About Colonial Penn Life Insurance Company

Domicile: PA

Established: 1957

For over 60 years, Colonial Penn has specialized in offering life insurance directly to consumers at affordable prices. In addition, we focus on providing life insurance protection for folks like you and your loved ones through mail, TV, our call center, and the web. The company was a pioneer in designing insurance products to meet the needs of the mature market and in 1968 became one of the first insurers to offer a Guaranteed Acceptance Life Insurance plan, exclusively for people ages 50 and over.

Today, Colonial Penn offers life insurance products for ages 18-85, and all our products are designed to help ease financial burdens at a difficult time. Our most popular plan is our Guaranteed Acceptance Life Insurance, available exclusively for ages 50 and over. Plus, we offer "easy-issue" term life insurance and permanent, whole life insurance.

We are committed to providing our customers with affordable, quality insurance coverage. So whether you prefer to call us to discuss a coverage plan that is right for you or get coverage through mail or online, we are here for you when you need us.

Source: Colonial Penn: About us

Company Values

Integrity, Excellence, Customer Focus & Teamwork

Colonial Penn States strives to live its four core values in each interaction with our customers. As a result, policyholders can rely on us for reliable, personal service, security, and peace of mind.

From the surface, it sounds like Colonial Penn is great but let's dig in.

In this Colonial Penn Whole Life Insurance Review, we will cover the following topics:

The Good

No Medical Exams

There is no Medical/physical exam required for any of the Colonial Penn products. All you will need to do to obtain a policy is complete the application and answer the health questions over a phone call with an underwriter from the company.

Guaranteed Approvals

Do not worry if you are not in perfect health. Colonial Penn has Guaranteed Acceptance Life Insurance. No health questions are asked, and no physical tests require.

Fixed Rates

Lock in premium and benefit amounts. If you purchase any of Colonial Penn's Whole Life insurance plans, you will never have any surprises regarding premiums or your benefits.

Quick Turnaround Coverage

If you are looking to lock in policy quickly, Colonial Penn's application process is fast and will offer a quick turnaround so you can protect the ones you love.

30-day money-back guarantee

Buy with confidence. Colonial Penn offers a 30-day money-back guarantee to be sure that you got what you paid for.

24/7 Online Customer Access

Current policyholders can manage their policy online, and make payments.

The Bad

Low Death Benefits

Unfortunately, if you look for sizable life insurance coverage amounts, you will not find this at Colonial Penn. The company's max coverage is $50,000 across any of its plans.

Limited Options

Colonial Penn has only three options for customers to choose from, plus there are no additional riders or options to add to their policies. Besides, the company does not serve all ages equally; only some products are available depending on your age.

Plans are not available in all states.

Plans are not available in all states, which is a significant inconvenience. The term insurance product is not available to Maine, New York, Vermont, and Montana. Permanent products are not available in Maine, New York, and Vermont.

Company Reviews

Colonial Penn has racked up a large number of complaints, more than most. Please don't take our word for it; check out the Better Business Bureaus and Google Reviews.

Better Business Bureau

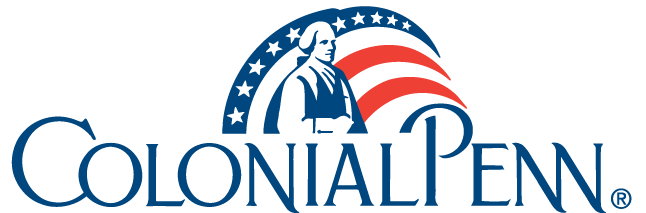

Finances

Colonial Penn's Financial history over the past five years looks promising.

- Steady investment yields in the past five years

- Conservative allocation of investment funds

Ratings

For more than 100 years, the company has provided customers with a high level of service, all in a stable financial environment. This has led to some of the best ratings in the industry, which include:

A.M. Best Rating

- A-

- Excellent. Assigned to companies that have, in our opinion, an excellent ability to meet their ongoing obligations to

policyholders.

- Excellent. Assigned to companies that have, in our opinion, an excellent ability to meet their ongoing obligations to

Standard & Poor's Rating

- BBB+

- An insurer rated 'BBB' has GOOD financial security characteristics but is more likely to be affected by adverse

business conditions than are higher rated insurers.

- An insurer rated 'BBB' has GOOD financial security characteristics but is more likely to be affected by adverse

Moody's Financial Strength Rating

- A3

- Insurance companies rated A offer good financial security. However, elements may be present which suggest a

susceptibility to impairment sometime in the future.

