[caption id="attachment_9130" align="alignnone" width="813"]

Whole Life 10 pay graph[/caption]

Whole Life 10 pay graph[/caption] Are you interested in purchasing whole life insurance, but concerned about your ability (or willingness) to make premium payments for the rest of your life?With a limited pay whole life insurance policy, you're required to pay a premium for a predetermined number of years or until you reach a specific age.

At that point, you are no longer required to make premium payments. However, unlike term life insurance, your death benefit remains in place until you pass on. In addition, your cash value and death benefit keep growing, without you having to pay any more.

There are many different kinds of limited pay life insurance. Most people associate a limited pay with a whole life policy. In this article we will go over whole life and some of the other limited pay policies.

The Benefits

Before making a final decision on what to buy, you'll want to learn more about the benefits of limited pay whole life insurance. Here are several to keep in mind:- You are not required to pay a premium until your death. Once you pay your policy in full, you no longer make payments but you get to keep your coverage. This is the top benefit and the primary reason why consumers consider this coverage.

- High cash value growth. With a limited pay whole life insurance policy, you achieve high cash value growth early on. If this is important to you, there aren't any other policies that offer the same growth rate.

- Good way to care for your family in the future. You can use this to provide for your family down the road. Once you're done paying your premiums, your policy remains intact so your children can take advantage.

The Biggest Downfall

With so many benefits, you may be wondering why more people don't have limited pay whole life insurance.There is a big reason for this: limited pay whole life insurance is not cheap. Due to the fact that you're paying premiums for a predetermined period of time - not the rest of your life - you should expect to pay more than you would with a traditional whole life policy.

One of the best ways around this is to lower your death benefit, as this will allow you to pay a smaller premium. However, thanks to your cash value growth and potential dividends, your policy will grow over the years.

If these premiums are to high for you, you should consider longer pay periods to lower your whole life rates.

Things to Know

While limited pay whole life insurance varies from one company to the next, some details are standard across the board.Let's start by looking at the different payment terms. The most common options include:

- 10 pay

- 20 pay

- Paid Until Age 65

For example, a $500k 10 year limited pay whole life insurance policy will cost more than a $500k 20 year policy.

Also the shorter the pay period the more faster you will accumulate cash value. If what you are looking for is cash value then check out our "Top 7 Companies for Whole Life Insurance Cash Value" article.

Tip: if you're on a budget, obtain quotes for each type available through the company you choose.

Here are some other things you need to know (and discuss with your provider):

- You can pay premiums annually, semi-annually, or monthly

- Most limited pay whole life insurance policies have a guaranteed cash value that grows tax-deferred

- Depending on the company, your limited pay whole life insurance policy may be eligible to earn dividends

- Just the same as other life insurance policies, the death benefit typically passes on to your beneficiary tax-free

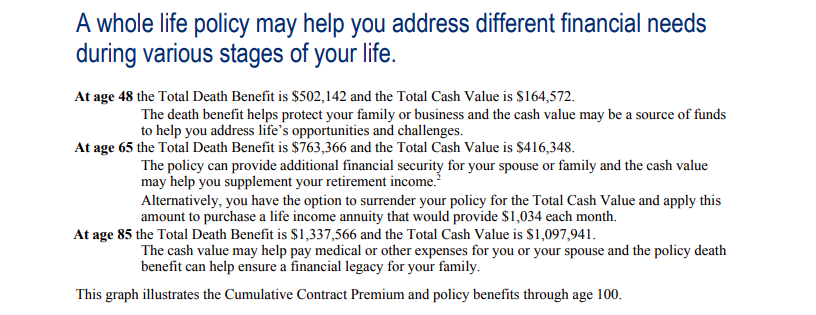

10 Pay Whole Life Example

A ten pay as it's commonly called, will give you significant cash value growth very quickly. In addition, the cost for your death benefit is very low. In about 10 years you will have all of your cash that you paid into the policy, and a permanent policy with no more premiums.Here is a sample illustration from a large company with a good 10 pay whole life. We ran numbers for a very healthy 30 year old male paying $10k for 10 years.

This person would get an initial death benefit of $352,000.

