Updated March 7th, 2019

Ethos is based in San Francisco California and founded in 2017. Ethos launched with the help of several backers: Sequoia Capital, Stanford University. Entertainment and Celebrities such as Arrive, a subsidiary of entertainment company Roc Nation. Actor Robert Downey Jr.'s Downey Ventures. Basketball player Kevin Durant's Durant Company. Actor Will Smith's Smith Family Circle. With the help of these many investment partners, the company focuses on providing term life insurance to consumers through an entirely online experience.

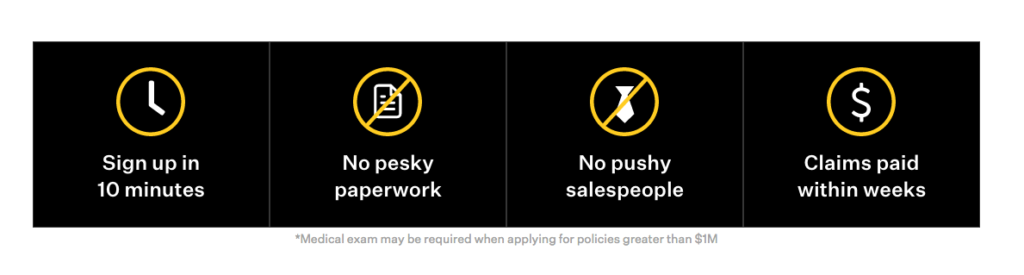

Ethos is one of the very few companies in the industry, projecting that the future of life insurance sales will be a complete online experience. As you can see below, this is what Ethos promises its visitors on their website when researching life insurance.

Ethos is not the only company that is trying to make it big in the online life insurance space. A significant competitor in this space is MassMutual Financial Group. This company owns subsidiaries who are called Haven Life and Coverpath. Both of these subsidiary companies offer an online experience; however, they have MassMutual a 160 Billion dollar company backing them.

It seems that a large enough consumer group is searching for an online solution for life insurance. Offering an online experience makes sense for life insurance. I think we all can agree that there is an expectation for most companies to provide an online option in today's age.

In this Ethos review, we will cover the following topics: So let's get started.

The exam is a very annoying step for many people and can stop someone from acquiring coverage. Well, great news you will not be required to take a medical test/exam to get life insurance with Ethos!

Special note: If you are applying for $1,000,000 or more then Ethos may require a medical exam to be approved.

Ethos provides policies issued by Assurity Life Insurance Co., a Nebraska-headquartered company founded in 1890.

Also, the term insurance products are not convertible to any permanent products in the future. Learn more as to why you may want a convertible term insurance policy.

When it comes to life insurance planning, there can be several situations that were not speaking to an advisor that can lead to improper purchasing of life insurance.

The products offered to people from ages 18 to 75.

They offer term lengths of 10 years, 15 years, 20 years, 25 years, and 30 years.

Coverages range from as low as $25K to $10 Million.

If you are comfortable with doing your research to figure out how much or little you need for coverage. Plus you are comfortable with the lack of contact with an advisor. Then Ethos may be just right for you to lock in coverage for you and your family.

Just remember not to worry if you prefer a phone call or chat option Haven Life and Coverpath offer both. Go check them out as it only takes minutes to compare.

Life for Dummies Get A Personal Quote

Ethos Life Insurance Review

In the article, you will find our Ethos Life Insurance Review, let's start by looking at Ethos the company.Ethos is based in San Francisco California and founded in 2017. Ethos launched with the help of several backers: Sequoia Capital, Stanford University. Entertainment and Celebrities such as Arrive, a subsidiary of entertainment company Roc Nation. Actor Robert Downey Jr.'s Downey Ventures. Basketball player Kevin Durant's Durant Company. Actor Will Smith's Smith Family Circle. With the help of these many investment partners, the company focuses on providing term life insurance to consumers through an entirely online experience.

Ethos is one of the very few companies in the industry, projecting that the future of life insurance sales will be a complete online experience. As you can see below, this is what Ethos promises its visitors on their website when researching life insurance.

