Prudential Whole Life Insurance Review

Before we get started, let's look at Prudential as a company.Prudential is one of the companies that has a very wide international reach.

One of their claims is:

"Helping people and businesses worldwide with their insurance and financial needs"

And it is very true!They can deliver on the promise with offices in the U.S., Asia, Europe, and Latin America.

Also they provide customers with a variety of products and services like:

- life insurance

- annuities

- retirement-related services

- mutual funds

- investment management

- Being that they are a large publicly trade company, they say they strive to create long-term value for their stakeholders.

Top Whole Life's Prudential Life Insurance Review

In this Prudential whole life insurance review we will cover the following topics: So let's get started.The Good

1. Various Types of Life Insurance

A company like Prudential does not have one type of life insurance. Instead, it offers a variety of options, each of which suits a particular type of buyer. As you shop for Prudential life insurance coverage, you will find policies that vary in terms of price, benefits, and of course, premium.You can use the company's Life Insurance Needs Estimator to decide how much life insurance to purchase. This gives you an added level of confidence as you begin the shopping process.

2. Large Selection of Riders

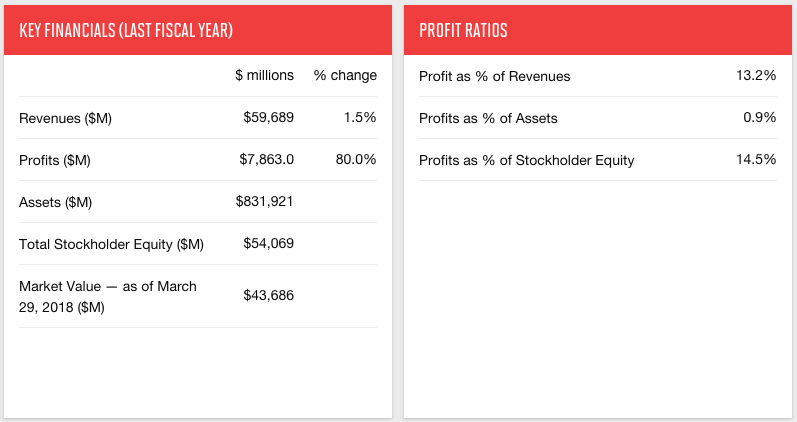

Accompanying Prudential's large variety of insurance products are several rider options. There are both free and paid riders that will allow you to customize your policy to fit your specific needs.3. Strong company ratings and financials

Overall Prudential is a very strong company financially. With over $1.4 Trillion dollars in assets under management, you can see that people all over the world would agree that they can trust Prudential.4. Favorable underwriting for specific niches

Prudential offers more lenient underwriting if you fall into specific groups compared to competitors.For example:

- Smokeless Tabacco

- Large Builds

- Diabetes

- DUI's on Driving Record

- Active Military

The Bad

1. Prudential does not offer a Whole Life Product

Prudential doesn't offer a Whole Life Insurance as I already mentioned. They offer a line up of Universal Life Insurance, which is a different product that could definitely fit many cases.There are many variables to consider when purchasing a Universal Life Insurance like how long does the guaranteed life insurance lasts, and what guarantees do you have on the crediting interest rate in the policy.

2. Consumer Review Regarding Poor Customer Service

Although Prudential has many great highlights it seems to struggle ongoing customer satisfaction. The company has several product options that really can fit anyone's need however after the product is sold it seems from the consumer reviews that the claims division and customer support needs some improvement.Finances

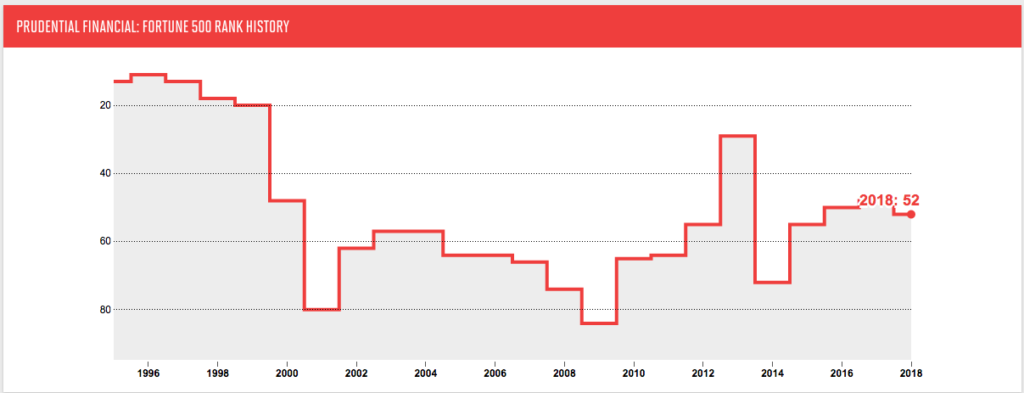

Prudential has been on the Fortune 500 list for more than a decade!

