Updated March 7th, 2019

The offering of life insurance is fairly new however they have been offering auto insurance since 1969. Over the years AAA has expanded into solutions such as homeowners insurance, travel insurance, annuities, and life insurance.

With AAA's consistency in honoring commitments, they were able to expand their offerings into other ancillary products that many of their current automobile customers need. At this time AAA provides over 1 million people AAA policies.

If you have ever considered AAA you may want to continue reading and find out if you should also be buying life insurance from them too.

In this AAA life insurance review we will cover the following topics: If all you want to get is a term, or whole life quote you can get one next:Get A Personal Quote Now

Some of the benefits that are offered to AAA members when buying life insurance are the waving of the annual policy fee of $60.00. Additionally, there are cross-purchase discounts that will also reduce your premium cost.

Weiss: B

These are decent ratings from a very large company. Now let's look at all the life insurance products AAA offers.

You can purchase anywhere between $25,000 - $250,000 of Term Insurance through AAA's online system.

Product Details:

Product details

Product Details:

Product Detail:

Product Details:

Product Details:

However, if you are looking for a quick easy process to get insurance for your final expenses than AAA may just be a great place to start. If you are curious about what the cost of AAA insurance is making sure to run a quote and see for yourself! If you are looking for more help and guidance you can also reach out to our life insurance specialists here at Top Whole Life.

17 Questions To Ask Before Buying Whole Life Insurance

Farmers Whole Life Insurance Review Get A Personal Quote

AAA Life Insurance Review

Thanks for visiting us today! In this article, we are covering the AAA Life Insurance Review.Company Overview

Personally, when I hear AAA I think of my car insurance or help to get my vehicle towed when I have flat or run out of gas. Well AAA does, in fact, offer other products such as life insurance.The offering of life insurance is fairly new however they have been offering auto insurance since 1969. Over the years AAA has expanded into solutions such as homeowners insurance, travel insurance, annuities, and life insurance.

With AAA's consistency in honoring commitments, they were able to expand their offerings into other ancillary products that many of their current automobile customers need. At this time AAA provides over 1 million people AAA policies.

If you have ever considered AAA you may want to continue reading and find out if you should also be buying life insurance from them too.

In this AAA life insurance review we will cover the following topics: If all you want to get is a term, or whole life quote you can get one next:Get A Personal Quote Now

The Good

Membership Benefits

All of AAA's insurance policies can be purchased by the public however if you are a member of AAA there are discounts and benefits that are associated with being a member. This is really great if you are looking for your life insurance and are trying to find maximum savings.Some of the benefits that are offered to AAA members when buying life insurance are the waving of the annual policy fee of $60.00. Additionally, there are cross-purchase discounts that will also reduce your premium cost.

Online Experience

AAA's overall online experience is very clean. We spend a lot of time researching insurance companies and AAA is definitely one that stands out as being very simple and straight forward to understand. AAA has found a way to make the look of the website inviting as well as the feel of the site. As you navigate you will notice that things are intuitive and you will be able to find most of there information pertaining to the company or their products.Many Policy Choices

If you are looking for options then AAA has plenty to choose from. From term insurance to universal life AAA offers several options when considering a life insurance policy. In addition to the life insurance products that the company offers they also provide Accident Insurance and Annuities.The Bad

Only Smaller Whole Life Policies Sold

Although AAA has several policies to choose from there whole life policies are not as expansive. AAA's offers two different whole life policies; simple whole life and guarantee issue whole life. Both policies offer a lifetime death benefit and some cash value growth however the max death benefit offered is only $25,000.Higher Cost Of Insurance

In comparison to similar policy options when comparing AAA's policies to other AAAs options seem to be more expensive than their competitors. If you are looking for the cheapest policy options then we may not recommend any of AAA's policies. If you are a AAA member then it could potentially make sense to combine your home, auto, and life insurance with AAA.Finances

