Best Whole Life Insurance of 2020

When looking for the "best whole life insurance," you probably have many things in mind. Just like any other purchase, you probably want the best in many areas.So picking the best policy may seem very complicated.

However, understanding what your primary purpose for the whole life is will make your choice much easier. Also, as you can imagine, different whole life policies have different strengths.

In this article, we will break down the best whole life policies by categories:

- Cash Value

- Price

- Company Strength

- Underwriting

- Most Options

Whole Life Insurance Is Simple

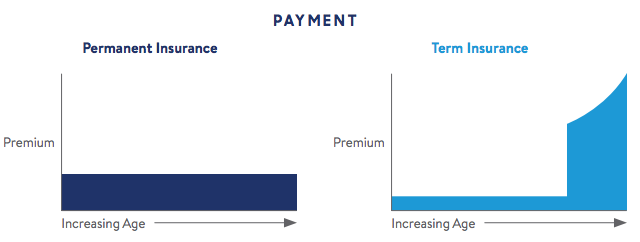

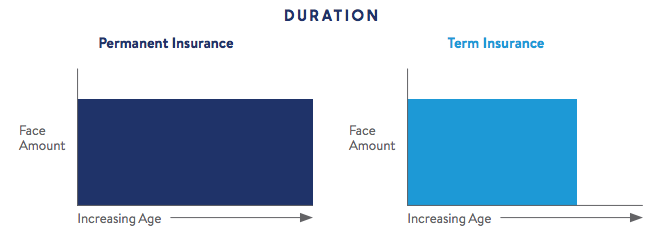

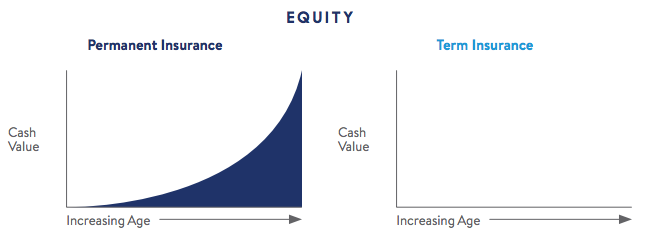

Whole life is a type of permanent life insurance. As long as you pay your premiums your beneficiaries are guaranteed a benefit in the future... simple right?You also have a savings feature in your whole life insurance called cash value, and you can access the cash value at any point in time.

Here is a simple visual comparison of three major factors of permanent whole life insurance vs. term insurance. Payments (Premiums),

Best Whole Life Insurance

So here is a list of all the different categories and the company you should pick.Best Whole Life For Cash Value

Cash value is one of the most attractive features of whole life insurance. This is an area we have lots of experience, and we are specialists. So we will give you a few tips as well.What you should look for here is a dividend-paying whole life insurance policy with a high performing dividend.

If you would like to read our full report, check out our article on the best whole life companies for cash value. We always edit our list as new data comes out.

Our pick: MassMutual.

Features:

- MassMutual is a Fortune 100 company.

- MassMutual has the #1 selling whole life products in the industry.

- MassMutual is recognized as the World's Most Ethical Company by the Ethisphere Institute.

- MassMutual has fantastic ratings throughout:

- A.M. Best Company: A++ (Superior; Top category of 15)

- Fitch Ratings: AA+ (Very Strong; second category of 21)

- Moody's Investors Service: Aa2 (Excellent; third category of 21)

- Standard & Poor's: AA+ (Very Strong, second category of 21)

Check out Penn Mutual Review

Best Whole Life For Prices

Many people shop online to find the best prices. It's not different while looking for the best whole life insurance prices.

Many people shop online to find the best prices. It's not different while looking for the best whole life insurance prices.However, before you only look at pricing, make sure you also consider other factors. Whole life is an asset, and when buying assets, you should look for the best, not just for the cheapest.

Strictly speaking about pricing for a permanent policy is hard to beat Ameritas' "Value Plus Whole Life."

Our Pick: Ameritas

Ameritas offers a participating whole life policy with great prices.

Check out our: Ameritas Review

Features:

- Ameritas has over 4 million customers in the U.S.

