars towards interest.In many cases, 30% of you're after-tax dollars are being eaten up by interest payments from your lifestyle.

A straightforward principle that Nash explains is that you finance everything you buy. He states that you either pay interest payments to someone else or you give up the interest you could have earned by paying for something in cash (opportunity cost).

- You pay interest to someone else.

- You pay cash and lose potential interest earned.

How to Create Your Own Bank?

The information we have covered thus far has been a high-level overview of the concept. Let us clarify what is being used actually to take the place of the current banking system?The product used for this is called Whole Life Insurance, specifically dividend-paying whole life insurance.

A Whole Life Insurance policies allow you to become both the consumer and seller of your own grocery store just like in the example we used at the beginning of this article.

Let's go into how...

Let's go into how...The Design and How It's Engineered?

Having the right designer for your infinite banking policy is very important.A good analogy is to think of your policy as like to build your home.

To ensure that you will have a strong, efficient, quality, home to live in, you would want an expert engineer to design the plans first. Then the next step is to have your builders follow the plan. Once the home is built, it is then up to you to maintain into the future.

In the life insurance space, actuaries are the engineers for your policy and life insurance agents are the builders. You want to make sure that you have picked an excellent stable mutual company for your infinite banking policy. Then you need to interview your "builder" to make sure he/she can build you a plan that is tailored to your needs.

You are the Owner

As we are continuing with our home building correlation. You will own the home that is being built, the (Banking Policy). As the designated owner, you have all the control of your policy.You can decide to make changes as you see fit. No one is above your control when it comes to your policy.

Now you are starting to take steps in building your own bank.

Your Obligation

You have a financial obligation to your "home." For example, we all have to pay property taxes on a property regardless if you have a mortgage on your property or not.Think of these annual property taxes as the premiums you will need to pay each year into your policy. The premiums that you pay each year into your Infinite Banking policy will be used to capitalize your bank, also called the cash value account.

Building your own bank is not a get rich quick scheme, and it may take several years of discipline.

Your Profit

Your profit is the DIVIDEND!Dividends are not guaranteed, but the engineers (actuaries) stake their careers on predicting the companies profit margins. Once a dividend has been declared, the value is then guaranteed. It can never lose value.

Taking Back Control of Your Money

Nash explains if nothing else you need to remember one thing about the Infinite Banking Concept. With a traditional bank, you are relying on somebody else to provide you with the funds you need.With this strategy, you are using your own money to reach your financial goals. This alone is why it's something you should consider.

Just the same as any other financial strategy; the Infinite Banking Concept is not the right choice for everyone. It takes a lot of knowledge, dedication, and financial discipline to make it work.

If you've come to realize that you want to be your own banker, this is one of the best ways to turn this dream into a reality. In the end, you gain more control over your finances.

How Do You Get Started?

First, you will need to believe that this what you want to do honestly.You will need to use that desire to focus as you start on your journey of distancing yourself from the traditional banking model. This is the only way you can truly take control of your money 100%.

To get started:

- You will need to capitalize your bank.

The most important piece of starting your infinite bank is patients. It will take several years to get your bank started, but over your lifetime it will be well worth it!

Pro tip: Connect with a life insurance expert who understands infinite banking concepts. Then you will want to start ASAP because the clock is ticking and time will only improve your results.

Pro tip: Connect with a life insurance expert who understands infinite banking concepts. Then you will want to start ASAP because the clock is ticking and time will only improve your results.Common Issues with Infinite Banking

