So what are paid up additions?

The paid-up additions rider or PUA rider (PUAR), has been talked about in length in books like Bank on Yourself and Infinite Banking.Or maybe you are considering an overfunded life insurance policy.

In this article, we help you will get the answer, and you will learn how to use paid-up additions (PUA).

Definition

So let's look at a standard definition of PUA. Here is a description from Investopedia:Paid-up additional insurance is additional whole life insurance that a policyholder purchases, using the policy's dividends. Paid-up additional insurance is available as a rider on a whole life policy. It lets the policyholder increase their living benefit and death benefit by increasing the policy's cash value. Paid-up additions themselves then earn dividends, and the value continues to compound indefinitely over time.Ok, that seems like a lot of words, but it's hard to understand, and it doesn't describe what it is.

We have a better way of describing it.

Mini Whole Life Policies

I want you to imagine paid-up additions as mini paid-up whole life insurance policies inside of your whole policy.A paid-up policy means that you don't have to pay any more premiums for it. But you still get to keep your death benefit and cash value. In this case, your mini death benefit and your mini cash value.

Even though you don't pay more premiums for the mini policies, they earn dividends, and they have a death benefit and cash value.

Also, the mini policies grow by themselves over time, and you can access their cash value at any time.

So How Do I Chose PUA?

First of all, PUA's are a feature that exists in all participating whole life insurance. This feature represents how you decide to receive your dividends.You can elect to get paid up additions among many other options:

- Receive cash

- Reduce your premium

- Payback loans

PUA Rider

Most whole life policies have a rider that will let you get these paid-up additions. Many companies use different names. The most common names you will find for this rider is:- Paid-Up Additions Rider (PUA or PUAR)

- Addition Life Insurance Rider (AILIR)

What does it do?

The main reasons that paid-up additions are important are because they help:- Grow Cash Value

- Grow Death Benefit

Compounded Interest

As Einstein mentioned, compound interest is the eighth wonder of the world.You probably already know, but compound interest helps grow money exponentially over time.

In our PUA rider case, each paid-up addition adds cash value, which earns dividends. These dividends add more paid-up additions, which then earn dividends themselves etc. etc.

This is the method of how whole life insurance policies grow over time.

PUA Rider Example

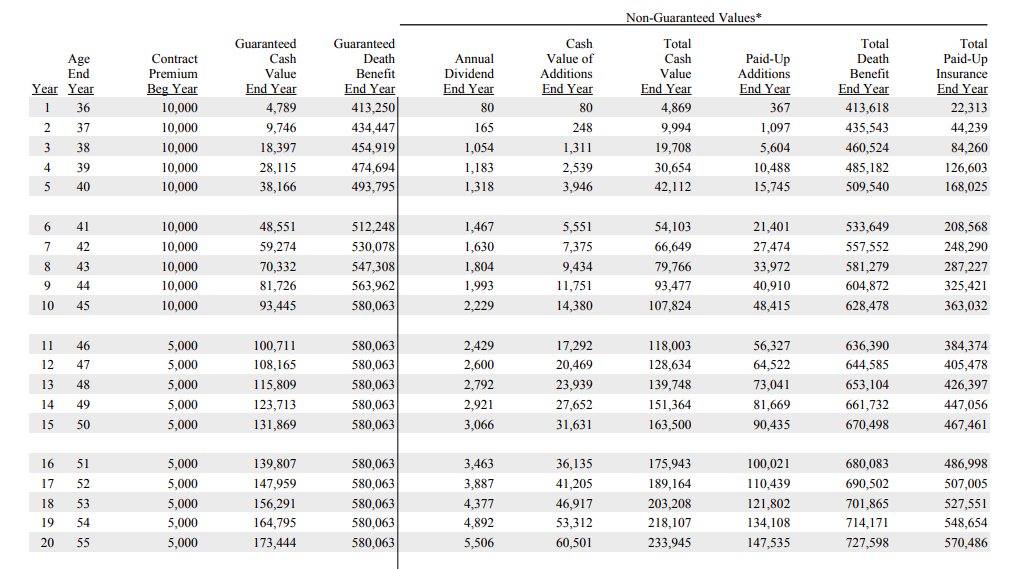

So let's look at a sample Illustration with Paid-Up Additions Rider. The following is a quote from a Mutual company for a 35-year-old male in excellent health.We added $5,000 a year of PUA for ten years.

With PUAR

Please look at the column that says Paid Up Additions End Of Year. The previous is an example of using the PUA rider to add more cash value to the policy.

The previous is an example of using the PUA rider to add more cash value to the policy.This is the method used in Infinite Banking and Bank on Yourself.

Yes That's What I Am Looking For

Get A Quote With PUAR!No PUAR

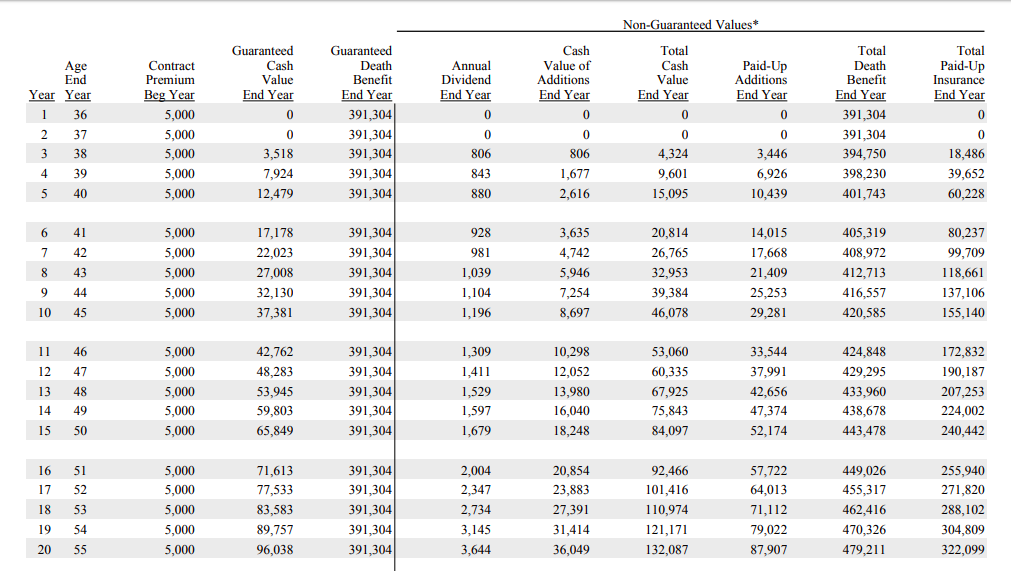

Here is the same illustration without the paid-up additions rider:

As you can see, there is a significant difference in cash value. This makes sense as we are paying more money into the policy.

You have $100,000 moreover 20 years even though you only paid $50k over 10 years.

More Paid-Up Additions

The great news is that it isn't hard to get a policy with PUA's. All you need to do is ask a good agent, and they should know what to do.But be careful, because most agents do not know how to design an acceptable policy.

The reliable way to maximize these paid-up additions is to get an overfunded policy.

Final Word

Paid-up additions are a standard feature of all policies. But to get an excellent policy, you can add PUA rider that will turbocharge your policy.Feel free to contact us for your whole life with PUA.