- Insurance companies rated A offer good financial security. However, elements may be present which suggest a

Fitch Ratings' Insurer Financial Strength Rating

- BBB+

- Good. 'BBB' IFS ratings indicate that there is currently a low expectation of ceased or interrupted payments. The

capacity to meet policyholder and contract obligations on a timely basis is considered adequate, but adverse changes

in circumstances and economic conditions are more likely to impact this capacity.

- Good. 'BBB' IFS ratings indicate that there is currently a low expectation of ceased or interrupted payments. The

Weiss Safety Rating

- D+

- Weak. The company currently demonstrates what we consider to be significant weaknesses that could negatively

impact policyholders. Moreover, in an unfavorable economic environment, these weaknesses could be magnified.

- Weak. The company currently demonstrates what we consider to be significant weaknesses that could negatively

Comdex Ranking

- 60

- Comdex gives the average percentile ranking of this company in relation to all other companies that have been

rated by the rating services. The Comdex Ranking is the percentage of companies that are rated lower than this

company.

- Comdex gives the average percentile ranking of this company in relation to all other companies that have been

Colonial Penn Life Insurance Company is a subsidiary of CNO Financial Group, Inc, a financial services organization headquartered in Carmel, Indiana. Through its subsidiary companies, CNO currently serves more than 4 million middle-income working Americans and retirees.

Products

Colonial Penn offers both term and two different permanent whole life plans.

Guaranteed Acceptance Whole Life Life Insurance

(Ages 50-85 in most states)

With Guaranteed Acceptance, you don't need to be in perfect health to get coverage. This is permanent, whole life insurance with no health questions asked and no physicals required.

Permanent Whole Life Insurance

(Ages 40-75)

With our Permanent Whole Life plan, your premium is locked in for life. Your rate will never go up.

Renewable Term Life Insurance

(Ages 18-75)

For adults of all ages, Renewable Term Life is guaranteed renewable up to age 90. Your rate is based on gender and age when coverage takes effect. Rates increase as you enter a new age band.

