Ohio National announced their 2018 dividend. A lower interest environment is hurting life insurance companies, as the 2018 dividend rate drops to 5.4%.

This numbers is a similar drop to what the competition is experiencing. MassMutual announced a 2018 lower dividend as well, and Northwestern Mutual had a drop as well.

Also, Penn Mutual and Guardian Life maintained their 2017 dividend rate.

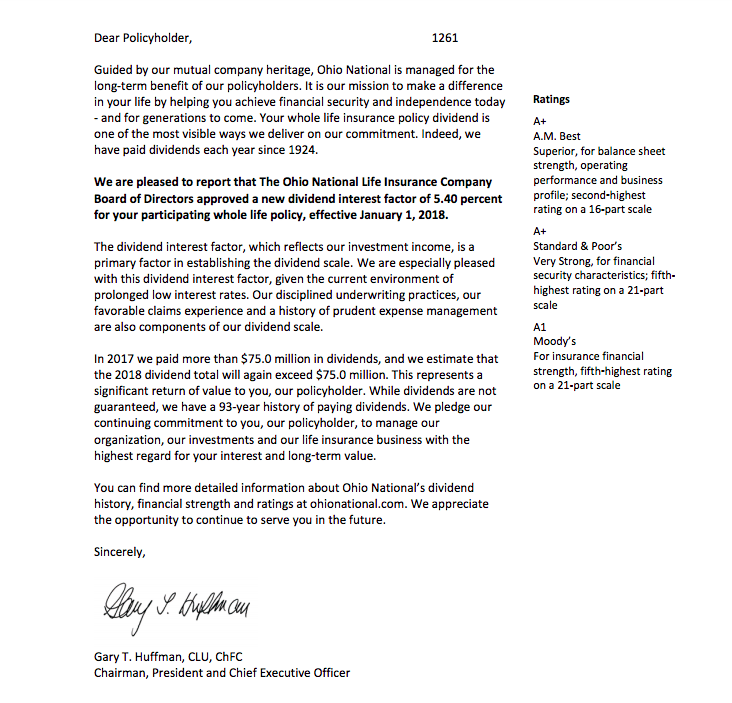

Here is the Ohio National Announcement:

[caption id="attachment_8218" align="alignnone" width="300"] Ohio National Letter 2018 Dividend[/caption]

Ohio National Letter 2018 Dividend[/caption]

Ohio National Whole Life Review

Whole Life Insurance Historical Dividend Rates

Top 7 Whole Life Insurance Companies For Cash Value

This numbers is a similar drop to what the competition is experiencing. MassMutual announced a 2018 lower dividend as well, and Northwestern Mutual had a drop as well.

Also, Penn Mutual and Guardian Life maintained their 2017 dividend rate.

Here is the Ohio National Announcement:

We are pleased to announce that The Ohio National Life Insurance Company Board of Directors approved a new dividend interest factor of 5.40% for participating whole life policies issued on or after August 1, 1998 (the "open block"), and 4.75% for participating whole life policies issued prior to August 1, 1998 (the "closed block"), effective January 1, 2018.

The 2018 dividend scales reflect our commitment to provide high value life insurance products to our participating policyholders. While dividends are not guaranteed, paying dividends is one of the most visible ways we deliver on our commitment. We have paid dividends each year since 1924. In 2017, we paid more than $75.0 million in dividends to participating policyholders, and we estimate that the 2018 dividend total will again exceed $75.0 million. This represents a significant return of value to our policyholders.

[caption id="attachment_8218" align="alignnone" width="300"]

Ohio National Letter 2018 Dividend[/caption]

Ohio National Letter 2018 Dividend[/caption]Other Topics

Check other articles about Ohio National:Ohio National Whole Life Review

Whole Life Insurance Historical Dividend Rates

Top 7 Whole Life Insurance Companies For Cash Value