Overview

MassMutual is a Fortune 100 Company with very high-quality ratings and a long history of performance. They have been around since 1851 and have never missed a dividend payment.MassMutual is one of the 3 big mutual companies that remain from the old days.

They are committed to a small product base, and in particular, to their best-selling whole life insurance.

MassMutual Whole Life Insurance Review

You cannot go wrong with a MassMutual whole life insurance.MassMutual has the #1 selling whole life products in the industry. In 2021 they issued $1.8 Billion in policy dividends to policy holders.

The company continues to grow in 2021 and 2022. In the U.S. alone, they had sales of $31 Billion.

In most of our rankings (Price, Cash Value Growth, Income at Retirement) MassMutual constantly ranks either #1 or #2. Their whole life product is the winner among the competition in so many areas, that you will be very happy with their whole life.

Company Strength

Financial ratings are one of the most important metrics you need to use when picking a life insurance company.MassMutual has fantastic ratings throughout:

- A.M. Best Company: A++ (Superior; Top category of 15)

- Fitch Ratings: AA+ (Very Strong; second category of 21)

- Moody's Investors Service: Aa3 (Excellent; third category of 21)

- Standard & Poor's: AA+ (Very Strong, second category of 21)

- Weiss A- (Safety Rating)

Also, in 2022 MassMutual again is recognized as the World's Most Ethical Company by the Ethisphere Institute. Check out the full press release here.

One of Americas Larges Companies

It is important to work with a strong financial company. Also, the larger they are, the more likely they will be there when you need your life insurance. MassMutual is making continual strides to be the best in the industry. They provide solid life insurance products backed by a company that is open-minded to change and improvement.In 2021, MassMutual ranks #123 on the Fortune 500 list (source).

MassMutual has made some major moves since 2021, as noted by fortune 500.

- Revenue increased an impressive 52% year over year to $35.9 billion

- Sales of its core protection product, whole life insurance, grew 25%, to a record $767 million

MassMutual Highlights

You may not be familiar with some of these highlights, but they are very impressive:

- Total Revenue in 2021: $35.8 Billion

- The company sold $1.4 Billion of whole life in 2021

- Assets increased to $383 billion

- Revenue hit a record high in 2021 at $35.8B

- They announced a 2021 Dividend of $1.7B to policy owners

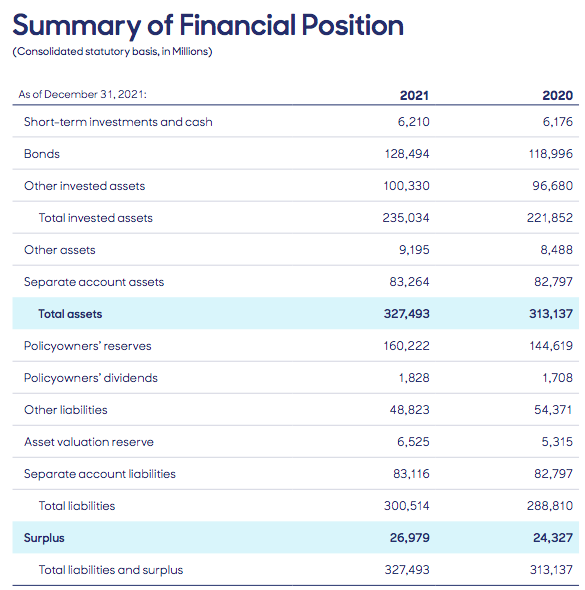

Summary of Financial Position

Dividend

Participating companies pay a dividend on top of their guaranteed rate of return.MassMutual recently announced a record-breaking dividend payout to its policy owners in 2023. This marks the fourth consecutive year that MassMutual has provided a substantial payout to its policyholders, highlighting the company's commitment to financial security and stability.

The dividend is the result of a strong year for the company, with strong growth in its life insurance business and overall financial performance. MassMutual has also invested heavily in its digital capabilities, allowing customers to access their accounts and policies with ease.

This has been reflected in their customer service ratings, with an overall satisfaction rate of 9.7 out of 10.

The record-breaking dividend payout will go to MassMutual's policyholders, providing them with additional financial security and stability. This is especially important in today's turbulent financial climate, and the dividend will provide a much-needed boost to many policyholders.

