Updated Dec 11th, 2022

Penn Mutual Whole Life Insurance Review

In this article you will find our complete review of Penn Mutual's Whole Life Insurance and more.Penn Mutual, founded in 1847, is a leading provider of life insurance policies.

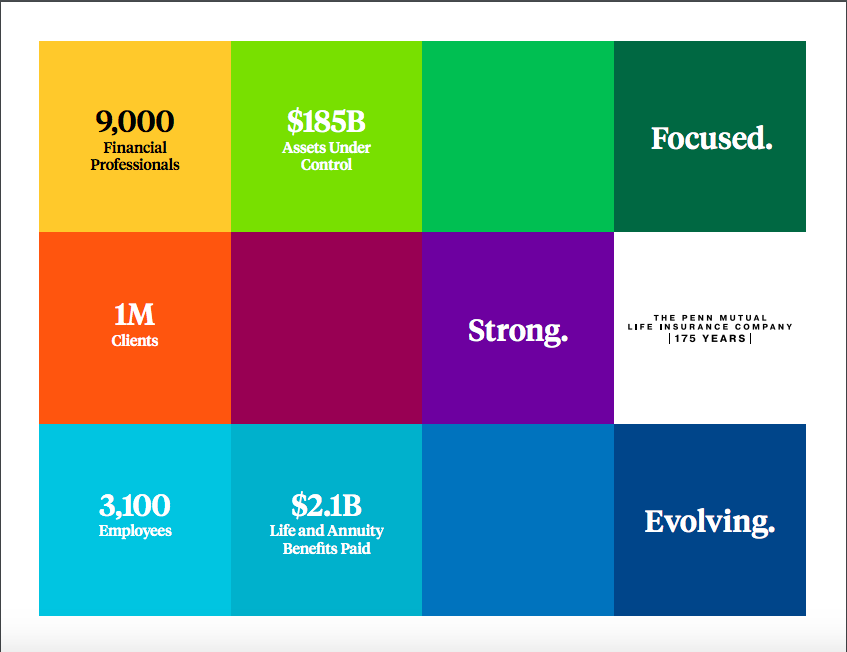

With total revenue of $4.5 billion for 2021, the company is growing rapidly. It also has over 9,000 financial professionals to serve their customers.

In 2022, Penn Mutual announced a record-breaking dividend payout to its policyholders. This dividend will provide them with additional financial security and stability, especially during today's uncertain economic climate. The record-breaking dividend reflects Penn Mutual's commitment to long-term financial stability and its customers.

It shows that the company values the loyalty and trust of its policyholders, and it will inspire greater customer loyalty.

Overall, the dividend is a testament to Penn Mutual's commitment to financial security and stability. It is a reflection of the company's performance and dedication to its customers, and it will provide much-needed financial security to many policyholders.

However, here's the question you may be asking yourself:

Does the company's whole life insurance stack up well when compared to the competition?[fancy-ul icon_type="font_icon" icon="icon-ok" color="Extra-Color-1" alignment="left" spacing="default"]

Pros

- Good Financial Ratings

- Participating Whole Life

- Stable Dividend Rate

- Good Customer Service

Cons

- Dividend Dropped

- No Direct Online Quotes

The Good

High Rating

It's essential to do business with a life insurance company with a solid financial rating because you don't have to concern yourself with trouble in the future.For more than 150 years, Penn Mutual has been one of the industry's highest-rated companies, thanks to its financial strength.

Its current ratings include:

- A.M. Best: A+ (Superior)

- Moody's Investors Service: Aa3 (Excellent)

- Standard & Poor's: A+ (Strong)

- Comdex: 93

Participating Whole Life Insurance

There is more to buying life insurance than the death benefit. In some cases, this can also be considered an investment in your future.With Penn Mutual, you'll be glad to know that its whole life insurance products are participating. In short, this means you earn a dividend along with a guaranteed interest rate.

NFP discusses this on its website, comparing Penn Mutual's whole life dividends to the competition. A quick review shows that Penn Mutual is competitive with other top whole life insurance companies. Also, their whole life insurance rates are very competitive.

Stable Dividend Rate

Penn Mutual is committed to providing competitive whole life insurance policies, complete with a solid dividend. Now let's see the company's dividend history, dating back to 2000:| Year | Dividend Rate |

| 2000 | 7.4 |

| 2001 | 7.4 |

| 2002 | 7.4 |

| 2003 | 6.48 |

| 2004 | 5.74 |

| 2005 | 5.74 |

| 2006 | 6.3 |

| 2007 | 6.3 |

| 2008 | 6.34 |

| 2009 | 6.34 |

| 2010 | 6.34 |

| 2011 | 6.34 |

| 2012 | 6.34 |

| 2013 | 6.34 |

| 2014 | 6.34 |

| 2015 | 6.34 |

| 2016 | 6.34 |

| 2017 | 6.34 |

| 2018 | 6.34 |

| 2019 | 6.1 |

| 2020 | 6.1 |

| 2021 | 5.75 |

| 2022 | 5.75 |

| 2023 | 5.75 |

We like to get averages over many different periods because it gives you an idea of stability. The following graph shows the average dividend:

| Years | Dividend Rate |

| 5 yr | 6.24 |

| 10 yr | 6.29 |

| 15 yr | 6.30 |

| 20 yr | 6.37 |

Related :

Penn Mutual Announced 2019 Dividend

Penn Mutual Announces 2018 Dividend

Customer Service

Buying life insurance is one of the biggest financial decisions you'll ever make, so it's important to work with a reputable company.Penn Mutual provides one of the best customer service experiences in the industry, thanks to its extensive network of agents and the ability to receive assistance via phone at any time.

