Aetna Whole Life Insurance Review

In the following Aetna whole life insurance review we will dig into several details about the company and if they would be a good fit for you. At Top Whole Life is mission is to provide you with the quality information so you can make a smart buying decision. We work directly with hundreds of top insurance companies and can help you get quotes when you are ready.About Aetna

Aetna was established back in 1971. The home base of operations is in the old insurance capital of the world in Hartford, Connecticut. It is one of the leading providers and has a massive scale with over 35,000 staff and business revenue north of $35 billion.The company provides several different insurance solutions:

- Health Insurance

- Dental Insurance

- Pharmacy Insurance

- Medicaid Insurance

- Group Life Insurance

- Group Disability Insurance

Aetna recently made a massive investment in upgrading its website and online user experience. For any insurance company in today's world we are seeing this is a must and Aetna's leadership sees this. Beyond the technology updates, the company clearly works to provide awesome service because they have great reviews too!

In this Aetna insurance review we will cover the following topics: So let's get started.

The Good

Multiple Plan Options

We all like to have options when searching for coverages and Aetna delivers. One of the items that stand out to us is how many different options are offered by this company. Aetna provides options for both individuals and employers:- Atena Medical

- Aetna Medicaid

- Pharmacy Plans

- Student health

- International

- Dental

- Vision

- Health Expense Funds

- Voluntary Plans

- Accident Plans

- Critical Illness Plans

- Hospital Plans

- Health & Wellness Programs

- Behavioral Health Programs

Great Website

Not all insurance companies have kept up to date with the fast-changing world of the internet. I am sure that you are accustomed to being able to search for something and find it almost instantly. Aetna understands this and has revamped its website to very simple to read and understand. In addition, if you are a customer they offer you a portal to log into where you can find all your plan information and make changes and premium payments.The Bad

Limited Availability

Aetna provides a wide scope of coverages in several states but not all of them. One of the major downsides in the coverages they provide is that they only offer Medicaid coverage in 14 States. Medicaid is designed for people with limited assets, special needs, or a disability. The coverage is usually offered at no or a very low cost for those who qualify.States that currently offer coverage:

- Arizona

- California

- Florida

- Illinois

- Kentucky

- Louisiana

- Maryland

- Michigan

- New Jersey

- New York

- Ohio

- Pennsylvania

- Texas

- Virginia

- West Virginia

Pricing

Overall Aetna is a great company but as we were doing our review we found that the second negative item is it's hard to find actual prices on the companies website. Although the site is very well designed and informative it is very difficult to find actual costs. You will need to ultimately speak with an agent to get prices for your personal situation. This is not the case for many other companies that provide online prices.Finances

This represents the company's financial snapshot as of 2019.

Ratings

Aetna has some remarkably good ratings. Here are how the major insurance rating organization rate Aetna:

- A.M. Best: A

- Standard & Poor's: A-

- Weiss: C

Products

Final Expense Whole Life Insurance

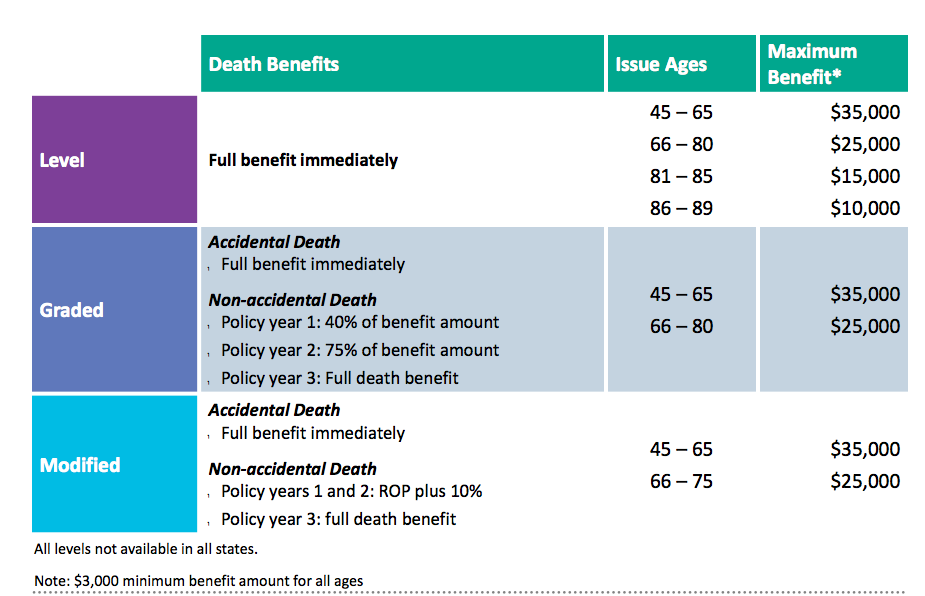

Does Aetna provide a whole life insurance policy? We have received this question before. The answer is yes they do! The company provides a specialized product called final expense whole life insurance. Aetna is not the actual entity that supplies the coverage, however.The actual supplier of this whole life insurance policy is American Continental Insurance Company (ACI). ACI is a good company with strong ratings. The policy comes in several different options. Level death benefit, graded death benefit, and a modified death benefit option. All the whole life policies build a cash value that could help pat premiums.

