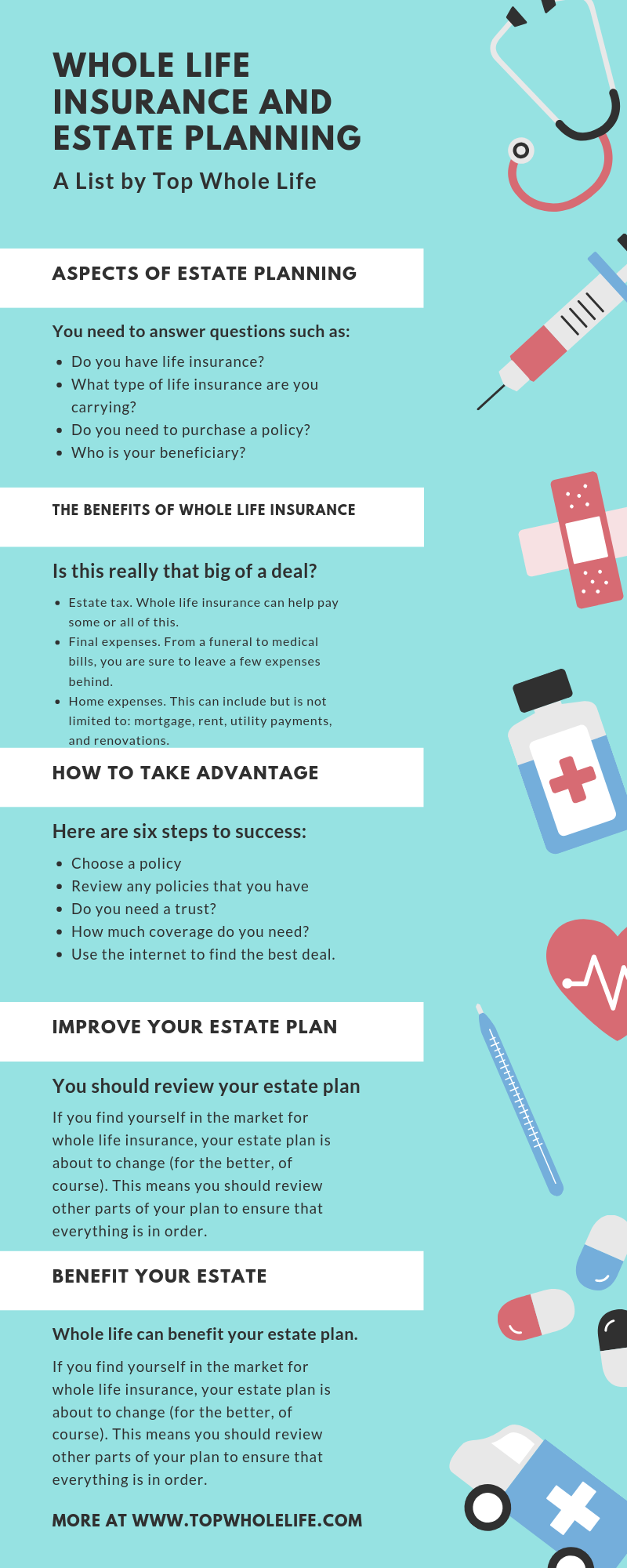

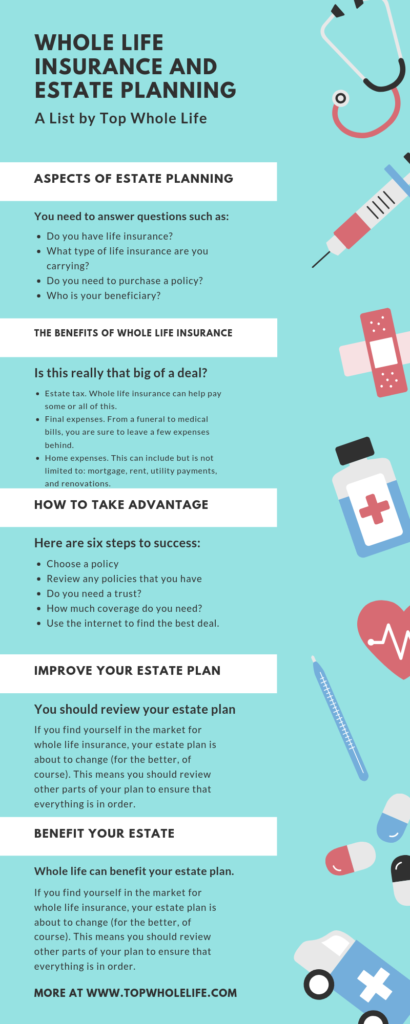

Whole Life Insurance and Estate Planning

Whole Life Insurance Estate Planning...Let's face it: there aren't too many people who look forward to creating an estate plan. There are many reasons for this, including the fact that you have to think about leaving your loved ones behind.

While this may not be something you want to do, it is something you have to do if being a responsible adult is important to you.

There are many aspects of estate planning, all of which should be important to you now and in the future. One such detail is life insurance. You need to answer questions such as:

- Do you have life insurance?

- What type of life insurance are you carrying?

- Do you need to purchase a policy?

- Who is your beneficiary?

The Benefits of Whole Life Insurance

Whole life insurance is not typically an investment in yourself (although it can be used for this). Instead, you purchase this type of coverage because it guarantees that your family will receive a payout upon your passing.Is this really that big of a deal? Some people don't understand the importance of leaving money to their heirs. But here are just a few of the many things that the proceeds of a life insurance policy can be used for:

- Estate tax. Are you worried about leaving your loved ones with a large estate tax bill? Whole life insurance can help pay some or all of this.

- Final expenses. From a funeral to medical bills, you are sure to leave a few expenses behind.

- Home expenses. This can include but is not limited to: mortgage, rent, utility payments, and renovations.

How to Take Advantage

Now that you understand the benefits of whole life insurance as it pertains to estate planning, it is time to implement a plan you can trust. Here are six steps to success: - Choose a policy. It is one thing to say you are interested in whole life insurance. The process of purchasing coverage is another thing entirely. You need to settle on details such as: the best company, death benefit, and what fits into your budget.

- Review any policies that you have. It doesn't matter what type of life insurance you have, it is important to understand the details associated with it. This includes the type and death benefit. Note: you should also make sure the appropriate beneficiary has been named.

- Do you need a trust? Depending on how much you have in assets, this may be a good way to protect your loved ones from estate tax.

- How much coverage do you need? More is always better when it comes to whole life insurance, but your budget may put some constraints on your purchasing power. Your goal is to understand how much coverage you need, and then seek out the company that offers the best policy at the lowest rate.

- Use the internet to find the best deal. There used to be a time when buying life insurance meant calling multiple agents and brokers on the phone. This is no longer the case. The internet can speed up the process, allowing you to locate a high quality, affordable policy.

- Don't wait. I'll buy coverage next year. I don't have the time right now. These are all excuses that could hold you back from getting the coverage you need to protect your family. Also, there are tax implications to consider. For example, there are deadlines (such as the three-year look back) associated with transferring an existing policy into a trust.

Improve Your Estate Plan

Even if you have an estate plan in place, it doesn't mean you are prohibited from making changes. You should review your estate plan, answer questions, and make changes based on your findings.If you find yourself in the market for whole life insurance, your estate plan is about to change (for the better, of course). This means you should review other parts of your plan to ensure that everything is in order.

There is no denying the fact that the right whole life insurance policy can benefit your estate plan. As long as you make the right decisions without delay, you can be confident in the plan you have created.Get A Personal Quote