Ratings

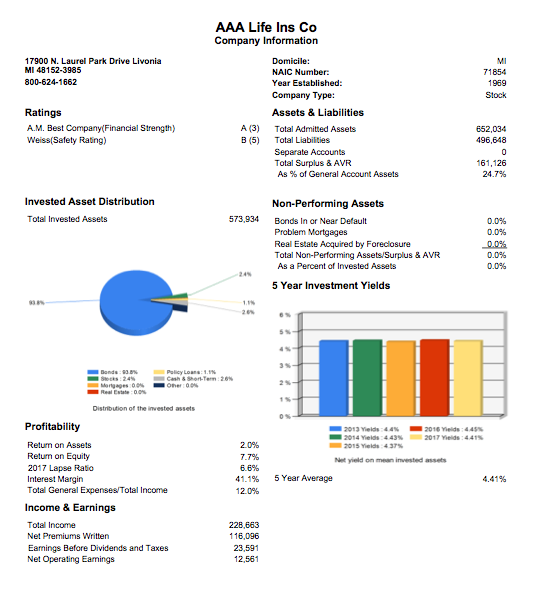

A.M. Best: AWeiss: B

These are decent ratings from a very large company. Now let's look at all the life insurance products AAA offers.

Life Insurance Products

AAA's policy offerings include:AAA Term Life Insurance Products

Next is the complete list of AAA's term life insurance products and all their details.Express Term

Express Term is AAA's complete online term life insurance offering.You can purchase anywhere between $25,000 - $250,000 of Term Insurance through AAA's online system.

Product Details:

- Term Life Insurance

- Choose a level term length of 10, 15, 20, 25 or 30 years

- Coverage may range between $25,000 - $250,000

- You are eligible at any age between 18 and 75 years old

- Health questions required to determine eligibility for coverage

- No physical exam necessary for qualified applicants

- As little as 10 minutes, if you qualify

- AAA membership not required to apply

- Annual policy fee waived for AAA members, a savings of $60 a year

- Premiums stay level until the initial term period ends, after which time the premiums increase each year

- Receive up to 50% of your benefit (up to $125,000) if you are diagnosed with a terminal illness with less than a year to live.

- Choose riders for Child Term, Disability Waiver of Premium, Travel Accident, or Accidental Death. The Lifetime Membership Benefit feature is included at no cost

- The policy is convertible until the end of the level term period or age 65, whichever is earlier

AAA Traditional Term Life

This is AAA's traditional term coverage as the name implies. The major difference to note between this product and the Express term is the death benefit limits and a medical exam is required to qualify.Product details

- Term Life Insurance

- Level Term options of 10, 15, 20, 25, or 30 years. Coverage ends at age 95

- Coverage may range between $50,000 - $5,000,000+ depending on your age

- Eligible for any age between 18 and 75 years old

- Health questions required to determine eligibility for coverage

- A medical exam could be required during the application process

- Coverage goes in force in 1-6 weeks

- AAA membership not required to apply

- Members may qualify for additional discounts on their auto/home insurance from AAA.

- Must apply with an AAA agent

- Premiums stay the same until the Term period ends, after which time the premiums increase each year

- You can get as much as 50% of your benefit (up to $500,000) if you are diagnosed with a terminal illness with less than a year to live

- Choose riders for Child Term, Disability Waiver of Premium, Travel Accident, or Return of Premium. The Lifetime Membership Benefit feature for surviving spouse is included at no cost

- The policy is convertible until the end of the level term period or age 65, whichever is earlier

- This policy does not build cash value

AAA Permanent Insurance Products

Permanent life insurance covers you for all of your life. In addition, this type of life insurance has other benefits like:- Guaranteed Premiums

- Cash Value

- Guarantees On The Death Benefit

Simple Whole Life

This product is an easy way to get whole life insurance with no medical exam required.Product Details:

- Whole Life Insurance

- Coverage designed to last a lifetime

- Coverage may range between $5,000 - $25,000

- Eligible to ages between 15 days and 80 years old

- Health questions will be used to determine eligibility for coverage

- No medical exam necessary

- Coverage in 5 - 7 days with temporary coverage while you wait, if you qualify

- AAA membership not required to apply

- Members may qualify for additional discounts on their auto/home insurance through AAA