The dividend payout for 2023 will be 6%.MassMutual's dividend is only rivaled by a few like Penn Mutual and New York Life. Also, their commitment to return a significant dividend is one of their strong points.

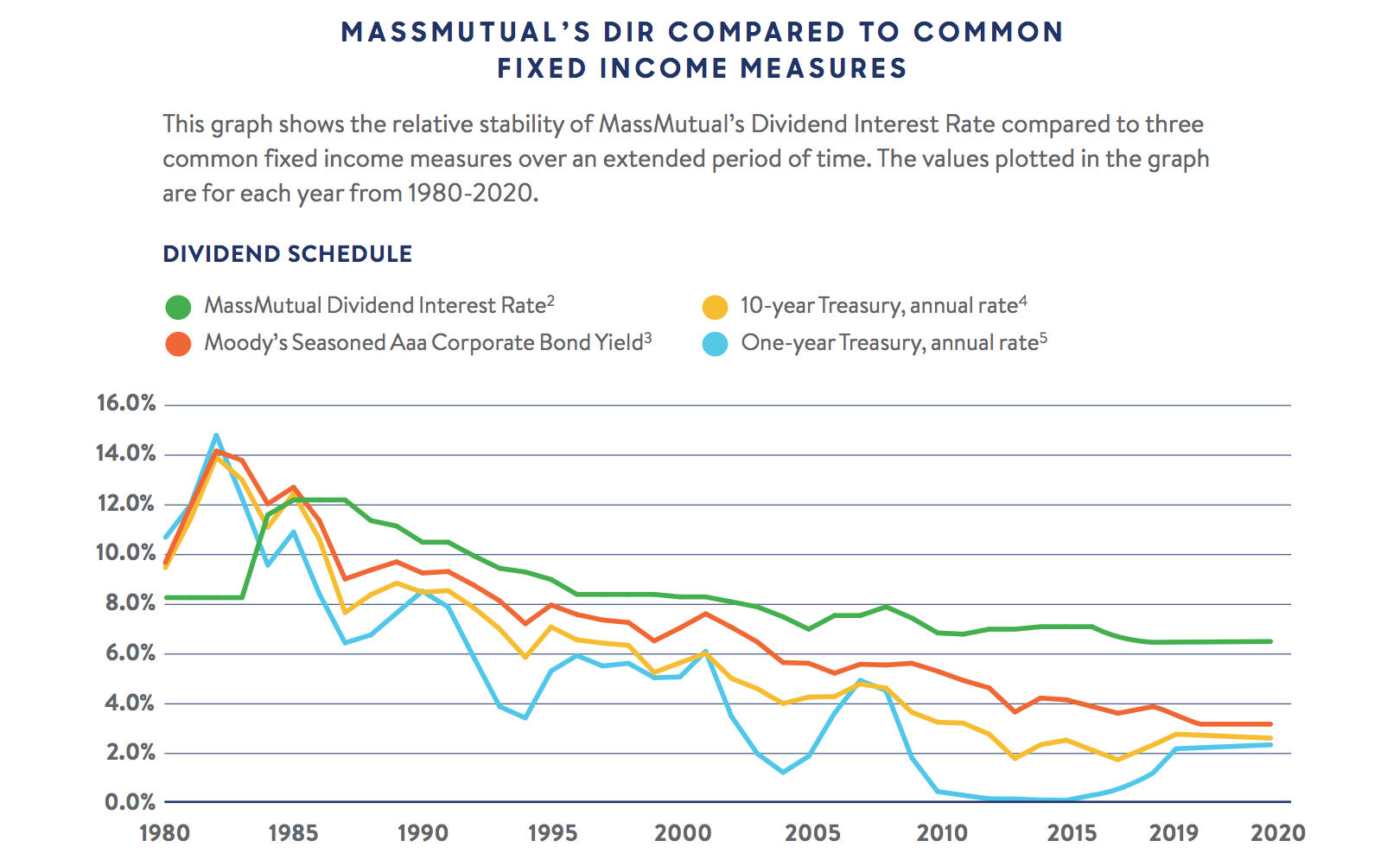

Dividend Returns vs. Fixed Income Options

You will note in the following image that MassMutual's dividend performance is extremely stable when put up against other fixed-income indexes if you are looking for a safe place to put your money away. MassMutual participating whole life insurance policies can be a great option.Dividend History

