Essential Questions Your Adviser Should Be Asking You Before Selling You Whole Life

A good financial advisor can make a world of difference. But now it's hard to find a good one. Many times we look for someone that makes us feel good. And very often, we find an agent that masks as an advisor.Also, we often forget they should be asking specific tough questions, to help us plan.

We list some of the crucial questions any good financial advisor should be asking before they sell you any whole life policy:

1.

What is important to you?

Don't let the simplicity of this question fool you. This is a compelling question to ask. What is important to you? This will be different for everyone.Personally, when I was asked this question, my answer was simple. Safety and security of my family for the rest of their lives if I were to die early.

Your answer will be different but think hard about this one. It will help to decide on your whole life insurance plans. If your insurance agent or financial planner is not asking you questions like this, you may want to find another advisor.

2.

Would you like to ensure your family is taken care of if you die? If so, would you like your family to be in the same situation or better?

This is a great question to consider and one that many may not think it too important. Do you want your family to be able to keep the same living situation they have now? If this is the case, then you need to look at what that is and what items would need to be addressed in the event of your death. For example, this could mean paying off the mortgage or any other debts that would be impossible to handle if you were to die.Free Term Life Insurance Quote

On the flip side, some may say that their family will be fine with what they currently have. They wouldn't need to be in the same or better situation if there was a death in the family. From our experience, if this is how you feel, then life insurance most likely is not the coverage you will end up buying.

3.

How do you feel about your kids receiving a more substantial inheritance?

This is a unique question for each person. Some do not want their kids to "have it all" they want to teach their kids that things in life are not free. Leaving a large inheritance to a child may not be something you want. That is OK! If you know this, then you can help your agent design a plan that will better fit your objectives.In a situation where you want to leave money to your kids but want to have control of the funds after your death, you would need to talk with an estate planner. They can help set up a trust to give you "control from the grave."

4.

How do you feel about life insurance?

What are your general feelings on life insurance? For many advisers, they are very used to speaking about insurance and how you can ensure your death. Sadly the one thing in our life we can bet on is that we will all die one day. For many, this is a hard pill to swallow, but this is true.It is OK if you are uncomfortable with life insurance. It is also OK if you don't believe in it. Telling your agent or know this for yourself will help with your overall financial plan. If you are not into life insurance, then you may need to find another option to take care of what is important to you.

5.

How much income would your family need in the event of your death?

The thought of my family having to be without me is scary, but I know that taking care of them even if I were to die is extremely important. How much will they need to survive? This is a bit of a math question that your adviser should be able to help you decide.According to may professionals in the retirement space, a safe withdrawal rate is about 4%. This would be the amount of money that will be returned to you in the form of income without running out of money.

So if you have $1,000,000, the 4% rule would provide you with $40,000 of income without spending down your principal and outliving your money.

If our household makes $200,000 per year and I make $100,000 of that then we can back into how many million would be needed in life insurance to recreate my income.

$100,000 / $40,000 = $2.5 X $1,000,000 = $2,500,000

To replace my income we would need $2,500,000 of life insurance.

Check out: Whole Life Insurance For Dummies

6.

How much income would your family need in the event of you and your spouse die?

Continuing to use the example above as a household, we make $200,000, so if my wife and I were to pass together and we wanted our kids to have the same income they are used to today, we would need to buy?$200,000 / $40,000 = $5 X $1,000,000 = $5,000,000

For my household, we need $5,000,000 of insurance to cover us and keep our household income the same if my wife and I were to die.

In this situation, we decided to buy $2,500,000 for each of us.

7.

If life insurance was not a thing, what would you do?

This is a bit of a scary question for some people? Honestly, for me, I am not sure what I would do? For some, this would mean self-insuring and setting aside a nest egg to take care of their family. For others, this could mean buying assets with leverage like real estate. As sadly, some may not be able to accomplish any of this and need the support of others like gofundme.The big take away from this question is, what is your plan? If you do not have one, don't expect others to take care of it for you.

8.

Do you own any life insurance currently? If so, how much? What kind?

Telling your insurance agent or adviser what kind of life insurance you currently have, how much, and who provides it is essential. If the adviser does not know your other coverage, they may suggest too much life insurance coverage.9.

When would you like to retire?

This is a big question but essential to have an idea. Do you want to retire early like age 30 or at a more reasonable age 65? Once your agent knows this, they can help you make the decision on your insurance choices and design a plan to help complement your retirement plan.10.

What amount of income in retirement would make you happy?