Ratings

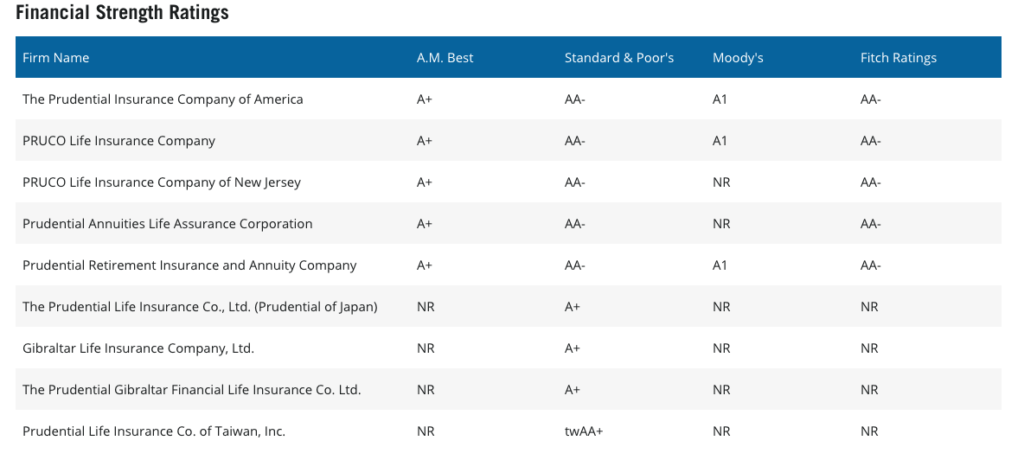

For more than 140 years, Prudential and its companies have been providing customers with a high level of service, all in a stable financial environment. This has led to some of the best ratings in the industry, which include:- A.M. Best Rating: A+

- Standard & Poor's Rating: AA-

- Moody's Rating: A1

Does MetLife have the highest ratings in the industry? Not really, but it does stand out from the crowd with consistent ratings towards the top end of the scale.

Does MetLife have the highest ratings in the industry? Not really, but it does stand out from the crowd with consistent ratings towards the top end of the scale. Products

As mentioned above in this article Prudential has several policies to choose from.

So how will you know what policy is right for you? As you begin to do your research you can reference the chart below to give you a sense. This is a great resource that Prudential provides to you.

You will want to as yourself:

what do you need your life insurance policy to do?

What Do You Need Your Life Insurance Policy to Do?

| I would like it to provide money for those who rely on me and €¦ | ||||||

|---|---|---|---|---|---|---|

| Prudential Policy | €¦ only that. | €¦ leave a legacy for them or a favorite institution. | €¦ create another source of income for me, perhaps for retirement. | €¦ give me access to the money if I become sick. | €¦ minimize or offset taxes. | €¦ protect or continue my business. |

| Term | ||||||

| Term Elite® | covered feature | not covered | not covered | not covered | not covered | not covered |

| Term Essential® | covered feature | not covered | not covered | not covered | covered feature | covered feature |

| PruTerm WorkLife 65SM | covered feature | not covered | not covered | not covered | not covered | not covered |

| PruLife® Return of Premium Term | covered feature | not covered | covered feature | not covered | not covered | not covered |

| PruTerm OneSM | not covered | not covered | not covered | not covered | not covered | covered feature |

| Universal Life | ||||||

| PruLife® Universal Protector | covered feature | covered feature | not covered | covered feature | covered feature | covered feature |

| PruLife® Universal Plus | not covered | covered feature | not covered | not covered | not covered | not covered |

| PruLife Essential UL® | covered feature | covered feature | not covered | covered feature | covered feature | covered feature |

| Indexed Universal Life | ||||||

| PruLife® Founders Plus UL | covered feature | covered feature | not covered | covered feature | covered feature | covered feature |

| PruLife® Index Advantage UL | not covered | not covered | covered feature | covered feature | covered feature | covered feature |

| Survivorship Universal Life | ||||||

| PruLife® SUL Protector | not covered | covered feature | not covered | not covered | covered feature | not covered |

| PruLife®Survivorship Index UL | not covered | covered feature | not covered | not covered | covered feature | not covered |

| Variable Universal Life | ||||||

| PruLife® Custom Premier II | not covered | not covered | covered feature | covered feature | covered feature | covered feature |

| VUL Protector® | not covered | covered feature | covered feature | covered feature | covered feature | covered feature |

| Survivorship Variable Universal Life | ||||||

| PruLife® SVUL ProtectorSM | not covered | covered feature | not covered | not covered | covered feature | not covered |