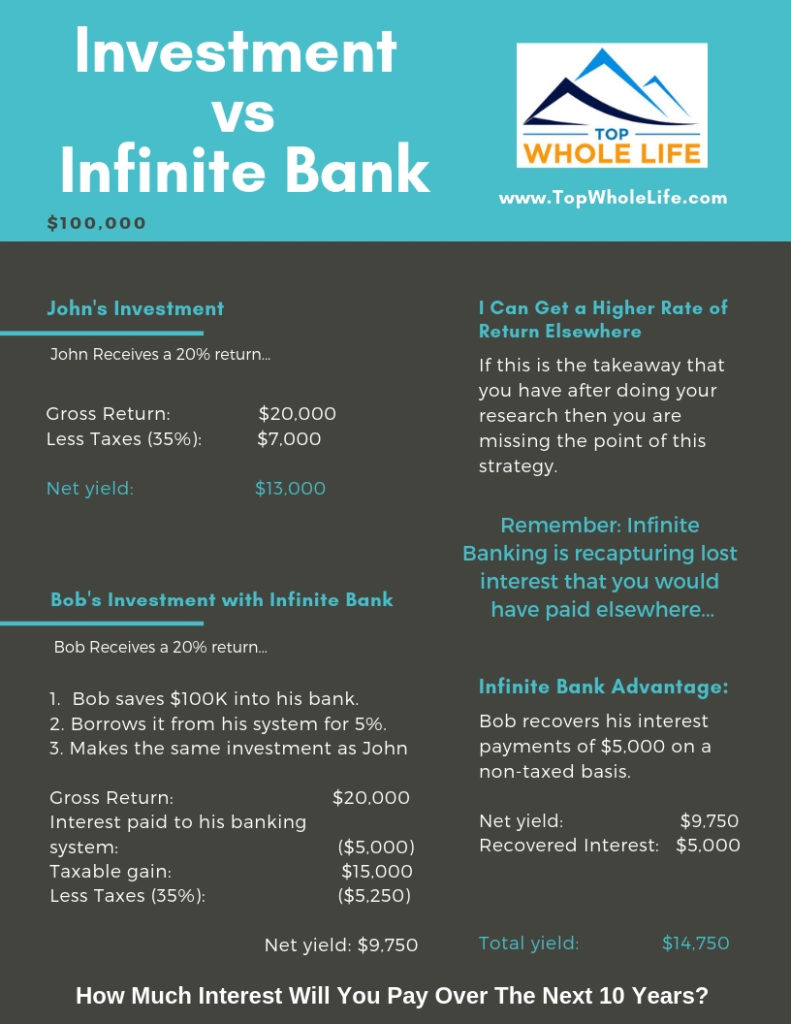

I Can Get a Higher Rate of Return Elsewhere ( Myth or Reality?)

This rationale most commonly comes up as someone is first beginning their research into this topic. You may be thinking well...I can get a higher rate of return if I invest in XYZ.If this is your takeaway, then you are missing the point of this strategy.

Infinite Banking is not trying to win the case on what the yield is. The argument that Nash has made is how you finance anything that you buy. Here is an example:

John invests $100,000 and receives a 20% return on investment.

Gross Return: $20,000

Less Taxes (35%): $7,000

Net yield: $13,000

Bob invests $100,000 into his Infinite Bank Policy

(Then borrows it from his system for 5% and then makes the same investment as John)

Gross Return: $20,000

Less interest paid to his banking system: ($5,000)

Taxable gain: $15,000

Less Taxes (35%): ($5,250)

Net yield: $9,750

But for Bob, he recovers his interest payments of $5,000 on a non-taxed basis.

Net return from the investment: $9,750

Net return from his banking system: $5,000

Total return: $14,750

Infinite Banking Does Recapture Interest (Check It Out)