Similar to the income replacement question we posed earlier in this article, the same question can be asked about retirement income. If you would like to have a retirement income of $100,000 per year well, how much cash would you need to be able to produce this?If $1,000,000 can produce $40,000 a year then you would need?

$100,000 / $40,000 = $2.5 X $1,000,000 = $2,500,000

WOW, that's a lot of cash to get to your retirement income goal.

The next quest is, how do taxes affect this income you have saved? If this $2,500,000 was saved in a 401K, this could be taxed when you start to distribute the funds. This would mean that you would not have enough money to meet your goals.

If you were to save just this about into a tax-free account, you would be able to distribute much more than your goal income. The point is that it's not always about what you save but how you are saving it.

Check out: Whole Life Insurance for Income

11.

What is your thought on taxes? Do you believe the will be the same or increase in the future?

This question is pretty straight forward. If you look at our country and the overall economy, do you feel that your taxes will get better or worse? The answer may not be best answered by emotion. We all hope taxes go down, but the reality is that our country and its economic condition will call for increased taxes, and this will ultimately affect your future income and retirement plan.12.

What is your current budget? Do you have one?

You and your adviser need to know what your budget is. If you do not have a budget, you should sit down and put one together. This is an essential step when buying whole life insurance. If you have a hard time with this, use the free app called MINT. Mint connects to all of your accounts then automatically tracks your spending. Using this app you can build your budget from there.Once you have your budget, then you can start to think about your life insurance. Whole life insurance is a big commitment and will require you to commit to steady premium payments. You will want to have your adviser carefully plane and designed this to fit into your budget. The last thing you want to do is over-commit to a whole life premium.

13.

What are your current debts?

This question will go inline with the budget question. What debts do you have? Student loans? Car Loans? Mortgages? Consumer debt? Credit Cards? If you have a lot of debt excluding your mortgage in this calculation, then you will want to be careful to buy whole life. Your money will often be better suited to be used towards paying down debt.If you do have a lot of debt and your adviser is suggesting whole life as your only option, do not go with this adviser. They are just trying to sell you to make a commission. Even though many insurance professionals and advisers are paid commission on the sale of life insurance, not all advisers or insurance salespeople will force buying whole life.

In the case of the person with high debts and a need for life insurance, Term insurance would be a much better option to consider.

Also, if you have a lot of debts, the reality is your income is a very valuable asset to make sure you can pay your bills and protect the ones you love. Do you have your paycheck insured? See how you could protect your paycheck in case you are disabled.

Protect my Paycheck - Get me a Disability Insurance Quote

14.

How much per month would you like to be saving?

After looking into your budget and debts and understanding what you can save, you can ask yourself the question, "how much would I like to be saving." There is a big difference between how much you can save and how much you want to save.You will want to keep in mind that there are two numbers that you and your adviser should consider. There is a "doable" number and a "meaningful." What do I mean by this?

Well, a very doable number might be $10 per month. But if you were to save $10 per month, will this amount at the end of the year, be very meaningful?

On the other side of this scale is a meaningful amount of $1,000 per month. This amount would be very meaningful at the end of the year, BUT is it a doable amount for your situation?

A good adviser should help you find the right size somewhere in between doable and meaningful for you.

15.

What is life insurance's primary purpose for you?

Do you currently have life insurance in force? This could be a policy that your parents took out on you years ago? Could it be a policy at work? It could also be a policy you purchased on your own in the past.Make sure to know what coverage you currently have (if any). This will significantly help your adviser to right-size the amount of life insurance you will need. It will also make sure you don't buy too much and are over-insured.

Also, depending on your objectives, you may not need a lot of death benefits. You may be more interested in whole life insurance for the tax-advantaged features. In this case, you will most likely have less death benefit.

You can learn more about this at our Infinite Banking Review

16.

If you had purchased life insurance before, how did you decide on the amount?

This question will tie into some of our earlier questions. How did you decide on how much coverage was right for you? Did you use an online calculator? Has an adviser suggested an amount? Were your parents tell you what to do?If you are looking into new coverage or doing a review of your personal finances with a new adviser, it is always good to have a second opinion and review how you got to your coverage amounts.

Three prevalent ways to calculate overages for life insurance are the income replacement model and the debt coverage model and mortgage protection model.

Income replacement:

As reviewed earlier, if we take into account the safe withdrawal rate of 4% and you had a $1,000,000 death benefit, this should hypothetically produce $40,000/ year of income for the beneficiary.If you need to replace the income that is more or less than $40,000, this can be calculated very quickly.

