MassMutual has approved an estimated $1.6 billion dividend payout in 2018.

This marks 150 straight years that MassMutual has paid a dividend. Also, the high dividend helps them maintain a strong position as one of the largest mutual insurers in the U.S.

To read the full release go here: MassMutual Press Release.

Northwestern also already announced its 2018 dividend: Northwestern Mutual 2018 Dividend.

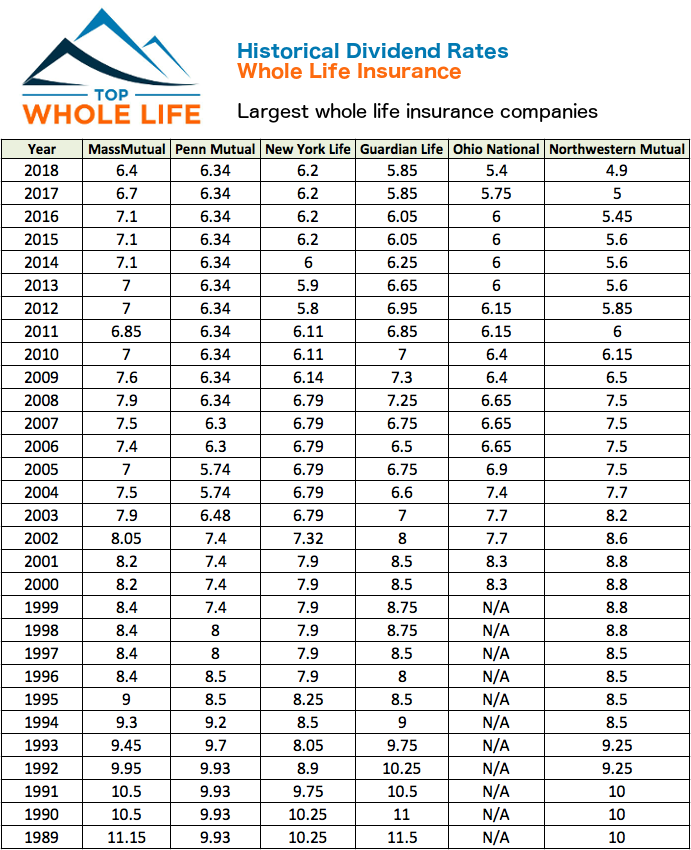

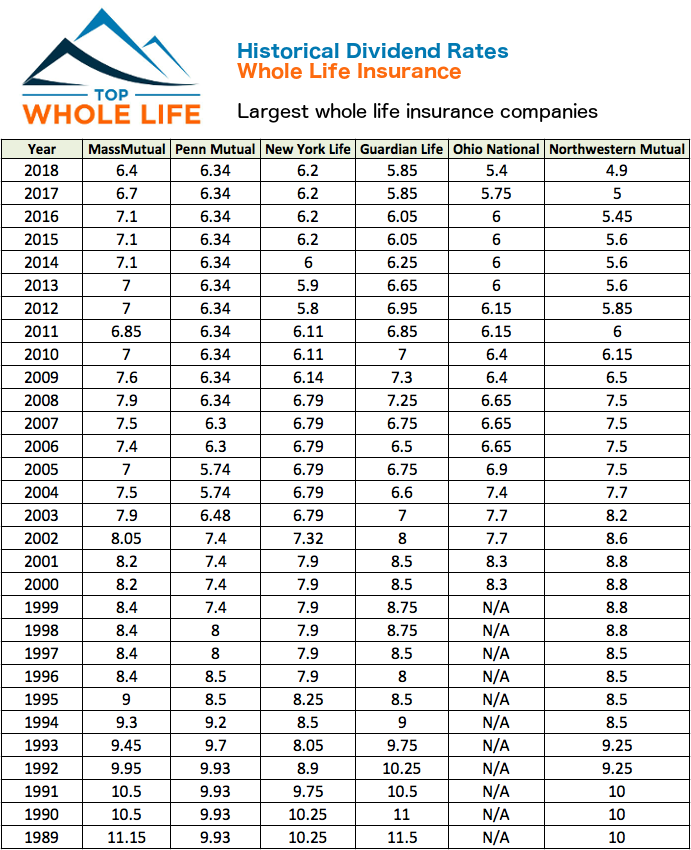

[caption id="attachment_11040" align="alignnone" width="691"] Historical Whole Life Insurance Dividend Rates Graphic V2[/caption]

Historical Whole Life Insurance Dividend Rates Graphic V2[/caption]

Whole Life Insurance Dividend Rate History

However, dividends to play an important part.

This marks 150 straight years that MassMutual has paid a dividend. Also, the high dividend helps them maintain a strong position as one of the largest mutual insurers in the U.S.

NOTE: MassMutual already announced their record $1.72 billion dividend in 2019.

2018 Dividend Rate Of 6.4%

The dividend represents a significant drop from 6.7% in 2017 to a dividend rate of 6.4% in 2018.To read the full release go here: MassMutual Press Release.

Northwestern also already announced its 2018 dividend: Northwestern Mutual 2018 Dividend.

[caption id="attachment_11040" align="alignnone" width="691"]

Historical Whole Life Insurance Dividend Rates Graphic V2[/caption]

Historical Whole Life Insurance Dividend Rates Graphic V2[/caption] Historical Dividend Rates

We track and analyze the historical dividend rates from many companies. You can see how MassMutual's dividend compares to the competition in our article:Whole Life Insurance Dividend Rate History

Dividends Drive Performance

Dividends in participating policies are what helps grow the cash value and the death benefit. A dividend is not everything in a whole life policy, there are many other aspects to consider: cost, type, company, etc.However, dividends to play an important part.