Updated March 7th, 2019

The company has a focus primarily on voluntary insurance products, which are payroll deducted through workplaces. They also provide products focused on the senior market. The company, which is very young in the insurance world, has its main offices in Virginia; however, officially, it is domiciled in Baton Rouge, Louisiana. This company has about $42 billion of insurance in force and protects over 800,000 people. 5Star Life Insurance motto is "Serving those who serve this great nation".

In this5Star Life Insurance Company Review, we will cover the following topics: So let's get started.

Fortunately, we can help you out right here to get a quote!

Where we feel that this is magnified is in the final expense insurance product they offer. We reviewed that it is only accessible to older people. This ends up excluding many who may still like to buy this type of coverage from 5Star.

Additionally, companies' worksite benefits have similar challenges. Although almost all of these policies offer on a guaranteed issue basis. If you have less than ten people, you would not be able to participate in these products ether.

Weiss (Safety Rating): C

Better Business Bureau Rating: A

5 Star's popular solution for final expense insurance offers different plans called Silver Premier Choice. This is a cash value whole life policy

The two types of options that consumers have to choose from are:

This option offers applicants a simplified way to get the life insurance they want. 5Star makes it much easier to obtain coverage. Where most applications for life insurance are 10-20 pages of questions, this policy only requires you to answer seven medical questions.

Product Features:

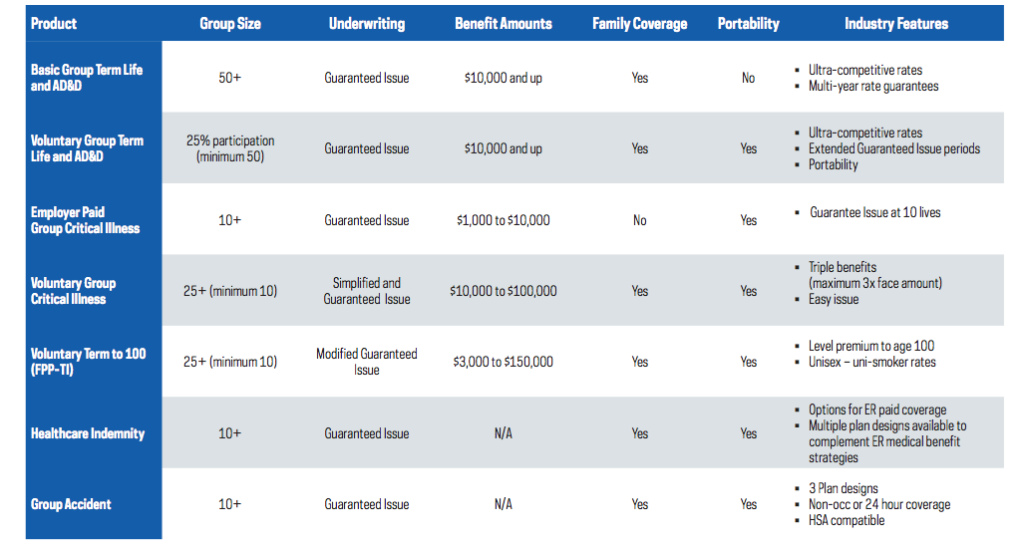

One of the significant benefits of this group insurance is that many of the following coverages are guaranteed issue. This means that as long as the employer meets the minimum amount of people to apply, then no one will be denied coverage. This is true even if there are underlying health conditions.

Also, as with the whole life product, many of these group insurance coverages include the emergency death benefit payment feature. This provides $15,000 to the beneficiary within one business day of notification to help loved ones with immediate expenses.

One final key feature of the several group benefits options is that the policies are portable. This means that if you were to leave the company or group where you acquired the coverage, then you could choose to continue to pay the premiums on your own and be guaranteed to keep the coverage. This is a very great benefit and an option for employees.

Here is a chart of all the group benefits offered by 5Star

Several riders may be added to the life insurance products offered by 5 Start Life Insurance Company.

