Whole Life Insurance Questions

If you find yourself in the market for whole life insurance, there are a few strategies for moving forward.You can buy from the first company that offers a policy that suits your needs. You can shop around, realizing that there are many policies and companies to do business with. And of course, you can also put this on the back burner for the time being.

Let's be honest: life insurance is not something you want to put off for too long, as you never know what the future holds. It would be in your best interest to make a purchase as soon as possible.

You may want to buy fast and put this in the past, don't get too far ahead of yourself. You want to move forward efficiently, all the while comparing your options until you are 100 percent confident in what you are doing.

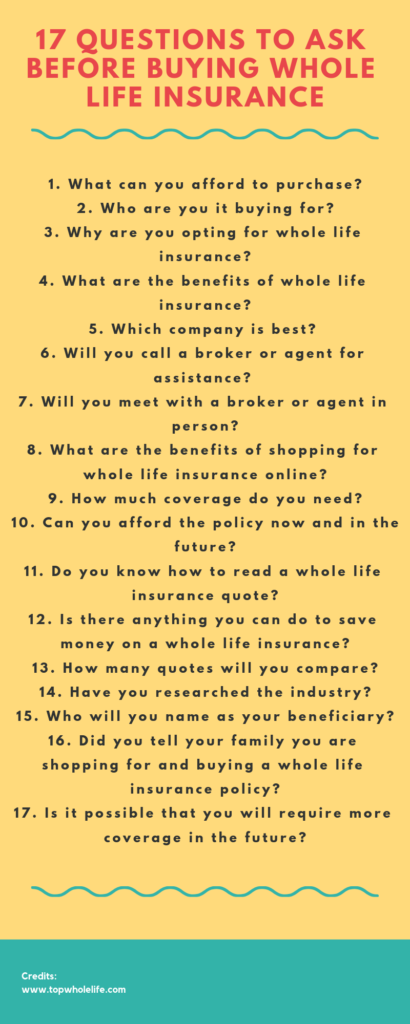

Check out these whole life insurance questions.

Also if you want to make sure you are working with a competent advisor check out the 22 Questions Your Advisor Should Be Asking You Before Selling You Whole Life

Buying Whole Life Insurance - Answer these questions

Do you need some assistance? Are you ready to move forward, but unsure of how to do so? These 17 questions will clear the air. When you ask these before buying, it won't be long before you have a better idea of where things stand. What Is Whole Life Insurance?1. What can you afford to purchase?

Above all else, you need to have a grasp on your monthly budget. It's important to know how much you are comfortable spending on whole life insurance.We made it easy for everyone to see how much whole life costs and what they can afford: Whole Life Insurance Rates

2. Who are you it buying for?

While some people are only shopping for a personal whole life insurance policy, others are doing the same for their spouse at the same time. From day one, you need to know who is on your shopping list.Related Post: Whole Life Insurance and Estate Planning

3. Why are you opting for whole life insurance?

There are other options to consider, such as term life insurance or universal life insurance, so be clear as to why you are making this decision.- Is it a permanent death benefit?

- To grow cash value?

- To secure a legacy?

4. What are the benefits of whole life insurance?

It is imperative to understand what you are getting with this type of policy, such as a guaranteed death benefit. Unlike term life insurance, whole life coverage never expires.Related Post: Whole Life - A Guaranteed Benefit

5. Which company is the best?

There are hundreds of companies selling whole life insurance, so you can spend quite a bit of time answering this question. Some have a better reputation than others, so don't forget to compare reviews and ratings.Related Post: Top Company's Review

6. Will you call a broker or agent for assistance?

There is nothing wrong with calling a broker or agent for help, but this is not your only option. Furthermore, you need to understand that this could lead to a hard sell.Related Post: Whole Life Insurance FAQ's Buy Whole Life Insurance Online

7. Will you meet with a broker or agent in person?

Just the same as calling on the phone, there are pros and cons of doing this. If you meet in person, you should once again be ready for a hard sell that could put you in a difficult position. However, if you want to meet in person, be prepared for a very long process. Our agency offers online meetings to customize whole life, and you can schedule them immediately.Related Post: Top Tips

8. What are the benefits of shopping for whole life insurance online?

More and more consumers are doing this, as it allows you to save both time and money. If nothing else, request a few quotes via the internet. This will clear the air, showing you what technology has to offer somebody in your position.Related Post: The Benefit Of Buying Whole Life Online

9. How much coverage do you need?

As a general rule of thumb, the higher the death benefit, the more expensive the monthly premium. Once you know how much coverage you need, you can decide what to do next. Here is a tool that will help you determine how much life insurance you need:10. Can you afford the policy now and in the future?

It's one thing to say you can afford the policy now, but you must be able to pay for it until you pass on. This is the only way to guarantee that the death benefit is paid.Related Post: Can You Afford Whole Life - FAQ's

11. Do you know how to read a whole life insurance quote?

This may sound difficult, but it's pretty simple once the information is in front of you. Quotes contain all the basic information you would expect, including the premium payment and death benefit. There are guaranteed values, and there may be non guaranteed values. So you may need an expert to interpret these properly.Related Post: What Is Whole Life Insurance?

12. Is there anything you can do to save money on whole life insurance?

Just the same as any insurance, there may be some steps you can take to save on the cost of your premium. Health plays an important part in the price. But a whole life expert should be able to help you pick the cheapest whole life, and also blend it. You can save over 40% of the price with a properly structured whole life.Related Post: Whole Life Insurance Rates

13. How many quotes will you compare?

There is no right or wrong answer to this question, but it makes sense to compare a minimum of three to five quotes. This will give you a clear understanding of what is available. It can also help you save a lot of money.Related Post: What Can You Learn Comparing Whole Life Quotes

14. Have you researched the industry?

From the companies that sell whole life insurance to the ratings of each provider, there is a lot of information to pick up. If you want to learn more about the industry, spend some time online.Related Post: Whole Life Insurance Online

15. Who will you name as your beneficiary?

This is one of the biggest questions you will answer. It is also one that you will have to make when you purchase your policy. You can change this at a later date if you so desire, but it's never a detail to take lightly.Related Post: 5 Tips To Buy the Cheapest Whole Life

16. Did you tell your family you are shopping for and buying a whole life insurance policy?

This is a big deal, as you want the appropriate people to know what you are doing from a financial point of view. Also, make sure you let all your beneficiaries know about your policy and how to contact your agent.Related Post: Protect Your Family

17. Is it possible that you will require more coverage in the future?

It's best to buy all the whole life insurance coverage you need at one time, but don't hesitate to shop for more in the future if necessary. Also, you can get a convertible term coverage, which gives you the ability to convert into a whole life policy without having to do a medical or underwriting. This way if your health changes, you can still lock in your previous health rating.Also, most whole life policies can be purchased with a rider that will give you the ability to increase coverage without underwriting. A common name for this rider is Guaranteed Insurability Rider.

Related Post: Cash Value Life Insurance

Final Thoughts

[caption id="attachment_11980" align="aligncenter" width="410"] 17 Questions To Ask Before Buying Whole Life Insurance[/caption]

17 Questions To Ask Before Buying Whole Life Insurance[/caption] Have you taken the time to address these questions? Do you know the answers like the back of your hand? Now go check out whole life insurance.

Get A Personal Quote