MassMutual dividend history is one of the strongest in the industry. The dividend history since 2000 is very impressive:| 2000 | 8.20 |

| 2001 | 8.20 |

| 2002 | 8.05 |

| 2003 | 7.90 |

| 2004 | 7.50 |

| 2005 | 7.00 |

| 2006 | 7.40 |

| 2007 | 7.50 |

| 2008 | 7.90 |

| 2009 | 7.60 |

| 2010 | 7.00 |

| 2011 | 6.85 |

| 2012 | 7.00 |

| 2013 | 7.10 |

| 2014 | 7.10 |

| 2015 | 7.10 |

| 2016 | 7.10 |

| 2017 | 6.70 |

| 2018 | 6.40 |

| 2019 | 6.40 |

| 2020 | 6.20 |

| 2021 | 6.00 |

| 2022 | 6.00 |

| 2023 | 6.00 |

MassMutual's Investment portfolio as you can see, that is a strong dividend. To see a complete historical analysis, you can read: Whole Life Dividend Rate Historical Analysis

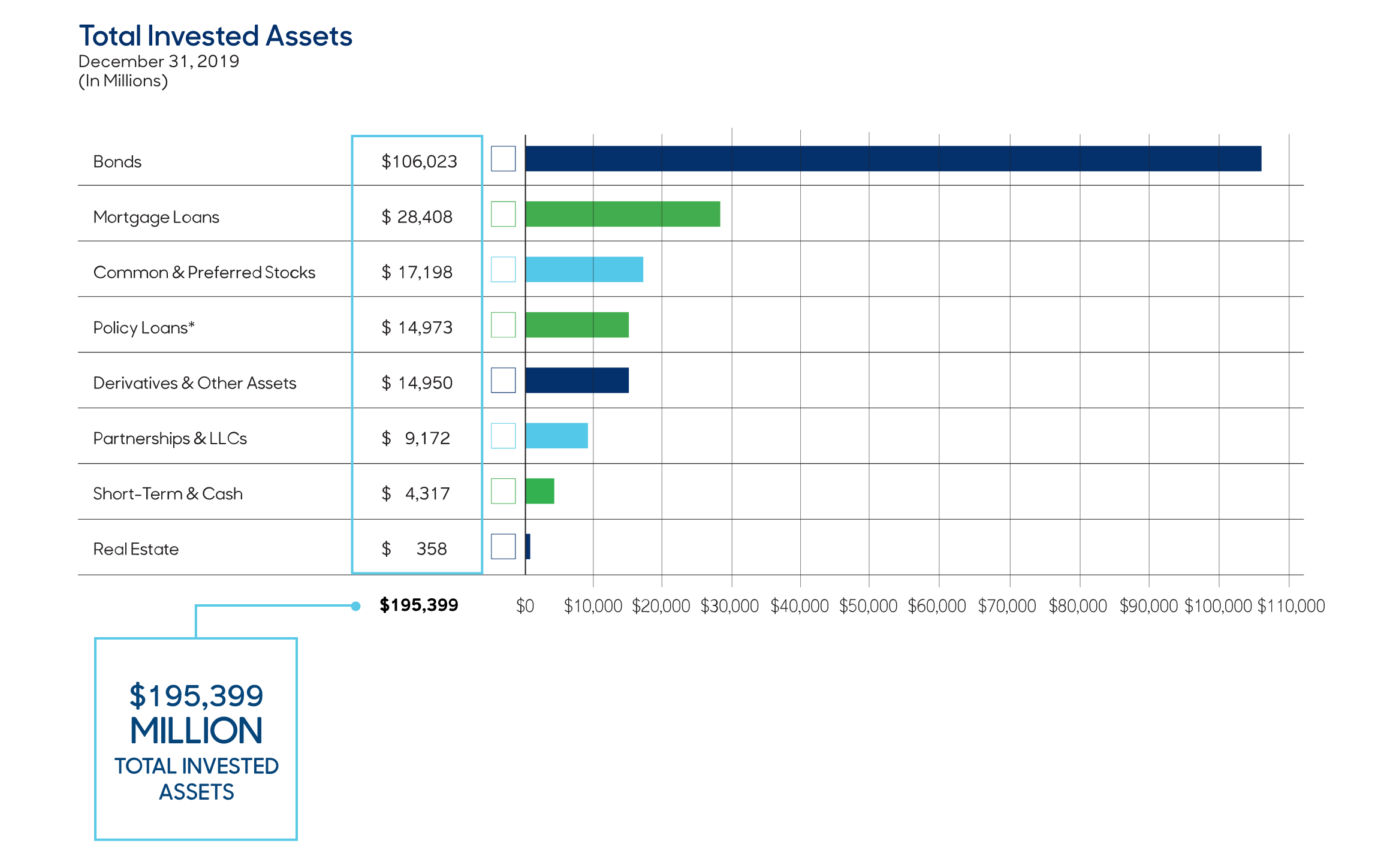

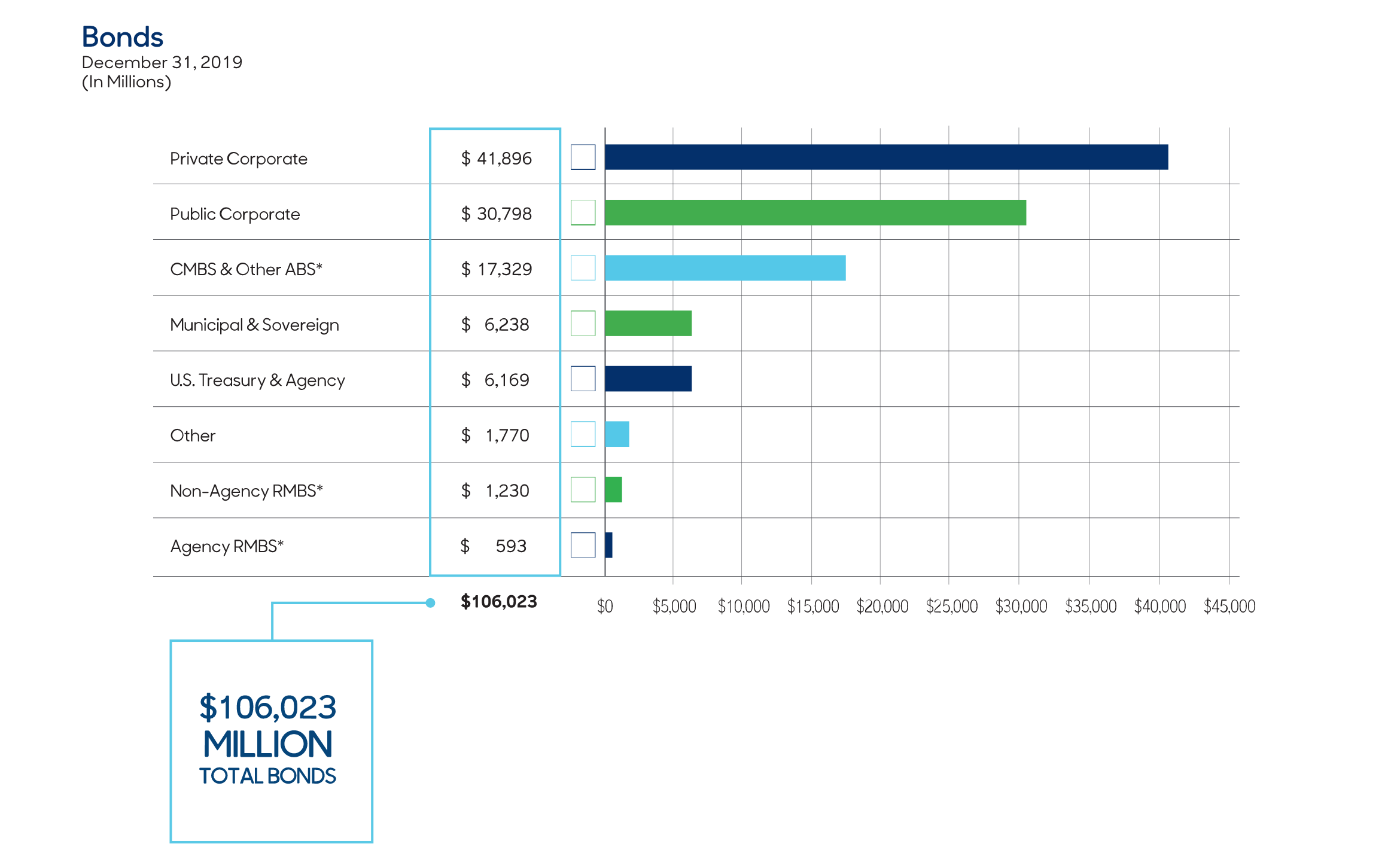

A company's investment portfolio is important because it shows how they invest their money. This is the money that helps the performance of the cash value in all of the policies. MassMutual takes a very diverse and calculated approach to their business and investment decisions. This, in turn, is what allows them to continue to pay dividends to the policy owners.

MassMutual's Investment Strategy

MassMutual's Investment Strategy

The company says that they have a long-term investment philosophy, and their actions do reflect this. MassMutual's life insurance goal is to generate long-term competitive results while maintaining the ability to weather downturns in financial markets.With this strategy, MassMutual life insurance products have chieved solid long-term investment returns for the benefit of its policy owners without exposing them to unnecessary risk, even in unpredictable markets and economic cycles.

Performance

The MassMutual Whole Life Insurance Performance numbers that we run at Top Whole Life show MassMutual among the top 5 constantly for Cash Value Growth and Income from Whole Life Insurance. Get Me A QuoteProducts