[caption id="attachment_9131" align="alignnone" width="816"]

Whole Life 10 pay sample numbers[/caption]

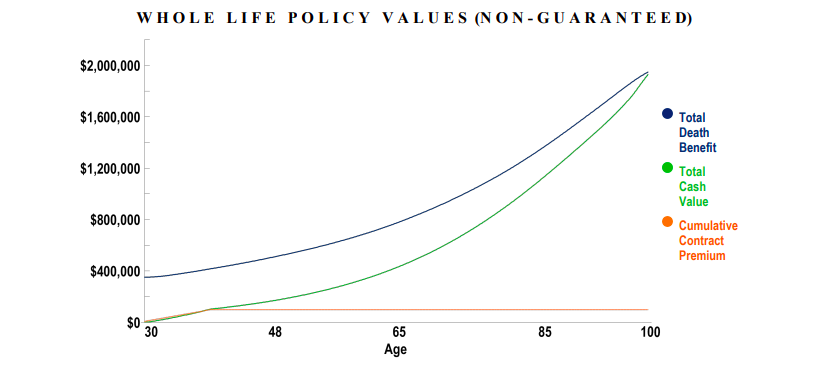

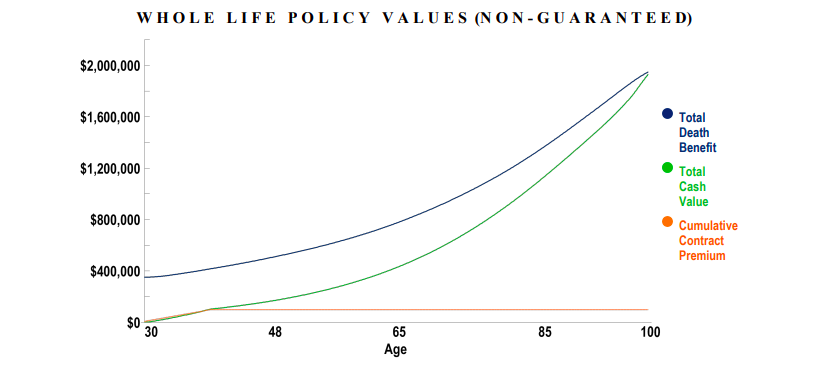

Whole Life 10 pay sample numbers[/caption]The following is a graph of the same illustration. As you can see the premium stops after 10 years, but the policy keeps growing. The death benefit grows and the cash value grows.

[caption id="attachment_9130" align="alignnone" width="813"]

Whole Life 10 pay graph[/caption]

Whole Life 10 pay graph[/caption]For other sample policies contact us and we can run you quotes.

Here is a chart for a Whole Life 10 pay costs for many different ages. This way you can get an idea how much a 10 pay would cost for you.

The following data is for $250,000 10 pay whole life for a male in excellent health:

| Age | Cost | Cash @ 65 |

| 25 | 521.78 | 326,700 |

| 30 | 617.05 | 295,214 |

| 35 | 733.19 | 267,052 |

| 40 | 873.48 | 241,420 |

| 45 | 1,038.56 | 217,402 |

| 50 | 1,227.57 | 147,707 |

| 55 | 1,451.38 | 174,093 |

| 60 | 1,705.42 | 76,267 |

The reason is the more time you have to build cash value, the longer it compounds.

These type of 10 pay whole life policy can be overfunded, which is used in strategies like Infinite Banking.

Universal Limited Pay Life Policy

There is another very common limited pay policy: A Universal Life Policy or UL.A Universal Life policy is a type of permanent policy, that builds cash value and it has level premiums. There are many different kinds of UL policies, so you have to understand them better before purchasing.

UL policies can be a little bit trickier because you have to use certain assumptions to make the policy limited pay. However, any good agent that knows what they are doing they would be able to design a limited pay universal life policy.

If designed properly it your premiums will stop, and you will keep your policy for ever. But make sure to look at the guaranteed assumptions on a UL so you can understand what you are buying.

A very popular policy currently is a limited pay Index Universal Life or IUL.

Final Thoughts

A limited pay whole life insurance policy is not the right choice for every consumer, but it's a nice alternative to traditional whole life or term life coverage.For some, it can be a burden to pay a high premium for a period of 10 to 20 years. However, once your obligation comes to an end, you'll be glad that you made this decision. At that point, you don't owe any more money, however, your death benefit remains in place.