Term Life Insurance

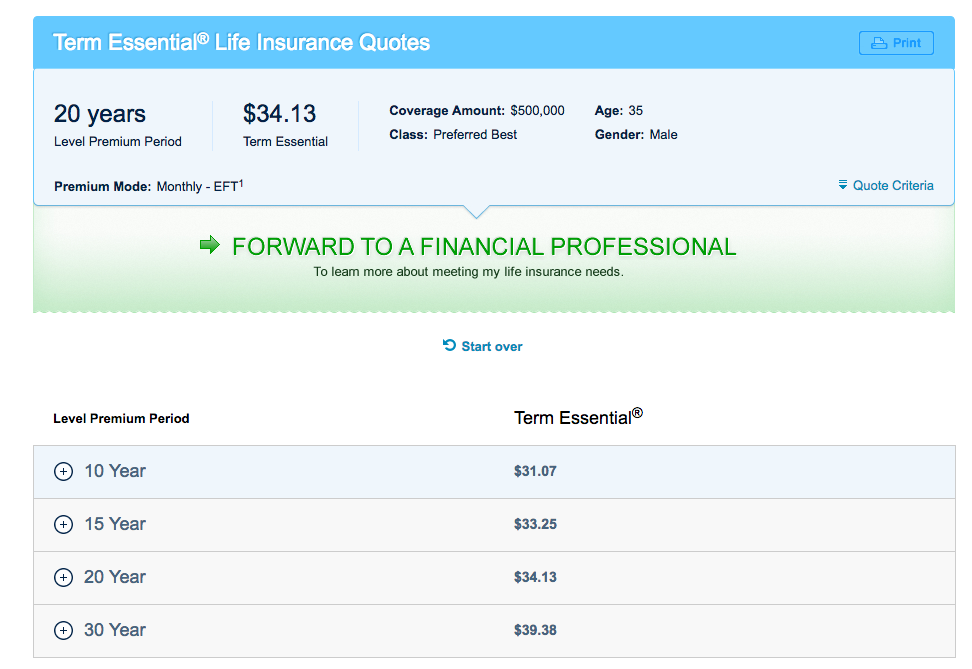

Term Essential

Term Essential is marketed as the companies most cost-effective term product. It offers you death benefit protection with the ability to convert to a permanent product.Term Essential Works well for:

- Income Protection

- Mortgage Protection

- Loan Collateral

Term Essential offers guaranteed level premiums payments for:

- 10 - years

- 15 - years

- 20 - years

- 30 - years

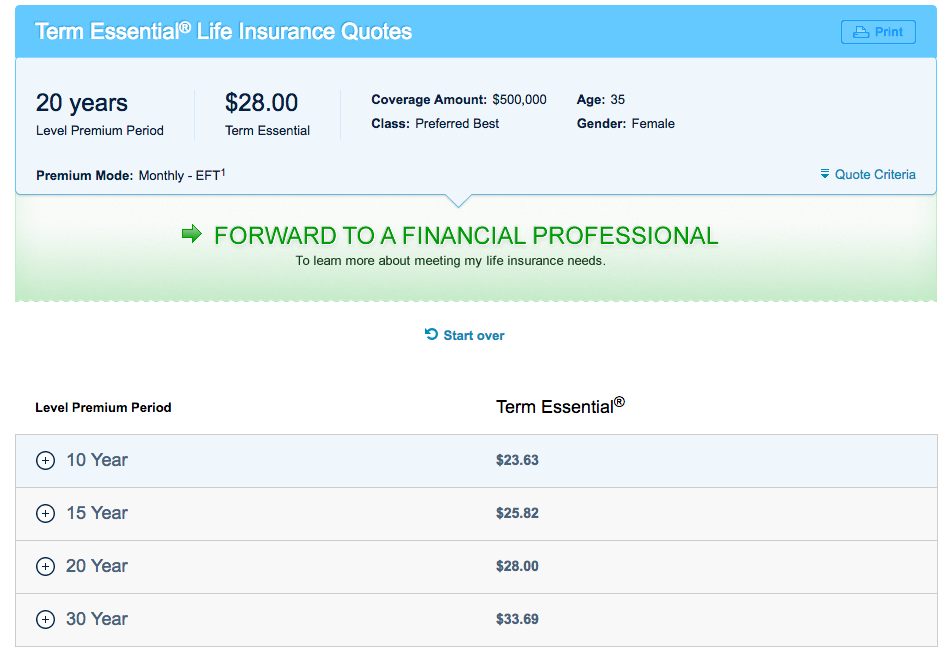

Below are sample quotes of the Term Essential product. You will note at the top the quote for a 20-year policy. If you reference the bottom of the image you will also see all the prices for the various level time frames offered. You will see that the shorter the level premium period is the cheaper the policy.

Male Age 35 - Term Essential Quote

Female Age 35 - Term Essential Quote

Term Elite

Term Elite is almost identical to Term Essential however it has an extra benefit. The first is if you choose to convert to a permanent policy in the first five years, you will receive credit on your first-year premium. This can help make the transition from term to permanent coverage a bit easier.Term Elite works well for:

- Income Protection

- Mortgage Protection

- Key Person

Term Essential offers guaranteed level premiums payments for:

- 10 - years

- 15 - years

- 20 - years

- 30 - years

SimpleTerm

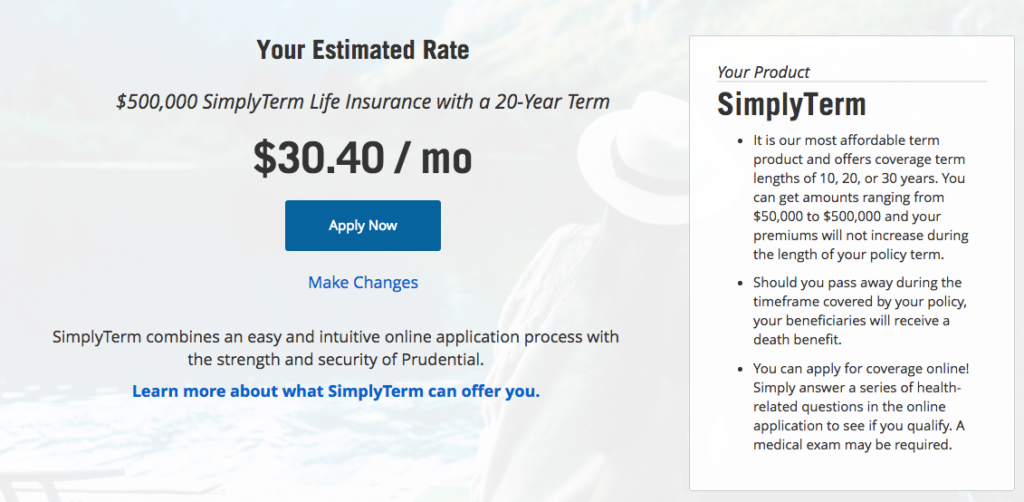

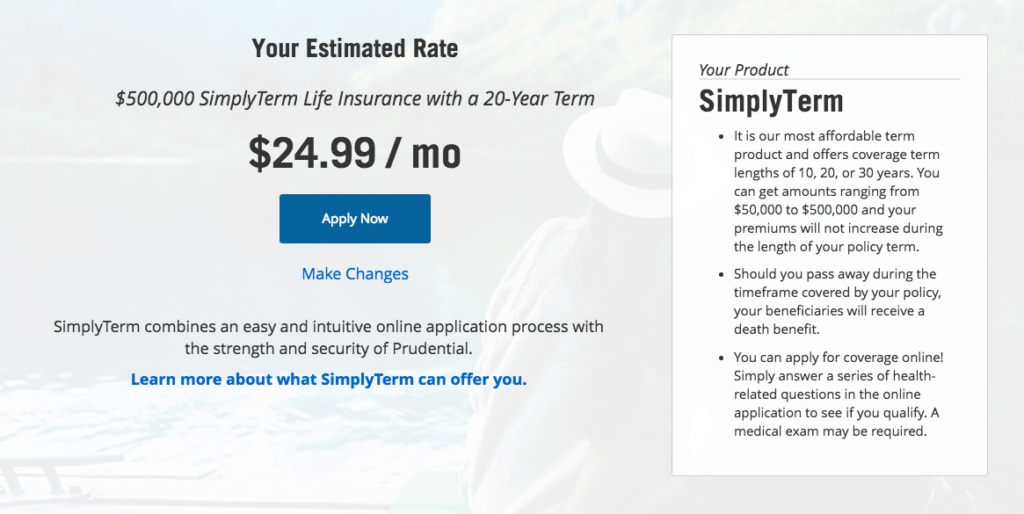

This product provides a term life insurance option that can be purchased only online. The product is designed to be affordable to fit into any budget.The max coverage is $500,000 and offers coverage between 10-30 years. Unfortunately, this option is not yet available in all states.

Male Age 35 - Simple Term Quote

Female Age 35 - SimpleTerm Quote

PruTerm WorkLife 65

This product is designed to provide life insurance coverage during normal working years. A very appealing part of this product is that there are some of the Prudentials rides already added to this policy at no extra cost. The benefits of the riders added are:- If you become disabled, you won't have to pay premiums until either your disability ends or you turn 65, whichever comes first; and,

- If you become unemployed after the first year of coverage, we will waive one continuous year of premiums one time.

PruTerm WorkLife 65 works well for:

- Income Protection

- Mortgage Protection

- Key Person Business Protection

- Guaranteed level-premium period to age 65.

- Includes built-in Insured's Waiver of Premium Benefit rider that waives premiums if:

- The insured becomes unemployed after the 1st contract anniversary but before age 65. We will waive one continuous year of premiums.

- The insured becomes disabled prior to age 65. Policy premiums will be waived until he or she recovers or turns 65, whichever happens first.

- The policy is convertible to any permanent product up to age 65.

PruLife® Return of Premium Term

This is like a term policy BUT it is very different at the same time because if you are still alive at the end of the term the company pays you your premium back tax-free! It has been said that people use the money to pay off a mortgage, pay for college, or supplement retirement income, or for business needs.PruLife® works well for:

- College Funding Protection

- Court-Mandated Life Insurance

- Key Person Business Planning

PruLife® offers guaranteed level premiums payments for:

- 15 - years

- 20 - years

- 30 - years

PruTerm One

This product is a short-term life insurance option. The product offers death benefit protection for one year at a time. This is sometimes also referred to as "annually renewable term".PruTerm works well for:

- Short-Term Income Protection

- Short-Term Mortgage Protection

- Short-Term Business Planning

- Annual renewable term insurance.

- Premiums guaranteed for one year. After the 1st year, premiums increase annually and are not guaranteed.

- Premiums can only be paid annually.