The following is a list of MassMutual's whole life insurance products:Whole Life Legacy 100

This is their oldest MassMutual life insurance product. It has been sold for more than 165 years. This product is designed to be contractually paid until Age 100 and is MassMutuals lowest premium level premium product.Whole Life Legacy 65

This MassMutual life insurance product is guaranteed to be paid up (no more premiums) at age 65. This is one of the best sellers, and it is often utilized when whole life is presented as an income stream at retirement. It is excellent if you are young and want to build long-term cash.Whole Life Legacy 20 Pay

A fantastic product with regards to cash value accumulation. You only need to pay premiums for 20 years. This is a strong option for someone who would like to accumulate cash values faster. It is an excellent product for people in the 40's.Whole Life Legacy 15 Pay

The Legacy 15 is a new MassMutual life insurance product released in December of 2019. It is a great product for those who want a shorter window than the 20 pay for cash accumulation. Parents and or grandparents may also like this product when buying coverage for their little ones to start their own whole life policy at a young age. The 15 pay, 12 pay, and 10 pay are great ways to give insurance to children, so they have a fully funded policy with cash values.Whole Life Legacy 12 Pay

Another new product offering by MassMutual in late 2019, the Legacy 12, is a really strong option for a short-paying whole life policy. Only fund the policy for 12 years, and then the policy is fully funded. You now have the flexibility to choose between 10, 12, 15, or 20 years when considering a limited pay design.Whole Life Legacy 10 Pay

