Here you will learn how to convert term insurance to whole life insurance.

Also we will address:

If your current policy is convertible, ask them for a quote for the amount of insurance that you have.

After you have received a quote from your current company, and if your health permits, get a new quote at TopWholeLife.com and compare them. If you old quote is better because of health reasons, convert it, if there is a chance that you will get approved for a better policy with a new company, you should definitely try it.

This may be very important, if your health has deteriorated over the years. Also, you may not want to go through the hassle of getting a new health rating. In reality, most people have a better health rating the younger they are.

Certain companies have a limited period of time where you can convert your term insurance, so you have to make sure that your term insurance is still convertible.

When converting a policy you will not need to answer any Health Questions.

Contact us to find out if your policy could be converted.

Converting your term insurance policy is not a hard process, and it can be done very quickly. If you want help just to make the process as easy as possible contact us at : quotes@topwholelife.com

So let's say you currently have term insurance policy from MetLife that you got 3 years ago. Now you can convert that policy into a whole life policy and keep the same rating you originally got.

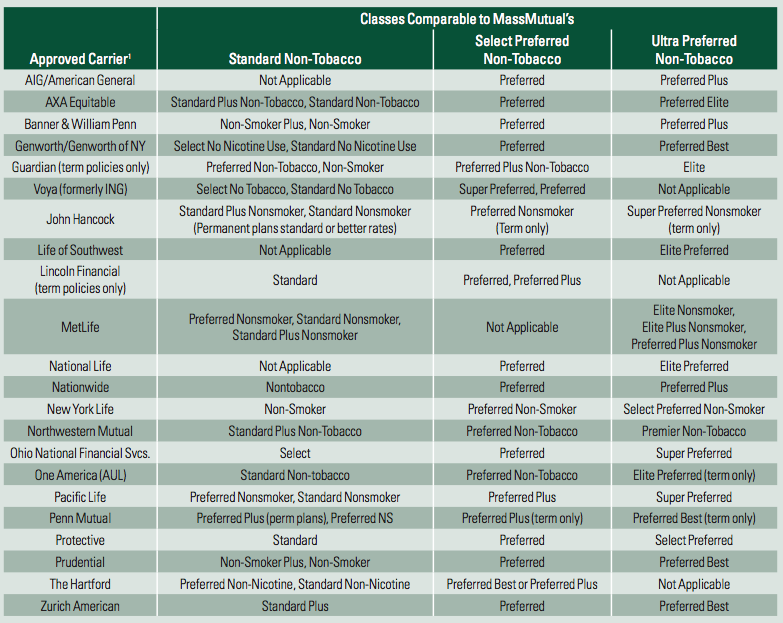

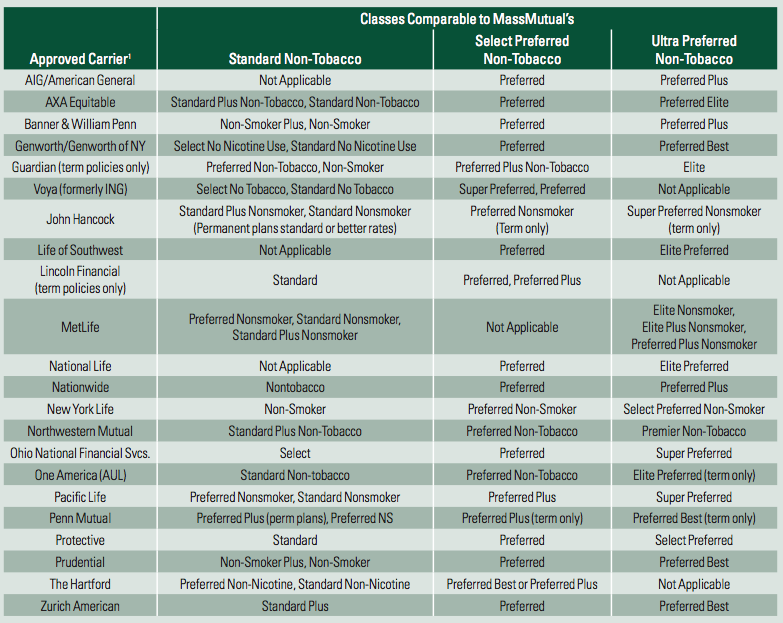

Below we have list of approved companies.

Also, the company has extended that "look-back" period from four to five years, opening up more opportunity for clients.

"Advisors can use E-Z Pass as an alternative to converting term life insurance at another carrier, which may be especially useful for former MPCG advisors as some MetLife products are sunsetting," said Pam Beals, vice president and chief life underwriter, Life Underwriting. "For eligible insureds, the program allows them to purchase coverage without additional medical tests or exams."