- PruTerm is only convertible for the first 5 years.

Universal Life Insurance

PruLife Founders Plus UL®

This product is designed to provide a cost-effective death benefit that is guaranteed. This means that the policy will be around when you need it the most.

PruLife Founders Plus UL® works well for:

- An Alternative to Guaranteed Universal Life

- Wealth Transfer

- Income Protection

- Buy/Sell Business Planning

- Flexible premiums

- Permanent life insurance with a focus on death benefit protection

- The flexibility of cash value accumulation

- Potential to access cash value.

- Issue age is based on your current age at your last birthday, NOT the nearest birthday.

PruLife Essential ULSM

This policy design will provide protection that can be guaranteed through age 90 and beyond. There is a steady cash value growth is not tied to the market. The cash value growth would be your living benefit. PruLife Essential UL also provides a death benefit for the ones you love.

PruLife Essential ULSM works well for:- A Cost-Effective Alternative to Whole Life

- A Way to Protect Income

- A Strategy for Efficient Wealth Transfer

- Focus on death benefit protection

- Cash value accumulation and living benefits

- The daily fixed interest crediting that is declared by Prudential with a compelling minimum rate guarantee

- Adjustable no-lapse guarantee period up to a lifetime. Less than a lifetime when illustrating on a current (non-guaranteed) basis.

PruLife Index Advantage UL®

This product will provide you a death benefit that can be guaranteed for up to 20 years. The policy also has the potential to build cash value through fixed and indexed interest options.

PruLife Index Advantage UL® works well for:- Cash Accumulation Potential

- Supplementing Retirement Income

- Executive Bonus Business Planning

- Flexible premiums

- Permanent life insurance

- Cash value accumulation potential

- Cash value accumulation potential with downside protection through four distinct account options:

- Your fixed account offers traditional fixed interest crediting that is declared by Prudential.

- Three Indexed Account options offer Index interest potential based on the performance of the S&P 500 Index excluding dividends (based on a 100% participation rate, subject to a current cap floor of 0%), multiplier, and/or spread as applicable.

- Limited No-Lapse Guarantee protects the policy from lapse during key accumulation years (earlier of 20 years of age 70, but at least 10 years).

PruLife® Universal Protector

This product is designed with a customizable no-lapse guarantee that can ensure coverage for life. In addition to this, the policy has recently been through a reprice offering great value!

PruLife® Universal Protector works well for:- Legacy Planning

- Income Protection

- Buy/Sell Business Planning

- Flexible premium

- permanent life insurance with a focus on death benefit protection and long-term, up-to-lifetime, No-Lapse Guarantees.

- Adjustable No-Lapse Guarantee period up to a lifetime.

PruLife® SUL Protector

The SUL Protector is designed to cover two people's lives with insurance. It will pay a benefit when the second insured dies.

PruLife® SUL Protector works well for:- Trust Planning

- Wealth Transfer

- Estate Equalization

- Flexible premium

- permanent life insurance with a focus on death benefit protection covering two lives.

- 2% guaranteed a minimum effective annual interest rate.

- Additional interest may be credited.

PruLife® Universal Plus

This product is a permanent policy that offers no-lapse guarantees for up to 25 years and the potential to build cash value based on adjustable fixed interest. You can access your cash value at any time through policy loans and withdrawals.

PruLife® Universal Plus works well for:- Final Expenses

- Key Person Business Planning

- Buy/Sell Business Planning

- Flexible premium

- Permanent life insurance that offers death benefit protection and is designed for cash value accumulation potential based on traditional, fixed-interest crediting rates declared by Prudential.

- Two No-Lapse Guarantee Periods:

- Short-Term No-Lapse Guarantee: 10 years for all ages.

- Limited No-Lapse Guarantee: The lesser of 25 years or to age 75, but at least 10 years.

- Lower minimum face amounts.

- Older issue ages.

PruLife® Survivorship Index UL

This policy will provide you a cost-effective way to get a death benefit for two lives offering meaningful guarantees, to age 95 +. There is also the potential for cash value growth based on fixed or index interest options.

PruLife® Survivorship Index UL works well for:- Wealth Transfer

- Trusts

- Estate Equalization

- Chronic or Terminal Illness Widowhood Protection

- Flexible premium

- Permanent life insurance with a focus on death benefit protection covering two lives with solid no-lapse guarantees (90+) and the flexibility of cash value accumulation potential and access.

- Cash value accumulation potential with downside protection, based on a choice of three indexed accounts or a traditional fixed account.

- The Fixed Account offers traditional fixed-interest crediting that is declared by Prudential (guaranteed to never be less than 2%).

- Indexed Account

- Index Account with Multiplier

- Uncapped Index AccountThe Indexed Accounts offer interest credits based on the performance of the S&P 500® Index (excluding dividends), using an annual point-to-point calculation method. Each account caters to a client's particular risk tolerance and market outlook. Indexed Accounts Offer include:

- Designated Transfer Amount (DTA) feature: The DTA is an amount, chosen by the client, used to create Index segments on a monthly basis. This feature provides clients with the ability to have multiple Index segments tracking against the S&P 500® throughout the year, which can help them diversify market-based interest credits over time.