- Ameritas also boast great ratings

- A.M. Best Company: A, Excellent

- Standard and Poor's: A+, Strong

- Better Business Bureau rates the company as an A+

Best Whole Life Company Rating

Picking the best company is one of the easiest choices you have. Many 3rd party companies spend a lot of resources rating the company strength. We are going to use their advice and pick the best this way.Our Pick: It's a tie between two companies!

New York Life- M. Best Rating: A++

- Fitch Ratings: AAA

- Standard & Poor's Rating: AA+

- Moody's Rating: Aaa

- A.M. Best Rating: A++

- Fitch Ratings: AAA

- Standard & Poor's Rating: AA+

- Moody's Rating: Aaa

Best Non-Medical Whole Life

A non-medical as the name says means that you do not have to do a medical exam. Non-Medical or no exam whole life insurance is a good option for those looking to get insurance quickly and without any hassle.Our pick: Foresters Financial

Foresters is an excellent company with a strong non-medical whole life. You can get non-medical coverage up to $400,000.

Read our: Foresters Whole Life review.

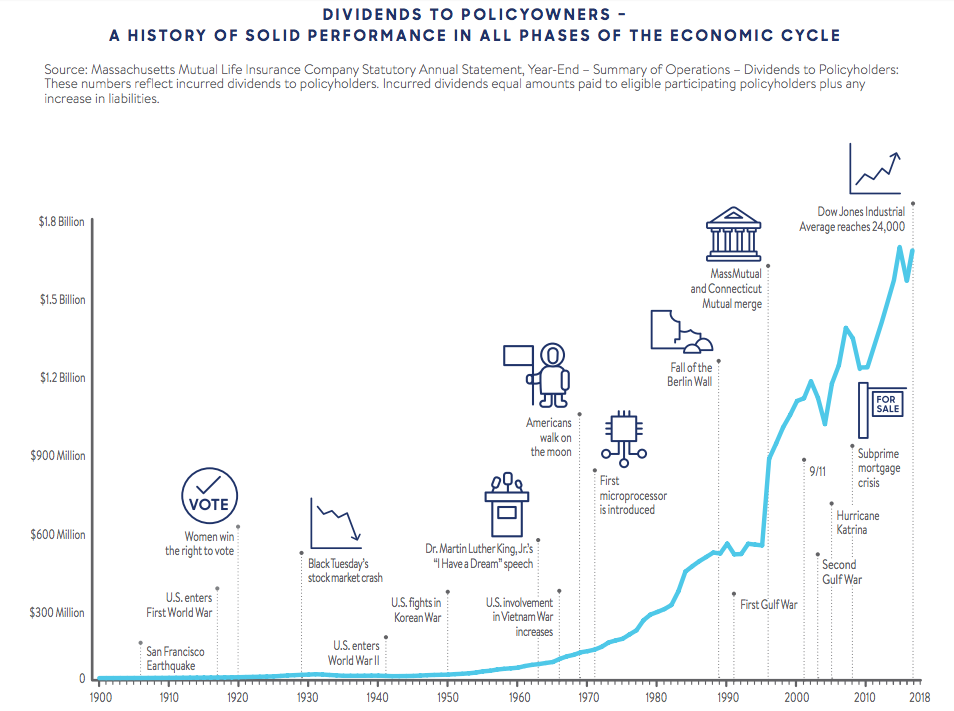

Best Whole Life for Dividends

Dividends are one of the most important features a good whole life needs. Dividends are paid by participating companies that share their profits with the policyholders. These dividends get added to the whole life policy and help it grow faster.Year to year all the companies' dividends are going to fluctuate to some extent up or down. Remember, dividends are not guaranteed. We like to look at track history when choosing who has the most reliable dividends.

Our pick is: MassMutual

Check out the full article on Whole Life Insurance Dividend Rate History

Check out the full article on Whole Life Insurance Dividend Rate History Best Whole Life for Income

One of the interesting ways to use whole life insurance is for retirement income. This is not a strategy that many people are familiar with, but it can be a good alternative to your traditional income strategies.We cover this topic extensively here in our experts guide Whole Life Insurance For Income

Our pick: MassMutual

What you should look for here is a non-direct recognition mutual company.The reason why "non-direct recognition" is so important is your policy cash value will continue to grow in value even when you have a loan outstanding on the policy.

