LEGAL: We are not MassMutual Agents, and we do not represent any of the companies on the list, this is third party review.

Coverpath by MassMutual

Still to this day, it is not simple to find a life insurance policy online. Coverpath by MassMutual is changing this.The typical online experience is you request quotes. Then your phone starts to ring off the hook from advisers looking to speak to you.

What if there was a better way? What if you could buy quality life insurance completely online all on your own!

That's right, NO MORE PHONE CALLS!!!

MassMutual has taken steps with their program called Coverpath to offer you a seamless online experience of buying life insurance.

Introducing Coverpath

By MassMutualWhat is Coverpath by MassMutual

Coverpath by MassMutual offers a complete online experience for buying life insurance.This is a new online platform that MassMutual has invested to help you apply and purchase quality convertible term life insurance. The biggest announcement going into 2020 is coverpath now offers several whole life products completely online. This is a huge breakthrough and now you can see live personalize whole life quotes from MassMutual.

Top Features:

- You can keep your insurance policy when you change jobs.

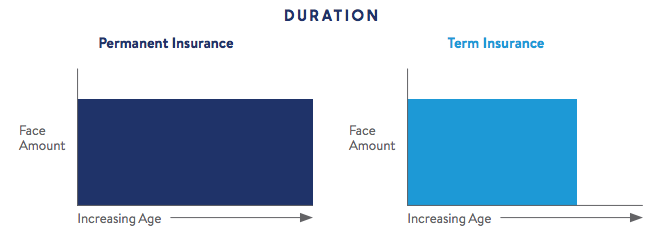

- Convert the term insurance to whole life insurance if you want permanent coverage in the future.

- You can choose to receive expert guidance from an advisor along the way or DIY the process.

- You can view personalized Whole Life illustrations live. See your death benefit and cash value projections.

- Coverpath eliminates the reasons you have not purchased life insurance for your life today.

Who is MassMutual?

MassMutual is a Fortune 100 Company with very high-quality ratings and a long history of performance.They have been around for more than 160 years.

Since 1851, MassMutual has been helping its clients protect their future and the ones they love.

MassMutual is growing very rapidly, which can only help their performance.

They are committed to a small product base, and in particular to their best selling whole life insurance.

Company Strength

MassMutual has fantastic ratings all throughout:- A.M. Best Company: A++ (Superior; Top category of 15)

- Fitch Ratings: AA+ (Very Strong; second category of 21)

- Moody's Investors Service: Aa2 (Excellent; third category of 21)

- Standard & Poor's: AA+ (Very Strong, second category of 21)

MassMutual Products Available through Coverpath

Convertible Term Insurance

- 10 Year Level Term Insurance

- 15 Year Level Term Insurance

- 20 Year Level Term Insurance

- 25 Year Level Term Insurance

- 30 Year Level Term Insurance

Additionally, you can choose to add a waiver of premium to cover premiums if you become disabled.

Whole Life Insurance

Whole life insurance is permanent life insurance that builds cash value. It can be a great tool if used correctly because you will be able to guarantee your beneficiaries get something.There are many kinds of policies, but the main difference is how long you pay for them. Some people call them limited pay life insurance as well.

- 10 Pay Whole Life

- 12 Pay Whole Life

- 20 Pay Whole Life

- Pay to age 65 Whole Life

- Pay to age 100 Whole Life

If you are looking for lifetime coverage that offers you cash values that grow over time, MassMutuals policies should be at the top of your list.

How It Works

1) Get your Quote

The quoting process for Coverpath by MassMutual is completely online. If you need help estimating your coverage you can speak to an advisor as well.2) Apply Online

Complete a simple online application There is no physical paperwork required.You can complete the entire application online from your phone or computer. If you need help answering any question you can reach out to an advisor for guidance.

Application Check List:

- Driver's license number and expiration date

- Social Security Number

- Current height and weight

- Personal and family medical history

3) Get a Decision

If approved, get your final price and start coverage.The approval process can be as fast as 90 Seconds!

Coverpath by MassMutual - What You Need To Know

Will you qualify for Coverpath Insurance?Convertible Term Insurance

- Issue ages for 10, 15, 20, 25yr level term premium terms:

- Ages 18 to 60: $100K to $3M

- Ages 61 to 64: $100k up to $1M

- Issue ages for 30yr level premium term:

- 18-54 non-tobacco classes

- 18-49 tobacco classes

- Issue ages for whole life policies 18 - 65 years of age only

- Max Policy Size Age 18 - 60: $3,000,000

- Max Policy Size Age 61 - 65: $1,000,000

- No Juvenile Policies

Add Waiver of Premium

What is it?A disability waiver of premium rider states:

If the policyholder becomes totally disabled either from illness or injury, then the policyholder doesn't have to pay premiums for the duration of the disability (if the disability lasts for longer than 6 months, the policyholder will receive a full refund from date of the disability).

Those who think they would be in danger of not being able to afford the premium if they were to become disabled may want to consider this option. Note: This rider is available with an additional monthly fee for applicants under the age of 50.

Coverpath by MassMutual - 3 Ways to get Covered

1) Temporary Life Insurance Coverage - TLIC

This path will approve you for temporary coverage at the time of submission. A medical exam needed schedule within 90 days of the application.2) Knock Out

This means no decision is reached and will you have not qualified for TLIC.This doesn't mean you cannot get life insurance however a medical exam needed within 30 days of application.

3) Express path

Congrats! You have just received an immediate acceptance with no medical exam required.You now are insured!

The Medical Exam

What to expect for your life insurance medical exam?

The exam process is intended to be convenient for you.

After completion of your application, Coverpath will order a trained paramedic will come to either your home, office.

Also if you prefer, you can elect to go to an ExamOne/Quest Labs location. And get your lands done there.

You will need to prove the examiner a few things:

- Review family medical history

- Measure blood pressure, height, and weight

- Collect blood and urine samples

Special Note:

Before the exam...DO NOT:

- Eat.

- Drink

- Exercise

Want to compare other companies to MassMutual?

We understand you may want to shop around and see if MassMutual is really the best option for your situation. Compare MassMutuals options with others here:Coverpath by MassMutual Conclusion

Coverpath by MassMutual is the future of purchasing life insurance. Check out Boston's Business Journal Article about this program.Now that MassMutual has released whole life products through Coverpath's platform this will change the game for people who are searching for whole life coverage. You can now get a get quote and compare.

As you can see, this is a big leap for the insurance industry. And it is a leap that will change the way we are used to buying insurance.

We are excited to see how the merging of technology and life insurance progresses in the years to come.

Still doing your homework check out:

Life Insurance For Dummies

Whole Life Insurance RatesGet Me A Quote