How is Technology Changing the Life Insurance Industry?

It doesn’t matter if you are seeking an online whole life insurance quote or are interested in consulting with your provider to discuss a concern, technology can step in to make your life easier.

There are approximately 95 million Americans without life insurance. While some are okay with this, others realize that a change is necessary. They understand that this is an investment in themselves, their family, and the future.

Many years ago, before the growth of the internet, purchasing life insurance was a challenging task. In today’s day and age, you can buy the best policy at the right price without all the hassles.

Maybe you are interested in comparing whole life insurance quotes. Go back in time 20 years, and your best option was to contact multiple agents on the phone. Unfortunately, this meant a lot of wasted time and plenty of salespeople ringing your phone at all times of the day.

Thanks to technology, everything has changed. From start to finish, you are now in charge of the process.

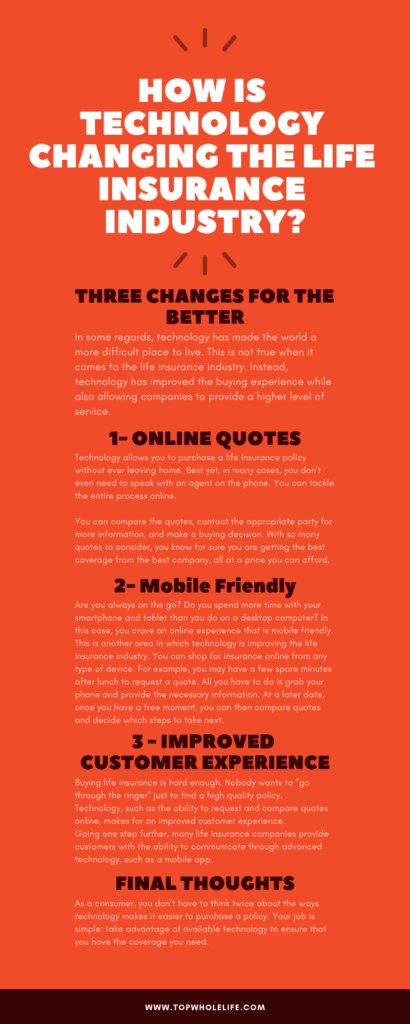

Three Changes for the Better

In some regards, technology is a two-edged sword.

On the one hand, it makes business harder for some companies, and on the other, it has improved the consumer’s ability to connect and mee their needs. Technology, however, has to improve the life insurance industry experience. Specifically, technology has improved the buying experience while also allowing companies to provide a higher level of service.

Here are three ways technology is changing the life insurance industry for the better:

1- Online Quotes

1- Online Quotes

Do you want to call multiple agents on the phone to collect quotes? Are you interested in meeting with agents in person to explain your needs? Like most, your answer to these questions is no.

Technology allows you to purchase a life insurance policy without ever leaving home. Best yet, in many cases, you don’t even need to speak with an agent on the phone. You can tackle the entire process online.

The first step is to provide the necessary information, such as your death benefit, date of birth, and gender. From there, the system will provide you with quotes from multiple providers.

Now for the real fun. You can compare the quotes, contact the appropriate party for more information, and make a buying decision. With so many quotes to consider, you know for sure you are getting the best coverage from the best company, all at a price you can afford.

2- Mobile Friendly

Are you always on the go? Do you spend more time with your smartphone and tablet than you do on a desktop computer? In this case, you crave an online experience that is mobile friendly.

Mobile-friendly quotes and applications is another area in which technology is improving the life insurance industry. You can shop for insurance online from any device. For example, you may have a few spare minutes after lunch to request a quote. All you have to do is grab your phone and provide the necessary information. At a later date, once you have a free moment, you can then compare quotes and decide which steps to take next.

Remember this: mobile internet usage is overtaking desktop usage.

3 – Improved Customer Experience

Buying life insurance is hard enough. Nobody wants to “go through the wringer” to find a high-quality policy.

Technology, such as the ability to request and compare quotes online, makes for improved customer experience.

Going one step further, many life insurance companies provide customers with the ability to communicate through advanced technology, such as a mobile app.

While some industries continue to lag, those in the life insurance space continue to improve with technology. And that is a good thing for consumers.

Final Thoughts

With roughly 275 million life insurance policies in force in the United States, many have come to realize the importance of having coverage.

Thanks to advanced technology that improves the overall customer experience, this number should continue to rise.

As a consumer, you don’t have to think twice about the ways technology makes it easier to purchase a policy. Your job is simple: take advantage of available technology to ensure that you have the coverage you need.

Can you think of any other ways technology is changing the life insurance industry?

Other reads:

You have to apply for health inursance and get approved before you will get an accurate quote. A web site my give you a preliminary quote depending on your age but it means nothing until the inursance company checks your application and health records which typically takes about a month after you submit your application.References :

That is correct Rayan. The insurance company will have to check your medical history.