Updated March 7th, 2019

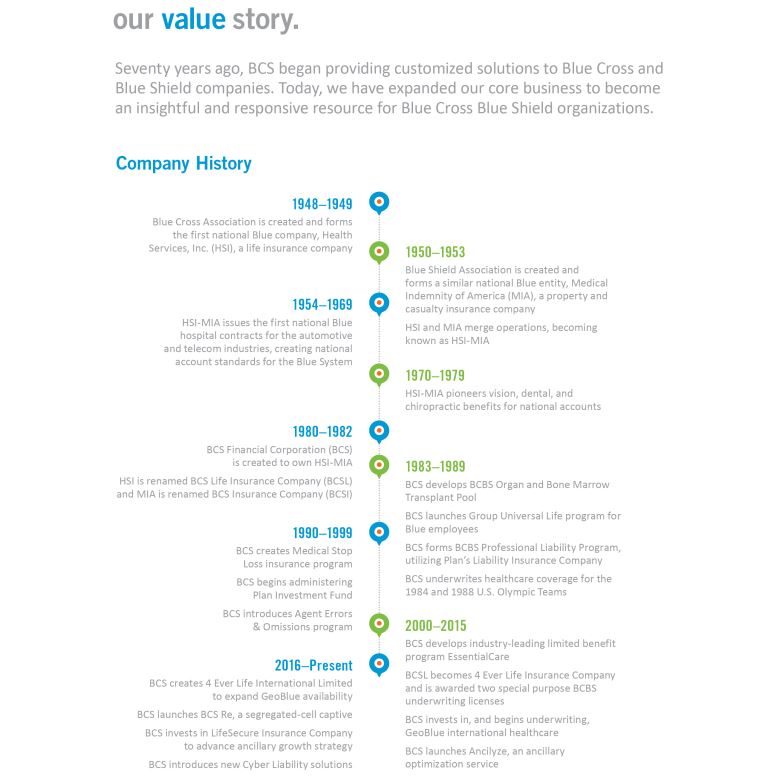

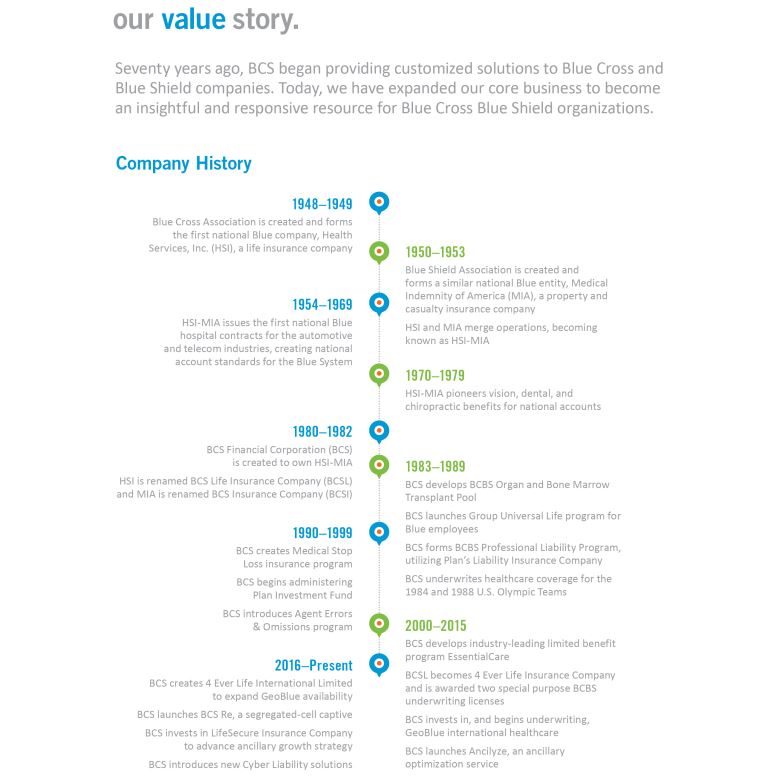

4 Ever Life Ins Co is an Illinois based insurance company. The company was created by BCS Life Insurance Co. 4 Ever Life Insurance Co is an independent licensee of the Blue Cross and Blue Shield Association and is wholly owned by BCS Financial Corp. To learn more Check out: BCSF Website for more information.

