If you have an old whole life insurance policy - such as one that you have been paying on for 20+ years - you may begin to wonder what you should do with it in the future.

Generally speaking, you have a few options:

If you want to reduce your policy and not cancel it, if so you should read our article: Reduce Your Whole Life Policy

If you are unable to make this payment for any reason, maybe because you don't have enough money in retirement, it may be something to consider.

However, you don't want to jump the gun before you look into your other options.

For example, you have the ability to loan the premiums and keep the policy. Along with this, you can take the cash value and keep a portion of the death benefit. The advantage here is easy to see: you won't lose the entire death benefit.

Depending on the type of policy, you may be able to opt for an arrangement in which you receive a monthly payment, all the while maintaining your coverage.

You need to consider your investment to date before you let your policy lapse.

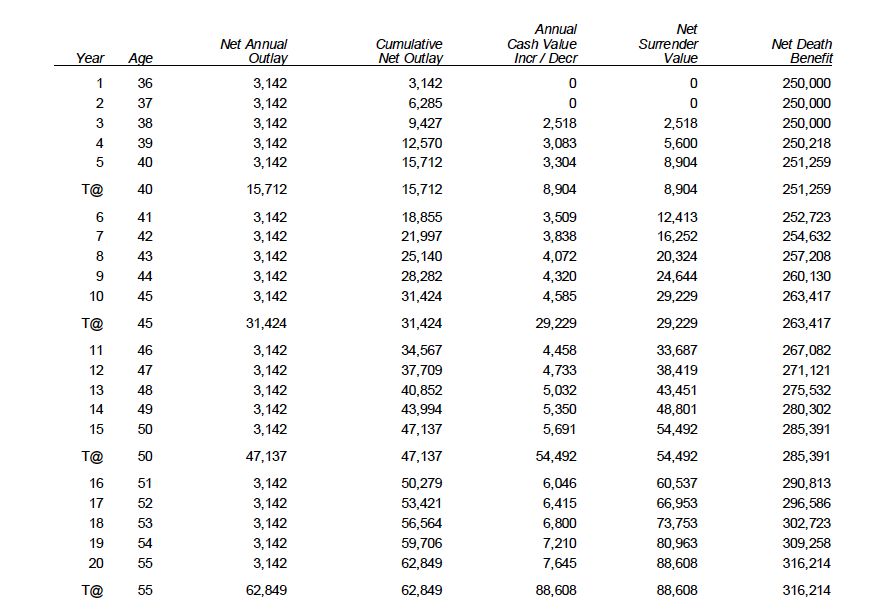

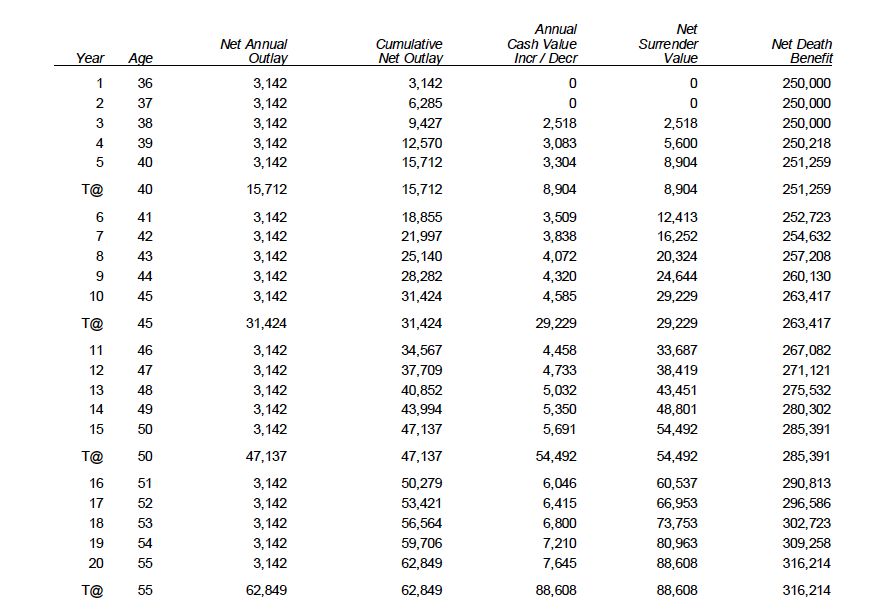

Example: 35 year old would pay over $3,100 for a $250,000 policy.

[caption id="attachment_7849" align="alignnone" width="884"] Should You Cancel Whole Life Insurance[/caption]

Should You Cancel Whole Life Insurance[/caption]

If you decide to cancel the policy after 20 years, then you could get back over $88,000, however you would lose over $300,000 of death benefit.

