Review Your Life Insurance Coverage

Do you own a life insurance policy? When did you review your life insurance coverage last? For most, the answer will be never!If you do own policy you will understand that there is no greater feeling than purchasing a life insurance policy. Once you sign on the dotted line, you'll immediately feel better about the future.However, there's something you need to remember: you should revisit your coverage every now and again. I know that reviewing your homeowner's insurance policy or auto insurance policy is more of a common practice. The same should hold true for your life insurance. As a general rule of thumb, review your life insurance policies at least one time a year.The problem with a "set it and forget it" approach is that your personal and financial situations can and probably will change as the years go by.For example, you may be okay for now with a single life insurance policy with a $500,000 death benefit.However, if something changes in the future, such as bringing additional kids into the world, you'll want to reconsider if this is enough. Related: Life Changes Lead to Purchasing Whole LifeQuestion To Review Your Policy

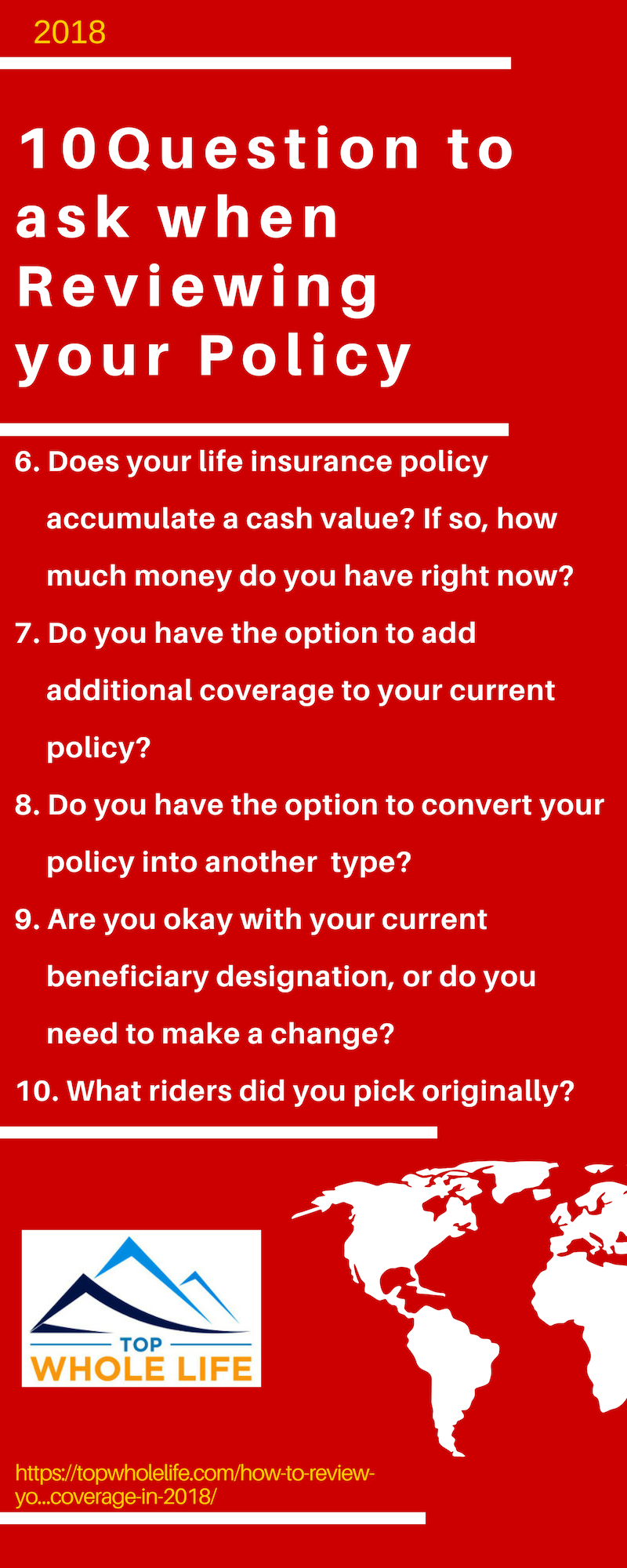

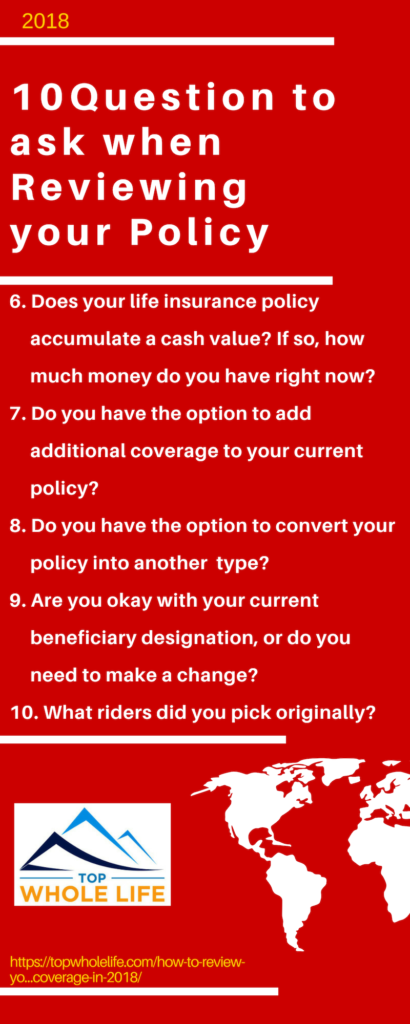

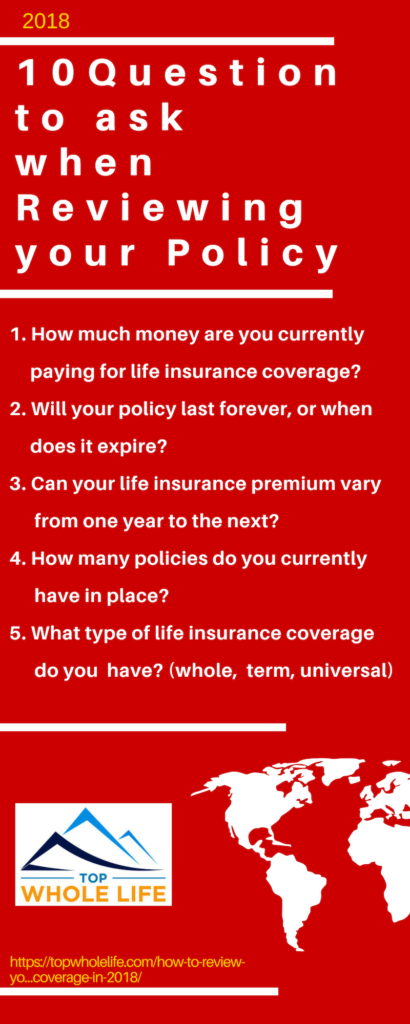

With all this in mind, let's examine several questions to answer as you review your life insurance coverage in 2018:

- How much money are you currently paying for life insurance coverage?

- Will your policy last forever, or when does it expire?

- Can your life insurance premium vary from one year to the next?

- How many policies do you currently have in place?

- What type of life insurance coverage do you have? (whole, term, universal)

- Does your life insurance policy accumulate a cash value? If so, how much money do you have right now?

- Do you have the option to add additional coverage to your current policy?

- Do you have the option to convert your policy into another type?

- Are you okay with your current beneficiary designation, or do you need to make a change?

- What riders did you pick originally?

If you like what you see and realize that you have enough coverage, you can leave everything as is. However, if you come to find that a change is necessary, you don't want to wait too long to consider what's best.

While all the questions above deserve your attention, here's the one you should really focus on: Do you have enough coverage to take care of your family in the event of your death?It's hard to think about a world in which you leave your family behind, but it's the responsible thing to do. If you aren't confident that your current death benefit(s) is enough for your loved ones to get by after your death, it's time for an immediate change.