Whole Life Insurance For Smokers

Protecting your family with life insurance is one of the most important acts of love you could do. But Getting whole life can seem complicated, and picking the right one if you are a smoker can be a nightmare.Costs can vary significantly between companies, and most agents do not know which company to use.TIP: Whole Life prices don't change as much as term prices for smokers!

This guide is here to help you understand and pick the best whole life insurance for a smoker.

Cheap Life Insurance for Smokers

Not sure you are interested in whole life?More interested in finding the cheapest option for life insurance as a smoker? If you continue reading this article we provide cost comparisons between term and whole life for smokers.

Additionally, we break down life insurance for smokers in your 40's, 50's and 60's. If you don't have time to reach our full article no sweat.

From our experience, as a smoker, you will most likely be better off buying a term insurance policy. The premium cost for a term policy will look more attractive than a whole life policy.

Want to see what your actual quote would be? Go check out cheap smoker term quotes here.

Why Whole Life Insurance?

Whole Life insurance is the most conservative and simple way of getting permanent life insurance. You will get life insurance with strong guarantees in cash value and death benefit. Also, your premiums remain level for life.In addition, you get a "savings" component called cash value. This cash value grows every year, and it has great tax advantages. To get a better understanding of whole life insurance read our article: Whole Life Insurance For Dummies

If you do want permanent life insurance with strong benefits, then you should definitely consider whole life.

[caption id="attachment_11008" align="alignnone" width="800"]

Can Smokers Get Whole Life Insurance?[/caption]

Can Smokers Get Whole Life Insurance?[/caption]Are You A Smoker?

The fact that you smoke will affect your price in any life insurance policy. As a matter of fact, anything that affects your health negatively can affect your ability to get life insurance.Life insurance companies consider someone a smoker if they do any of the following:

- cigarettes

- pipe

- snuff

- chew

- smokeless tobacco

- electronic cigarettes

- Hookah/ Hookah Tobacco

- smoking cessation aids

- non-nicotine smoking cessation aids

How Do They Know If I Smoke?

You may be wondering how they know if you smoke or not. First, the insurance company pulls medical history, and if they find out you smoke then you get a smoker rating.Also, the insurance company will request a urine test. This urine test is how they verify to make sure you are not a smoker.

