Can I Reduce My Whole Life Insurance Policy?

You may be asking yourself:- Can I cancel my whole life policy?

- Can I reduce my whole life insurance policy?

- Can I stop paying for my whole life?

There are many ways to reduce your whole life policy. But before we get into how you can reduce it, we want to understand WHY you want to lower your policy.

Whole life insurance offers many options once you have had the policy a few years. So we want you to be aware of all your options.

In reality, most agents don't even understand all the options you have in whole life policies, but our experts can help you get a quote on a reduction. All of the following are the options you have:

- Lower Premiums

- Use Dividends To Lower Premiums

- Pause Payments

- Take Cash Out

- Reduce A Whole Life

- Switch To A Cheaper Policy

We will show you actual illustrations of whole life insurance reductions so you can see the numbers. Remember that all of these numbers depend on your current whole life performance, your cash value, and health ratings.

Lower Premiums

Most of our clients that want to reduce their policy, what they truly want is to reduce their premium. They are still interested in keeping their whole life, but they can make the payments for a few months.If you have had a whole life for a few years, and you have cash value in your policy, then you can lower your premiums without lowering the death benefit.

Let me show you a quick example.

[caption id="attachment_13936" align="alignnone" width="1020"]

Lower Premiums[/caption]

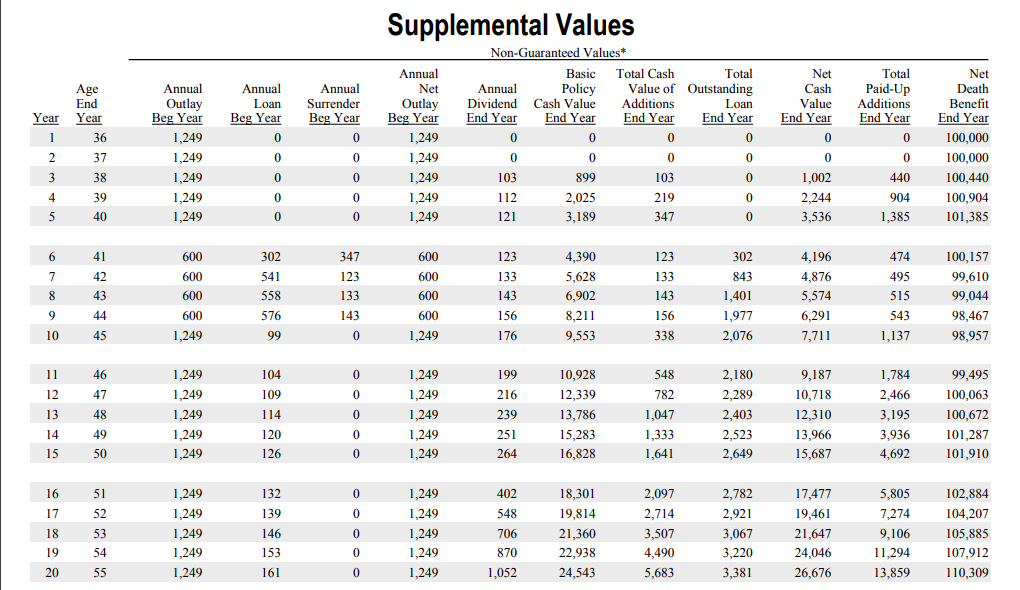

Lower Premiums[/caption]In this example, a client reduces their whole life premium temporarily for 4 years, and then resumes with his regular premium.

The dividend and cash value interest help pay for the premium and death benefit cost.

So what you can see there is a small loan that starts building inside of the policy. But don't worry, this loan may seem scary, but in the long run, as long as you keep the plan, you will not have to pay it.

It will be taken out of your death benefit.

Related: Whole Life Insurance Rates

Let Dividends Reduce Premiums

If you have a participating policy, then you get dividends. Most people use these dividends to get "paid-up additions." Without getting to complex, paid-up additions are like mini policies that are paid up. Also, these paid-up additions help grow the death benefit and the cash value in your policy.But there is another feature which you may be interested in.

You can elect to switch to the dividends to "Reduce Premium". This feature will use the dividends in your policy to reduce how much you pay for your policy.

Yes, it reduces the premium over time!

