Do you want a $500,000 Whole Life Insurance Quote?

If all you want is $500,000 whole life insurance quotes, you can get it right now online. Click here topwholelife.com to get your $500,000 whole life quote in less than 1 min. You will be able to compare whole life insurance cost, company strength, cash value growth, and withdrawals.We also prepared this table to give you an idea of the MONTHLY prices with the best companies. We listed a policy that you will pay until age 100. All the following rates are assuming good health:

Male $500k paid until age 100

| Type | Age 40 | Age 45 | Age 50 | Age 55 | Age 60 |

| Whole Life | $651 | $827 | $1,057 | $1,351 | $1,725 |

| Type | Age 40 | Age 45 | Age 50 | Age 55 | Age 60 |

| Whole Life | $522 | $653 | $837 | $1,083 | $1,406 |

As you can see, the prices vary greatly the older you get and depending on if you are male or female. Therefore, it is highly recommended that you start as early as possible, and you lock in your insurability for the rest of your life. Remember, your whole life insurance price will be guaranteed forever.

Different factors will determine what is the best whole life for you. Your main goal shouldn't be to get the cheapest whole life insurance and top whole life insurance. Whole life is an asset, and as such, you don't want the cheapest one. You want the one that will give you the best returns in the long run.

You should think about $500,000 whole life insurance as an investment property. Price is important but it's definitely not the most important.Get Me A $500K Quote

$500,000 Whole Life Insurance Break Down

To get an idea of how you should pick your whole life, we will dissect the policies based on different features. Multiple variables will determine the best whole life company for you.Here is a list of categories and the top $500,000 whole life insurance companies for each:

Top Whole Life Overall

Best Price

Top Company

Highest Death Benefit

Short Payment Schedule

Cash Value at Beginning

Cash Value Growth

Income from Whole Life

Death Benefit Growth

Top $500,000 Whole Life Insurance Overall

It's hard to pick the best $500,000 whole life insurance policy from a wide array of different companies and multiple variables. Still, we put everything together in a simple ranking considering everything:| # 1 | #2 | #3 |

MassMutual |  Foresters |  Penn Mutual |

Best Whole Life Price

Price is relative in a whole life insurance plan; as I mentioned, Whole Life Insurance is an asset, so you want the best. However, be careful getting the cheapest policy in terms of price vs. death benefit, as it might not be the best pick in the long run.However, here is one of the best priced $500,000 whole life insurance policies:

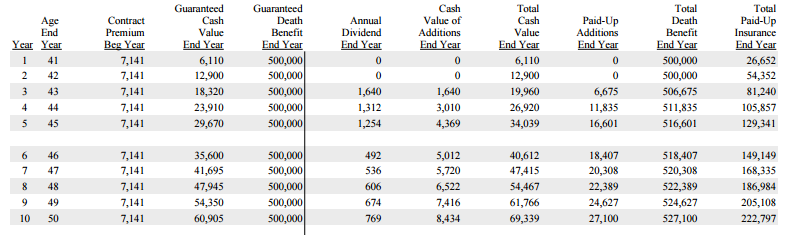

[caption id="attachment_10857" align="alignnone" width="100"]

Foresters Financial[/caption]

Foresters Financial[/caption]Our pick for best price vs. value is Foresters.

You can read a full review here: Foresters.

Our pick on the lowest price in a Whole Life is Assurity Life.

Top $500,000 Whole Life Insurance Company

This is one of the most important factors you should consider. Look into company strength, ratings, size, and history. You also want to make sure you pick a mutual company, as the performance will beat most non-mutual companies.Our pick for the best company is MassMutual. AM Best Rating of A++

Highest Death Benefit in a Whole Life

This is very similar to the best price. If we compare companies on the initial death benefit:Our Pick is Liberty Mutual.

Shortest Payment Schedule

You will have to define how long you want your payments to be. Most people pick a policy that you pay for 100 years. Other prevalent $500,000 whole life insurance policy premium payments are for 10 or 20 years, and after that payment period, you will keep the policy forever.You can pick any company in this category as most companies offer all of these payment methods.

Read more on: limited pay life insurance.

Best Cash Value Early

Do you plan to access the cash value early in the $500,000 whole life insurance policy?Each company has a product that will have a lot of cash early in the policy, but one of our favorites is:

Our pick here is MassMutual with its HECV product. HECV is short for High Early Cash Value. Yup that is right; this company has designed a plan specifically for someone who wants to see as much cash value as they can get at the start of the policy.

MassMutual's HECV plan provides you with approximately 90% of your premium in cash value on day one.

The one downside to this product is it is contractually set up to be paid till age 85, and the premiums are typically more significant. Nevertheless, here is what a $500,000 HECV looks like for a male, age 40, in good health.

Take note that in year one premium paid is $7,141.

The cash value is $6,110.

After year 3, your cash value is greater than your contributions.

Cash Value Growth in a Whole Life

When we compare companies on how much the cash value grows. This is one of our preferred methods of ranking the top $500,000 whole life insurance companies.

Our Pick is Foresters

Income from Whole Life Insurance

This is one of the most important aspects of a $500,000 whole life insurance policy. Many people use their whole life as an investment, and they want to generate income in retirement.Our pick for income from Whole Life is MassMutual.

Death Benefit Growth

The best $500,000 whole life insurance policy where the death benefit grows throughout the years will be through:

Our pick is Penn Mutual. More info here Penn Mutual Whole Life Insurance ReviewSometimes you will not know the most important aspect to you in a whole life policy. When speaking with someone with experience, that will help you determine the best fit.

The most important is to determine the purpose of the whole life - Why are you getting the $500,000 whole life policy?

- Is it to leave a legacy to your family?

- For Legacy, we would suggest using Penn Mutual.

- Is it to get the best return on your cash value?

- We would suggest Foresters.

- Is it to generate income in retirement?

- We would suggest MassMutual.

We can help you find the best fit for you.The Bottom Line

Whole Life Insurance is a little more complicated with all the features that it has. However, with an agent's help, you can find out what features are relevant and then find the best $500,000 whole life insurance policy for your needs. Learn about the 7 lies of your whole life (is it really a good investment?).

Also, check out our whole life $250,000 and $1,000,000 whole life article.