- Adjustable No-Lapse Guarantee period based on the number, amount, and timing of premium payments.

Variable Life Insurance

VUL Protector®

The VUL Protector contract offers death benefit protection and also allows you to take on moderate risk in pursuit of moderate returns in the cash value. Regardless of what your cash value does the policy offers a guarantee that it will not laps.

VUL Protector® works well for:

- Additional Protection Strategy

- Wealth Transfer

- Income Protection

- Deferred Compensation Plans

PruLife® Custom Premier II

Permanent death benefit protection with a focus on the potential to build cash value, perhaps to supplement income.

This type of policy might be a good fit for you if you have a need for protection and your primary objective is on long-term growth. It allows you to take on higher risk levels for the potential of higher returns from your cash value.To ensure you are protected in the early years of this policy from any downturns it offers two different no laps guarantees.

- Short Term - For ages 0 - 59 years, it's 8 years. For ages 60+, it's 6 years.

- Limited - For all ages, the period is the greater of 10 years of age 75.

- Supplementing Retirement Income Strategy

- Deferred Compensation

- Executive Bonus

- Split-Dollar

- Flexible premium

- Permanent life insurance designed for greater cash value accumulation potential. 20th-year cash value accumulation potential.

- Two No-Lapse Guarantee Periods

- Short Term (Ages 0 - 59: 8 years and Ages 60+: 6 years)

- Limited (All ages: greater of 10 years of age 75)

- Over 60 underlying investment options covering a broad range of asset classes and styles from well-known fund companies.

PruLife® SVUL ProtectorSM

This policy is a legacy tool. If you want to leave money to the next generation this survivorship policy is designed to meet your needs. This policy also offers a guarantee of no laps regardless of whether the cash value goes up or down.

PruLife® SVUL ProtectorSM works well for:- Wealth Transfer

- Trust Planning

- Estate Equalization

- Business Planning

- Cost-effective

- Permanent life insurance has the potential to provide cash value accumulation and access.

- Adjustable No-Lapse Guarantee (based on factors including the number, amount, and timing of premium payments).

- Over 50 underlying investment options covering a broad range of asset classes and styles from well-known fund companies.

Riders

Prudential offers a wide range of free and paid riders.Free Riders

Living Needs BenefitSM1 (Accelerated Death Benefit) - This rider will let the policy owner receive a portion of the death benefit prior to the insured's death if the insured has been sent to a nursing home for at least six months, is terminally ill with a life expectancy of six months, and/or requires an organ transplant and would only have 6 months to life without the procedure.MyNeeds Benefit -If you would like to make a withdrawal from your policy, this rider ordinarily, there could be a surrender or withdrawal charge. With this benefit, if you are in a nursing home and take a withdrawal, we will waive those charges.

Paid Riders

List the paid riders that can be added to the products:BenefitAccess Rider - This rider offers an accelerated death benefit that will advance up to 100% of the policy's death benefit if a chronic or terminal illness presents itself to the insured.

Disability Waiver of Premium - If the insured becomes disabled premiums will be waived as long as the insured continues to qualify as disabled.Accidental Death Benefit - This rider will pay your beneficiary an additional death benefit equal to the face amount of the policy up to a maximum of $500,000 if the insured's death is accidental as defined in the rider.

Children's Protection Rider - The Children's Protection Rider provides level term insurance on the life of each covered child. The rider can be converted on or after the policy anniversary following the child's 18th, 22nd or 25th birthday as long as the rider is still in effect. This rider can also be converted to a permanent policy when its coverage expires.

Children Level Term Rider - This rider gives you the option to provide life insurance for your young children. It also provides the option to convert the coverage to a new permanent life insurance policy at specific ages when they are older.Overloan Protection Rider- If you have an outstanding policy loan, there's the potential that your policy could lapse. This rider helps to prevent the policy from lapsing. It's kinda like overdraft protection on your bank account. There is a one-time charge if you use it.

Enhanced Cash Value Rider - This rider is used to help accelerate cash value growth. available in NY.)

Dividend Rate

N/APrudential Whole Life Insurance Review Final Word

Wow well as you can see Prudential has a ton to offer.Even though the company does not offer a Whole Life Insurance product they are not lacking in alternative options. Prudential has several great choices for term insurance many that are convertible to the large selection of permanent products. Regardless if you are a conservative or risky person there will be insurance products to fit your needs.

We believe that Prudential is a great option to consider for insurance protection.

If you would like to talk with a Prudential agent feel free to call us. If you would simply like to see a quote that fits your personal need you can find this our by entering your information below.

Get A Personal Quote [divider line_type="No Line" custom_height="20"][toggles style="default"][toggle color="Default" title="Can I change my Prudential life insurance beneficiary?"]

Yes, you can change your beneficiary information by accessing the "Forms Library" or "Change Beneficiary" from your policy profile page and selecting the option to change the beneficiary on your insurance form.

