Accordia Life Insurance Review

This company has a very interesting history to recap as we start to review the company. Accordia Life is located in Des Moines, Iowa. They actually have a parent company called Global Atlantic Financial Group Limited.Global life was a creation of Goldman Sachs back in 2004. Yes, that is Goldman Sachs, one of the most powerful financial institutions in the world. Throughout the years, Accordia Life grew to provide life insurance, annuities, and even reinsurance.

Additionally, Global Life also was a parent to a company called Forethought and Commonwealth Re.

Today Global Atlantic is not more than a $40 billion insurance company.

They offer through the help of their subsidiaries term insurance, index universal life, universal life, whole life, as well as annuities and investment advice.

Company Timeline Overview

- 2005 - Goldman Sachs buys Allmerica Life then renamed it Commonwealth Life and Annuity.

- 2006 - Commonwealth grows a large reinsurance platform.

- 2009 - They start to offer insurers risk management solutions and capital management.

- 2011- Commonwealth then begins to start selling Annuities

In this Accordia Life Insurance review we will cover all the following topics: So let's get started will our review.

The Good

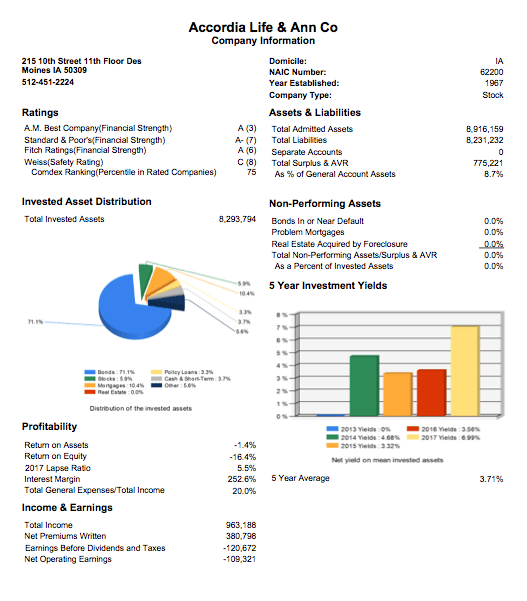

Ratings

Accordia Life has not been in the insurance business very long when comparing to companies like MassMutual or New York Life.However Accordia Life does have some decent company ratings, but the ratings do not compare to some of the large insurance companies in the industry.

- A.M Best Company for Financial Strength: A

- Standard and Poor's: A-

- Fitch Ratings: A

- Weiss reviewing the companies Safety: C

Several Options

Another great positive for the company is the variety of products they offer. According provides over 10 different product options to consumers.They have options for Term Insurance, Final Expense, Universal Life, and Indexed Universal Life.

There are also a ton of Riders to choose from to even further customize your life insurance policy.

In addition to their life insurance products and rides the company also offers several Annuity policies.

They offer annuities to solve for different needs such as; Fixed Annuities, Variable Annuities, Fixed Index Annuities, and Income Annuities.

The Bad

Several Ownership Changes

As noted at the beginning of this review Accordia was ultimately created after several business acquisitions.Although in the insurance industry it is not uncommon for companies to be acquired in the case of Accordia we believe that several transitions created issues with existing customers.

Whenever there is a business transition there is goo and also bad since you are often joining new leadership together. In this case, we believe that this is a negative.

Customer Complaints

In reference to our thoughts above this, there are several confirmed complaints towards Accordia and Global Financial.Many of these complaints have to do with ongoing customer service and large scale billing issues that resulted in customer policies lapsing for nonpayment.

Although this may not sound like a big deal we disagree. When you sign up for a life insurance policy this is a binding contract between you and the insurance company.

There is really only one way to break this contract as a consumer and this is for non-payment of your premium.

Essentially if you miss your insurance premium and the policy lapses then you could be without coverage and the insurance company has no obligation to reinstate the policy.

Due to the several complaints and issues noted from customers, we believe this is a very big negative for Accordia.

