The Minnesota Life Insurance Company, now doing business under the umbrella known as Securian Financial Group, Inc., is well known for its large selection of financial products and services, including whole life insurance. They went though a complete rebranding in 2018.

Since its founding in 1880, the company has grown to employ more than 5,000 people. Furthermore, it does business with approximately 15 million people throughout the United States.

Minnesota Life writes many types of life insurance policies, including: whole life, universal life, indexed life, variable universal life, and fixed universal life.

For the sake of this review, we're going to discuss the many pros and cons of Minnesota Life whole life insurance products.

When compared to other companies, Minnesota Life premiums are typically on the low side.

This isn't the only detail to consider when buying whole life insurance, but it's something to pay attention to. It's reason enough to at least take a closer look.

For many years, Minnesota Life has been known for its financial strength.

Here are some of its ratings (source):

This can give you peace of mind when buying a whole life insurance policy. You know they will be around to service your policy in the future.

They have over $55 billon of assets, and for those interested in digging the financials here is a complete filing with their balance sheet and much more: Securian Filling

Minnesota Life excels in this area, providing potential customers with all the information they need to make informed decisions.

Whereas some companies slack off in regards to moving applications through the pipeline, Minnesota Life doesn't take the same approach. Once you make it clear that you need a quote and are interested in moving forward, your agent can help push the process along.

Depending on who you listen to, this is a problem for Minnesota Life.

Despite the online claims reporting system, many customers state that it takes entirely too long to get in touch with the right person. This slows down the claims process, thus making it more difficult to obtain payment in a reasonable period of time.

With a mutual insurance company, the policyholders are the owners. This may not sound important, but it means you are in position to receive dividends. And these dividends are more likely to be much higher.

Minnesota Life does pay dividends, but they are not a mutual company. This means you are could be missing the opportunity to add value to your policy. Even if you pay more money for a policy from a mutual company, there's a good chance you'll make out better in the end thanks to dividend payments. Minnesota Life Whole Life Illustration Sample[/caption]

Minnesota Life Whole Life Illustration Sample[/caption]

We have a complete review on Securian IUL options.

Other great Reviews:

Nationwide Whole Life Review

Oneamerica Whole Life Review

Farmers Whole Life Review

Whole Life vs IUL

Since its founding in 1880, the company has grown to employ more than 5,000 people. Furthermore, it does business with approximately 15 million people throughout the United States.

Minnesota Life writes many types of life insurance policies, including: whole life, universal life, indexed life, variable universal life, and fixed universal life.

For the sake of this review, we're going to discuss the many pros and cons of Minnesota Life whole life insurance products.

The Good

Affordable

It goes without saying that Minnesota Life is not having any trouble selling its policies, which is due in large part to the affordability.When compared to other companies, Minnesota Life premiums are typically on the low side.

This isn't the only detail to consider when buying whole life insurance, but it's something to pay attention to. It's reason enough to at least take a closer look.

Financial Strength

Minnesota Life has been in business for nearly 150 years, meaning that you can trust that it's doing something right.For many years, Minnesota Life has been known for its financial strength.

Here are some of its ratings (source):

- A.M. Best: A+ (Superior , 2nd highest rating).

- Fitch: AA (Very Strong , 3rd highest rating).

- Standard & Poor's: A+ (Strong).

- Moody's: Aa3 (Excellent, fourth highest).

This can give you peace of mind when buying a whole life insurance policy. You know they will be around to service your policy in the future.

They have over $55 billon of assets, and for those interested in digging the financials here is a complete filing with their balance sheet and much more: Securian Filling

Customer Service

There is a lot to consider when buying whole life insurance, including the premium and how much of a death benefit you require. This leads many people to overlook the importance of a strong customer service experience.Minnesota Life excels in this area, providing potential customers with all the information they need to make informed decisions.

Whereas some companies slack off in regards to moving applications through the pipeline, Minnesota Life doesn't take the same approach. Once you make it clear that you need a quote and are interested in moving forward, your agent can help push the process along.

The Not So Good

Slow Claims Process?

There is no way of knowing what will happen if it comes time to make a life insurance claim, but you hope that the company will act fast.Depending on who you listen to, this is a problem for Minnesota Life.