The sooner you cancel your whole life the worst of an investment it will be. If you see the previous example, then you can see that in the first two years there is not cash value. So you would get nothing back.

In our previous example, this client could keep the death benefit going forever without paying premiums, if he just let's the premium be taken from the cash value.

In our previous example, the death benefit would be over $200,000 and the cash value over $88,000 and the policy would remain forever, without any more premiums. Also the cash and the death benefit would increase as time goes by.

You should also learn more about term and universal coverage.

This option can give you access to cash immediately.

There are many companies out there that want to buy your life insurance from you. You sell your life insurance, they give you money and you do not have to worry about the life insurance as it's theirs now.

Companies can give you a free quote with no obligations.

If you like the price they would buy it for, then you can decide to sell.

You want to learn more about the cash value of your policy. You want to learn more about taking a loan against the policy. Don't be surprised if you find that there is a much better option than canceling your coverage. There's never a good reason to leave cash on the table!

In addition, we know what questions to ask the life insurance company before you cancel.

Generally speaking, you have a few options:

- Continue to pay on the policy to ensure that it remains active (and will pay a death benefit)

- Reduce pay it up, which means no more premiums but you keep the policy

- Cancel the policy so that you no longer have to pay the premium and take the cash.

- Pay the policy with the cash value.

- Sell Your Life Insurance For Money

If you want to reduce your policy and not cancel it, if so you should read our article: Reduce Your Whole Life Policy

Should You Cancel?

There is only one benefit of an "outright" cancellation: you are no longer responsible for making the premium payment.If you are unable to make this payment for any reason, maybe because you don't have enough money in retirement, it may be something to consider.

However, you don't want to jump the gun before you look into your other options.

For example, you have the ability to loan the premiums and keep the policy. Along with this, you can take the cash value and keep a portion of the death benefit. The advantage here is easy to see: you won't lose the entire death benefit.

Depending on the type of policy, you may be able to opt for an arrangement in which you receive a monthly payment, all the while maintaining your coverage.

Consider Your Investment To Date

On the surface, it may make sense to cancel your whole life insurance policy as a means of saving on the annual premium. This is even more so the case if you have a high premium. This often holds true if you purchased later in life or had a preexisting health condition.You need to consider your investment to date before you let your policy lapse.

Example: 35 year old would pay over $3,100 for a $250,000 policy.

[caption id="attachment_7849" align="alignnone" width="884"]

Should You Cancel Whole Life Insurance[/caption]

Should You Cancel Whole Life Insurance[/caption]Option 1: Cancel Whole Life Insurance

Canceling your whole life, is definitely and option. However, it's probably not the best choice in the log run.If you decide to cancel the policy after 20 years, then you could get back over $88,000, however you would lose over $300,000 of death benefit.

The sooner you cancel your whole life the worst of an investment it will be. If you see the previous example, then you can see that in the first two years there is not cash value. So you would get nothing back.

Option 2: Loan The Policy

You can take loans from the policy at any time. In addition, the policy premiums can be loaned from the actual accumulated cash value.In our previous example, this client could keep the death benefit going forever without paying premiums, if he just let's the premium be taken from the cash value.

Option 3: Reduce Pay It Up

This can be a technical term, but we will explain it the simplest way possible. When you reduce pay up a policy, the death benefit reduces, and you do not have to make premiums ever again, and you keep your death benefit.In our previous example, the death benefit would be over $200,000 and the cash value over $88,000 and the policy would remain forever, without any more premiums. Also the cash and the death benefit would increase as time goes by.

You should also learn more about term and universal coverage.

Option 4: Pay Lower Premiums

You can actually lower the premiums on a whole life very easily. All you need to do is call you agent and tell them you can to lower your premiums.Option 5: Sell Your Life Insurance For Money

There is a little know option that will allow you to sell you life insurance.This option can give you access to cash immediately.

There are many companies out there that want to buy your life insurance from you. You sell your life insurance, they give you money and you do not have to worry about the life insurance as it's theirs now.

Companies can give you a free quote with no obligations.

If you like the price they would buy it for, then you can decide to sell.

Contact Your Insurance Company

Before you cancel your old whole life insurance policy and move on, make sure you contact your company to see what options are available to you.You want to learn more about the cash value of your policy. You want to learn more about taking a loan against the policy. Don't be surprised if you find that there is a much better option than canceling your coverage. There's never a good reason to leave cash on the table!

We Can Call With You

Many clients have lost contact with the original agent, and they do not know what questions to ask. If you need help, we can call the insurance company with you. We want to make sure you consider all of your options carefully.In addition, we know what questions to ask the life insurance company before you cancel.