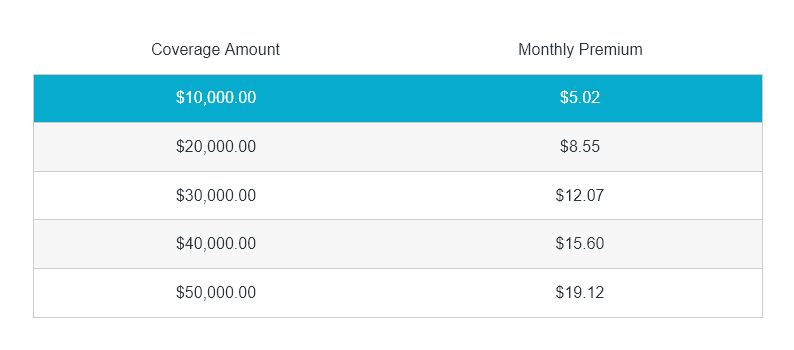

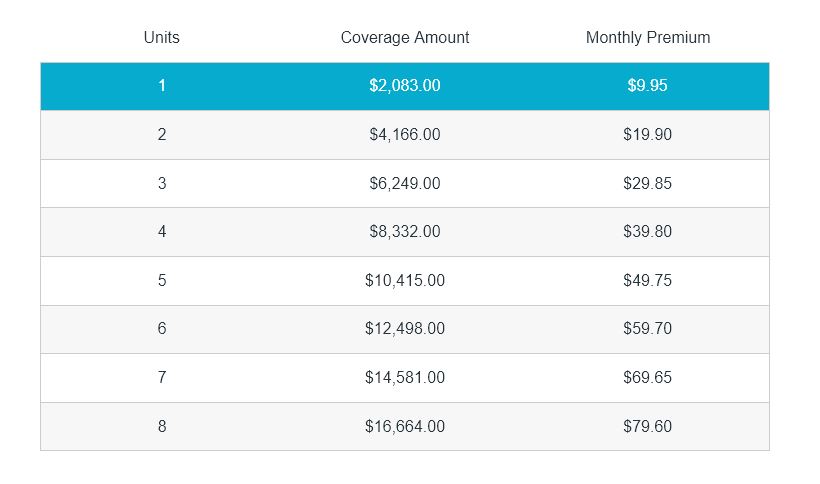

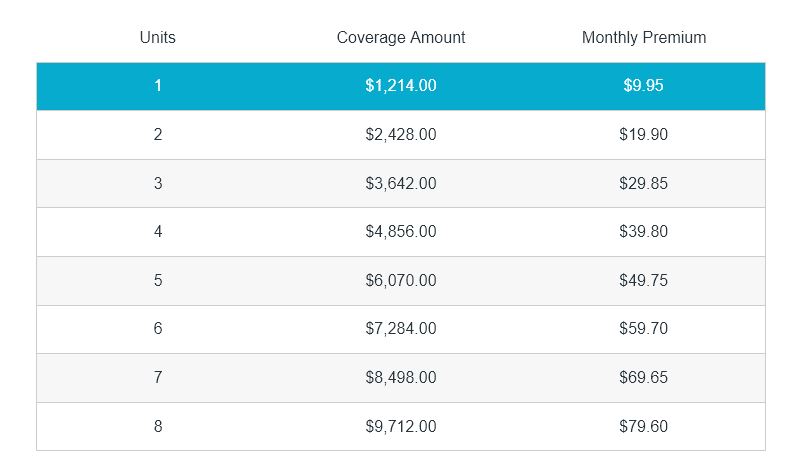

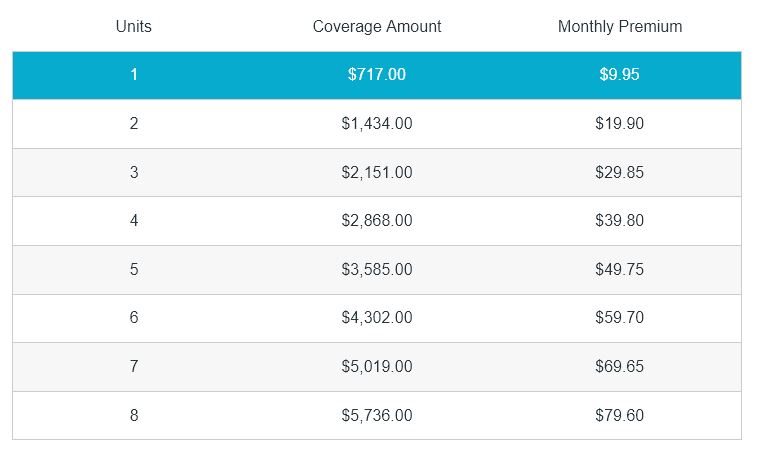

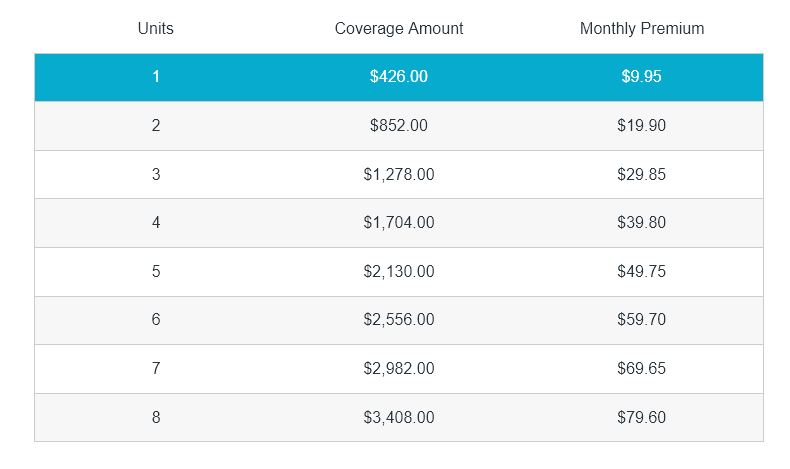

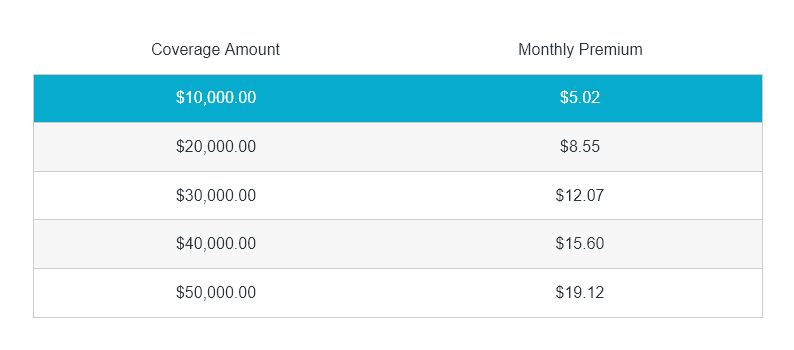

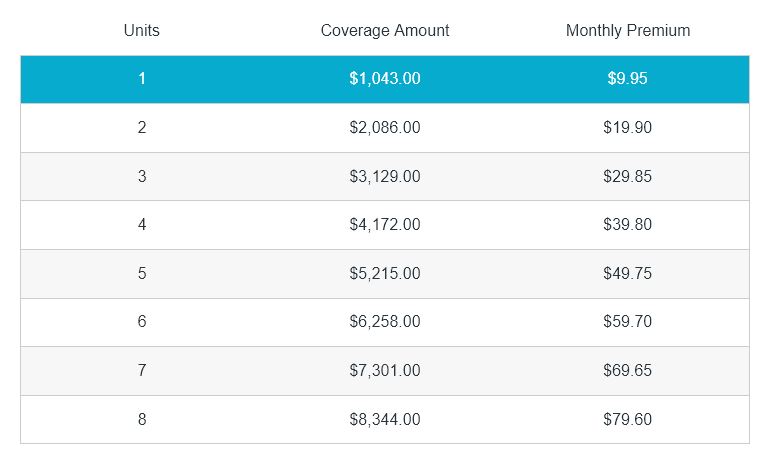

Colonial Penn Price Examples

Check out price estimates for all of Colonial Penn's policy options below. The prices at each age will differ based on gender.

Female Age 30

Product: Renewable Term

Male Age 30

Product: Renewable Term

Female Age 40

Product: Renewable Term

Male Age 40

Product: Renewable Term

Female Age 50

Product: Renewable Term

Female Age 50

Product: Whole Life

Female Age 50

Product: Guaranteed Acceptance Whole Life

Male Age 50

Product: Renewable Term

Male Age 50

Product: Whole Life

Male Age 50

Product: Guaranteed Acceptance Whole Life

Female Age 60

Product: Renewable Term

Female Age 60

Product: Whole Life

Female Age 60

Product: Guaranteed Acceptance Whole Life

Male Age 60

Product: Renewable Term

Male Age 60

Product: Whole Life

Male Age 60

Product: Guaranteed Acceptance Whole Life

Female Age 70

Product: Renewable Term

Female Age 70

Product: Whole Life

Female Age 70

Product: Guaranteed Acceptance Whole Life

Male Age 70

Product: Renewable Term

Male Age 70

Product: Whole Life

Male Age 70

Product: Guaranteed Acceptance Whole Life

Female Age 80

Product: Guaranteed Acceptance Life Insurance

Male Age 80

Product: Guaranteed Acceptance Life Insurance

Riders

Many companies offer riders or additions to a policy to enhance the base benefit of the insurance policy. Colonial Penn does not offer these options. Here is what you may be missing out on:

Disability Coverage

If you are disabled, no additional benefit will be paid out.

Premium Waver

Some insurance companies offer coverage of premium if you are to become disabled. However, Colonial Penn does not offer this type of protection.

Kids Life Insurance Rider

Colonial Penn does not offer a rider to add additional insurance for your children or minors.

Living Benefits

Sometimes companies offer early access to the death benefit if there is a terminal illness is diagnosed. This type of option is not available for Colonial Penn's policies.

Dividend Rate

Colonial Penn does not reference a dividend rate.

Payment Options

Credit Cards

Electronic Funds Transfer (EFT)

Direct Billing

Get the best Rate

If you are trying to get the best rate with Colonial Penn, do not overthink it. Unfortunately, Colonial Penn does not offer specifics that will help you but industry-wide, below are some items to keep in mind.

- Family History

- History of substance abuse

- Current use of alcohol or tobacco

- Criminal history

- Job History

- Hobbies

Final Word

So, who should be considering Colonial Penn Life Insurance? If you are looking for a company that offers a fast, easy way to obtain life insurance without a medical, then Colonial Penn could be one to consider. On the other hand, if you need a higher coverage amount or a policy with all the bells and whistles, it would be best to consider another company as an option. Make sure to compare Colonial Penn vs. other companies to ensure you are obtaining the best policy for you and your family.

Recommended Reading:

How Much Does Whole Life Insurance Cost? Whole Life FAQ's