Furthermore, its online customer service center is a great place to turn tax forms, make payments, manage your account, and much more.

The Not So Good

Dividend Drop

In reality, it is hard to find bad things about Penn Mutual. Unfortunately, their incredibly stable dividend that stayed at 6.34% for 11 years suffered a hit in 2019, and 2021. However, it has stabilized since then.Penn Mutual's new dividend for 2023 is 5.75%.This is great news because after a decrease in 2019, in 2020, the dividend holds.

That is still a very high dividend compared to the competition, and it ranks highly in our Dividend Rate History article.

No Quotes Online

One of the downsides of Penn Mutual is that like all mutual companies is very difficult to get a quote online. The great news is we have simplified this and you can get a quote with Penn Mutual with us.Get Me A Quote

Finances

There is plenty of information available in regards to Penn Mutual's finances, including the following:- Over $44 billion in assets

- Total Revenue of $4.5 billion for 2021.

- Paid a total of $2.1 billion to policy holders in 2021.

Image Source Penn Mutual.

Image Source Penn Mutual. Financial Ratings

Again here are Penn Mutual's exceptional ratings:- A.M. Best: A+ (Superior)

- Moody's Investors Service: Aa3 (Excellent)

- Standard & Poor's: A+ (Strong)

- Comdex: 93

Products

Penn Mutual sells term, whole life insurance, universal life insurance, disability insurance, and much more. Its whole life policies are among the most popular, with the company making a note of the following benefits:- Money when you need it, thanks to the ability to build cash value.

- Security and stability, allowing you to plan for the future.

- Simple and flexible, ensuring that you get the policy that best suits you and your family.

Guaranteed Choice Whole Life

The main whole life product that Penn Mutual offers is called Guaranteed Choice Whole Life. It provides a death benefit and cash value guarantees of a traditional whole life policy. Also, you can have additional flexibility in policy payments.You can choose how long to pay for the policy. For example, you can choose a whole life that you pay for five years or up to age 100. Regardless of the length of the period you chose, once the policy is paid up, the death benefit and cash values are guaranteed to age 121.

Also, as a participating plan, the policy is eligible for non-guaranteed dividends.

Versatile Choice Whole Life

This policy gives you great flexibility as you can design how long you want to pay for it.Do you want to pay only for 10 or 15 years? No problem.

Also, you get some default riders:

- Overloan Protection Benefit Rider makes sure that you don't lapse the policy, even if you have loans on it.

- Waiver of premium riders to help protect the policy if the insured becomes totally disabled

- Chronic Illness Accelerated Benefit Rider

Survivorship Choice Whole Life

Survivorship Choice Whole Life is permanent life insurance for two people that pay a death benefit after the second death. This policy's main purpose is to pass wealth to the next generation or pay for estate taxes.Direct Recognition vs Non-Direct Recognition

Penn Mutual uses direct recognition on their whole life insurance.This means that when taking a loan on your whole life policy Penn Mutual will directly recognize the amount taken out of your policy. So, for example, if you have $100K in your cash values and decide to take out $50K, your cash value will drop to $50K, which will be the amount you receive a dividend on.

Inversely assuming the same scenario above, when you take out the 50K from a company that uses non-direct recognition, your cash-value account would reflect that you still have the complete $100K, which would keep accumulating dividends that amount. The companies do this by giving you a loan from their general account and using your insurance as collateral for the loan.

Without getting too technical non-direct recognition companies may distribute income much better than direct recognition companies. However, Penn Mutual's whole life is so strong that it doesn't suffer while taking income.

MassMutual is one of Penn Mutuals' biggest rivals and two companies that we are constantly compared to when considering a whole life policy. Check out our Penn Mutual Vs. MassMutual Review.

Compare Penn Mutual to MassMutual

Health Rating Classifications

Here are the possible health ratings that you can get to compare policies apples to apples. We listed them in descending order from best to worst:- Preferred Best (Available for Guaranteed Term products)

- Preferred Plus Non-Tobacco

- Preferred Non-Tobacco

- Standard Non-Tobacco

- Preferred Tobacco

- Standard Tobacco

Final Word

Finally, with a long history of providing high-quality products and services, many consumers trust Penn Mutual with their life insurance requirements.Our final take is that you cannot go wrong with a Penn Mutual Whole Life policy.

See how Penn Mutual Ranks in our Top 7 Whole Life Companies For Cash Value.

Other Reviews

Check out some of our other top whole life reviews:- MassMutual Whole Life Insurance Review

- Foresters Whole Life Insurance Review

- Ohio National Whole Life Insurance Review

- New York Life Whole Life Insurance Review

I Would Like To Get A Quote Now

Best Whole Life For Cash Value

Get Me A Quote Address:The Penn Mutual Life Insurance Company PO Box 178 Philadelphia, PA 19105

Website: https://www.pennmutual.com/

Phone Number: (800)523-0650