For example, let us assume you have $100,000 in cash values and decide to take a 50K loan on the policy. Policy one is Direct recognition, and policy two is non-direct recognition.

Policy 1:

Cash Value = $100,000

Loan $50,000

Cash value balance earning dividends = $50,000

Policy 2:

Cash Value = $100,000

Loan $50,000

Cash value balance earning dividends = $100,000

MassMutual offers policies that are like policy two examples where your loan is not directly recognized. MassMutual does this by providing you a loan from their general account and using your life insurance policy as the collateral if you were never to pay back the balance. Learn more here.

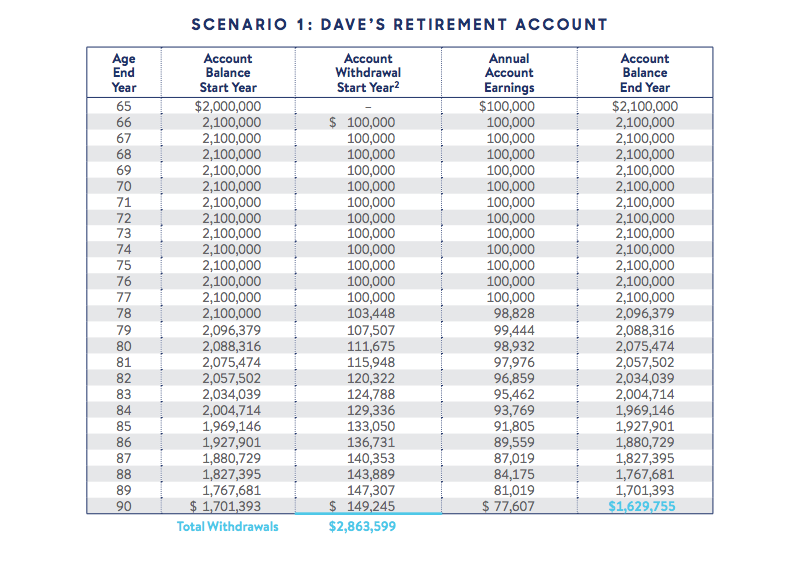

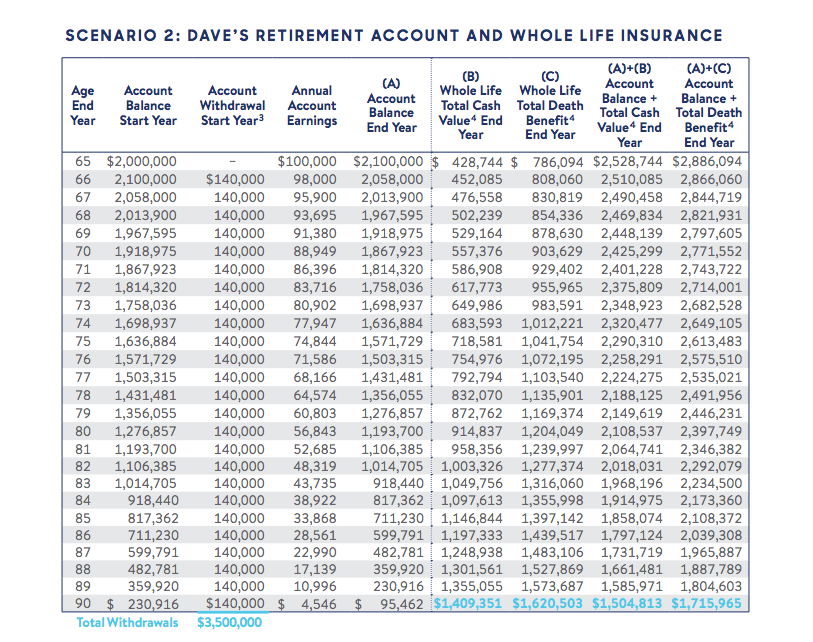

Check out this example of a retiree with and without permanent insurance:

In this first example, the client Dave retires without whole life insurance.