No Whole Life Products

Although Accordia offers several options to consumers for life insurance coverage the one major gap in their product portfolio is whole life insurance.According does not currently offer whole life products that provide you a guaranteed death benefit and cash value accumulation.

Finances

Ratings

As we already pointed out one of the good parts is the Ratings:- A.M Best Company (Financial Strength): A

- Standard and Poor's (Financial Strength): A-

- Fitch Ratings (Financial Strength): A

- Weiss (Safety Rating): C

Products

Accordia's life insurance products are mainly in focused on:- Universal Life Insurance

- Indexed Universal Life Insurance

- Term Life Insurance

- Final Expense

Index Universal Life Options

Indexed universal life insurance is a permanent life insurance policy. If provides death benefit protection for your loved ones and it also has the potential for cash accumulation.These types of policies will credit your cash-value account with an interest rate. This rate is typically based on a major stock market index.

The premiums you pay for your policy and the cash values that accumulate are never invested directly in the stock market.

Index universal life provides you the opportunity to capture upside potential without market downside risk. This means that if the index that your policy is tracking with were to go to zero you will not lose any money.

Keep in mind these policies often have a cap on the upside as well.

- Flexible coverage

- Tax-free death benefit

- Tax-deferral

- Guaranteed floor interest rate

- Fixed-rate crediting option

- Several options for indexed crediting options

- Potential for greater interest crediting over the life of the policy

- Protection from negative market returns

Lifetime Builder ELITE

Lifetime Builder Elite is designed to provide a tax-free benefit to your beneficiaries as well as potential cash value accumulation. The policy provides great flexibility for the owner.Product Details:

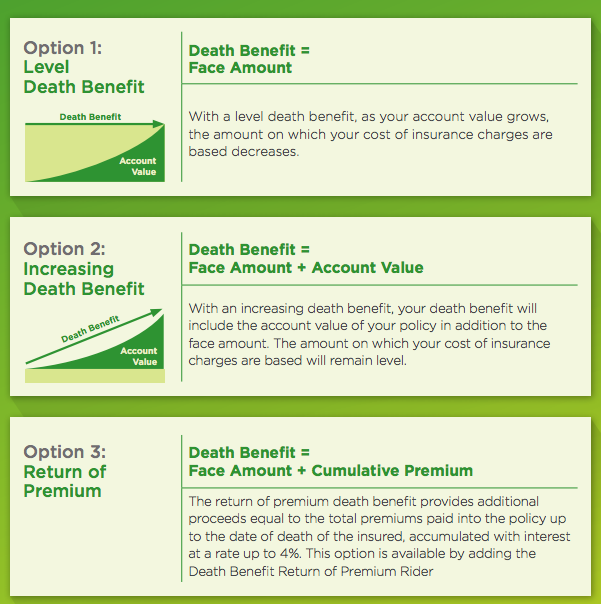

- Three death benefit options

- LEVEL DEATH BENEFIT

- INCREASING DEATH BENEFIT

- RETURN OF PREMIUM

- Access to the cash value through withdrawals or loans

- Guaranteed 1% Account Value Enhancement beginning at the end of Policy Year 5

- Includes additional riders and features that allow for customization.

Lifetime Foundation ELITE

Lifetime Foundation Elite is designed to provide guaranteed death benefit till age 90 or 40 years.Product Details:

- Death benefit guarantee to age 90, or 40 years depending on the insured's underwriting class

- Design to allow for the elimination of policy charges after 90, on a current, non guaranteed basis. This effectively makes it easier to keep a life insurance policy for the long-term.

- The ability to achieve the cost of insurance discounts and lower overall cumulative premiums with the Wellness for Life® Rider

- Includes additional riders and features that allow for customization to meet your objectives

Lifetime Provider

Lifetime Provides is a great option for very affordable protection.Product Details:

- Affordable death benefit protection

- Flexibility with your premium

- Potential for greater cash value growth compared to traditional universal life policies

Survivorship Builder

Survivorship Builder is a policy that covers two lives in one.It has many of the features of the above products however will pay a benefit after the second insured's death.