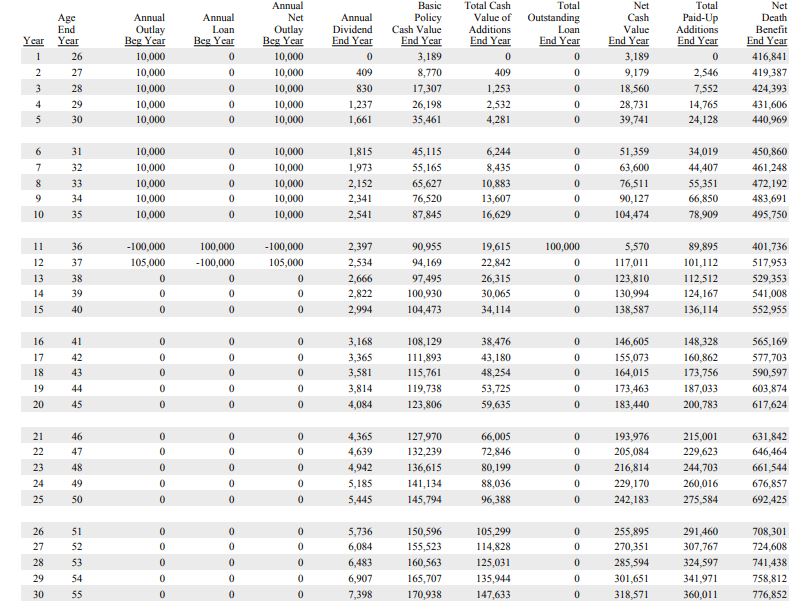

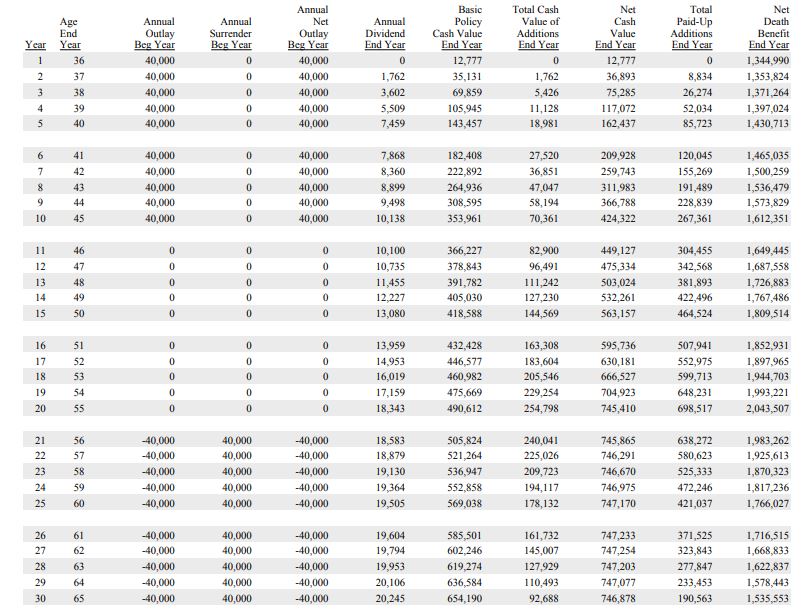

Below is a perfect illustration example of Bob's use of his Infinite Bank.At age 36, he decided to make the same $100,000 investment that John had made.

Bob loans the funds from his banking system at 5% and pays the $100,000 with interest back the following year.

During this time, not only did Bob make the same return as John. Bob recovered the interest and also had significant life insurance coverage as a back up in case something were to happen to him unexpectedly.

What If I Cannot Be Approved For Insurance?

Not being approved for life insurance can happen and is an excellent question to ask.It is essential to understand that your infinite bank a life insurance policy. So you need to be healthy to be approved.

If you are not in excellent health, your application could be declined, or it is given a "rating" where the premium cost may not be affordable.

For someone who is looking to design their own infinite bank, fortunately, WHO is insured is not the challenge.

For example, if you are in your 60's and cannot be insured anymore, you could consider funding a policy on a younger family member.

By funding a policy on a young family member, this could allow you to have the same result. You will still have all the benefits of the infinite bank without the need to be approved for life insurance.

Example:

Dave age 45 wants to start up an infinite bank; however, he has had a history of heart issues and has had an open heart transplant in the past five years. He speaks with his wife Jane who is age 35 and in excellent health.

They decided to fund a policy on her life for $40,000 per year. Dave will become the owner of the policy, and Jane is the insured.

As the owner, Dave holds all the control and can do as he pleases with the policy. Dave can then decided to take money out of the policy for anything he would like.

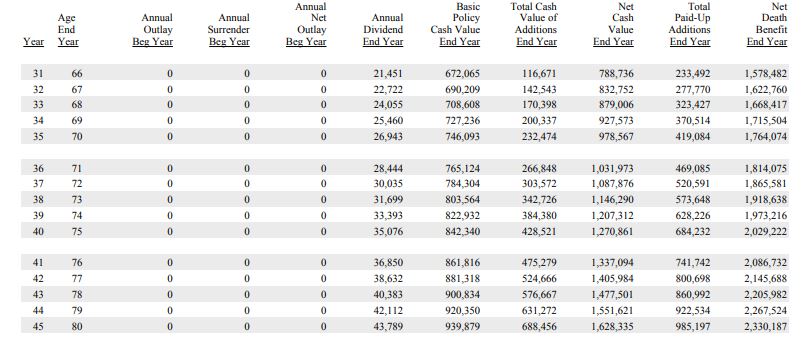

In the below example, Dave will withdraw an income stream at his age 70.

You can see in the below illustration that Dave takes $40,000 / year for 10 years (Tax-Free).

In this scenario, let's assume that Dave passes at age 80, now his wife becomes the owner of the policy.

Although she does not receive a death benefit at her age 70, she has $978K dollars in her bank, which she can also draw off of for additional income (Tax-Free).

At her time of passing the death benefit would transfer to her beneficiaries (Tax-Free).

As you can see, the infinite banking system is quite efficient from a tax perspective.