While it is not a conversion or replacement program, E-Z Pass allows clients to increase their protection, up to a $3 million maximum, if they have been fully underwritten and approved by MassMutual or an approved carrier in the past five years.

E-Z Pass may be an attractive alternative for healthier clients who are considering converting their term policies at other carriers. Here are a few key details:

Here are some additional questions to answer:

Contact us to get a quote!

Also we will address:

- What is the process of converting to whole life?

- Reasons to convert to whole life

- What policies are you allowed to convert?

- Health Questions

- Should I convert or get a new policy?

- What if I can't convert my policy?

What is the process of converting term insurance to whole life insurance?

Talk to your current agent about your options. If you do not know your agent, you can always call us and we can become the agent of record on your policy and help you get all the information you need. Otherwise, call your insurance company or agent to ask them if your policy is convertible.If your current policy is convertible, ask them for a quote for the amount of insurance that you have.

After you have received a quote from your current company, and if your health permits, get a new quote at TopWholeLife.com and compare them. If you old quote is better because of health reasons, convert it, if there is a chance that you will get approved for a better policy with a new company, you should definitely try it.

Reasons to convert term to whole life

The main reason to convert your term policy to Whole Life is to have permanent insurance that never expires. If you current term policy is convertible, you will be able to keep the health rating you got when you first got your insurance policy.This may be very important, if your health has deteriorated over the years. Also, you may not want to go through the hassle of getting a new health rating. In reality, most people have a better health rating the younger they are.

What policies are you allowed to convert to?

The type of policy you can convert to depends on your provider. Most companies have a 2 options of permanent insurance, Universal Life Insurance or Whole Life Insurance.Certain companies have a limited period of time where you can convert your term insurance, so you have to make sure that your term insurance is still convertible.

Health Questions

You will need to determine if your current health is better than when you purchased your policy. If so it may make sense to try to get a better rating for your new policy. There is nothing to lose, because you could always convert your current policy even if you get a worst rating on a new policy by taking a medical test.When converting a policy you will not need to answer any Health Questions.

What if I can't convert my policy?

If your current company doesn't allow you to convert to a whole life insurance, some companies will allow you to convert between different companies.Contact us to find out if your policy could be converted.

Converting your term insurance policy is not a hard process, and it can be done very quickly. If you want help just to make the process as easy as possible contact us at : quotes@topwholelife.com

Other Interesting Conversion Options

E-Z Pass from MassMutual offers clients a way to get easy approvals when converting from term to whole life insurance coverage on clients who have been fully underwritten and approved by a list of companies.So let's say you currently have term insurance policy from MetLife that you got 3 years ago. Now you can convert that policy into a whole life policy and keep the same rating you originally got.

Below we have list of approved companies.

Also, the company has extended that "look-back" period from four to five years, opening up more opportunity for clients.

"Advisors can use E-Z Pass as an alternative to converting term life insurance at another carrier, which may be especially useful for former MPCG advisors as some MetLife products are sunsetting," said Pam Beals, vice president and chief life underwriter, Life Underwriting. "For eligible insureds, the program allows them to purchase coverage without additional medical tests or exams."

While it is not a conversion or replacement program, E-Z Pass allows clients to increase their protection, up to a $3 million maximum, if they have been fully underwritten and approved by MassMutual or an approved carrier in the past five years.

E-Z Pass may be an attractive alternative for healthier clients who are considering converting their term policies at other carriers. Here are a few key details:

- Existing policy must be fully underwritten.

- Insured must be 60 or younger.

- Waiver of premium, Life Insurance Supplement Rider (LISR) and Additional Life Insurance Rider (ALIR) are available (some limitations apply).

- Minimum face amount of $100,000.

Do You Qualify for the E-Z Pass Program?

If you're interested in the E-Z Pass Program, you'll first want to learn more about your eligibility. Here are the eligibility checklist questions to answer:- Are you applying for a new whole life?

- Did you get your original policy from an approved carrier?

- Was the original policy fully underwritten and issued within the past five years at standard or better rates?

- Are you applying for three million or less and equal to or less to the original policy?

- Are you 60 years old or younger?

- Do you want to apply for a minimum face amount of $100,000?

Here are some additional questions to answer:

- Is the new policy replacing a MassMutual policy?

- Are you a pilot?

- Did you get your original policy without blood testing?

- Did you apply for new riders?

- Do you want to apply for more that one application?

- Are full/age amount requirements being submitted?

Important Points

In addition to the questions above, there are some other important points to keep in mind:- All E-Z Pass cases will be underwritten financially

- Motor vehicle reports, pharmacy database checks, and PHIs will be required

- E-Z Pass it not a guaranteed issue program

- E-Z Pass is not available for business insurance coverage

Final Word

Converting policies is a great way to get permanent coverage and start building cash value. It is simple, quick and it doesn't require a medical.Contact us to get a quote!