If you require a policy to cover the final items in your life when your time is right well, 5Star certainly is one of the best options on the market. We know that the insurance products from 5Star are not for everyone. If you find that you do fit they're key demographic, we would recommend this company.

5Star Life Insurance Company Review

In the article, you will find our 5Star Life Insurance Company Review, let's start by looking at who 5Star Life Insurance Company is?Company Overview

5Star Life Insurance Company also knows as "5Star Life," founded in 1996. The company has a unique background by providing insurance coverage for the Armed Forces Benefit Association (AFBA). This association (AFBA) was established back in 1947 in collaboration with Dwight D. Eisenhower. It was created to help the general welfare of military families during war and peace. Interestingly soldiers were not able to purchase life insurance that would provide for their family if they die in the line of duty. The association operates as a non-profit and has expanded its membership to more than just military families. Now they offer membership to groups such as law enforcement, firefighters, and emergency medical personnel.The company has a focus primarily on voluntary insurance products, which are payroll deducted through workplaces. They also provide products focused on the senior market. The company, which is very young in the insurance world, has its main offices in Virginia; however, officially, it is domiciled in Baton Rouge, Louisiana. This company has about $42 billion of insurance in force and protects over 800,000 people. 5Star Life Insurance motto is "Serving those who serve this great nation".

In this5Star Life Insurance Company Review, we will cover the following topics: So let's get started.

The Good

Underwriting

5Star offers several different product types, but the underwriting requirements are what attracted our attention. For almost all of the companies policies, they underwrite based on "simplified" or "guaranteed issue". This means that:- If you are being underwritten in the simplified issue process, it is possible to obtain coverage almost immediately by answering just a seven key nock out questions.

- If you are in a workplace and being provided benefits from 5star, you could be guaranteed coverage regardless of your health background as long as there were enough participants to apply.

Final Expense Life Insurance

5Star has expanded its market share and now is a large provider of final expense insurance for the senior market. The specific product to reference is called Silver Premier Choice Plan. This plan offers two types of coverage availabilities: One is called preferred, which allows the policy to pay a benefit from day one. The second option is Graded, which doesn't pay in full until the third policy year. Check out the Product section below to learn more about this solution.Service To Those Who Serve

We are big fans of those who offer up their time and lives to the support of this country. It is not an easy or glorious thing to commit to, and 5Star Life has been steadfast in its mission to provide support to the great men and women who have devoted their lives to serving others. We believe that this is a great positive attribute about 5Star Life.The Bad

Overall we did not find anything terrible about this company. They have a strong history of doing good; however, here is a couple of bad things about 5Star Life.No Quote Option on Website

One of the major downsides we did discover is that the company does not provide access to quotes on their website for people like you who are reading this article. For us, this is a major ding because, in today's age, this is very important. You, as a consumer, want to be able to see what things will cost before you waste your time.Fortunately, we can help you out right here to get a quote!

Access to Products

Although 5Star offers products to individuals and groups, they are both very specialized and do not leave much room to include people who may want to obtain their insurance. Although this may be for a reason, this we feel is a negative deduction.Where we feel that this is magnified is in the final expense insurance product they offer. We reviewed that it is only accessible to older people. This ends up excluding many who may still like to buy this type of coverage from 5Star.

Additionally, companies' worksite benefits have similar challenges. Although almost all of these policies offer on a guaranteed issue basis. If you have less than ten people, you would not be able to participate in these products ether.

