Updated Feb 13th, 2023

The numbers displayed are for a male with good health but not excellent health.

Here are the rates for Women:

The previous table shows the average price for a top whole life insurance company with good cash value accumulation and great death benefit growth.

There are multiple ways to do this blend, with every single company out there. However, you have to know that the term portion will not build cash or is not permanent coverage.

While many agents do not know how to blend policies, if you request a quote from our experts, they are very familiar with blending.

As you can see, blending a whole life policy with term insurance can reduce costs significantly.

In the previous example, prices went from approximately $12,500 to $6,500.

That is a 48% decrease in price. So this type of blended whole life can be a great alternative to a Universal life insurance policy.

Cash value adds another important layer to your whole life insurance. Imagine cash value like a saving portion of your whole life insurance. Also, this savings portion grows each year and that can be accessed at any time.

Certain policies grow cash value much faster than others, so you need to know which company to pick. The easiest way to compare the cash value accumulation is to get an online whole life insurance quote with us.

In addition, if you want to get maximum cash value growth you should consider whole life policies that are participating. Because these types of whole life policies will get a dividend to help the cash value grow much faster.

For more information on cash value check out our article: Top 7 Whole Life Companies For Cash Value

Also, the price is guaranteed to remain the same for the rest of your life. So do not wait and lock in that low premium forever.

Age plays a significant factor in how much you pay for whole life, much more than health.

Health ratings will affect your whole life insurance, but the changes won't be as drastic compared to a Term Life insurance.

Many different factors will determine the best whole life insurance for you. In addition, whole life is an asset and not an expense. Therefore, you want your assets to be the best and not the cheapest. Imagine a house that you are investing in. You would like to have a great asset, not just the cheapest one.

Price is important but it's definitely not the most important.

You will still need to answer medical questions, but it will not require blood and urine.

You should only consider this option if you have health issues. A medical test is used to determine your health rating. The actual value of a whole life will improve if you get a better health rating.

If you still want to get a non-Medical $1,000,000 whole life, then we would suggest getting $400,000 non-Medical, and then $600,000 in a whole life with a medical.

So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam.

Get a $1,000,000 guaranteed issue quote.

You can buy a term policy today for $1,000,000 and change that policy into whole life in the future. You can even decide to change only a portion of the $1,000,000 if you do not want to convert the entire term policy. The best part about this is you will not be required to perform any medical exams at the time of conversion.

Check out your $1,000,000 Convertible Term Quote

Here is the next read which you may find interesting:

Top 7 Whole Life Insurance Companies For Cash Value

Whole Life Insurance For Dummies

Whole Life Insurance Dividend History

Do You Want $1,000,000 Whole Life Insurance?

If all you want is an instant online $1,000,000 whole life quote, you can get it in seconds at Online Whole Life Insurance Quotes or use the link to our quoter below. You will be able to compare whole life insurance prices, company strength, cash value growth, and company size.I Would Like To Get A $1M Whole Life Insurance Quote Now

Best Whole Life At Best Price

Get Me A QuoteCost, Tables And Tips

In this article you will find everything you need to know to get a one million dollar whole life insurance. You will find prices for different ages and health ratings for your convenience. Also you will learn what factors affect pricing.In addition, you will learn how to lower the price by 40% with a simple trick.

Why A Whole Life Insurance?

Whole life insurance is true permanent life insurance. You get solid guarantees that will last a lifetime like:- Cash Value Growth That Is Guaranteed

- Guaranteed Death Benefit

- Guaranteed Level Premiums For Life

If you want to get an idea of the prices, let's look at the numbers

The following table displays a $1 million whole life insurance policy cost with a particular top-rated whole life company. All the numbers that we display change based on your health rating or if you are a smoker or non-smoker. If you want a smaller whole life, you should check out our article: How Much Does Whole Life Insurance Cost?The numbers displayed are for a male with good health but not excellent health.

2023 Whole Life Insurance $1,000,000 Cost By Age

| Male Whole Life $1,000,000 | ||

| Age | Excellent Health | Great Health |

| 30 | $836.07 | $889.14 |

| 35 | $1,019.64 | $1,095.33 |

| 40 | $1,299.78 | $1,405.92 |

| 45 | $1,640.82 | $1,783.50 |

| 50 | $2,103.66 | $2,289.84 |

| 55 | $2,688.30 | $2,931.03 |

| 60 | $3,484.35 | $3,807.99 |

| 65 | $4,468.32 | $4,892.88 |

| 70 | $5,825.82 | $6,257.04 |

| Female Whole Life $1,000,000 | ||

| Age | Excellent Health | Great Health |

| 30 | $715.14 | $737.76 |

| 35 | $851.73 | $882.18 |

| 40 | $1,050.96 | $1,112.73 |

| 45 | $1,292.82 | $1,397.22 |

| 50 | $1,675.62 | $1,809.60 |

| 55 | $2,153.25 | $2,323.77 |

| 60 | $2,848.38 | $3,060.66 |

| 65 | $3,716.64 | $3,979.38 |

| 70 | $5,235.66 | $5,515.80 |

Whole Life Prices Can Be Cheaper

Some strategies can be implemented to reduce the cost of a whole life insurance policy. One common strategy is blending a whole life policy with Term insurance to lower the price.There are multiple ways to do this blend, with every single company out there. However, you have to know that the term portion will not build cash or is not permanent coverage.