4 Ever Life Insurance Company provides underwriting solutions for insurance companies, brokers, agents, administrators, employers, employees, and individuals in the United States.

The company states that they believe protection is enhanced by longevity, stability, and availability. 4 Ever Life has over 60 years of experience in protection.

In this review we will cover the following topics: Let's get started!

Here is a shortlist of some of their ratings:

Farmers Whole Life Insurance Review

Mutual of Omaha Whole Life Review

Allstate Whole Life Review

4 Ever Life Ins Co Review

In this article, you will find our 4 Ever Life Ins Co Review. Let start by looking at who 4 Ever Life Ins Co is?4 Ever Life Ins Co is an Illinois based insurance company. The company was created by BCS Life Insurance Co. 4 Ever Life Insurance Co is an independent licensee of the Blue Cross and Blue Shield Association and is wholly owned by BCS Financial Corp. To learn more Check out: BCSF Website for more information.

4 Ever Life Insurance Company provides underwriting solutions for insurance companies, brokers, agents, administrators, employers, employees, and individuals in the United States.

The company states that they believe protection is enhanced by longevity, stability, and availability. 4 Ever Life has over 60 years of experience in protection.

In this review we will cover the following topics: Let's get started!

The Good

Several Solutions

- International Travel Protection

- Group Universal Life Insurance

- Excessive Reinsurance

- Limited Benefits for Cost-sensitive Employees

- Ability to connect to several carriers in all 50 states

Consistently Rated

4 Ever Life Insurance Co is licensed in all 50 states and carries strong and consistent ratings.Here is a shortlist of some of their ratings:

- AM. Best Rating (Financial Strength): A-

- Weiss (Safety Rating): B

The Bad

Website

Although 4 Ever Life Co seems to have great solutions their website only explains the basics. The site does not guide you easily to the solution you are looking for. When we were trying to connect with 4 Ever Life we used the "Contact Us" page link and this then brought us to the parent company's website BCS. Interestingly BCS's website was far more helpful and offered a more user-friendly experience.Recognition

Honestly, do not be surprised if you have never heard of this company. Although 4 Ever Life Co and BCS offer products to consumers much of their work is Business 2 Business.Finances

Here are some of the financial highlights for 4 Ever Life CoRatings

- A.M. Best Rating: A-

- Weiss: B

Products

- International Travel Insurance

- Stay protected when you travel internationally. 4 Ever Life Co provides access to healthcare not limited by borders. The company will provide you or your clients the care they need from trusted doctors and hospitals whenever and wherever they need it most.

- Group Universal Life Insurance

- Group Life Insurance coverage protects families from the loss of life, but by also offering cash accumulation interest rates returning a guaranteed minimum of 4%. This is especially great when compared to bank CD rates. The cash accumulation feature of the Group UL is low-risk protection for your money and also offers a death benefit protection.

- Excess Reinsurance

- 4 Ever Life Insurance Co offers is a proven reinsurer. Reinsurance protection offers insurance company partners protection by shielding them from significant claim activity. This reinsurance protection, insurance companies are able to mitigate their risk exposure from volatile underwriting loss results. In other words, 4 Ever Life Excess Reinsurance is protection for protectors.

- Limited Benefits

- From term life insurance to short-term disability, 4 Ever Life provides basic yet essential benefits for cost-sensitive employees and employers. And, since no employer contributions are required to offer these simple yet meaningful coverages, 4 Ever Life's term life and short-term disability solutions are easy ways to provide employees access to group worksite benefits.

- Issuing Carriers

- 4 Ever Life knows how to connect its customers to the right solutions. They specialize in connecting the dots which takes a special balancing between requirements of customers, underwriters, administrators, reinsurers, and regulators. This is the art of the insurance business 4 Ever Life specializes in enhancing these types of opportunities.

Dividend Rate

N/AFinal Word

4 Ever Life knows how to connect their customers to solutions. This is the strength they offer. As we have noted earlier n this blog connecting people to the correct solution is the essence of any insurance provider. 4 Ever Life co takes special care to do just this!Interesting Read:

Colonial Penn Whole Life Insurance ReviewFarmers Whole Life Insurance Review

Mutual of Omaha Whole Life Review

Allstate Whole Life Review