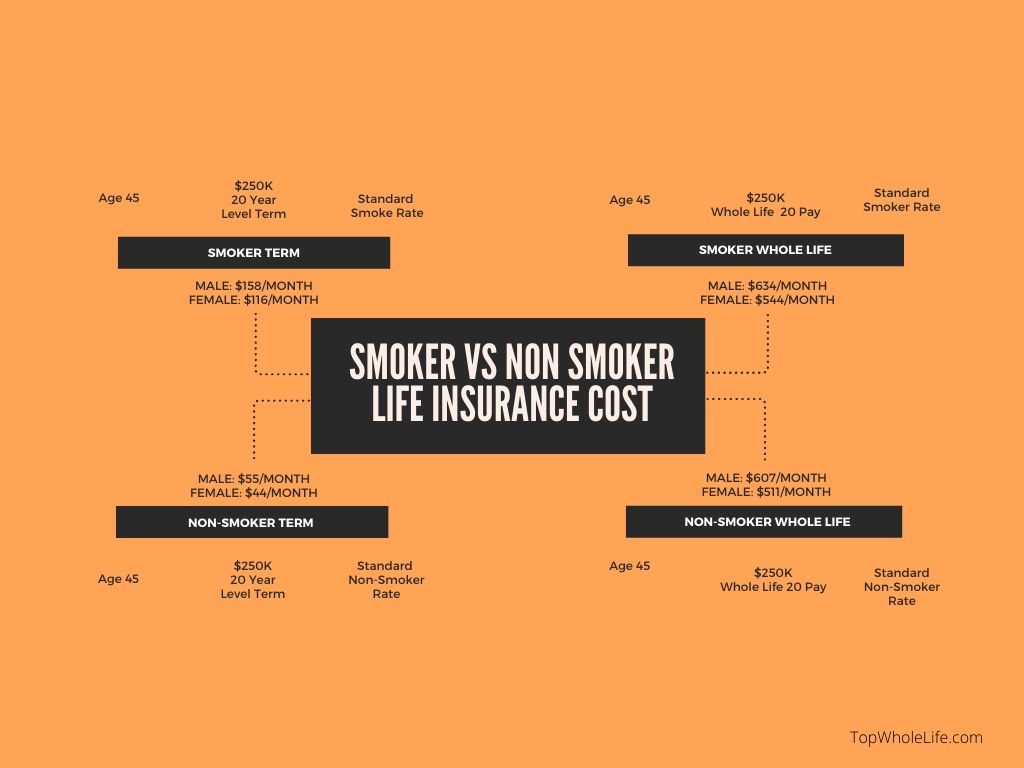

Smoker vs Non-Smoker Costs

Now we want to give you ideas in terms of pricing, and how much it affects you to be a smoker.

So let's start with an example for a 45-year-old male considering $250k term life insurance:

- Non-smoker pays $55/mo

- A smoker will pay $158/mo

- Non-smoker pays $44/mo

- A smoker will pay $116/mo

However, when we look at permanent insurance the rates are not double.

If you are considering a $250k whole life plan:

- A male smoker will pay $634/month VS non-smoker $607/month

- A female smoker will pay $544/month VS non-smoker $511/month

What Happens If I Stop Smoking?

The great news is that if you stop smoking, most companies will modify your rating. There is a period of time you need to stop smoking before you can get a non-smoker rating.Most companies will require at least 1 year of not smoking before you can change your rating.

Not All Smokers Are The Same

Not all smokers get the same rating. You can have great health but you are a smoker, in that case, you will be considered a "Preferred Smoker". This means your rates are better than if you smoke and you have other health issues.Most companies offer the following health rates:

- Smoker

- Preferred Smoker or Select Smoker

[caption id="attachment_11004" align="alignnone" width="800"]

Cigars Are Not That Bad For Life Insurance[/caption]

Cigars Are Not That Bad For Life Insurance[/caption] Cigar Smokers

Cigars are not that bad for life insurance. If you are a social cigar smoker, then most companies will not treat you like a smoker. Please ask your agents for the details of how the company you are applying treats cigar smoker.There are many companies that will treat you like a smoker, so make sure you are aware before you apply.

Marijuana Smokers

Marijuana smokers will be treated still as smokers. Most companies will not decline you. Marijuana most of the time is not considered drug use, but the insurance company will give you smoker ratings.Cost Of A Whole Life Insurance For Smokers

We prepared a reference of cost, cash value and death benefit of many different companies. Please know that is meant as a guide and you should always get quotes for your individual situation.In the following table, we have included company names. We included company names because we want to have transparency and help you see that there is a significant difference between companies.

If you like any of these policies feel free to request a quote, and one of our agents will reach out.

| Age 45 Male Smoker Good Health | |||

| Name | Premium | Cash @ 65 | Benefit @ 65 |

| Nationwide | $424 | $102,418 | $250,000 |

| Minnesota Life | $465 | $121,270 | $312,268 |

| Penn Mutual | $512 | $147,439 | $338,434 |

| MassMutual | $521 | $137,128 | $343,729 |

| Ohio National | $618 | $147,129 | $342,344 |

| Assurity | $687 | NA | $250,000 |

| Foresters | $690 | $154,670 | $359,723 |

| Age 35 Male Smoker Good Health | |||

| Name | Premium | Cash @ 65 | Benefit @ 65 |

| Nationwide | $279 | $122,048 | $250,000 |

| Minnesota Life | $314 | $166,798 | $361,159 |

| MassMutual | $322 | $184,154 | $395,796 |

| Penn Mutual | $335 | $214,699 | $415,741 |

| Ohio National | $370 | $194,317 | $383,556 |

| Foresters | $404 | $206,955 | $413,205 |

| Assurity | $433 | NA | $250,000 |

Life Insurance For Smokers Over 40

Below are some great affordable life insurance for smokers to consider. The following tables outline the costs for Male and Female Standard rate smokers for $250K, $500K, and 1M of term insurance coverage. These rates provide an estimate of costs for someone in their 40s considering applying for coverage.$250,000 - 20-year level term insurance coverage:

| Age 40 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $85.70 | $72.65 | $250,000 |

| Banner | $95.96 | $71.18 | $250,000 |

| Pacific Life | $96.69 | $71.19 | $250,000 |

| American National | $96.77 | $70.85 | $250,000 |

| AIG | $97.25 | $71.69 | $250,000 |

| Transamerica | $97.83 | $72.03 | $250,000 |

| Symetra | $98.40 | $76.34 | $250,000 |

| Company Name__ | Male | Female | Death Benefit |

| Centrian Life | $100.21 | $71.78 | $250,000 |

| Ameritas | $100.21 | $74.17 | $250,000 |

| Protective | $100.52 | $83.09 | $250,000 |

| North American | $101.20 | $77.00 | $250,000 |

| Mutual of Omaha | $102.77 | $77.40 | $250,000 |

| Prudential | $106.10 | $79.63 | $250,000 |

| MassMutual | $106.58 | $86.58 | $250,000 |

$500,000 - 20-year level term insurance coverage:

| Age 40 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $152.25 | $129.20 | $500,000 |

| Banner | $177.83 | $122.68 | $500,000 |

| Pacific Life | $178.50 | $133.45 | $500,000 |

| American National | $181.44 | $135.65 | $500,000 |

| AIG | $177.84 | $122.69 | $500,000 |

| Transamerica | $178.88 | $123.41 | $500,000 |

| Symetra | $188.84 | $144.58 | $500,000 |

| Company Name_ | Male | Female | Death Benefit |

| Centrian Life | $181.96 | $134.32 | $500,000 |

| Ameritas | $187.88 | $136.23 | $500,000 |

| Protective | $195.08 | $158.58 | $500,000 |

| North American | $186.12 | $143.00 | $500,000 |

| Mutual of Omaha | $198.88 | $148.14 | $500,000 |

| Prudential | $204.75 | $151.82 | $500,000 |

| MassMutual | $200.13 | $141.83 | $500,000 |

$1,000,000 - 20-year level term insurance coverage:

| Age 40 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $292.32 | $247.08 | $1,000,000 |

| Banner | $334.11 | $229.98 | $1,000,000 |

| Pacific Life | $335.75 | $259.67 | $1,000,000 |

| American National | $349.94 | $264.38 | $1,000,000 |

| AIG | $337.72 | $229.99 | $1,000,000 |

| Transamerica | $339.70 | $231.34 | $1,000,000 |

| Symetra | $354.72 | $276.63 | $1,000,000 |

| Company Name_ | Male | Female | Death Benefit |

| Centrian Life | $341.59 | $259.14 | $1,000,000 |

| Ameritas | $354.10 | $258.62 | $1,000,000 |

| Protective | $382.08 | $299.63 | $1,000,000 |

| North American | $341.88 | $268.84 | $1,000,000 |

| Mutual of Omaha | $379.48 | $289.18 | $1,000,000 |

| Prudential | $392.44 | $295.32 | $1,000,000 |

| MassMutual | $385.03 | $273.63 | $1,000,000 |

Life Insurance For Smokers Over 50

$250,000 - 20-year level term insurance coverage:

| Age 50 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $255.78 | $198.58 | $250,000 |

| Banner | $213.96 | $155.33 | $250,000 |

| Pacific Life | $213.56 | $155.34 | $250,000 |

| American National | $222.26 | $156.82 | $250,000 |

| AIG | $227.81 | $156.25 | $250,000 |

| Transamerica | $202.96 | $168.13 | $250,000 |

| Symetra | $237.86 | $169.07 | $250,000 |

| Company Name__ | Male | Female | Death Benefit |

| Centrian Life | $228.40 | $163.65 | $250,000 |

| Ameritas | $229.33 | $163.36 | $250,000 |

| Protective | $247.78 | $179.57 | $250,000 |

| North American | $233.86 | $160.82 | $250,000 |

| Mutual of Omaha | $238.22 | $168.35 | $250,000 |

| Prudential | $240.19 | $177.63 | $250,000 |

| MassMutual | $232.50 | $171.18 | $250,000 |

$500,000 - 20-year level term insurance coverage:

| Age 50 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $432.83 | $335.82 | $500,000 |