What is the Final Expense?

Final expense offer benefits such as:- Affordable Coverage

- Peace of mind

- Coverage for burial or any final cost after passing

- No increase in rates

- Options to meet anyone situation (state specific)

Final Expense Options Details

Additional AIG Products

Medicare Advantage Plans (medical with or without drug)

- Medicare Advantage HMO plans

- This plan is best for someone who will work with their primary doctor and together they ensure that the care needed stays within the network coverage offered.

- Medicare Advantage HMO-POS plans

- This plan gives you the ability to work with doctors and hospitals outside of your provided network. There is an additional cost to do this but it gives you more options.

- Medicare Advantage PPO plans

- With this plan, you can visit any Medicare-approved doctor, in or out of Aetna's provider network.

- Medicare Advantage Dual Special Needs Plans (DSNP)

- This is a very specific plan available to anyone who has both Medicare and Medicaid.

Medicare Prescription Drug Plans (Part D)

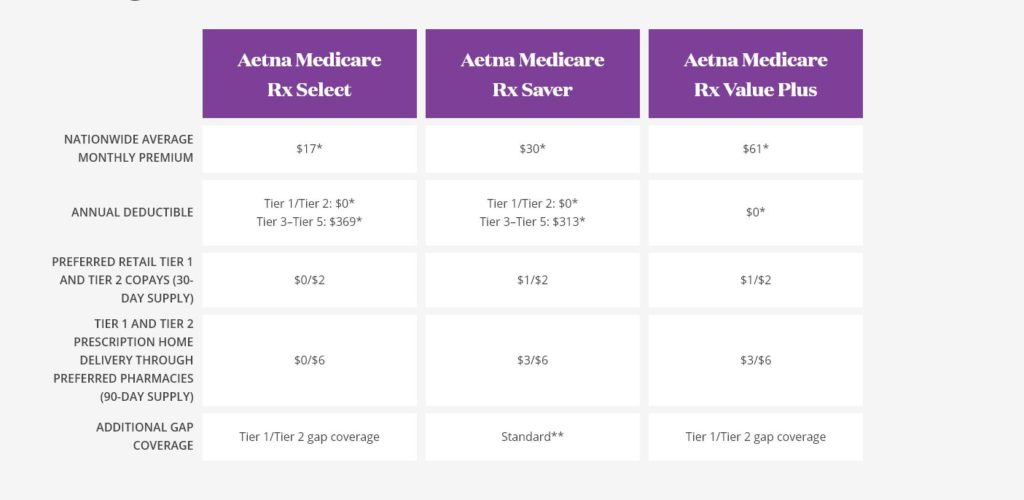

- Aetna Medicare Rx® Select (PDP)

- This plan has the lowest premiums overall. Plus you pay nothing for copays at preferred retail pharmacies or through home delivery.

- Aetna Medicare Rx® Saver (PDP)

- This place provides Part D coverage plus more.

- Affordable cost-sharing at our nationwide pharmacy network.

- Low copays at our preferred pharmacies.

- Drugs delivered by mail or home delivery.

- This place provides Part D coverage plus more.

- Aetna Medicare Rx® Value Plus (PDP)

- This plan offers no deductibles and you will enjoy very inexpensive co-pays. Additionally, you receive Tier 1 and 2 gap coverage.

Medicare Supplement Insurance Plans (Medigap)

-

- This plan works with your base medicare plan to help with the cost of medical needs however it is not available in all states.

Riders

Aetna does offer many additional benefits to its members.Plan Benefits

- Dental Benefits

- Vision and hearing benefits

- Fitness memberships

- Care management aid

- Concierge services

- Prescription home delivery

- Ask a nurse options

- Flu shots

- Over the counter health solutions

- Meal delivery program

Aetna Whole Life Insurance Review - Final Word

As you can see Aetna is a massive company with strong overall ratings. The company is clearly focused on providing quality service. The coverage they offer primarily falls into the health insurance space however they do have a large network where you can get other needs met. If you are looking for more information as you are trying to make your decision about health insurance make sure to visit Aetna's website.Sources: https://www.aetna.com/individuals-families.html

Additional Resources To Read

Top 12 Questions Answered About Final Expense Life InsuranceWhole Life Insurance top FAQ's

State Farm Whole Life Insurance Review

Liberty Mutual Whole Life Review