American Income Life Whole Life Insurance Review

American Income Life Insurance Company sounds like a company that would provide high-quality whole life insurance coverage to a large audience.While it has several products to choose from, these continually come up short compared to the competition.

If all you are looking for is a quote to compare, you can get one here:

Compare American Income Life vs. The Competition

Get A Whole Life & Cheap Prices

Get Me A Quote [fancy-ul icon_type="font_icon" icon="icon-ok" color="Extra-Color-1" alignment="left" spacing="default"]The Good

- Strong Financial Ratings

- Lot's of Riders

- Good Product List

- Solid Customer Base

The Bad

- Bait And Switch

- Non-Participating Whole Life

- Poor Customer Service

- Hard To Find Your Agent

Here are some crucial details and statistics associated with the company:

- American Income Life Insurance Company was founded in 1951 based in Waco, Texas.

- American Income Life Insurance is a wholly-owned subsidiary of Globe Life Inc. (NYSE: GL), an S&P 500 Company (source AIL)

- The company is licensed in 49 states, the District of Columbia, and Canada.

- Along with their New York subsidiary National Income Life, American Income Life has combined assets of more than $4.2 billion with more than $59 billion of life insurance in force in 2017 (as of 3/18).

However, it's also important to compare all the finer details to other providers, as this is the only way to understand what's available fully. (data from AIL Website).

The Good

Strong Financial Rankings

While some companies fall short in this area, American Income Life Insurance Company has remained relatively strong over the years.Consider the following:

- AM Best: A+

- Fitch: A+

- S&P: AA-

Solid Customer Base

There is no denying that American Income Life Insurance Company is smaller than some whole life insurance industry leaders.Even so, the company has grown to more than two million policyholders throughout the United States and Canada.

When you consider its $59 billion of life insurance in force, you have a company with a solid customer base. One of their main focus is to:

"AIL's efforts are focused on creating more union jobs. We proudly proclaim our status as a 100% union label Company."As you can see, they have a decent size customer base.

Wide Product List

American Income Life Insurance Company sells more than just whole life insurance. They have many different policies like:- Hospital Indemnity

- Cancer Protection

- Critical Illness

- Whole Life Insurance

- Term Insurance

For example, its term life policies are very popular.

The Not So Good

Non-Participating Whole Life Insurance

When shopping for whole life insurance, it's best to avoid non-participating companies.American Income Life's whole life has a 4.5% guaranteed rate, enough to attract many consumers. However, it's important to note that there is no dividend on top of this.

Here's why this is a big deal: many other companies offer both a guaranteed rate and a dividend. With this dividend, it's easier to see that your policy will grow much faster with each passing year. As a result, your cash value grows faster, and your death benefit can also grow.

As a comparison, please look at our historical dividend article: Historical Whole Life Dividend Rates.

This one pitfall alone is reason enough to shy away from American Income Life Insurance Company's whole life policies instead of choosing a participating company.

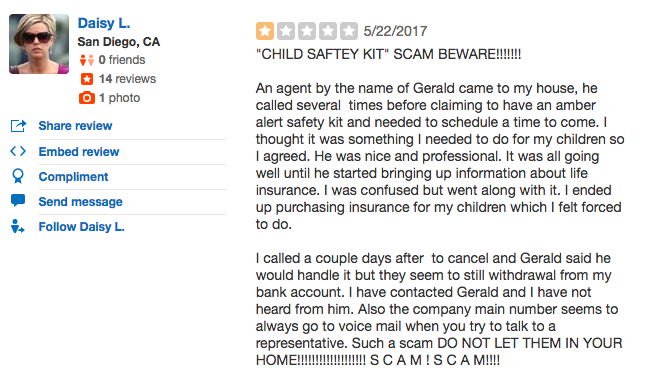

Bait And Switch

Unfortunately, there have been many instances of clients complaining about a bait and switch on the sale of Child Safety Kits. These kits seem like a fantastic idea: The problems come with a salesperson trying to pressure you into buying life insurance.

The problems come with a salesperson trying to pressure you into buying life insurance.In reality, everyone needs life insurance, but it's strange when you expect one thing and get something else.

Now let's look at some other reviews that are worrying.

Check out some of the bad reviews on Yelp:

Here are some other bad comments on the marketing tactic:

Here are some other bad comments on the marketing tactic: The kits can be a great idea if sold properly. But this strange way agents sell American Income Life policies can leave customers feeling cheated, and that's why they call it a scam.

The kits can be a great idea if sold properly. But this strange way agents sell American Income Life policies can leave customers feeling cheated, and that's why they call it a scam. Bad Customer Service

There is nothing more important than keeping customers happy in today's day and age. But unfortunately, it only takes a few bad online reviews to harm a company.Unfortunately, the American Income Life Insurance Company finds itself in this position. As a result, hundreds upon hundreds of online reviews, both from individual policyholders and employers, are unhappy with the company.

Some people complain that it takes entirely too long to purchase a policy. You may be disappointed with the customer service. Some customers say that they are unable to get in touch with a company representative when they have questions or concerns.[image_with_animation image_url="16380" animation="Fade In" hover_animation="none" alignment="" border_radius="none" box_shadow="none" image_loading="lazy-load" max_width="100%" max_width_mobile="default"]Don't take our word for it read more directly from the Better Business Bureau: Click Here to read more

It's good that American Income Life Insurance Company has strong financial ratings, but this doesn't do anything for the company regarding its online reviews.

Final Word

If there is one thing you should know about whole life insurance, it's this: many reputable companies are selling high-quality policies while providing the best possible customer service.Our American Income Life Whole Life Insurance Review is not favorable.

American Income Life Insurance Company has been around for more than 65 years, but it's not the right choice for whole life insurance buyers for two reasons:

- It is a non-participating company, meaning your money will go further elsewhere.

- It doesn't have positive reviews from other consumers.