For example if you needed to replace $200,000 of income then you would need $200,000 / $40,000 = $5,000,000

If you needed to replace $20,000 of income, then you would need about $500,000 death benefit to produce this income. $500,000 X .04 = $20,000

Debt replacement:

This equation is simple. You add up all the debts that you would like to cover if you die. This could be your car debts, mortgage, student loans, credit cards, etc. You would then purchase enough coverage to pay off all these debts if you were to die.For example, let us say your debts look like this:

Two Car loans - $40,000

Mortgage - $250,000

Student Loans - $150,000

Credit Cards - $30,000

Total = $470,000

So you would then purchase $470,000 of coverage to pay off all these debts.

Mortgage Protection Model:

This model is similar to the debt protection model; however, it is focused on protecting your beneficiaries by paying off your mortgage. This expense, for many, is the largest in any budget. By paying off this expense, you can relieve a high burden for your beneficiaries.For example, if you have a home already or just purchased it and the mortgage is $280,000. You would buy a $280,000 term insurance policy for 20 or 30 years to protect you during the time the mortgage is in place.

17.

Who helped you buy your life insurance in the past?

Who was the person who helped you pick out your insurance? Was it a professional? Was it a friend? A parent or other family member? Was it someone at your work?We are creatures of habit, and this holds for buying life insurance. If you ask your friends and family how much insurance to buy, you will most likely get an answer from them that mirrors what they currently have.

Unfortunately, this is where the problem lies for many families. Personal finance is "personal." So the right amount of insurance for my family and I will not be the right amount for you.

If your friends or family members are the ones who told you what to buy, then you will want to think about talking to a 3rd party. An insurance agent or financial planner will use proper questions and calculations to solve how much coverage you will need to take care of what is important to you.

Get A Free Insurance Quote

18.

How much could you save systematically every month?

At this point in the questions from your advisor, he or she will most likely have a good idea of how much you really can save. This will be driven primarily by your budget.Even though your current budget may dictate a different number for now, if you are the one to pick the amount, then you are more likely to follow through and save. Remember, you want the number to be meaningful but also doable.

19.

Are you financially prepared to die?

This is a massive question to ask. Most advisers will not ask this, but if you genuinely think about this question, it will open your eyes to the truth. When asked this question and at first, I thought I was "all set," but after an adviser walked me through many of the questions above, I realized that I did not have proper items in a line to take care of what was important to me if I died.I will tell you that after applying and purchasing life insurance, I drove home to my family that day with indescribable peace, knowing they would be OK if the unexpected happened to me.

20.

Would you like to guarantee your family's future?

This question will connect back to your "why"? If you don't have someone or some organization you genuinely care about, chances are you will not be buying life insurance.If you do want to ensure that your family will be OK, then whole life insurance is a way to guarantee that your family's future will OK when you die.

21.

Would you be interested in a program where you get a million dollars at your retirement, or your family receives a million dollars if you die before retirement?

I think the answer to this question is who wouldn't be? So how would this correctly work?Check it out:

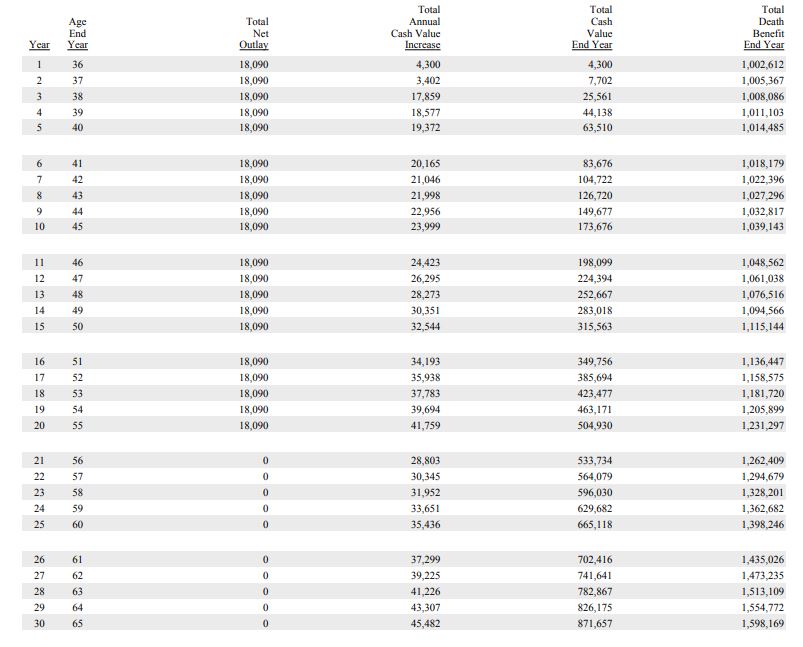

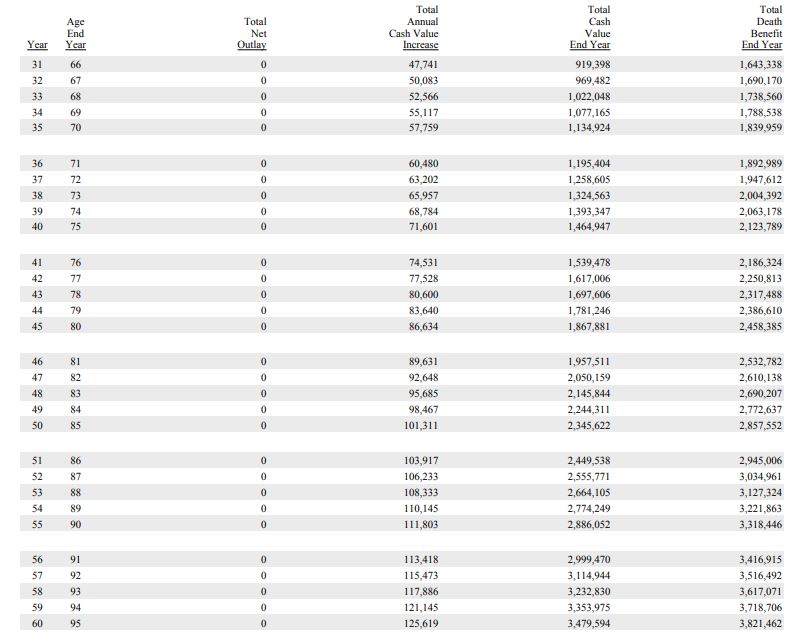

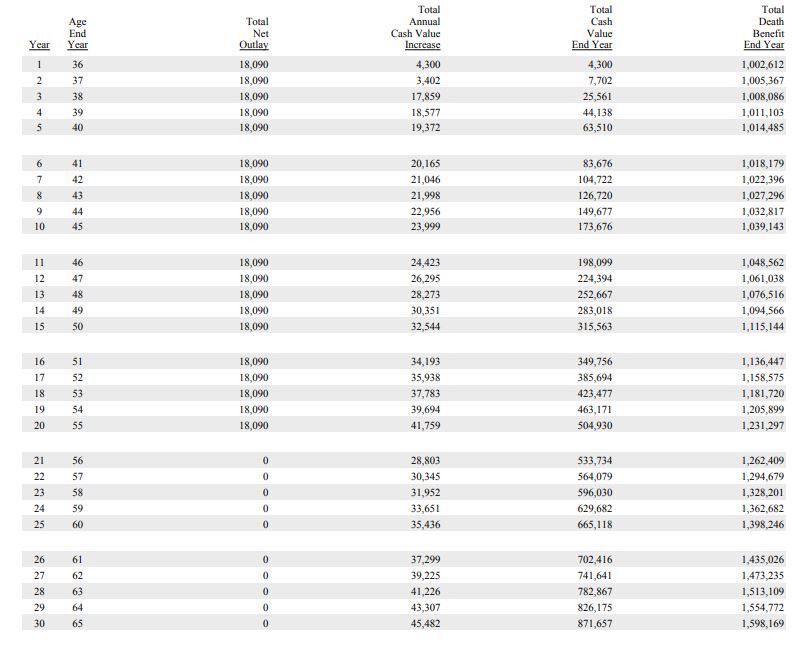

Take a 35-year-old male in good health. We are assuming that the retirement age is between 65 -70.

22.

Are you interested in a plan that could: Allow you to leave more to your children? Increase your income? Reduce your taxes? Allow you to move more to your children?

Again who wouldn't want these benefits? Whole Life insurance provides these types of benefits and solutions.

In Closing

Buying life insurance is not always easy, and deciding on whole life insurance can be even harder. The biggest take away that I would like to give you from this article is your adviser should be asking tough questions. If you have decided to purchase life insurance on your own and are using the internet to buy, disregard all the "recommendations" and determine what is important to you and your family? Once you have done this, you will find the right fit.If you have pondered these questions and you are now ready to start looking at whole life insurance, you can learn more about your custom quote below.

I Would Like To Get A Quote Now

Get Me A QuoteRecommended Reading

Top 7 Guaranteed Universal Life Insurance CompaniesTop 7 Whole Life Insurance Companies For Cash Value

Whole Life Insurance For Dummies

Coverpath by MassMutual