While many agents do not know how to blend policies, if you request a quote from our experts, they are very familiar with blending.

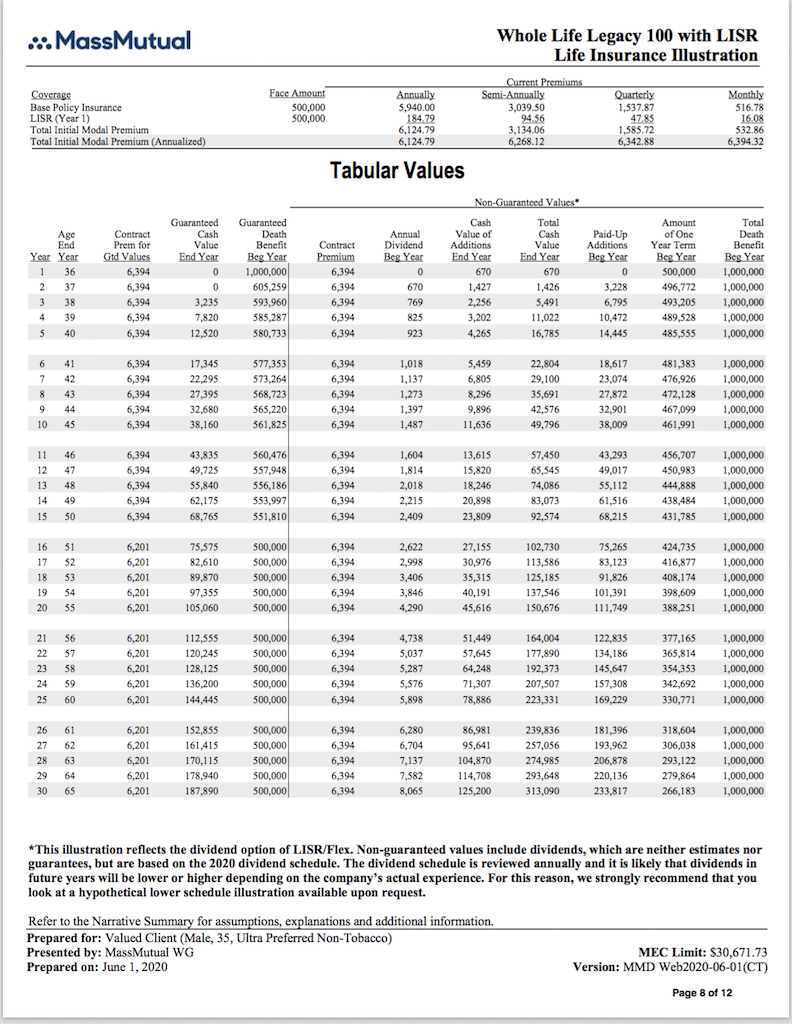

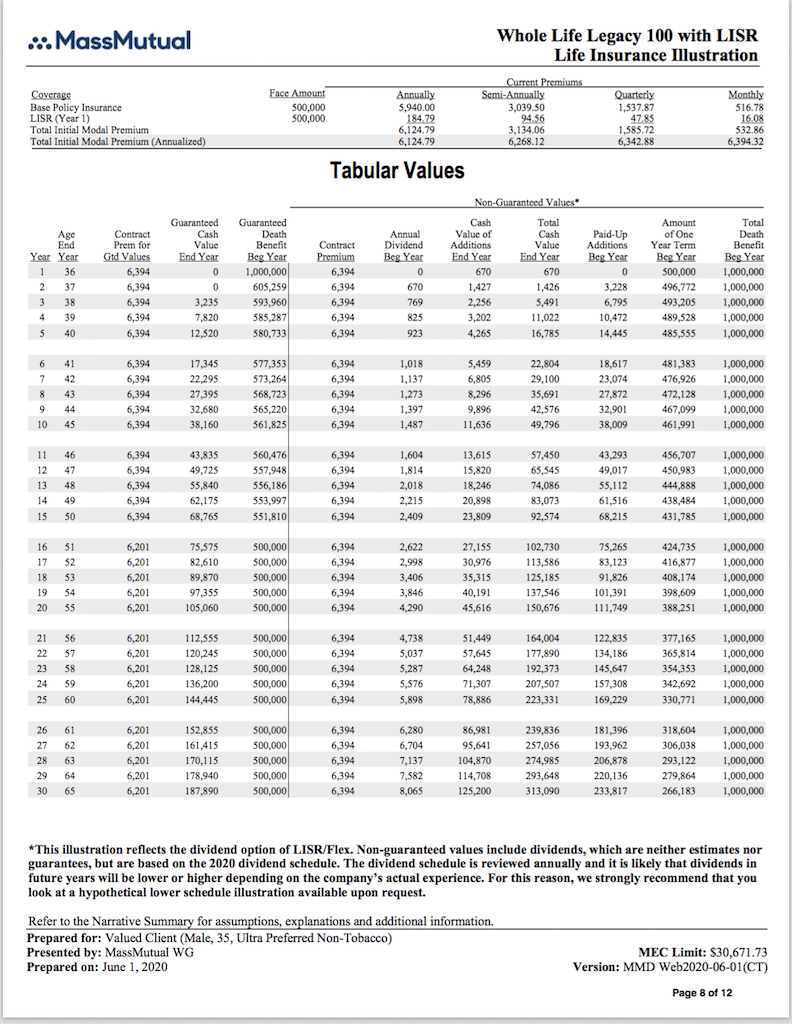

Blending a Whole Life can reduce the costs by 40%Here is an illustration example of a blended whole life policy:

- 35-Year-Old Male

- Excellent Health

- $1,000,000

- $532.86/mo

As you can see, blending a whole life policy with term insurance can reduce costs significantly.

In the previous example, prices went from approximately $12,500 to $6,500.

That is a 48% decrease in price. So this type of blended whole life can be a great alternative to a Universal life insurance policy.

Get A $1,000,000 Whole Life Insurance Quote

Cheapest 2023 Rates Possible

Get Me A QuoteCash Value Accumulation

We are not displaying the cash value accumulation in our original table because we want to keep things simple.Cash value adds another important layer to your whole life insurance. Imagine cash value like a saving portion of your whole life insurance. Also, this savings portion grows each year and that can be accessed at any time.

Certain policies grow cash value much faster than others, so you need to know which company to pick. The easiest way to compare the cash value accumulation is to get an online whole life insurance quote with us.

In addition, if you want to get maximum cash value growth you should consider whole life policies that are participating. Because these types of whole life policies will get a dividend to help the cash value grow much faster.

For more information on cash value check out our article: Top 7 Whole Life Companies For Cash Value

Age vs. Health

The prices on a whole life increase the older you get, just like any other policy. The sooner you get whole life insurance, the cheaper it will be in the long run.Also, the price is guaranteed to remain the same for the rest of your life. So do not wait and lock in that low premium forever.

Age plays a significant factor in how much you pay for whole life, much more than health.

Health ratings will affect your whole life insurance, but the changes won't be as drastic compared to a Term Life insurance.

Many different factors will determine the best whole life insurance for you. In addition, whole life is an asset and not an expense. Therefore, you want your assets to be the best and not the cheapest. Imagine a house that you are investing in. You would like to have a great asset, not just the cheapest one.

