Whole Life Insurance For Income

If you are reading this, then probably you have heard of using whole life insurance for retirement income. In this article, we will explore why whole life insurance can be an interesting alternative for income.Cash Value

Clearly, whole life insurance rates are much more expensive than term insurance, so there has to be a great benefit to whole life.Before we get started with income, we need to understand cash value. Cash value is probably the #1 reason people buy whole life insurance.

Cash value is a feature that all whole life insurance policies have. Imagine cash value like a savings account that grows inside of a whole life policy.

This cash value is your money that can be used for any purpose. Also, it has excellent tax benefits as it grows tax-deferred.

But the reality is that cash value is only useful if you use it for something, as income or take loans for other purposes. Many interesting books have strategies on how to use cash value like Bank On Yourself and Infinite Banking.

Taking Money Out Of A Whole Life

The cash value that we mentioned that grows inside of a whole life can be taken out for any purpose.Before we understand whole life as a retirement income source, we need to understand what ways you can take money out of a policy. There are many ways to take out cash from a whole life policy. The following is a list

Distributions

Taking a distribution is one of the least common ways due to taxation. A distribution is a return of principal, but it becomes taxable after you have taken out more than you have put into the policy.Loans

Loans are one of the most efficient ways of taking money out of a whole life policy. Loans are not taxable as long as the policy is in force. The good news with whole life is that your policy should last you forever. So policy loans do not have to be paid back. Your beneficiaries get the death benefit minus the policy loans that you have take out.So you get your money in life, or your family gets it when you die.

One of the best ways to understand loans is if we think of it as a Home Equity Line Of Credit. Many people are familiar with a HELOC, and they have used it in the past. Taking a loan from a whole life is very similar to a HELOC, the only difference is that the interest paid on the loan, is paid back to your policy, not to a bank.

This means you can recapture all of the interest back into your own policy.

Surrendering A Policy

If you decide to cancel a whole life insurance, you will get all your cash value back. Surrendering makes sense in some extreme scenarios, as most people could do better just keeping the policy.Whole Life Insurance For Income

In a low-interest environment, it is very important for people to find ways to generate income efficiently. Most people that are looking for income are thinking about retirement.Whole Life Insurance can be an excellent tool for retirement income.

However, we need to understand why it can be a great tool.

The 4% Rule

So now we are going to get a little bit technical so that you can compare apples to apples.The 4% Rule is a method that has been used in the past to determine how much income an asset can generate is the 4% rule. This is an old school rule that says that if you have $1,000,000, then you can generate $40k a year and not run out of money:

$1,000,000 at 4% = $40,000

This rule has been used by many financial advisors to estimate how much assets you should get before you retire.

However, this rule was established in an environment with much much higher interest rates. As of the writing of this article, the 10-year treasury note (U.S. Government Bond) is at 2.7%.

This means that if you have $1,000,000 on a government bond, then you can only generate $27,000. So that's a problem.

The average American does not have remotely close to $1,000,000. Check out this interesting article: Retirement Savings By Age

So not only most people don't have enough saved, but they also can't generate as much income as they used to.

What Are The Alternatives?

There are many alternatives to generate income, but most of them have risks associated with them.- Real Estate Rentals

- Stock Market

- Higher Risk Bonds

- Annuities

So that brings us to a whole life insurance policy sample where we will take income.