| Banner | $390.56 | $291.54 | $500,000 |

| Pacific Life | $390.57 | $291.55 | $500,000 |

| American National | $436.75 | $295.49 | $500,000 |

| AIG | $392.44 | $293.26 | $500,000 |

| Transamerica | $394.74 | $302.72 | $500,000 |

| Symetra | $450.67 | $321.94 | $500,000 |

| Company Name_ | Male | Female | Death Benefit |

| Centrian Life | $413.70 | $293.54 | $500,000 |

| Ameritas | $439.60 | $304.19 | $500,000 |

| Protective | $489.60 | $351.90 | $500,000 |

| North American | $428.12 | $301.84 | $500,000 |

| Mutual of Omaha | $463.33 | $330.03 | $500,000 |

| Prudential | $472.94 | $347.82 | $500,000 |

| MassMutual | $451.98 | $324.53 | $500,000 |

$1,000,000 - 20-year level term insurance coverage:

| Age 50 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $835.20 | $648.15 | $1,000,000 |

| Banner | $771.79 | $571.61 | $1,000,000 |

| Pacific Life | $771.80 | $571.62 | $1,000,000 |

| American National | $838.08 | $584.93 | $1,000,000 |

| AIG | $776.33 | $573.70 | $1,000,000 |

| Transamerica | $780.88 | $577.06 | $1,000,000 |

| Symetra | $861.29 | $609.70 | $1,000,000 |

| Company Name_ | Male | Female | Death Benefit |

| Centrian Life | $798.87 | $573.63 | $1,000,000 |

| Ameritas | $841.05 | $584.99 | $1,000,000 |

| Protective | $957.53 | $692.33 | $1,000,000 |

| North American | $815.32 | $591.80 | $1,000,000 |

| Mutual of Omaha | $901.50 | $621.15 | $1,000,000 |

| Prudential | $897.32 | $651.44 | $1,000,000 |

| MassMutual | $880.03 | $632.93 | $1,000,000 |

Life Insurance For Smokers Over 60

$250,000 - 20-year level term insurance coverage:

| Age 60 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $676.71 | $494.38 | $250,000 |

| Banner | $486.83 | $345.51 | $250,000 |

| Pacific Life | $486.84 | $345.52 | $250,000 |

| American National | $480.82 | $343.66 | $250,000 |

| AIG | $513.85 | $352.69 | $250,000 |

| Transamerica | $620.06 | $486.12 | $250,000 |

| Symetra | $596.63 | $364.44 | $250,000 |

| Company Name__ | Male | Female | Death Benefit |

| Nationwide | $598.50 | $348.91 | $250,000 |

| Ameritas | $496.89 | $361.26 | $250,000 |

| Protective | $510.85 | $449.23 | $250,000 |

| North American | $503.58 | $366.08 | $250,000 |

| Mutual of Omaha | $520.73 | $367.01 | $250,000 |

| Prudential | $529.82 | $360.94 | $250,000 |

| MassMutual | $515.05 | $364.33 | $250,000 |

$500,000 - 20-year level term insurance coverage:

| Age 60 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $1,186.68 | $866.52 | $500,000 |

| Banner | $896.03 | $660.01 | $500,000 |

| Pacific Life | $940.95 | $660.02 | $500,000 |

| American National | $955.58 | $653.61 | $500,000 |

| AIG | $979.83 | $698.10 | $500,000 |

| Transamerica | $985.56 | $897.84 | $500,000 |

| Symetra | $1,119.13 | $700.44 | $500,000 |

| Company Name_ | Male | Female | Death Benefit |

| Nationwide | $1,156.31 | $691.25 | $500,000 |

| Ameritas | $940.00 | $683.07 | $500,000 |

| Protective | $1,015.07 | $891.65 | $500,000 |

| North American | $974.16 | $683.32 | $500,000 |

| Mutual of Omaha | $1,034.80 | $727.78 | $500,000 |

| Prudential | $1,052.19 | $714.44 | $500,000 |

| MassMutual | $1,009.23 | $681.23 | $500,000 |

$1,000,000 - 20-year level term insurance coverage:

| Age 60 Male / Female - Standard Smoker (Monthly Premium Cost/Death Benefit) | |||

