Whole Life Insurance Vs Variable Universal

Before making a final decision, you should review your current situation as it relates to you, your family, and your finances. Furthermore, you need to consider how your loved ones will be impacted after your death.

In this article, we're going to discuss the finer details of whole life insurance vs variable universal.

- Whole life insurance: With a fixed premium, guaranteed cash value accumulation, and a guaranteed death benefit, this is a popular choice among consumers.

- Variable Universal life insurance: This provides flexibility in regards to premium payments, savings, and death benefits. And it has upside potential if your investments perform.

What Is Whole Life Insurance?

Simply put, whole life insurance protects you as long as you live. It doesn't matter when you pass on, as long as you continue to make your payments in full, and on time you can rest assured that your beneficiary will receive a death benefit payout.Here is a breakdown of the many reasons why whole life insurance remains so popular:

- The fixed premium for the life of your policy, allowing you to budget for this expense (both now and in the future)

- Guaranteed cash value accumulation

- Guaranteed death benefit

- Opportunity to earn dividends (with participating whole life insurance policies)

What Is Universal Life Insurance?

Universal life, also known as adjustable life insurance, has more flexibility compared to standard whole life coverage.

Here are some of the many things you need to know:

- Significant upside potential compared to a Whole Life

- Higher risk than a whole life

- You can pay your premiums at any time, in any amount

- You can't increase the face value of your policy until you pass another medical exam

- Two death benefit options: a fixed amount or one that grows based on the face value of your plan, along with any cash value

Note: you need to have enough cash value to cover your premium payments. If you don't, your policy will lapse.

So, What's The Variable Part?

Variable universal life insurance uses the investment to help grow the cash value.The unique thing about variable universal life insurance is the way it combines a death benefit component with a savings component. Not only does this allow for more flexibility in regards to your management, but it also provides the opportunity to grow your cash value over time.

Every premium payment you make is paid into the savings component, with the life insurance company taking the money it requires to cover administrative costs.

However, it's still a Universal Life Policy with all of its drawbacks.

Subaccounts, Not Investments

One of the biggest myths of variable universal life is that your money is invested. While true to a certain extent, these policies use subaccounts.The subaccounts are structured in the same way as a group of mutual funds, meaning that your money is invested in different stock and bond accounts.

Since these are not considered "real investments," there are higher fees associated with variable universal life.

Cost Of Insurance & Lapse

All universal life policies have something called the cost of insurance. This cost of insurance is taken every year from the cash value. Also, this cost of insurance increases each year.As you age, what can happen is that your cost of insurance is so high that your cash value stops growing and starts going down.

When the cash value reaches zero (or before then), you will get a notice from your insurance company saying that you will need to pay a higher premium, or your policy will disappear. This is called a "lapse."

When the policy lapses, you will have no more coverage and no more cash value, and you will lose all of the premiums you paid into the policy. If you currently have a VUL or any UL, make sure you check to see how it is projected to perform.Get Me A Quote

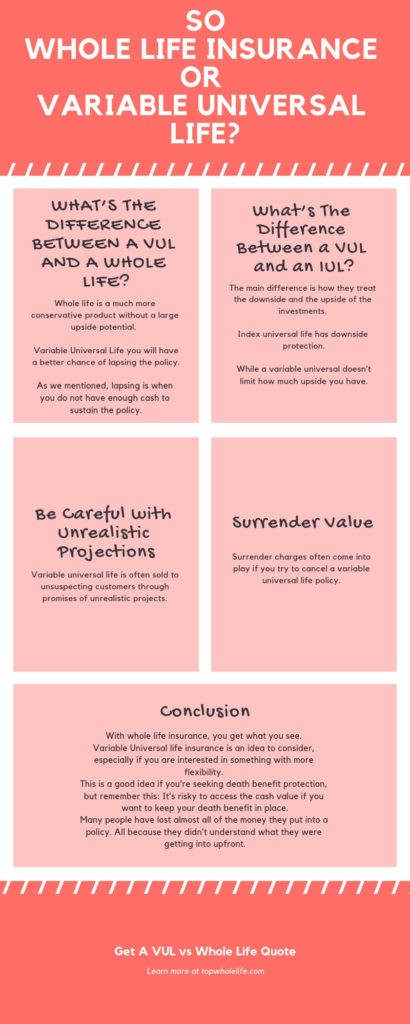

What's The Difference Between whole life insurance vs variable universal?

These policies are have common aspects like cash value, but they are very different. A whole life is a much more conservative product without a large upside potential. However, in a Variable Universal Life, you will have a better chance of lapsing the policy. As we mentioned, lapsing is when you do not have enough cash to sustain the policy.So a simple breakdown will be:

- VUL has more much more upside potential

- VUL has a higher risk

- VUL has more flexibility

- Whole Life has more guarantees

What's The Difference Between a VUL and an IUL?

The main difference between these two universal life policies is how they treat the downside and the upside of the investments.Index universal life or Indexed Universal Life (IUL) has downside protection.

Also, indexed universal life can have a cap on how much money you can make on your investments. While a variable universal doesn't limit how much upside you have. While variable universal life doesn't. Here is an article comparing a Whole Life Insurance vs IUL.

Be Careful with Unrealistic Projections

Variable universal life is often sold to unsuspecting customers through promises of unrealistic projects. Agents tell prospects something like this:"All you have to do is purchase a VUL policy, and the money will grow tax-deferred. You have the option to choose how to invest. It's sort of like an IRA, just better. When you need the money, you can borrow from the policy, tax-free. And of course, when you pass on, your beneficiaries also receive the money tax-free."When put like this, it's hard to imagine anyone would pass by variable universal life insurance.

Unfortunately, there are many problems with this arrangement, including the fact that there are high fees and expenses associated with this type of policy.

Furthermore, if you attempt to get out of the policy before five years, you lose most (or all) of the money put in as a "surrender charge." This alone keeps people tied up with a policy they don't want, all the while costing them money in fees every year.

Surrender Value

As noted above, surrender charges often come into play if you try to cancel a variable universal life policy.Take, for example, a situation in which you purchase a $500,000 VUL policy. You read over your contract to find that after 15 years, the surrender charge is 25 percent. What this means is simple: if you try to cancel your policy at this time, the insurance company will charge you 25 percent of the cash value, thus making your surrender value much less than what you initially believed.

There are two things you need to know:

- Surrender charges can last as long as 15 years

- Whole life insurance doesn't have a surrender charge

Conclusion

With whole life insurance, you get what you see. This is the most common permanent life insurance coverage, with many consumers enjoying the fixed premium and death benefit, along with the ability to accumulate cash value.

Variable Universal life insurance is an idea to consider, especially if you are interested in something with more flexibility. And you would like to have a higher upside growth on your cash value, but remember this:

It's risky to access the cash value if you want to keep your death benefit in place.

Many people have lost almost all of the money they put into a policy. All because they didn't understand what they were getting into upfront.You can only make an informed decision after you compare every type of life insurance policy. In the end, you'll probably find that whole life coverage is the safest and most stable option.

If You Have A VUL contact us immediately for a quick analysis.

You don't want your insurance and your investment to disappear.