Complaints

Again we found it hard to find things that were very bad with this company. There were some reported complaints on the BBB site. Several of these complaints were regarding billing issues and miscommunications between agents and or staff members at 5Star. Additionally, there were a few referencing distaste of the products they purchased. We feel that although it is bad to have these complaints, 5Star has done a good job replying to many of these comments, and the BBB agrees that they are an A in this matter.Finances

Ratings

A.M. Best Company(Financial Strength): A-Weiss (Safety Rating): C

Better Business Bureau Rating: A

Products

5 Star Life provides solutions in two specific markets only. These include term insurance coverage to employer groups. The second market is a simplified issue whole life insurance in the senior market. Being that they only focus on these two particular niches and even further only offer protection to specific professions or age, they are very good at what they do. We have broken the product offerings into three sections Whole Life Insurance, Simple Issue, and Group Insurance. Let's take a look at the following products that 5Star has to offer.Whole Life Insurance:

Silver Premium Choice Plan5 Star's popular solution for final expense insurance offers different plans called Silver Premier Choice. This is a cash value whole life policy

The two types of options that consumers have to choose from are:

- Preferred - Benefit Payable from day one

- Graded - Benefit Graded year 1-2 and fully payable in the third policy year

- Offered to ages 50 - 85

- No medical exam to qualify

- Application and Approvals typically same day

- Death benefit $5,000 and $25,000.

- Coverage guaranteed not to decrease in value.

- Premiums guaranteed level

- Non- Cancelable

- Cash value accumulation, tax-deferred.

- Coverage lasts up to age 121.

- Emergency death benefit - to provide funds quickly for final expense and or other related costs.

Simple Issue:

Family Protection PlanThis option offers applicants a simplified way to get the life insurance they want. 5Star makes it much easier to obtain coverage. Where most applications for life insurance are 10-20 pages of questions, this policy only requires you to answer seven medical questions.

Product Features:

- No medical exam or database check is required

- The application can be processed and coverage active in a few days

- Cost is level to age 100

- Children and grandchildren can be added as additionally insured up to age 23.

Group Insurance

As mentioned above, the company has a larger product suite for business and group insurance coverage. The policies seemed to be designed to be perfect for small to mid-sized employers.One of the significant benefits of this group insurance is that many of the following coverages are guaranteed issue. This means that as long as the employer meets the minimum amount of people to apply, then no one will be denied coverage. This is true even if there are underlying health conditions.

Also, as with the whole life product, many of these group insurance coverages include the emergency death benefit payment feature. This provides $15,000 to the beneficiary within one business day of notification to help loved ones with immediate expenses.

One final key feature of the several group benefits options is that the policies are portable. This means that if you were to leave the company or group where you acquired the coverage, then you could choose to continue to pay the premiums on your own and be guaranteed to keep the coverage. This is a very great benefit and an option for employees.

Here is a chart of all the group benefits offered by 5Star

Riders

Riders

Several riders may be added to the life insurance products offered by 5 Start Life Insurance Company. - Critical Illness Rider:

- This ride will provide 30% of the policy's death benefit if the insured has a heart attack, life-threatening cancer, stroke, or other specific diagnoses.

- Waiver of Premium Rider

- This rider ensures that premiums would continue to be paid if they are totally disabled. The benefit would start to pay premiums after a six-month waiting period.

- Terminal Illness Rider:

- This rider pays 30% of the death benefit if the insured is diagnosed with a terminal illness and has less than 12 months or less to live.

- Quality of Life Rider

- This rider will accelerate some of the insureds insurance death benefit monthly if the insured is faced with a chronic medical condition. The distribution monthly is around 3 - 4%. The insured can receive up to 75% of the death benefit if needed.

- TI Air Rider

- This rider allows you to increase your coverage without any further questions at the time of the request.

Dividend Rate

N/A5Star Life Insurance Company Review - Final Word

Even though 5Star Life is a fairly new company in the insurance industry, they are defiantly one to offer high-quality service. Their association with the Armed Forces Benefit Association provides a lot of appeal to active duty military members and their families. As well as the expanded family of public servants in this country.If you require a policy to cover the final items in your life when your time is right well, 5Star certainly is one of the best options on the market. We know that the insurance products from 5Star are not for everyone. If you find that you do fit they're key demographic, we would recommend this company.

Make sure also to read:

Get A Personal Quote