Ethos is not the only company that is trying to make it big in the online life insurance space. A significant competitor in this space is MassMutual Financial Group. This company owns subsidiaries who are called Haven Life and Coverpath. Both of these subsidiary companies offer an online experience; however, they have MassMutual a 160 Billion dollar company backing them.

It seems that a large enough consumer group is searching for an online solution for life insurance. Offering an online experience makes sense for life insurance. I think we all can agree that there is an expectation for most companies to provide an online option in today's age.

In this Ethos review, we will cover the following topics: So let's get started.

The Good

Complete Online Experience

Ethos is unique in that they offer an entirely online experience to its customers. The experience is quick and easy, so they say.

No Medical Exams

That's right! Most life insurance companies require that you fill out an extensive life insurance application and then complete a medical exam to get coverage. The exam requires you have blood drawn and a urine specimen collected to be approved.The exam is a very annoying step for many people and can stop someone from acquiring coverage. Well, great news you will not be required to take a medical test/exam to get life insurance with Ethos!

Special note: If you are applying for $1,000,000 or more then Ethos may require a medical exam to be approved.

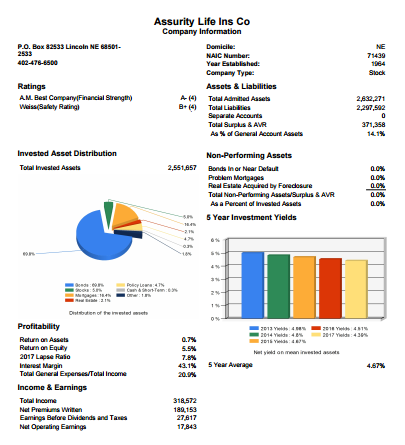

Financial Strength

Remember, Ethos is just a marketing company. They are not the ones providing life insurance protection. So the financials of Ethos do not matter.Ethos provides policies issued by Assurity Life Insurance Co., a Nebraska-headquartered company founded in 1890.

The Bad

No Permanent Life Insurance

Unfortunately, Ethos only offers temporary life insurance "Term." They do not provide coverage types such as whole life insurance, universal life insurance, index universal, variable life insurance.Also, the term insurance products are not convertible to any permanent products in the future. Learn more as to why you may want a convertible term insurance policy.

No Advisors

Ethos is again a 100% online experience so you will not be speaking to an advisor or insurance expert. For some, this may is positive, but others will say this is a negative feature. There is a saying, "you don't know what you don't know."When it comes to life insurance planning, there can be several situations that were not speaking to an advisor that can lead to improper purchasing of life insurance.

Finances

Ratings

Ratings are established by third-party companies to determine how reliable a company is.- A.M. Best Rating (Financial Strength): A-

- Weiss Rating (Safety Rating): B+

Products

To recap, Ethos only offers term insurance policies. The term policies they offer are very standard for the industry.The products offered to people from ages 18 to 75.

They offer term lengths of 10 years, 15 years, 20 years, 25 years, and 30 years.

Coverages range from as low as $25K to $10 Million.

Riders

In addition to the basic term insurance coverage. Ethos provides additional riders to consumers so they can customize their life insurance policy.Critical Illness Rider

The Critical Illness rider pays out a lump sum if diagnosed with invasive cancer or carcinoma.Child Protection Rider

The Child Protection rider covers children up to the age of 25.Endowment Benefit rider

This rider returns a portion of your premiums after a specific time.Waiver of Premium rider

This Rider means you are not obligated to pay premiums if you become totally disabled.Dividend Rate

N/AFinal Word

Remember, Ethos is a marking company; however, they are on the cutting edge of the insurance industry. We believe that insurance providers expect sales to become a 100% online experience. The company has made a baby step, and they are only focusing on the simplest of products (Term Insurance).If you are comfortable with doing your research to figure out how much or little you need for coverage. Plus you are comfortable with the lack of contact with an advisor. Then Ethos may be just right for you to lock in coverage for you and your family.

Just remember not to worry if you prefer a phone call or chat option Haven Life and Coverpath offer both. Go check them out as it only takes minutes to compare.

Make sure check out:

Whole Life vs. Term Who is the Winner?Life for Dummies Get A Personal Quote