Updated August 28th, 2019

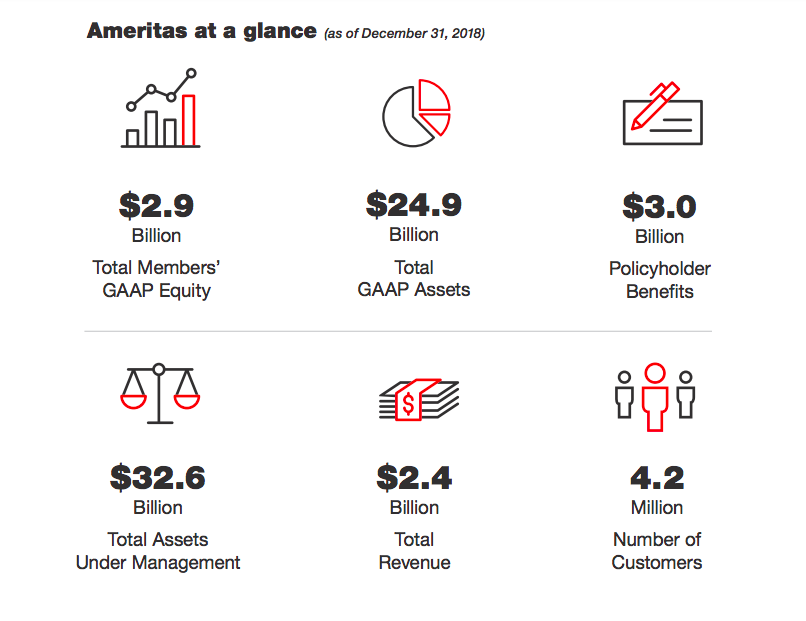

For more than 125 years, Ameritas has been one of the top names in the life insurance industry. A large part of the company's success is based on its strong mission statement:"We help make the lives of our customers and their families better by offering proven, trusted and valued insurance and financial solutions over lifetimes. This is what we do and we strive to do it better than anyone."A quick review of the Ameritas 2018 Annual Report shows that the company is in strong financial standing. Here are a few key statistics:

- $24.9 billion total GAAP assets

- $3.0 billion policyholder benefits

- $32.6 billion total assets under management

- $2.4 billion in total revenue

The Good

Strong Financial Rating

Some whole life insurance companies struggle to maintain a solid financial footing, but this is not the case with Ameritas.For many years, the company has taken great pride in its financial strength, with current ratings including:

- A.M. Best: A, Strong (third highest of 13 possible rankings)

- Standard & Poor's: A+, Excellent (fifth highest of 21 possible rankings)

Guaranteed Cash Value Growth

It's not the case with every company, but Ameritas has a variety of whole life insurance policies with guaranteed cash value growth. This is exactly what it sounds like: your whole life insurance policy will build cash value at a guaranteed interest rate.As tax-deferred growth, you're in a position to accumulate a nice sum of money over the length of your policy.

Although it's not guaranteed, whole life insurance policies from Ameritas typically receive an annual dividend, which is another way to build cash value.

Tip: you can use the cash value of your policy however you see fit, such as to pay for educational expenses or a home renovation project. Even though it reduces the amount of the death benefit, it's an option to consider.

Custom Whole Life Coverage

Since no two people are exactly the same, it's nice to have multiple customizable options when shopping for whole life insurance.Ameritas offers great flexibility with its products, giving you the opportunity to meet your exact wants and needs.

The four types of policies offered by Ameritas include:

- Ameritas Growth Whole Life (a most popular choice)

- Ameritas Value Plus Whole Life (for consumers on a tighter budget)

- Keystone Whole Life

- Keystone Foundation Whole Life

Very Affordable Whole Life

Ameritas offers a great affordable whole life product, it's called Ameritas Value Plus Whole Life. This a good choice for consumers that are looking for looking for a good price from a decent company. This product is not the greatest for cash value accumulation, but if you want permanent coverage for a cheap price, then it's hard to beat.The Not So Good

The Fine Print

When buying any type of insurance, it's important to carefully review your policy documents before signing on the dotted line.While not a widespread problem, a quick internet search turns up a few customers disgruntled by the terms and conditions of their policy.

Here's the good thing: if you read the fine print before buying, you won't be caught off-guard by anything.

And, if you have any questions, you can contact the Ameritas customer service team. Ameritas is well known for its dedication to customer service, so you shouldn't have any problem getting answers to all your questions.

Higher Pricing For Growth

You should never buy whole life insurance based on price alone, but you have to know how a company stacks up before making a final decision.We already said that Ameritas has a cheap whole life, so why are we saying that it's expensive now? Ameritas is only expensive when you are looking for whole life with cash value growth.

When it comes to whole life rates, Ameritas is not the most expensive, but it is in the top tier. If you're looking for something more affordable, without giving up anything in terms of reputation, quality and cash value, check out MassMutual and Penn Mutual.

While Ameritas may have higher rates than many competitors, don't lose sight of what you're getting in return. For example, you may be able to secure a lower premium with another company, but it may not offer guaranteed cash value growth.

Final Word

Ameritas is a great option when you are looking for a cheap whole life policy.Also, Ameritas is one of the better life insurance companies for cash value. When you combine this with custom coverage and strong financial ratings, you have a company that's well worth your consideration.

Even if you don't end up buying an Ameritas whole life insurance policy, you can learn a lot by requesting and comparing multiple quotes.Get A Personal Quote