| Company Name | Male | Female | Death Benefit |

| Assurity | $2,298.54 | $1,678.49 | $1,000,000 |

| Banner | $1,761.71 | $1,244.81 | $1,000,000 |

| Pacific Life | $1,855.55 | $1,244.82 | $1,000,000 |

| American National | $1,866.11 | $1,233.79 | $1,000,000 |

| AIG | $1,826.27 | $1,302.42 | $1,000,000 |

| Transamerica | $1,836.96 | $1,749.24 | $1,000,000 |

| Symetra | $2,128.44 | $1,333.94 | $1,000,000 |

| Company Name_ | Male | Female | Death Benefit |

| Securian | $1,992.86 | $1,383.80 | $1,000,000 |

| Ameritas | $1,766.34 | $1,285.46 | $1,000,000 |

| Protective | $2,014.93 | $1,553.58 | $1,000,000 |

| North American | $1,939.96 | $1,288.76 | $1,000,000 |

| Mutual of Omaha | $2,034.12 | $1,439.86 | $1,000,000 |

| Prudential | $2,052.32 | $1,473.07 | $1,000,000 |

| MassMutual | $1,975.33 | $1,353.33 | $1,000,000 |

What Are Other Alternatives?

Guaranteed Universal Life Policies

A guaranteed universal life policy (GUL) can be a great alternative to whole life insurance. They work if you do not want to access cash value, but you still want permanent insurance.It's an affordable way of getting permanent insurance.

| Guaranteed Universal Life 250k Male Smoker | ||

| Age | Premium | Death Benefit |

| 35 | $179.67 | $250,000 |

| 30 | $223.03 | $250,000 |

| 45 | $269.98 | $250,000 |

Term Insurance

Maybe the best route is to pick term insurance. If you want cash value growth and you are a smoker, then maybe whole life is not the best option.To get the cheapest life insurance for a smoker you should go with Term Insurance.You can also consider a return of premium term insurance. In this policy, after the term is over you get all of your money back.

Here is a sample of a Male 250k smoker 20-year term and a return of premium term:

| Term 20 | Premium | Death Benefit |

| Normal | $45.50 | $250,000 |

| Return Of Premium | $213.99 | $250,000 |

Should I Wait Until I Stop Smoking?

You definitely shouldn't wait. The point of getting life insurance is to protect your loved ones from the unexpected. The unexpected can hit at any point in time.And your health can also change at any point in time.

Whole Life Insurance For Smokers - Final Word

Now you understand what it means to get a whole life insurance for a smoker. Also, you can see prices and we listed alternatives so you can make a good decision.I Would Like To Get A Quote Now

Cheapest Whole Life For Smokers

Get Me A Quote [divider line_type="No Line" custom_height="20"][toggles style="default"][toggle color="Default" title="What counts me as a smoker?"]Whole life insurance companies consider you as a smoker if you consume any product that contains tobacco. These will give you a smoker rating if you consume either of the following:

- Cigarettes

- Snuff

- Pipe

- Chew

- Smokeless tobacco

- Electronic cigarettes

- Hookah

- Smoking cessation aids

- Non-nicotine smoking cessation aids, etc.

Yes, you do. For example, a 45-year-old non-smoker male considering $250k term life insurance needs to pay $55/month. On the other hand, a smoker will pay $158/month for the same.

If you consider a $250k whole life plan, a male smoker (age 45) will pay $634/month, and a non-smoker, $607/month.

[/toggle][toggle color="Default" title="If I quit smoking, do I need to pay the same premium?"]A majority of whole life insurance companies will modify your smoker rating to non-smoker if you quit smoking. But there is a period you need to serve before you can get a non-smoker rating. For most companies, the time is one year.

[/toggle][toggle color="Default" title="How do insurance companies know that I smoke?"]Most insurers require some medical tests to distinguish between smokers and non-smokers. In addition, they can look up your medical history. It helps them determine the premium for whole life insurance coverage for smokers.

Medical tests help identify the traces of nicotine present in your blood. Nicotine stays in your body depending on your age, how often you smoke, and general health conditions.