One of the best cash value accumulation products in the marketplace. You only pay premiums for 10 years. This is one of the best-limited pay whole life products.Whole Life Legacy HECV

Utilized in business insurance frequently. This MassMutual life insurance product will have 90% of the premium in cash in the first year. We have a complete article dedicated to this product: High Early Cash Value Life Insurance. This is a product that most likely your agent will not show, as it pays the lowest commission of all.Survivor Whole Life 20 Pay

This product is unique to all the rest. The survivor 20 pay product is designed to ensure two people with a whole life policy. The policy will be a more affordable option when planning for whole life costs. Keep in mind that the policy pays on the second-to-die.All the previous whole life insurance products from MassMutual are second to none. If you are thinking about whole life insurance, you will not go wrong choosing this company.

Convertible Term Insurance

If you are not ready to take the leap and start a whole life policy yet, MassMutual also has a wide selection of term products to chose from.Vantage Term 30 & 30 Extended Conversion Period

MassMutual released their 30-year level convertible term product in 2019. This is a fantastic option for someone looking to lock in coverage for a long time and then decide if they want whole life in the future. There is also an option to pay more for an extended conversion window. The standard is 10 years, and the extended window would be 20. If you are on the fence about whole life, you will want to consider the Vantage term 30.Vantage Term 25 & 25 Extended Conversion Period

The Vantage 25 is similar to the 30 above, but you are not locking in as many years. This will provide you the coverage you need at a lower price than the 30-year level product. You can also choose to buy up the extended conversion option.Vantage Term 20& 20 Extended Conversion Period