Product Details:

- Covers two lives under one policy

- Tax-free death benefit at the second insureds death

- Can help with liquidity for estate taxes and wealth transfer

- Tax-advantaged features such as access to cash values

- A policy could potentially provide coverage to someone who is uninsurable

Universal Life Options

Lifetime Assure UL

Lifetime Assure UL is a policy very similar to the Lifetime Provider however it does not participate in the index crediting and potential upside that is offered by the Lifetime Provider policy.Product Details:

- Death Benefit Protection for loved ones

- Cash Value growth

- Access to cash values

- Flexible options and riders to customize a policy

Term Life Insurance

Accordia offers four different types of term insurance.- Annually Renewable Term

- 10-year level term

- 20-year level term

- 30-year level term

- Annually Renewable Term provides a one year guaranteed level premium and usually increase in cost annually.

- The 10, 20, and 30-year policies offer a guaranteed level premium for that specified term period selected

- All the term policies can be converted to one of our permanent life insurance policies

- The minimum Term amount is $50,000. Many other insurance companies cap their minimum at $100,000.

Preneed Life Insurance

Preneed Life is an alternative way to say Final Expense Insurance. This policy is intended to help provide for smaller items associated with putting the deceased owner to rest.Policy Details:

- Ment for Final Expense

- The benefit is paid to the funeral provider

- Provides peace of mind

- Offered nationwide through funeral homes

Riders

Accordia provides several great additional riders to customers to enhance the policy that they choose to go with.

Accelerated Access Rider

This is a free-rider until you need to use it. It provides the insured access to a portion of their life insurance death benefit if they are diagnosed with a chronic or critical illness.

Overloan Protection Rider

This rider is a safety net for the insured. It will prevent your policy from lapsing if took to much cash out of the policy. There is no cost for the rider however if used there is a one-time charge.

Primary Insured Rider

It provides an additional level of death benefit protection for the primary insured.Additional Insured Rider

With this rider, you can ensure your family too. It provides coverage to three family members all under one policy.Children's Insurance Rider

You can protect your children with this rider. Any child ages 15 days to 17 years can obtain coverage. This coverage will last till the child's age 25. Even better the children's rider can be converted to a permanent policy for up to five times the rider face amount.Accidental Death Benefit Rider

This rider will add additional coverage should the insured die from an accident.Terminal Illness Accelerated Death Benefit Rider

If you become terminally ill with 12 months or less to live this rider will ensure that a portion of the death benefit proceeds is paid out to you well you are living.Return of Premium Rider

This rider provides a death benefit equal to the face amount plus the premiums less any withdrawals, accumulated with interest.Waiver of Monthly Deductions Rider

If you are to become disabled and could not subsequently pay your premiums the waiver of premium rider can help. All charges would be waived if the insured is totally disabled for at least 6 months before age 65.Waiver of Premium Rider

The monthly premium specified under the rider is credited to the policy if clients become totally disabled for at least 6 months before age 65.Additional riders available

- - Waiver of Surrender Charge Due to Confinement Rider

- - Guaranteed Purchase Option Rider

Additional riders available only on Index Universal Life's Survivorship Builder

- - First to Die Rider

- - Estate Protection Rider

- - Survivor Insured Rider

- - Policy Split Option Rider

Dividend Rate

There is no driving dividend rate, as Accordia Life doesn't have a whole life product (for cash value).Final Word

Even though Accordia is a newer life insurance company compared to others they have been able to rise to the top when it comes to ratings. Accordia has a fantastic rating from various 3rd party agencies.Even though the company has strong ratings you may want to think twice before purchasing from Accordia Life.

When comparing Accordia to other companies you may find that there are some better alternatives especially if you are looking for Whole Life Insurance. We hoped you like our Accordia Life Insurance Review, keep reading other company reviews.

And don't forget you can get a life insurance quote in minutes with us.

Recommended Reading

American Income Life ReviewAmeritas Whole Life Review