In this second example, Dave has Whole Life included in his retirement planning.

Clearly, you can see that whole life can become part of your income stream and help you have more money in retirement. It seems like a no brainer.

Best Limited Pay Whole life

A limited pay whole life is a type of whole life that you only have to pay for a limited time. Even-though you only pay for a short period, you keep your permanent coverage and cash value for the rest of your life.Most of these policies come in different time frames on how long you have to pay. The most common payment time frames are:

- 10 years

- 15 years

- 20 years

- Until Age 65

Our Pick: MassMutual

- Whole Life Legacy 10 Policy

- Whole Life Legacy 20 Policy

Features:

- Limited time paying into a policy.

- Higher cash values.

- Fewer fees

Best Whole Life for Seniors

Many seniors decide to purchase whole life insurance to cover their burial expenses.Our pick: Mutual of Omaha

Features:- Guaranteed coverage

- Policy issue ages: 45 - 85 (in NY, ages 50-75)

- Benefit amounts: $2,000 - $25,000 (in WA, $5,000 - $25,000)

- Benefits that are never reduced because of age or health

- No medical exams or health questions to answer

- Rates that never increase

- Free Funeral Concierge 24/7 at no extra cost

Best Whole Life for Kids

Most people are familiar with Gerber Life. However, they are not our pick for the best whole life policy for kids.They do a fantastic job of promoting their life insurance. Also, many parents do not know that their life insurance is a whole life. While Gerber Life does an excellent job of promoting, their product is not the best choice for kids.

Read our full Gerber Review

Pretty much any whole life insurance company will offer whole life insurance for kids. All of the big mutuals (Guardian, MassMutual, Penn Mutual, New York Life, and many more). Even-thought other websites will make you think that's not the case.

Our Pick: MassMutual

Reasons:The main reason we like MassMutual is you can use their Legacy 10 or 20 product for kids. This means that in 10 or 20 years you are done paying and you keep your policy forever. Also, MassMutual is our #1 choice for cash value growth, so your kids will have tons of cash value when they are older.