The Vantage 20 is one of the most popular options prior to the 25, and 30 options were released. If you only need protection for the years your kids are in college for the remainder of your mortgage; this is an affordable policy. If you decide this is the right policy and are considering converting later down the line, you can also add the extended conversion option on this product.Vantage Term 15 & 15 Extended Conversion Period

The vantage 15 has been a great alternative to the annually renewable term and the 10-year term options. MassMutual has age restrictions for when you can buy some of their products. All the other products we have reviewed so far have a max purchase age, but the Vantage 15 can be locked in until age 70.Vantage Term 10

Looking for cheap short-term coverage? Vantage 10 is going to be a great choice. This is a level premium for 10 years and is convertible for the full 10-year window.Vantage Term Annually Renewable (ART)

If the Vantage 10 pay is too costly, the Vantage ART policy is the absolute cheapest policy to buy. If you plan to convert in the first 3 years, this policy is a better buy than the Vantage 10 pay.Coverpath

One of MassMutual's most interesting offerings in 2020 is that you can now research, quote, and apply for convertible term insurance and the suite of whole life products above completely online. This is a massive breakthrough and is going to be a game-changer for consumers. Check out our Coverpath Review.Underwriting

You will have a tougher underwriting process with MassMutual than your average company. If you have average health or better, you will not have any issues; otherwise, they will be tougher than normal.However, if you do have health issues, there may be better choices for you.

We have seen cases that MassMutual declines, but they get a great rating with Foresters or Penn Mutual.

Health Ratings

Here is the list of ratings that MassMutual uses from best to worst:- Ultra Preferred

- Select Preferred

- Standard

- Select Preferred Tobacco

- Tobacco

MassMutual Whole Life Quote in Seconds

Best Whole Life For Cash Value

Get Me A QuoteLEGAL: We are not MassMutual Agents, this is third party review.

[divider line_type="No Line" custom_height="20"][toggles style="default"][toggle color="Default" title="What are the benefits of creating an account for MassMutual life insurance?"]It will save you time and makes updating policy details easy. After you've created your account, you can view your policy details including

- Outstanding loans

- Beneficiaries

- Investment selections

- 1099 forms

- The total value on your insurance

- Payments due

- Additional policy statements, etc.

You can also change your address, set up recurring payments, change beneficiaries, and find valuable financial resources.

[/toggle][toggle color="Default" title="Can I make one joined payment for all of my MassMutual life insurance policies?"]Unfortunately, not. MassMutual does not provide such an option to pay for multiple policies through a single combined payment. All payments must be made at the individual policy level.

To make your payment process easier, you can save your personal banking information at the customer level or set up recurring payments.

[/toggle][toggle color="Default" title="Can I make a payment for MassMutual life insurance without creating an account?"]Yes, you can make a payment through an online guest payment option.

- Simply visit MassMutual.com.

- Click on the "Billing and Payments" option (mentioned at the top of the screen).

- Fill out your policy details and make payment.

- You have the option to establish monthly recurring payments or just make a one-time payment.

That said, Top Whole Life recommends creating your account to save your bank information, view your bill, choose paperless billing, and more.

[/toggle][toggle color="Default" title="What is required to create an account for MassMutual life insurance?"]All you need is your phone number and email address. For those individuals who represent any corporation or trust, you will need to mention your Tax Identification Number (TIN) and policy number.