Sample Policy

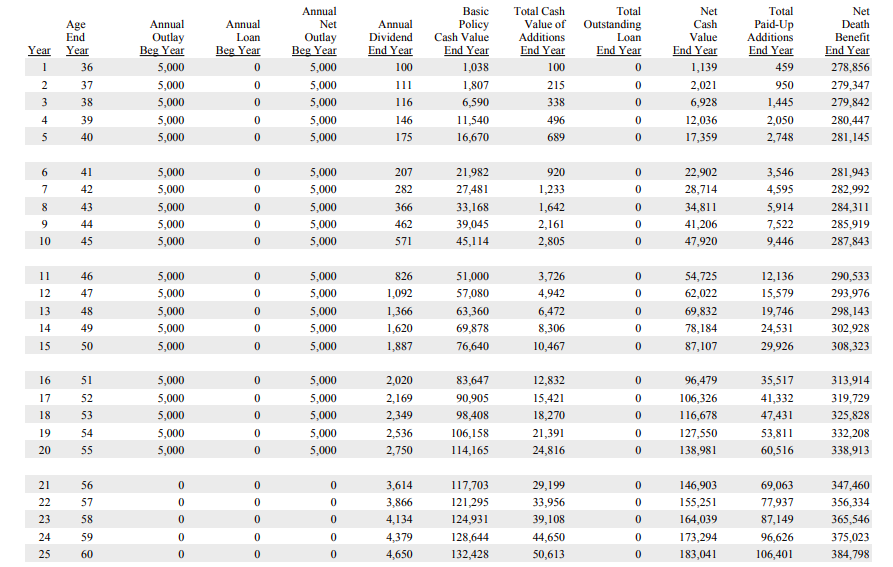

So let's look at a policy for a 35-year-old male with great health.[caption id="attachment_13800" align="alignnone" width="893"]

Whole Life Insurance For Income Start[/caption]

Whole Life Insurance For Income Start[/caption]This is a policy from a large Mutual company that will is paid up in 20 years. The policy was designed so, at age 65, it generates income for 20 years. This is income age, and the amount is something that can be modified.

Now let's see the income a policy like this generates at retirement:

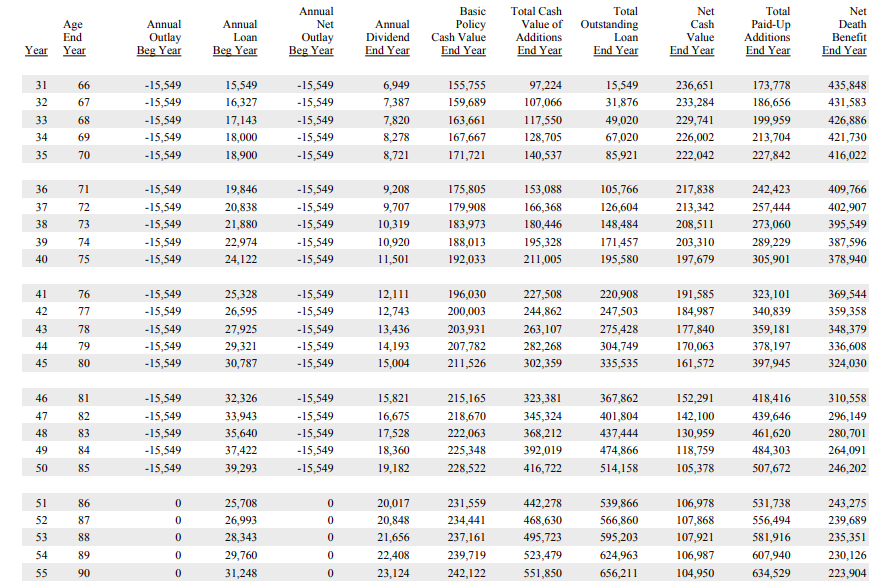

[caption id="attachment_13801" align="alignnone" width="893"]

Whole Life For Income Retirement[/caption]

Whole Life For Income Retirement[/caption]So this policy made over $15k per year tax-free.