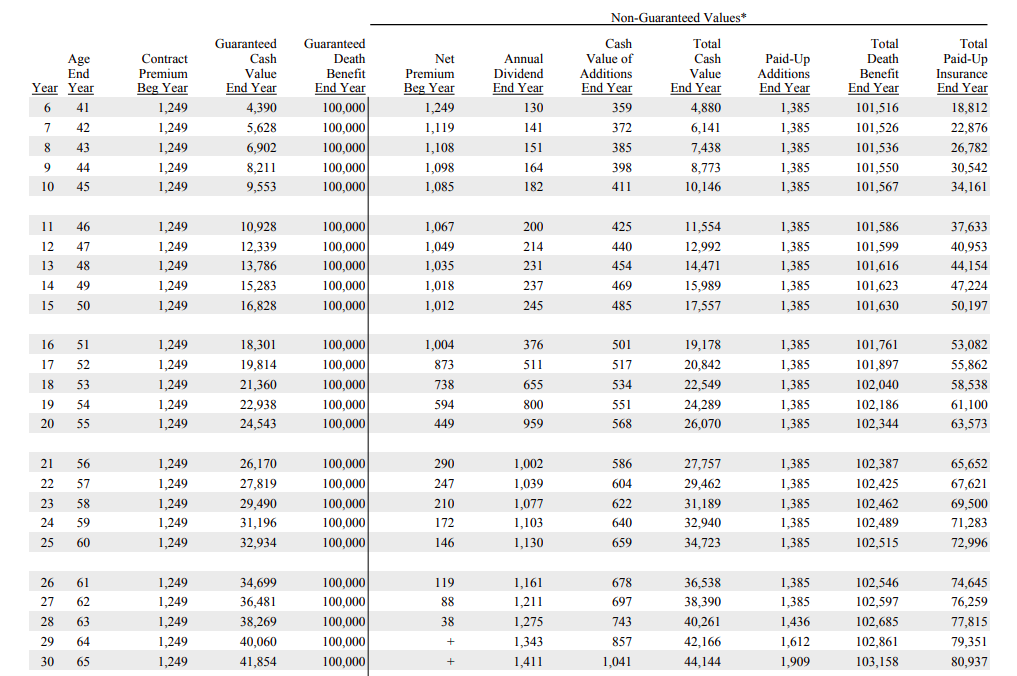

Please pay attention to the column that says "Net Premium Beg Year." This column illustrates how much you have to pay for the policy.

In our example, we assumed someone wanted to use whole life dividends to lower premiums at after 5 years of having the policy.

What you see is that the premium starts decreasing. The longer you have had the policy, the larger the premium decrease. If you have had a policy for over 10 years, then, likely, you will not have to pay much of a premium.

Pause Payments For Some Time

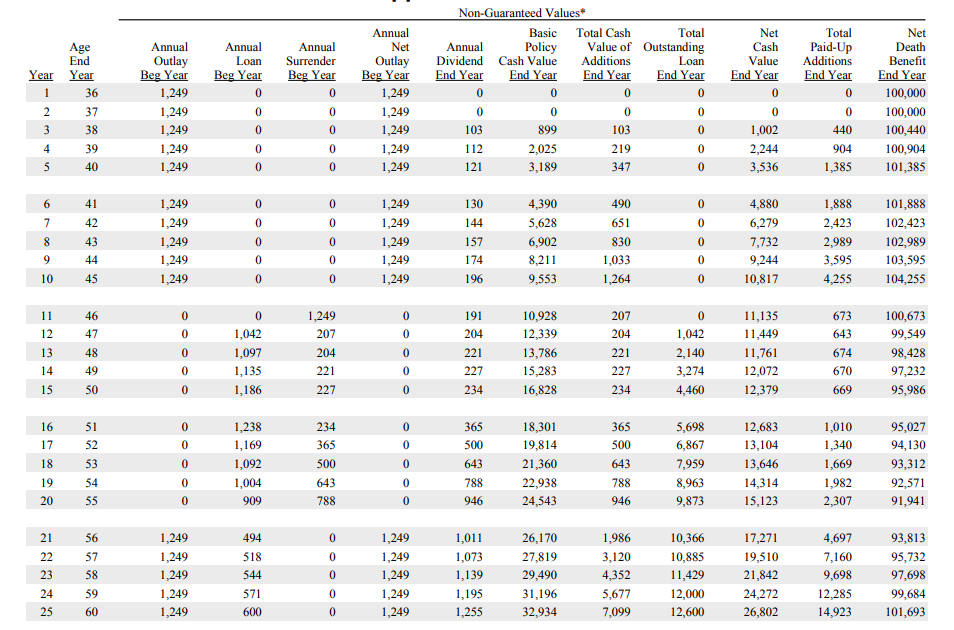

Another option is to pause your payments for some time. The length of time that you can pause your whole life will depend on how much cash value you have in comparison to your premiums.Let's look at an example:

This loan may seem scary to you, but let's see what happens if you keep this policy forever. In reality, if you fast forward the previous example at age 90, what you find is that the policy keeps growing.

After you have paused payments, you can decide to resume them at any time. Also, if you are doing better financially, you can pay back your loan, and keep your whole life as if nothing happened.

Take Cash Out

Most people want to reduce their whole life due to financial issues. Sometimes these issues can be fixed by taking cash out of your whole life.For example, you may have a high-interest rate credit card that you need to make payments on. It may be a good idea to pay off that card with your cash, instead of lowering your whole life.

If you decide to take cash out of a policy, you will need to consider two choices:

- Loans

- Withdrawals

Reduce A Whole Life

If you decide that you do want to reduce your whole life insurance, then you can. Remember, this will reduce the death benefit, and you will not be able to increase it without doing going through underwriting again.Reducing a whole life is quite easy; most companies have a reduction sheet you will need to sign. The agent from your company will process this, and in general, within 1-2 months, your policy will reduce.

Switch To A Cheaper Policy

In reality, whole life insurance can be large out of pocket expense. If you are in financial trouble, but you still want to keep your life insurance, then maybe you should consider switching to a different kind of policy.A guaranteed universal life policy is a permanent policy that will give you some of the benefits a whole life has. But also you will get a lower premium.

Another option is Term insurance, which can be very affordable for a substantial death benefit. Many whole life policies have a feature that you can use the cash value to purchase a term insurance. You would surrender your cash value but you will not have to pay premiums for your term policy.

If you would like to get a quote on term or Universal you can request a quote an our agents will help you.

We hoped with the article gave you some options you hadn't considered.

Did you have to lower your whole life insurance? Get Me A Cheeper Quote