[/toggle][/toggles]JTNDJTIxLS1GQVElMjBDb2RlJTIwU3RhcnQtLSUzRSUwQSUzQ3NjcmlwdCUyMHR5cGUlM0QlMjJhcHBsaWNhdGlvbiUyRmxkJTJCanNvbiUyMiUzRSUwQSU3QiUwQSUyMCUyMCUyMiU0MGNvbnRleHQlMjIlM0ElMjAlMjJodHRwcyUzQSUyRiUyRnNjaGVtYS5vcmclMjIlMkMlMEElMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyRkFRUGFnZSUyMiUyQyUwQSUyMCUyMCUyMm1haW5FbnRpdHklMjIlM0ElMjAlNUIlMEElMjAlMjAlMjAlMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyUXVlc3Rpb24lMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJuYW1lJTIyJTNBJTIwJTIyV2hhdCUyMGNvdW50cyUyMG1lJTIwYXMlMjBhJTIwc21va2VyJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMldob2xlJTIwbGlmZSUyMGluc3VyYW5jZSUyMGNvbXBhbmllcyUyMGNvbnNpZGVyJTIweW91JTIwYXMlMjBhJTIwc21va2VyJTIwaWYlMjB5b3UlMjBjb25zdW1lJTIwYW55JTIwcHJvZHVjdCUyMHRoYXQlMjBjb250YWlucyUyMHRvYmFjY28uJTIwVGhlc2UlMjB3aWxsJTIwZ2l2ZSUyMHlvdSUyMGElMjBzbW9rZXIlMjByYXRpbmclMjBpZiUyMHlvdSUyMGNvbnN1bWUlMjBlaXRoZXIlMjBvZiUyMHRoZSUyMGZvbGxvd2luZyUzQSU1Q25DaWdhcmV0dGVzJTVDblNudWZmJTVDblBpcGUlNUNuQ2hldyU1Q25TbW9rZWxlc3MlMjB0b2JhY2NvJTVDbkVsZWN0cm9uaWMlMjBjaWdhcmV0dGVzJTVDbkhvb2thaCU1Q25TbW9raW5nJTIwY2Vzc2F0aW9uJTIwYWlkcyU1Q25Ob24tbmljb3RpbmUlMjBzbW9raW5nJTIwY2Vzc2F0aW9uJTIwYWlkcyUyQyUyMGV0Yy4lMjIlMEElMjAlMjAlMjAlMjAlMjAlMjAlN0QlMEElMjAlMjAlMjAlMjAlN0QlMkMlMEElMjAlMjAlMjAlMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyUXVlc3Rpb24lMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJuYW1lJTIyJTNBJTIwJTIyRG8lMjBJJTIwbmVlZCUyMHRvJTIwcGF5JTIwbW9yZSUyMGlmJTIwSSUyMHNtb2tlJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMlllcyUyQyUyMHlvdSUyMGRvLiUyMEZvciUyMGV4YW1wbGUlMkMlMjBhJTIwNDUteWVhci1vbGQlMjBub24tc21va2VyJTIwbWFsZSUyMGNvbnNpZGVyaW5nJTIwJTI0MjUwayUyMHRlcm0lMjBsaWZlJTIwaW5zdXJhbmNlJTIwbmVlZHMlMjB0byUyMHBheSUyMCUyNDU1JTJGbW9udGguJTIwT24lMjB0aGUlMjBvdGhlciUyMGhhbmQlMkMlMjBhJTIwc21va2VyJTIwd2lsbCUyMHBheSUyMCUyNDE1OCUyRm1vbnRoJTIwZm9yJTIwdGhlJTIwc2FtZS4lNUNuJTVDbklmJTIweW91JTIwY29uc2lkZXIlMjBhJTIwJTI0MjUwayUyMHdob2xlJTIwbGlmZSUyMHBsYW4lMkMlMjBhJTIwbWFsZSUyMHNtb2tlciUyMCUyOGFnZSUyMDQ1JTI5JTIwd2lsbCUyMHBheSUyMCUyNDYzNCUyRm1vbnRoJTJDJTIwYW5kJTIwYSUyMG5vbi1zbW9rZXIlMkMlMjAlMjQ2MDclMkZtb250aC4lMjIlMEElMjAlMjAlMjAlMjAlMjAlMjAlN0QlMEElMjAlMjAlMjAlMjAlN0QlMkMlMEElMjAlMjAlMjAlMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyUXVlc3Rpb24lMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJuYW1lJTIyJTNBJTIwJTIySWYlMjBJJTIwcXVpdCUyMHNtb2tpbmclMkMlMjBkbyUyMEklMjBuZWVkJTIwdG8lMjBwYXklMjB0aGUlMjBzYW1lJTIwcHJlbWl1bSUzRiUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMmFjY2VwdGVkQW5zd2VyJTIyJTNBJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMkFuc3dlciUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMnRleHQlMjIlM0ElMjAlMjJBJTIwbWFqb3JpdHklMjBvZiUyMHdob2xlJTIwbGlmZSUyMGluc3VyYW5jZSUyMGNvbXBhbmllcyUyMHdpbGwlMjBtb2RpZnklMjB5b3VyJTIwc21va2VyJTIwcmF0aW5nJTIwdG8lMjBub24tc21va2VyJTIwaWYlMjB5b3UlMjBxdWl0JTIwc21va2luZy4lMjBCdXQlMjB0aGVyZSUyMGlzJTIwYSUyMHBlcmlvZCUyMHlvdSUyMG5lZWQlMjB0byUyMHNlcnZlJTIwYmVmb3JlJTIweW91JTIwY2FuJTIwZ2V0JTIwYSUyMG5vbi1zbW9rZXIlMjByYXRpbmcuJTIwRm9yJTIwbW9zdCUyMGNvbXBhbmllcyUyQyUyMHRoZSUyMHRpbWUlMjBpcyUyMG9uZSUyMHllYXIuJTIyJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTIwJTIwJTdEJTJDJTBBJTIwJTIwJTIwJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMlF1ZXN0aW9uJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIybmFtZSUyMiUzQSUyMCUyMkhvdyUyMGRvJTIwaW5zdXJhbmNlJTIwY29tcGFuaWVzJTIwa25vdyUyMHRoYXQlMjBJJTIwc21va2UlM0YlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJhY2NlcHRlZEFuc3dlciUyMiUzQSUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJBbnN3ZXIlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjJ0ZXh0JTIyJTNBJTIwJTIyTW9zdCUyMGluc3VyZXJzJTIwcmVxdWlyZSUyMHNvbWUlMjBtZWRpY2FsJTIwdGVzdHMlMjB0byUyMGRpc3Rpbmd1aXNoJTIwYmV0d2VlbiUyMHNtb2tlcnMlMjBhbmQlMjBub24tc21va2Vycy4lMjBJbiUyMGFkZGl0aW9uJTJDJTIwdGhleSUyMGNhbiUyMGxvb2slMjB1cCUyMHlvdXIlMjBtZWRpY2FsJTIwaGlzdG9yeS4lMjBJdCUyMGhlbHBzJTIwdGhlbSUyMGRldGVybWluZSUyMHRoZSUyMHByZW1pdW0lMjBmb3IlMjB3aG9sZSUyMGxpZmUlMjBpbnN1cmFuY2UlMjBjb3ZlcmFnZSUyMGZvciUyMHNtb2tlcnMuJTVDbiU1Q25NZWRpY2FsJTIwdGVzdHMlMjBoZWxwJTIwaWRlbnRpZnklMjB0aGUlMjB0cmFjZXMlMjBvZiUyMG5pY290aW5lJTIwcHJlc2VudCUyMGluJTIweW91ciUyMGJsb29kLiUyME5pY290aW5lJTIwc3RheXMlMjBpbiUyMHlvdXIlMjBib2R5JTIwZGVwZW5kaW5nJTIwb24lMjB5b3VyJTIwYWdlJTJDJTIwaG93JTIwb2Z0ZW4lMjB5b3UlMjBzbW9rZSUyQyUyMGFuZCUyMGdlbmVyYWwlMjBoZWFsdGglMjBjb25kaXRpb25zLiUyMiUwQSUyMCUyMCUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCU1RCUwQSU3RCUwQSUzQyUyRnNjcmlwdCUzRSUwQSUzQyUyMS0tRkFRJTIwQ29kZSUyMEVuZC0tJTNF