Advance Insurance of Kansas Review

A Brief Into To the company.You may not be familiar with the company in this review. A more popular name that you may be recognized is Blue Cross and Blue Shield (BCBS). Advance Insurance Company of Kansas (AICOF) offers product solutions by (BCBS). AICOF specifically provides life and disability insurance for individuals and businesses. In addition, their parent company BCBS also offers accidental death & dismemberment coverage, cancer insurance, health insurance, medical supplement insurance, and dental insurance.

Advance Insurance Company of Kansas is located in, yep you guessed it! Kansas! The headquarters is 1133 SW Topeka Blvd, Topeka, Kansas. The company was originally founded back in 1985 called itself Advance Insurance Company but rebranded in 2004 to the current name of Advance Insurance Company of Kansas.

As we noted above the company provides its insurance products through its parent company Blue Cross and Blue Shield of Kansas Inc.

In this review we will cover the following topics: So let's get started.

The Good

Final Expense Insurance

Advance Insurance of Kansas offers a great product that is focused on protecting families from the cost of final expenses. They make is very easy to sign up for coverage. The policy does not require a medical exam and you can get up to $10,000 of coverage to cover final expense cost. As you will see in the below image this is a good estimate for final expenses.

Ratings

Advanced Insurance of Kansas has excellent ratings from third-party reviews. Specifically, the one that stands out the most is A.M. Best Rating of an A. M. Best focuses on the financial strength of a company.Since insurance products are backed by Blue Cross Blue Shield you can rest assured that your policy will work for you and your loved ones.

The Bad

Insurance offered in Kansas Only

Unfortunately, we found that the company only provides coverage to clients who live in Kansas.This is a major downside for you is you are reading this and do not live in the state. If you are out of the state of Kansas you cannot qualify for their products.

Limited Product Options

Although the Advance Insurance of Kansas provides great products they have very limited options. Only two product options for individual customers and four types of products for employers to offer employees.There are several other companies in the market that offer more options than Advance Insurance of Kansas and for this reason, this is a negative ding for the company.

Finances

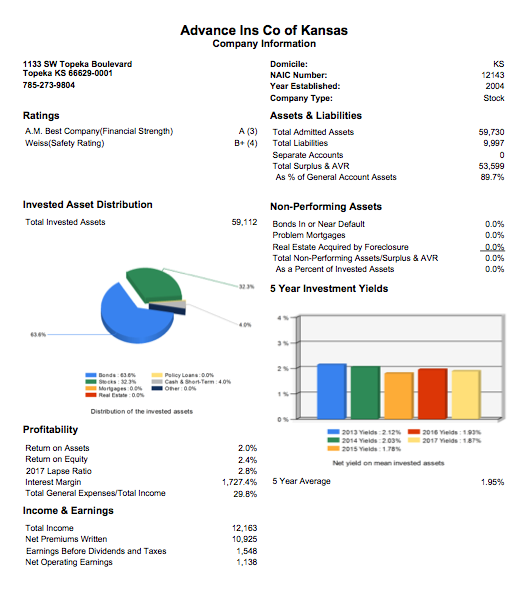

Here are some financial highlights for the Advance Insurance of Kansas. These may not be the largest numbers by an insurance company but they are defiantly part of the reason for the companies' strong ratings.- Total admitted assets: $59,730

- Total admitted liability: $9,997

- 5-year investment yields: 1.95%

- 2.6 Billion in Life Insurance in force.

Ratings

Since 1985 Advance Insurance Co has been providing its customers with services in a stable financial environment. Although they are not rated by all the third party agencies the ratings they do have include:- A.M. Best Rating (Financial Strength): A

- Standard & Poor's Rating: N/A

- Moody's Rating: N/A

- Weiss (Safety Rating): B+

Products

Individual Life & Disability Options

AdvanceCare Simple Life Insurance

Product details:- AdvanceCare Simple is an Advance's only term insurance product option.

- The max policy benefit is $10,000 which makes this policy a final expense solution.

- The premiums are going to be cheaper than competitors in the early years.

- Premiums are guaranteed level for 10 years.

- Apply completely online.

- NO EXAMs health questions only.

- Guaranteed Renewable - As long as your premiums are paid each year policy will not be canceled by the company.

- Applicants must be older than 1 year and younger than age 65 to apply for coverage.

- There is a reduced death benefit for the first two policy years.

- A benefit may be paid for accidental death in a covered accident as defined in the Policy during this period.

- Underwritten by Advance Insurance Company of Kansas wholly-owned subsidiary of Blue Cross and Blue Shield of Kansas and an independent licensee of the Blue Cross and Blue Shield Association.

AdvanceCare Short-Term Disability

Product Details:- AdvanceCare STD is a solution to help cover expenses if you are to become disabled and cannot go to work.

- This product will help to take care of immediate expenses in the event of a disability. It is essentially an insurance policy for your paycheck.

- Weekly cash benefits - $150 to $300.

- Maximum of 26 weeks of payments.

- Quick Benefit - only wait 15 days to receive your benefit.

- The maximum benefit paid $7800

- Apply online

Business Life and Disability Coverage

Term Life Insurance

- Basic and Voluntary Term Life options available to employers to offer to employees.

- Up to $50,000 of coverage.

- Term insurance can be convertible to an individually owned permanent policy without evidence of insurability.

Accidental Death & Dismemberment (AD&D) Insurance

- This coverage can act as a supplement to the life insurance if there is a loss of life due to an accident.

Dependent Life Insurance

- This coverage is an add on for an employee's spouse and unmarried children.

- You can only add this if you have the basic term and AD&D coverage.

- Eligibility:

- Spouses that are not legally separated.

- Divorced and unmarried children at least 15 days old or under 23 are eligible.

Group Short Term Disability Insurance

- This coverage is similar to the individually owned STD however the employer is in charge of sending you the payments.

- This coverage will help protect the employer and employee if a disability were to happen.

Riders

If you are looking to customize your insurance beyond the basic coverage you can add these riders.Dependent Child Rider

- This rider does exactly what it sounds like. The Dependent Child Rider will cover the insured's children (age 14 days to 23 years).

- This will cost you about $1.00 per month to add this to your policy. What a great deal!

- Acceleration of Death Benefit Rider allows you to access a portion of the death benefit if you are terminally ill.

- This rider does come at an extra cost of a few pennies a day.

Dividend Rate

N/AFinal Word

Advance Insurance of Kansas is not going to be a company that the masses will look to for coverage. The fact that they only provide coverage to individuals and businesses in Kansas is a major downside. If you are however reading this article and live in Kansas Advance Insurance of Kansas is a great option for final expense and short term disability insurance.If you are in need of life insurance that is greater than $10,000 we do not suggest considering Advanced Insurance. For starters, the company does not offer benefits of this nature. If you are looking for term or whole life benefits greater than $10,000 you can find these quotes here.