Updated July 27th, 2022

In the following article, we will review Liberty Mutual Whole Life Insurance.However, if all you would like is a Liberty Mutual whole life insurance quote without jumping hoops, use our quoter here: Liberty Mutual Whole Life Quote.

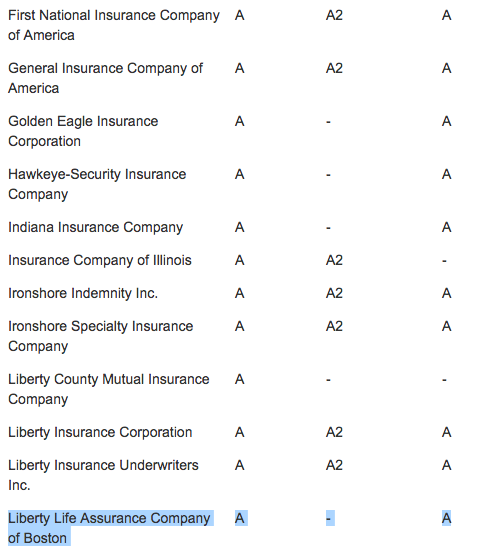

Liberty Mutual is a really large company. They have different branches that deal with different insurance types. Liberty Life Assurance Company of Boston distributes the life insurance.

However, Liberty Life Assurance Company of Boston was acquired by Lincoln Financial Group.

"Effective May 1, 2018, Liberty Life Assurance Company of Boston ("Liberty Life") became part of Lincoln Financial Group upon completion of a purchase and sale agreement between Liberty Mutual and The Lincoln National Life Insurance Company (a Lincoln Financial Group company)."

Liberty Mutual is one of the companies in our selected online whole life insurance quotes.

Company Overview

Liberty Mutual is one of the largest insurers in the U.S., Currently ranked #75 on the Fortune 500 list. Liberty Mutual has been around since 1912. They offer a wide range of products, from life insurance, disability insurance, and car insurance, including whole life insurance.Ratings

- A.M. Best Company rating: 'A.'

- Standard and Poor's rating: 'A' (Strong)

If you want more information on the Ratings for Liberty Mutual, go here; note that they have a very long list of companies so it can be a bit confusing: All Of Liberty Mutual Ratings

Wide Range of Whole Life Insurance Products

Whole life insurance offers guaranteed premiums that never go up in price and a guaranteed death benefit.

Here is a list of Liberty's whole life products. Death Benefits start from $250,000 up if you are under age 65. From age 66, your death benefit could be as low as $15,000.

The main difference between these products is how long you pay for them:

- Liberty Series Whole LifeSM: Payments until age 100. This is the most common whole life insurance, and it's the best product to get the maximum death benefit but the worst for cash value.

- Liberty Series Life paid up at 65SM: Payments last until age 65. Then you will keep your policy forever without any more premiums. This product may be a good fit if you want to use your whole life cash value for retirement purposes. It has the right balance between cash and death benefit.

- Liberty Series 20-year Payment LifeSM : Premiums for 20 years, then you keep our insurance forever. This product is better for cash value accumulation than a death benefit and s commonly used if the insured is a child.

- Liberty Series Extra Value LifeSM : A mix between whole life insurance and term life insurance that gives you more insurance for a lower price. You still have the benefits of whole life, but the term increases the death benefit.

- Liberty Series Estate Maximizer Next Generation ® 1, 2: Whole life insurance that you buy with just one payment, then you keep the insurance forever. It's mainly used for estate planning or transferring money from generation to generation.

Most companies have a very similar product list. Depending on what your goals are, one of these products may fit your scenario better.

Simple or Full Underwriting

You can elect to do a simplified issued or fully underwritten policy with all Liberty Mutual's whole life products. A simplified issue means you will be asked a few questions and get an answer in 10 minutes.So it can be a good option if you are in a hurry to get your whole life. Also, you can elect to do an e-application, saving you time.

Riders

Here are the available riders or features that you can add to your whole life:- Children's protection rider - This rider gives you the chance to add insurance on your kids.

- Disability waiver of premium - You will not have to pay premiums if you are totally disabled for 6 months.

- Accidental death & dismemberment - You can add more insurance in case of accidental death.

- Liberty's Living Benefit - If you are terminally ill or can't perform six of the activities of daily living, then you will be able to access up to 90% of the death benefit.

- Payor death & disability - You can protect the payor of the life insurance (if it is someone else than the insured).

- Guaranteed insurability option - This will allow you to add more death benefits without going through underwriting.

Liberty Mutual Whole Life Insurance Review

Pros

Liberty Mutual is a strong company and a recognized name. Great for a pure death benefit that lasts forever. However, if you want death benefit only for an affordable price, Liberty's whole life is a great choice. Additionally, the simplified issue feature is an excellent choice for people who do not want to undergo full medical and underwriting.Cons

Very low cash value accumulation. Liberty mutual whole life insurance does very poorly compared to their immediate competitors looking for a savings vehicle.Also, the death benefit in Liberty Mutual's whole life doesn't increase. In general, the performance of all of their whole life insurance products is sub-par.

Term Life Insurance Products

Liberty Mutual also offers term life insurance products.Term life gives you:

- Guaranteed Level Premiums

- Coverage For Certain Years (10, 20, 30 years)

- Affordable Pricing

- Options To Convert To Whole Life

Liberty Mutual's term life product is called: Liberty Series Passport Term.

You can get a simplified issue policy, which means you will answer a few questions that will take 5-10 minutes, and if all goes well, you can be approved immediately. However, if your health isn't the best, they may make you do additional underwriting.

Passport Term is available in Terms of 10, 15, 20, and 30 years.

Liberty Mutual Whole Life Insurance Quotes

Getting a quote for a whole life with Liberty Mutual will be just as challenging and time-consuming as with any company. Here are the steps:- Fill out a contact form online

- Give all of your information to an agent that will call you constantly

- Wait until an agent calls you and you speak to him

- Request a quote from an agent

- Wait to receive all the quotes

- Try to figure out what all of the different numbers mean

However, you could get a quote from Liberty Mutual with us in seconds.

Alternative Options

As we already mentioned, if you want to build Cash Value, Liberty Mutual probably shouldn't be your go-to. However, here are two good options that you could consider: Penn Mutual and MassMutual.These 2 companies are just as respected and stable with great ratings, but you will accumulate significantly more cash value. They rank very highly on our cash value growth rankings.