In our last post, we detailed some of the top reasons to choose a whole life insurance policy (when compared to other options).

From lifetime protection to level premiums to the ability to accumulate cash value, there are many benefits of purchasing this type of coverage.

If you’re sure this is the right move to make, the next step is simple: compare a variety of whole life insurance policies and companies.

By taking this step, you’ll soon understand what the market has to offer somebody in your position.

How to Compare

It’s one thing to understand the benefits of comparing policies and companies. It’s another thing entirely to implement a system for doing so.

Fortunately, there are three basic steps you can take:

1. Use the Internet

Gone are the days of calling agents on the phone to request a quote and discuss your situation. The same holds true for meeting with insurance professionals in person.

These options still exist, but there’s nothing better than using the internet to your advantage.

With an online strategy in place, comparing policies and companies is more time-efficient than ever before. On top of this, it’s much easier to collect all the information you need to make an informed decision.

You need to make sure you get illustrations from multiple companies. This will keep you in control and make sure you are getting the right policy.

We would be more than happy to provide you with multiple quotes for you to compare, but there are many brokers that can do the same.

2. Know What You Want

It’s hard to compare policies and companies if you don’t know what you’re actually shopping for.

It’s not good enough to know that you want to purchase a whole life policy. You need to address questions such as:

- How much coverage do you require?

- Are you interested in working with a particular company?

- How much stock do you put in the ability to earn dividends on an annual basis?

As a general point of advice, let the company provide you with a list of its top benefits. You can then use these, along with your personal wants and needs, to make a decision.

3. Narrow Your Options

With hundreds of companies selling whole life insurance, it’s easy to become bogged down during the process.

At some point, once you have completed your basic research, it’s imperative to narrow your options. Generally speaking, you should cut your list to three providers as soon as possible.

You can do this by focusing on things such as:

- Policy benefits

- Company reputation

- Customer service

- History

- Financial standing

- Price

It’s your decision as to how you narrow your options. Once you know which companies make the most sense for somebody in your shoes, you can decide how to make a final choice.

A good way to start is to compare companies by one metric that you are interested in, for example, compare them by cash value accumulation.

4. Comparing Illustrations

Once you receive illustrations from multiple companies, then you start comparing apples to apples.

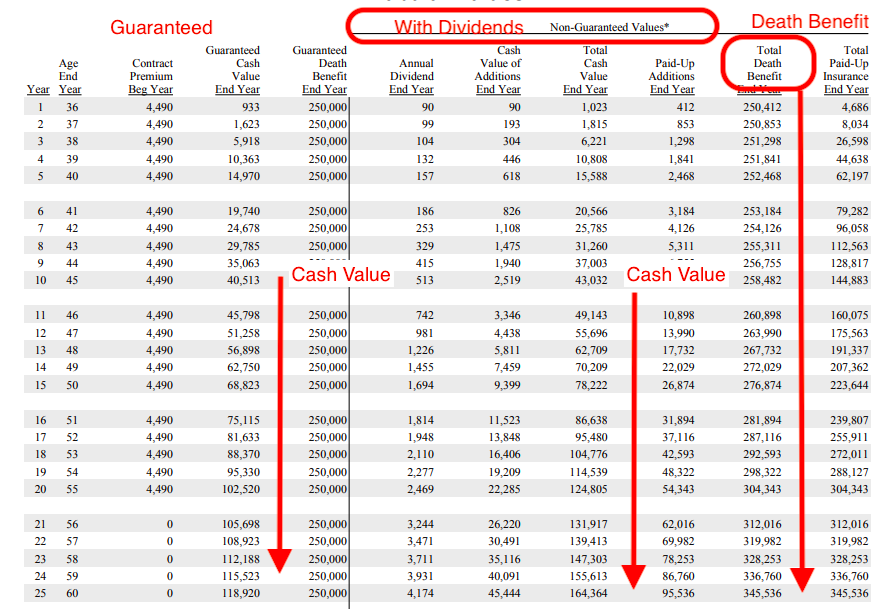

We are going to show you a sample illustration so you can see what to focus in.

In the previous illustration, we point out 3 major aspects to compare.

- Guaranteed Cash Value Growth

- Cash Value With Dividends

- Death Benefit With Dividends

If you focus on these 3 things when you compare each illustration you will get an idea of how well the whole life can perform.

Remember that these illustrations are projections, and most of them are based on the current company dividend. If the company changes their whole life dividend, then your projections can change.

5. Company Financial Strength

It is extremely important to consider the company strength you are going to pick. Your life insurance needs to be there when you are going to die, this means that the company needs to be there for many decades.

When comparing whole life companies, make sure you check the companies ratings:

- Standard & Poor Ratings

- A.M. Best Ratings

- Moody’s Ratings

- Comdex Ratings

Use these 3rd party agencies to help you decide which company to go with.

In addition, the size of the company is also relevant. A large company is more likely to be there in 20, 30, or 40 years. Many of the mutual companies have existed since the mid-1800s, so you are safe betting with them.

Conclusion

Knowing how to compare whole life insurance policies is a big part of making the right buying decision.

With this advice, you should never struggle to pinpoint the company and policy that is best for you and your family.