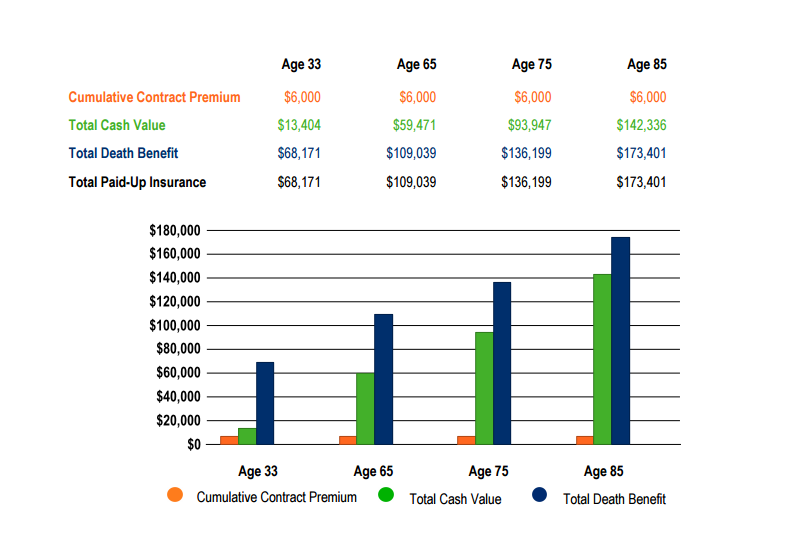

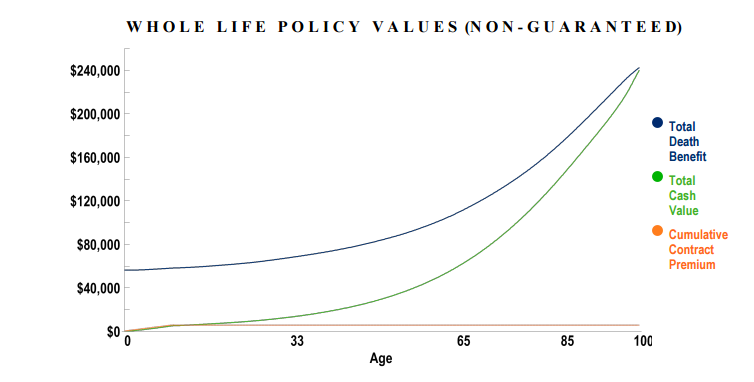

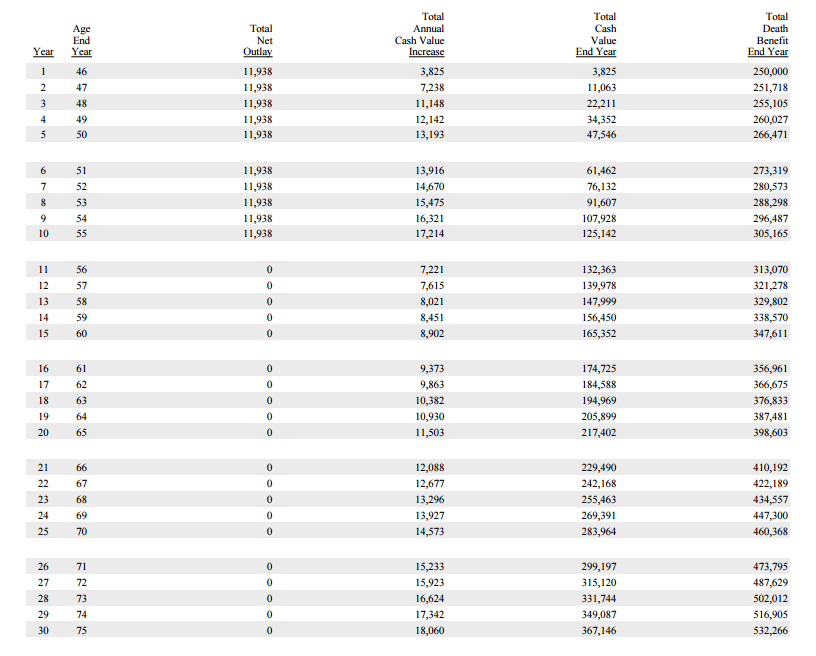

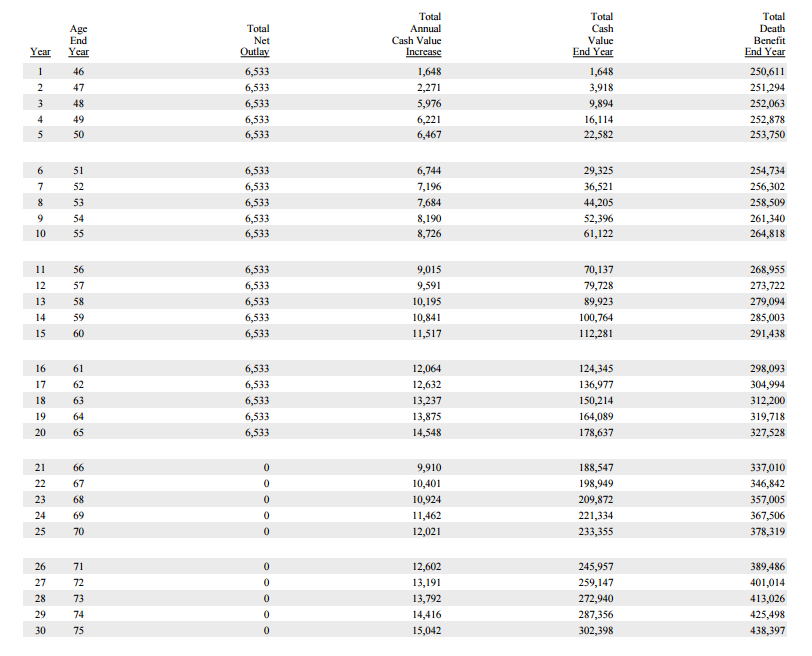

In the below example this was a $50.00 per month contribution to a juvenal policy that will provide your child's future.

The below policy design was the Legacy 10 so you only make payments for 10 years.

By age 10 you have put away $6,000 for your child with no more premium contributions needed.