[/toggle][/toggles]JTNDJTIxLS1GQVElMjBDb2RlJTIwU3RhcnQtLSUzRSUwQSUzQ3NjcmlwdCUyMHR5cGUlM0QlMjJhcHBsaWNhdGlvbiUyRmxkJTJCanNvbiUyMiUzRSUwQSU3QiUwQSUyMCUyMCUyMiU0MGNvbnRleHQlMjIlM0ElMjAlMjJodHRwcyUzQSUyRiUyRnNjaGVtYS5vcmclMjIlMkMlMEElMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyRkFRUGFnZSUyMiUyQyUwQSUyMCUyMCUyMm1haW5FbnRpdHklMjIlM0ElMjAlNUIlMEElMjAlMjAlMjAlMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyUXVlc3Rpb24lMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJuYW1lJTIyJTNBJTIwJTIyV2hhdCUyMGFyZSUyMHRoZSUyMGJlbmVmaXRzJTIwb2YlMjBjcmVhdGluZyUyMGFuJTIwYWNjb3VudCUyMGZvciUyME1hc3NNdXR1YWwlMjBsaWZlJTIwaW5zdXJhbmNlJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMkl0JTIwd2lsbCUyMHNhdmUlMjB5b3UlMjB0aW1lJTIwYW5kJTIwbWFrZXMlMjB1cGRhdGluZyUyMHBvbGljeSUyMGRldGFpbHMlMjBlYXN5LiUyMEFmdGVyJTIweW91JTI3dmUlMjBjcmVhdGVkJTIweW91ciUyMGFjY291bnQlMkMlMjB5b3UlMjBjYW4lMjB2aWV3JTIweW91ciUyMHBvbGljeSUyMGRldGFpbHMlMjBpbmNsdWRpbmclMjAlNUNuT3V0c3RhbmRpbmclMjBsb2FucyU1Q25CZW5lZmljaWFyaWVzJTVDbkludmVzdG1lbnQlMjBzZWxlY3Rpb25zJTVDbjEwOTklMjBmb3JtcyU1Q25UaGUlMjB0b3RhbCUyMHZhbHVlJTIwb24lMjB5b3VyJTIwaW5zdXJhbmNlJTVDblBheW1lbnRzJTIwZHVlJTVDbkFkZGl0aW9uYWwlMjBwb2xpY3klMjBzdGF0ZW1lbnRzJTJDJTIwZXRjLiU1Q24lNUNuWW91JTIwY2FuJTIwYWxzbyUyMGNoYW5nZSUyMHlvdXIlMjBhZGRyZXNzJTJDJTIwc2V0JTIwdXAlMjByZWN1cnJpbmclMjBwYXltZW50cyUyQyUyMGNoYW5nZSUyMGJlbmVmaWNpYXJpZXMlMkMlMjBhbmQlMjBmaW5kJTIwdmFsdWFibGUlMjBmaW5hbmNpYWwlMjByZXNvdXJjZXMuJTIyJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTIwJTIwJTdEJTJDJTBBJTIwJTIwJTIwJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMlF1ZXN0aW9uJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIybmFtZSUyMiUzQSUyMCUyMkNhbiUyMEklMjBtYWtlJTIwb25lJTIwam9pbmVkJTIwcGF5bWVudCUyMGZvciUyMGFsbCUyMG9mJTIwbXklMjBNYXNzTXV0dWFsJTIwbGlmZSUyMGluc3VyYW5jZSUyMHBvbGljaWVzJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMlVuZm9ydHVuYXRlbHklMkMlMjBub3QuJTIwTWFzc011dHVhbCUyMGRvZXMlMjBub3QlMjBwcm92aWRlJTIwc3VjaCUyMGFuJTIwb3B0aW9uJTIwdG8lMjBwYXklMjBmb3IlMjBtdWx0aXBsZSUyMHBvbGljaWVzJTIwdGhyb3VnaCUyMGElMjBzaW5nbGUlMjBjb21iaW5lZCUyMHBheW1lbnQuJTIwQWxsJTIwcGF5bWVudHMlMjBtdXN0JTIwYmUlMjBtYWRlJTIwYXQlMjB0aGUlMjBpbmRpdmlkdWFsJTIwcG9saWN5JTIwbGV2ZWwuJTVDbiU1Q25UbyUyMG1ha2UlMjB5b3VyJTIwcGF5bWVudCUyMHByb2Nlc3MlMjBlYXNpZXIlMkMlMjB5b3UlMjBjYW4lMjBzYXZlJTIweW91ciUyMHBlcnNvbmFsJTIwYmFua2luZyUyMGluZm9ybWF0aW9uJTIwYXQlMjB0aGUlMjBjdXN0b21lciUyMGxldmVsJTIwb3IlMjBzZXQlMjB1cCUyMHJlY3VycmluZyUyMHBheW1lbnRzLiUyMiUwQSUyMCUyMCUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCUyMCUyMCU3RCUyQyUwQSUyMCUyMCUyMCUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJRdWVzdGlvbiUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMm5hbWUlMjIlM0ElMjAlMjJDYW4lMjBJJTIwbWFrZSUyMGElMjBwYXltZW50JTIwZm9yJTIwTWFzc011dHVhbCUyMGxpZmUlMjBpbnN1cmFuY2UlMjB3aXRob3V0JTIwY3JlYXRpbmclMjBhbiUyMGFjY291bnQlM0YlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJhY2NlcHRlZEFuc3dlciUyMiUzQSUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJBbnN3ZXIlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjJ0ZXh0JTIyJTNBJTIwJTIyWWVzJTJDJTIweW91JTIwY2FuJTIwbWFrZSUyMGElMjBwYXltZW50JTIwdGhyb3VnaCUyMGFuJTIwb25saW5lJTIwZ3Vlc3QlMjBwYXltZW50JTIwb3B0aW9uLiUyMCU1Q25TaW1wbHklMjB2aXNpdCUyME1hc3NNdXR1YWwuY29tLiU1Q25DbGljayUyMG9uJTIwdGhlJTIwJUUyJTgwJTlDQmlsbGluZyUyMGFuZCUyMFBheW1lbnRzJUUyJTgwJTlEJTIwb3B0aW9uJTIwJTI4bWVudGlvbmVkJTIwYXQlMjB0aGUlMjB0b3AlMjBvZiUyMHRoZSUyMHNjcmVlbiUyOS4lNUNuRmlsbCUyMG91dCUyMHlvdXIlMjBwb2xpY3klMjBkZXRhaWxzJTIwYW5kJTIwbWFrZSUyMHBheW1lbnQuJTVDbllvdSUyMGhhdmUlMjB0aGUlMjBvcHRpb24lMjB0byUyMGVzdGFibGlzaCUyMG1vbnRobHklMjByZWN1cnJpbmclMjBwYXltZW50cyUyMG9yJTIwanVzdCUyMG1ha2UlMjBhJTIwb25lLXRpbWUlMjBwYXltZW50LiU1Q24lNUNuVGhhdCUyMHNhaWQlMkMlMjBUb3AlMjBXaG9sZSUyMExpZmUlMjByZWNvbW1lbmRzJTIwY3JlYXRpbmclMjB5b3VyJTIwYWNjb3VudCUyMHRvJTIwc2F2ZSUyMHlvdXIlMjBiYW5rJTIwaW5mb3JtYXRpb24lMkMlMjB2aWV3JTIweW91ciUyMGJpbGwlMkMlMjBjaG9vc2UlMjBwYXBlcmxlc3MlMjBiaWxsaW5nJTJDJTIwYW5kJTIwbW9yZS4lMjIlMEElMjAlMjAlMjAlMjAlMjAlMjAlN0QlMEElMjAlMjAlMjAlMjAlN0QlMkMlMEElMjAlMjAlMjAlMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyUXVlc3Rpb24lMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJuYW1lJTIyJTNBJTIwJTIyV2hhdCUyMGlzJTIwcmVxdWlyZWQlMjB0byUyMGNyZWF0ZSUyMGFuJTIwYWNjb3VudCUyMGZvciUyME1hc3NNdXR1YWwlMjBsaWZlJTIwaW5zdXJhbmNlJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMkFsbCUyMHlvdSUyMG5lZWQlMjBpcyUyMHlvdXIlMjBwaG9uZSUyMG51bWJlciUyMGFuZCUyMGVtYWlsJTIwYWRkcmVzcy4lMjBGb3IlMjB0aG9zZSUyMGluZGl2aWR1YWxzJTIwd2hvJTIwcmVwcmVzZW50JTIwYW55JTIwY29ycG9yYXRpb24lMjBvciUyMHRydXN0JTJDJTIweW91JTIwd2lsbCUyMG5lZWQlMjB0byUyMG1lbnRpb24lMjB5b3VyJTIwVGF4JTIwSWRlbnRpZmljYXRpb24lMjBOdW1iZXIlMjAlMjhUSU4lMjklMjBhbmQlMjBwb2xpY3klMjBudW1iZXIuJTIyJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTVEJTBBJTdEJTBBJTNDJTJGc2NyaXB0JTNFJTBBJTNDJTIxLS1GQVElMjBDb2RlJTIwRW5kLS0lM0U=