- Short application with an AAA agent

- Premiums stay the same until age 100, at which time premium payments are no longer required

- You can get as much as 50% of your benefit if you are diagnosed with a terminal illness with less than a year to live

- Choose from Child Term, Disability Waiver of Premium, Travel Accident, and Accidental Death

- This is permanent life insurance

- This policy does build some cash value

Guaranteed Issue Whole Life

You can get coverage right away online or with an agent. Plus to get this policy your health does not matter when qualifying.Product Detail:

- Guaranteed acceptance Whole Life Insurance

- Coverage is lifelong and does not expire

- Up to $25,000 in benefits. A graded benefit provided in the first two years

- Acceptance guaranteed between ages 45 and 85

- No medical questions

- No medical exam

- Coverage begins when payment is processed

- AAA membership not required to apply

- The annual policy fee is waived for AAA members and their spouses, a savings of $60 a year

- Apply online, by mail or over the phone

- Premiums stay the same until age 100, at which time premium payments are no longer required

- Travel Accident Endorsement that doubles the death benefit and there is the Lifetime Membership benefit after the second year

- This is permanent life insurance

- This policy builds cash value

Lifetime Universal Life Insurance

A policy that provides potentially lifetime protection with level premiums.Product Details:

- Universal Life Insurance

- Coverage designed to last a lifetime

- Coverage may range between $25,000 - $5,000,000+

- Eligible for any age between 15 days and 85 years old

- Health questions required to determine eligibility for coverage

- A medical exam may be required during the application process

- Coverage goes in force in 1-6 weeks

- AAA membership not required to apply

- Members may qualify for additional discounts on their auto/home insurance from AAA

- Must apply with an AAA agent

- Premiums can stay the same until age 100, at which time premium payments are no longer required

- You can get as much as 50% of your benefit (up to $500,000) if you are diagnosed with a terminal illness with less than a year to live

- Choose from Child Term, Disability Waiver of Premium, and Accidental Death

- This is permanent life insurance

- This policy does build some cash value

Accumulator Universal Life

This policy is another one of AAA's Universal Whole Life designs with a focus on cash value accumulation.Product Details:

- Universal Life Insurance

- Coverage designed to last a lifetime

- Coverage may range between $25,000 - $5,000,000+

- Eligible for any age between 15 days and 80 years old

- Health questions required to determine eligibility for coverage

- A medical exam may be required during the application process

- Coverage goes in force in 1-6 weeks

- AAA membership not required to apply

- Members may qualify for additional discounts on their auto/home insurance from AAA

- Must apply with an AAA agent

- You can adjust your premiums as your needs change with this product. By paying the "no-lapse" amount, coverage is guaranteed for 10 years

- You can get as much as 50% of your benefit (up to $500,000) if you are diagnosed with a terminal illness with less than a year to live

- Choose from Child Term, Disability Waiver of Monthly Deduction, Accidental Death, Additional Insured (such as for a spouse), Guaranteed Purchase Option, and Primary Insured. The Lifetime Membership Benefit feature for surviving spouse is included at no cost

- This is permanent life insurance

- This policy does build cash value

Riders

- Disability Waiver of Premium

- Child Protection Rider

- Accidental Death Benefit

Dividend Rate

N/AFinal Word

AAA has proven itself to be a company that people can trust. From there auto and home insurance all the way to life insurance and annuities. The company provides many different solutions to the public and its members. If you are considering a whole life policy with AAA you may want to think twice is you are looking for a policy that provides high cash value.However, if you are looking for a quick easy process to get insurance for your final expenses than AAA may just be a great place to start. If you are curious about what the cost of AAA insurance is making sure to run a quote and see for yourself! If you are looking for more help and guidance you can also reach out to our life insurance specialists here at Top Whole Life.

Continue Reading

How Much Does Whole Life Insurance Cost? Whole Life Insurance FAQ's17 Questions To Ask Before Buying Whole Life Insurance

Farmers Whole Life Insurance Review Get A Personal Quote