Price is important but it's definitely not the most important.

I Would Like To Get A $1M Whole Life Policy Quote Now

Best Whole Life At Best Price

Get Me A QuoteCan I Get $1,000,000 Whole Life Without A Medical?

In reality, you can't get 1 million of whole life insurance without a medical exam. However, we know of a company that will get your whole life insurance up to $400,000 without having to do a medical test.You will still need to answer medical questions, but it will not require blood and urine.

You should only consider this option if you have health issues. A medical test is used to determine your health rating. The actual value of a whole life will improve if you get a better health rating.

If you still want to get a non-Medical $1,000,000 whole life, then we would suggest getting $400,000 non-Medical, and then $600,000 in a whole life with a medical.

$1,000,000 Single Premium Whole Life

Another option is to do a Single Premium Whole Life if you have the funds. Because this whole life is paid upfront, many companies will not require a medical exam.So this way, you will be able to get a $1,000,000 whole life insurance without a medical exam.

Guaranteed Issue Life Insurance $1M Cost

Another option to get a million-dollar policy is a $1,000,000 guaranteed issue policy. Some policies are term some are whole life. The good news is that you will not have to worry about getting approved. If you decide to get a guarantee issue term, the cost will be much cheaper.Get a $1,000,000 guaranteed issue quote.

$1,000,000 Convertible Term to Whole Life

If you still can not decide on a $1,000,000 whole life policy is right for you. However, don't hesitate to consider buying a convertible term insurance policy first. This is a fantastic strategy, especially at younger ages.You can buy a term policy today for $1,000,000 and change that policy into whole life in the future. You can even decide to change only a portion of the $1,000,000 if you do not want to convert the entire term policy. The best part about this is you will not be required to perform any medical exams at the time of conversion.

Check out your $1,000,000 Convertible Term Quote

Final Word

So now you have a better idea of pricing for a $1,000,000 whole life insurance. Also, remember that there are ways to get cheaper whole life insurance. Contact our agents, and they can show you how.Here is the next read which you may find interesting:

Top 7 Whole Life Insurance Companies For Cash Value

Whole Life Insurance For Dummies

Whole Life Insurance Dividend History