ACE Insurance Review

Originally started back in 1985 and they specialize in commercial property causality and personal insurance for high net worth clients.The company acquired Chubb for a cool $28.3 billion further increasing the massive size of the company. ACE made the decision to continue to operate their business as Chubb.

Chubb offers several insurance products including commercial, specialized liability, and accident and health. Additionally, they provide coverage for auto and home insurance.

ACE/CHUBB provides its services primarily to high net worth individuals.

In this review we will cover the following topics:

The Good

Financial Strength

ACE/Chubb has a history of very strong financial strength.ACE comes in with stellar A.M. Best Rating of A++ (Superior).

In addition, they are rated as an overall company with J.D. Power 3 out of 5 (Above Average).

Claims

ACE has outstanding reviews and a history of taking care of their policyholders.J.D. Power Study from 2018 ranked ACE/CHUBB "Among the Best" for claims.

If you are looking for a company that will pay your claim without question then ACE/Chubb is the company to hang your hat with.

Being that the company primarily deals with high net worth clients they take a very white-glove service approach when dealing with claims.

High-End Perks

ACE/CHUBB provides a high-end experience to their clients. This means that if you work with this company you will be privy to perks that are not typically included in others.For example:

- Identity Management - You are protected from identity fraud with this perk.

- Cyber Protection - in this current day and age this is a must and ACE/CHUBB is there to protect.

- Property Manager - the company will provide assistance with your seasonal home in the event of a hurricane. If you cannot be there ACE/CHUBB will.

The Bad

Cost

ACE offers above-average service however you will find that this service does not come cheap. When comparing ACE to other companies ACE is most defiantly more expensive than you traditional coverage.Access

Looking for high-level service and extra perks? Well if you want it then ACE is the company to offer these perks. The big downside is that ACE is hard to access because it primarily focuses on protecting high net worth individuals.No Life Insurance Offered

ACE/CHUBB offers several protections for their clients however the one item that they do not protect is life insurance. The company does not directly offer any products like term, whole life, universal life or variable life insurances.Finances

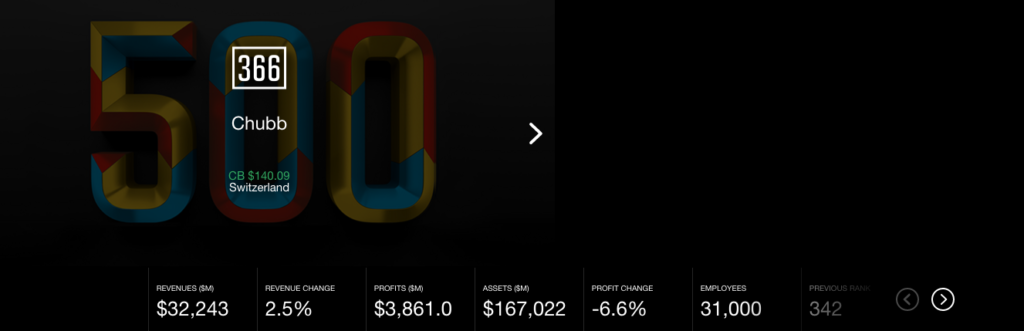

ACE/CHUBB is very strong financially. The company is billions and finds itself consistently on the fortune 500 lists. Previously they ranked 342 in 2017 and shifted only slightly down to 366 in 2018.Ratings

When looking at the various third party ratings that have been given to ACE you can see why so many clients place their trust in them.AM Best: A++

Fitch: AA

S&P: AA

Products

ACE sells coverage for all types of personal needs:- Cars

- Yachts

- High Valued Homes

- Valuables

Many times these coverages are designed in a bundle plan. ACE/Chubb will actually review all of your needs and current policies and then provide you with the best-bundled coverage option.

The Difference

ACE's policies really separate from the competition when you start to look at the details of the policy. The company knows that in a world where most policies are somewhat similar the value to a client is in the little details.For example, ACE separates from the competition by offering things like:

Valuations

ACE will provide coverage at an "agreed" at the time you bind coverage and this will not happen on an ongoing basis. This ensures the owner who is buying a policy through ACE that they are truly protected from a potential loss.No Limit Coverages

This unique contract detail ensures that if you need are in need of rental during a car repair you will not run into any caps or limits. You will never need to worry about the vehicle you receive in this scenario. This is not the case for many other companies who do limit your options.Higher Limit Liability Coverages

Want to make sure you or your family will not be in a pinch if you have to replace a car or home due to an accident or loss. You can do this with ACE. You will have access to higher limits to protect you in the event of a loss of a home or an accident that could lead to lawsuits.Umbrella Insurance

Umbrella insurance is intended to fill in the gaps not covered by other types of protection. It is exactly what it sounds like. Think of an umbrella that covers you in a rainstorm this insurance coverage is there to protect you and your family in the same way. It can help cover the cost of settlements and legal counsel if needed.

Business Insurance

In addition to personal insurance ACE also provides insurance products for businesses. Regardless of size ACE is fully equipped to provide liability protection in this space.

Riders

ACE does not offer riders however they do add on several unique items to their policies. When you compare this to other companies these options are typically items that will need to be added as a rider at an additional cost.With ACE you will be receiving these bells or rider type options as part of your contract standard and not as an add on the rider.

- Fraud Insurance

- Identity Theft Insurance

- Kidnapping/ransom Insurance

Dividend Rate

N/AACE Insurance Review Final Word

As you can see ACE is really a great company. They have grown over the years into a massive company extending internationally. The products they provide are truly not for everyone. As you have seen in our review ACE is definitely geared toward high-income customers, and the coverages offered may not be relevant to someone with fewer assets to protect. Being that ACE focuses on the high net worth client they also put major effort into creating a unique experience. In doing so the clients can expect to pay more for this higher level of service.Recommended Reading

MassMutual Insurance ReviewNationwide Insurance Review

Whole Life Insurance FAQ's