A quick break down of the numbers:

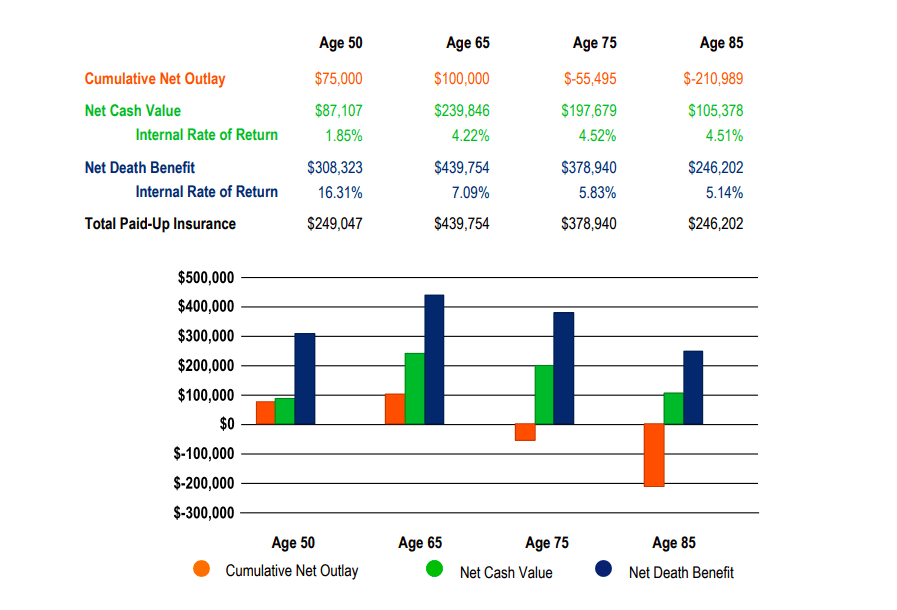

[caption id="attachment_13802" align="alignnone" width="897"]

Whole Life Insurance For Income Graph[/caption]

Whole Life Insurance For Income Graph[/caption]So this client would invest $100k into a policy over 20 years.

Then he would take out over $300k at retirement TAX-FREE, and also, he would still leave his beneficiaries $256k at death TAX-FREE.

100k generated a total of over $556k in his lifetime TAX-FREE.

The Real Numbers

Whole life insurance (and IUL's as well) are very efficient vehicles to take income.The numbers vary from person to person because whole life insurance is life insurance. This means that it is still based on your age and health. So for people that are looking for income but have significant health issues, whole life is probably not a good choice.

In our previous example

$240k of the cash value in a whole life insurance policy could generate over $15,000/yr for 20 years. That number is much higher than our previous 4% rule. At 4%, we would make only $9,600/yr.

As you can see, whole life generates income much more efficiently than many other assets. Also, this income is tax-free.

How Does Whole Life Compare To The Alternatives?

Here is a list of some alternative to whole life.Stock Market

The stock market the most common way people invest nowadays, in their 401ks and mutual funds. According to the Investment Company Institute, there are $5.6 trillion in 401ks, and about 55 million Americans have 401ks (source). The stock market can be a great tool to grow assets. However, when you are looking to distribute assets, it can run into problems.The main reason is when you have a terrible year (say 30% down), you start taking money at the bottom of the market, which means it is tough ever to bounce back from it.

You can read all about this type of risk here: Sequence Of Returns Risk

Bonds

Even though people think of bonds as a very safe investment, they still have risks associated with them. If the bond of the company, municipality, or county defaults, then you can be in trouble.Even U.S. bonds are not safe, with an astronomical $21 trillion debt, the U.S. could default on its loans in the future.

Real Estate

Real estate can be a great way to generate income, but it requires significant capital. The good news is that you can fund your real estate with a whole life policy: Whole Life for Real Estate InvestorsAnnuities

There are many flavors of annuities:- Income Annuities

- Fixed Annuities

- Variable Annuities

- Index Annuities

Should You Consider A Whole Life For Income?

This is a very personal question that we hope you have a better understanding after reading the previous points. In reality, if you decide to use your whole life for income, make sure it isn't your only source of income.Whole Life is not the end all be all!

Whole life is a conservative and less volatile income source, and it plays much better with more aggressive and volatile assets. If you are considering buying a policy