[/toggle][toggle color="Default" title="Can I make changes to my Prudential life insurance policy online?"]Through Prudential's online account access service, you can make the following changes to your policy:

- View policy documents€”premium notices, annual statements, and tax documents

- Perform self-service on your insurance policy€”changing your email address, home address, and beneficiary designation

- Find policy values€”beneficiary information, cash values, death benefit, and loan values

- PruLife® Survivorship Index UL: It focuses on death benefit protection covering two lives with solid no-lapse guarantees (90+) and the flexibility of cash value accumulation potential and access.

- PruLife® Universal Protector: It focuses on death benefit protection and long-term, up-to-lifetime, No-Lapse Guarantees.

- PruLife® Universal Plus: It offers no-lapse guarantees for up to 25 years and the potential to build cash value based on adjustable fixed interest.

Yes, you can input your Prudential life insurance premium payment info. and schedule an effective future date of the payment up to 30 days from the current date.

[/toggle][/toggles]JTNDJTIxLS1GQVFQYWdlJTIwQ29kZSUyMFN0YXJ0LS0lM0UlMEElM0NzY3JpcHQlMjB0eXBlJTNEJTIyYXBwbGljYXRpb24lMkZsZCUyQmpzb24lMjIlM0UlMEElN0IlMEElMjAlMjAlMjIlNDBjb250ZXh0JTIyJTNBJTIwJTIyaHR0cHMlM0ElMkYlMkZzY2hlbWEub3JnJTIyJTJDJTBBJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMkZBUVBhZ2UlMjIlMkMlMEElMjAlMjAlMjJtYWluRW50aXR5JTIyJTNBJTIwJTVCJTBBJTIwJTIwJTIwJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMlF1ZXN0aW9uJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIybmFtZSUyMiUzQSUyMCUyMkNhbiUyMEklMjBjaGFuZ2UlMjBteSUyMFBydWRlbnRpYWwlMjBsaWZlJTIwaW5zdXJhbmNlJTIwYmVuZWZpY2lhcnklM0YlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJhY2NlcHRlZEFuc3dlciUyMiUzQSUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJBbnN3ZXIlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjJ0ZXh0JTIyJTNBJTIwJTIyWWVzJTJDJTIweW91JTIwY2FuJTIwY2hhbmdlJTIweW91ciUyMGJlbmVmaWNpYXJ5JTIwaW5mb3JtYXRpb24lMjBieSUyMGFjY2Vzc2luZyUyMHRoZSUyMCU1QyUyMkZvcm1zJTIwTGlicmFyeSU1QyUyMiUyMG9yJTIwJTVDJTIyQ2hhbmdlJTIwQmVuZWZpY2lhcnklNUMlMjIlMjBmcm9tJTIweW91ciUyMHBvbGljeSUyMHByb2ZpbGUlMjBwYWdlJTIwYW5kJTIwc2VsZWN0aW5nJTIwdGhlJTIwb3B0aW9uJTIwdG8lMjBjaGFuZ2UlMjB0aGUlMjBiZW5lZmljaWFyeSUyMG9uJTIweW91ciUyMGluc3VyYW5jZSUyMGZvcm0uJTIyJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTIwJTIwJTdEJTJDJTBBJTIwJTIwJTIwJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMlF1ZXN0aW9uJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIybmFtZSUyMiUzQSUyMCUyMkNhbiUyMEklMjBtYWtlJTIwY2hhbmdlcyUyMHRvJTIwbXklMjBQcnVkZW50aWFsJTIwbGlmZSUyMGluc3VyYW5jZSUyMHBvbGljeSUyMG9ubGluZSUzRiUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMmFjY2VwdGVkQW5zd2VyJTIyJTNBJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMkFuc3dlciUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMnRleHQlMjIlM0ElMjAlMjJUaHJvdWdoJTIwUHJ1ZGVudGlhbCVFMiU4MCU5OXMlMjBvbmxpbmUlMjBhY2NvdW50JTIwYWNjZXNzJTIwc2VydmljZSUyQyUyMHlvdSUyMGNhbiUyMG1ha2UlMjB0aGUlMjBmb2xsb3dpbmclMjBjaGFuZ2VzJTIwdG8lMjB5b3VyJTIwcG9saWN5JTNBJTVDblZpZXclMjBwb2xpY3klMjBkb2N1bWVudHMlRTIlODAlOTRwcmVtaXVtJTIwbm90aWNlcyUyQyUyMGFubnVhbCUyMHN0YXRlbWVudHMlMkMlMjBhbmQlMjB0YXglMjBkb2N1bWVudHMlNUNuUGVyZm9ybSUyMHNlbGYtc2VydmljZSUyMG9uJTIweW91ciUyMGluc3VyYW5jZSUyMHBvbGljeSVFMiU4MCU5NGNoYW5naW5nJTIweW91ciUyMGVtYWlsJTIwYWRkcmVzcyUyQyUyMGhvbWUlMjBhZGRyZXNzJTJDJTIwYW5kJTIwYmVuZWZpY2lhcnklMjBkZXNpZ25hdGlvbiU1Q25GaW5kJTIwcG9saWN5JTIwdmFsdWVzJUUyJTgwJTk0YmVuZWZpY2lhcnklMjBpbmZvcm1hdGlvbiUyQyUyMGNhc2glMjB2YWx1ZXMlMkMlMjBkZWF0aCUyMGJlbmVmaXQlMkMlMjBhbmQlMjBsb2FuJTIwdmFsdWVzJTIyJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTdEJTBBJTIwJTIwJTIwJTIwJTdEJTJDJTBBJTIwJTIwJTIwJTIwJTdCJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyJTQwdHlwZSUyMiUzQSUyMCUyMlF1ZXN0aW9uJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIybmFtZSUyMiUzQSUyMCUyMldoaWNoJTIwUHJ1ZGVudGlhbCUyMGxpZmUlMjBpbnN1cmFuY2UlMjBwb2xpY2llcyUyMG9mZmVyJTIwbm8tbGFwc2UlMjBndWFyYW50ZWVzJTNGJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIyYWNjZXB0ZWRBbnN3ZXIlMjIlM0ElMjAlN0IlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjIlNDB0eXBlJTIyJTNBJTIwJTIyQW5zd2VyJTIyJTJDJTBBJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIwJTIydGV4dCUyMiUzQSUyMCUyMlBydUxpZmUlQzIlQUUlMjBTdXJ2aXZvcnNoaXAlMjBJbmRleCUyMFVMJTNBJTIwSXQlMjBmb2N1c2VzJTIwb24lMjBkZWF0aCUyMGJlbmVmaXQlMjBwcm90ZWN0aW9uJTIwY292ZXJpbmclMjB0d28lMjBsaXZlcyUyMHdpdGglMjBzb2xpZCUyMG5vLWxhcHNlJTIwZ3VhcmFudGVlcyUyMCUyODkwJTJCJTI5JTIwYW5kJTIwdGhlJTIwZmxleGliaWxpdHklMjBvZiUyMGNhc2glMjB2YWx1ZSUyMGFjY3VtdWxhdGlvbiUyMHBvdGVudGlhbCUyMGFuZCUyMGFjY2Vzcy4lNUNuUHJ1TGlmZSVDMiVBRSUyMFVuaXZlcnNhbCUyMFByb3RlY3RvciUzQSUyMEl0JTIwZm9jdXNlcyUyMG9uJTIwZGVhdGglMjBiZW5lZml0JTIwcHJvdGVjdGlvbiUyMGFuZCUyMGxvbmctdGVybSUyQyUyMHVwLXRvLWxpZmV0aW1lJTJDJTIwTm8tTGFwc2UlMjBHdWFyYW50ZWVzLiU1Q25QcnVMaWZlJUMyJUFFJTIwVW5pdmVyc2FsJTIwUGx1cyUzQSUyMEl0JTIwb2ZmZXJzJTIwbm8tbGFwc2UlMjBndWFyYW50ZWVzJTIwZm9yJTIwdXAlMjB0byUyMDI1JTIweWVhcnMlMjBhbmQlMjB0aGUlMjBwb3RlbnRpYWwlMjB0byUyMGJ1aWxkJTIwY2FzaCUyMHZhbHVlJTIwYmFzZWQlMjBvbiUyMGFkanVzdGFibGUlMjBmaXhlZCUyMGludGVyZXN0LiUyMCUyMiUwQSUyMCUyMCUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCUyMCUyMCU3RCUyQyUwQSUyMCUyMCUyMCUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJRdWVzdGlvbiUyMiUyQyUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMm5hbWUlMjIlM0ElMjAlMjJDYW4lMjBJJTIwc2NoZWR1bGUlMjBteSUyMHByZW1pdW0lMjBwYXltZW50JTIwZm9yJTIwYSUyMGZ1dHVyZSUyMGRhdGUlM0YlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjJhY2NlcHRlZEFuc3dlciUyMiUzQSUyMCU3QiUwQSUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMCUyMiU0MHR5cGUlMjIlM0ElMjAlMjJBbnN3ZXIlMjIlMkMlMEElMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjAlMjJ0ZXh0JTIyJTNBJTIwJTIyWWVzJTJDJTIweW91JTIwY2FuJTIwaW5wdXQlMjB5b3VyJTIwUHJ1ZGVudGlhbCUyMGxpZmUlMjBpbnN1cmFuY2UlMjBwcmVtaXVtJTIwcGF5bWVudCUyMGluZm8uJTIwYW5kJTIwc2NoZWR1bGUlMjBhbiUyMGVmZmVjdGl2ZSUyMGZ1dHVyZSUyMGRhdGUlMjBvZiUyMHRoZSUyMHBheW1lbnQlMjB1cCUyMHRvJTIwMzAlMjBkYXlzJTIwZnJvbSUyMHRoZSUyMGN1cnJlbnQlMjBkYXRlLiUyMiUwQSUyMCUyMCUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCUyMCUyMCU3RCUwQSUyMCUyMCU1RCUwQSU3RCUwQSUzQyUyRnNjcmlwdCUzRSUwQSUzQyUyMS0tRkFRUGFnZSUyMENvZGUlMjBFbmQtLSUzRQ==