Also, it will help you to create multi-generational wealth. However, you need to manage your policy wisely.

7 Thought-Provoking Questions

- There are only two ways income is produced.

- People at work

- Money at work

- If you knew at the time when you needed the passive income that you would get back everything that you paid into a system, tax-free, would you object to putting more money into it?

- When you are paid for the work that you do, you put all of it into "someone else's bank" and then write checks from that account to buy things in life. If you owned a banking system, wouldn't you want to put all your money into your bank?

- When the government creates a problem (excessive taxation) and then grants you an exception to the problem (any tax-qualified plan) aren't you suspicious that you are being manipulated? If the government wanted to give you a break all they would need to do is cut out taxes. Do you think they want to do that?

- Wealth must reside somewhere. Where would you like it?

- You finance everything you buy. You either pay interest to someone else, or you give up the interest you could have earned by paying cash. No exceptions.

- Your need for finance, during your lifetime, exceeds your need for life insurance protection.

Important Definitions

Banking - The business of a bank, originally restricted to money changing and now devoted to taking money on deposit subject to check or draft, loaning money and credit, and any other associated form of general dealing in money or credit.Capital - Accumulated possessions calculated to bring in income: accumulated assets, resources, sources of strength, or advantages utilized to aid in accomplishing an end or furthering a pursuit.

Capitalization Period - The time required to actually create a pool of money with which to start your own banking system.

Cash Value - The cash value on any policy anniversary to which premiums have been paid is: the then-present value of future benefits provided by the policy; less: the then-present value factors for each year remaining in the premium payment period. The cash value at any time during the policy year is the value on the date to which premiums have been paid, adjusted to the date of surrender.

Contingency Fund - The amount that an insurance company retains as surplus after paying death claims, expenses, and dividends to policyholders. This is an essential measure of the strength of a particular company and an indication of its ability to pay dividends in the future.

Dividends - The earnings of a life insurance policy, based on the company's mortality, expenses, and investment experience during the year. When dividends are used to buy additional paid-up insurance at no cost the owner the cash value of the additions becomes guaranteed at that time. This value will increase with time but cannot decrease.

Finance - The system that includes the circulation of money, the granting of credit, the making of investments, and the provision of banking facilities. (You finance everything you buy - you either pay interest to others, or you give up interest that you could have earned elsewhere.)

Interest - The price paid for borrowing money generally expressed as a percentage of the amount borrowed paid in one year.

Recommended Reading

Becoming Your Own Banker: Unlock the Infinite Banking Conceptsby Infinite Banking Concepts

Rich Dad, Poor Dad

by Robert Kiyosaki

The Cashflow Quadrant

by Robert Kiyosaki

A History of Money & Banking in the United States

by Murray Rothbard

Age of Inflation

by Hans F. Sennholz

Economics for Real People

by Gene Callahan

Economics in One Lesson

by Henry Hazlitt

The Case Against the Fed

by Murray Rothbard

The End of Money and the Struggle for Financial Privacy

by Richard W. Rahn

The Mystery of Capital

by Hernando de Soto

The Transfer Society

by David N. Laband and Geroge C. McClintock

The Demise of the Dollar...and Why It's Great For Your Investments

by Addison Wiggin

The Millionaire Next Door

by Thomas Stanley and William Danko

Conclusion

Nelson Nash covers excellent information in his book Becoming Your Own Banker. As we have seen in our above review, the Infinite Banking Concept is at its core an exercise in changing your beliefs.So many people overlook how they are participating in programs and systems that the government has so "kindly" provided to us. Are these programs really for our best interest?

We participate and deposit our hard-earned money into banks and do not think beyond the surface level as to WHY the governments provide us with an easy solution.

The Infinite Bank Concept re-frames the idea that all your money needs to go into someone else hands. Nash's book identifies where banks and institutions are making their money gives you actionable steps to take back control of your money. As noted in our review, the process of creating your own bank is far from simple. To become your own personal banker will take discipline.

If you genuinely want to take control of your own money and stop paying interest to someone else you will need to commit and begin systematically building your own bank. Once you fund your bank, you can escape the financial norm and break free into financial independence.

If you have made it to this part of the review, please make sure to continue your research and request a free quote. Our team would be happy to help you as you begin to build your own bank.

Disclaimer

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. TopWholeLife.com is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.Related Reading

IBC Founder Nelson Nash ObituaryWhole Life For Dummies

Top 7 Whole Life Insurance Companies For Cash Value