Despite the online claims reporting system, many customers state that it takes entirely too long to get in touch with the right person. This slows down the claims process, thus making it more difficult to obtain payment in a reasonable period of time.

Not A Mutual

There are many good reasons to purchase whole life insurance, so it would be in your best interest to take advantage of every last benefit.With a mutual insurance company, the policyholders are the owners. This may not sound important, but it means you are in position to receive dividends. And these dividends are more likely to be much higher.

Minnesota Life does pay dividends, but they are not a mutual company. This means you are could be missing the opportunity to add value to your policy. Even if you pay more money for a policy from a mutual company, there's a good chance you'll make out better in the end thanks to dividend payments.

Quick Comparison

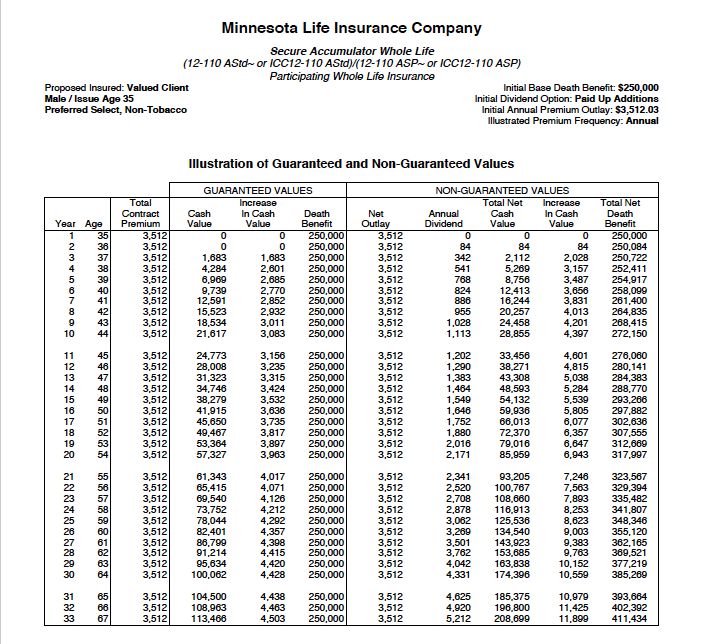

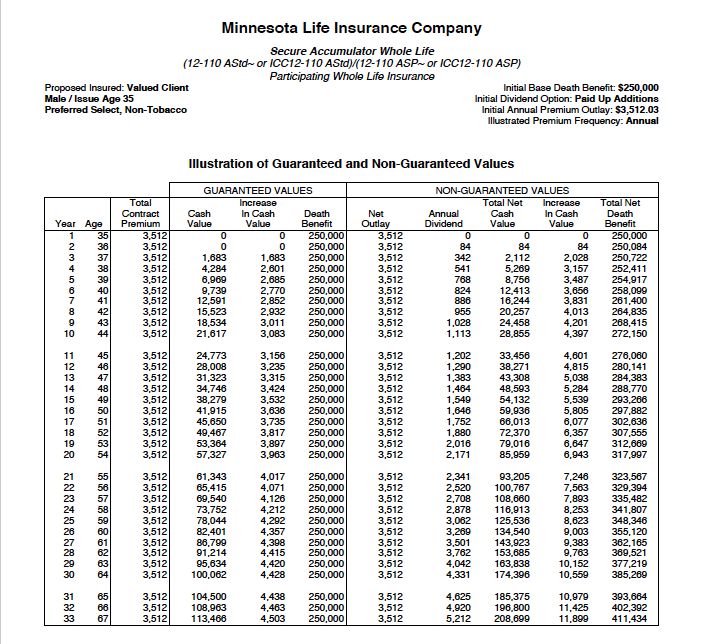

Here is a quick illustration for a Minnesota Life Whole Life. This is just a sample with the following variables:- Male

- Age 35

- The Best Health Rating

- $250,000

- Pay Until Age 121

Minnesota Life Whole Life Illustration Sample[/caption]

Minnesota Life Whole Life Illustration Sample[/caption]Results

- The Minnesota Life whole life's cash value at 65 is $45,000 lower than Penn Mutual's whole life.

- TheMinnesota Life whole life's cash value at 65 is $75,000 lower than MassMutual's whole life.

The Products

Term Life Insurance

Term life offers you guaranteed level premiums for a number of years. It's very affordable and a great option when you are looking for lots of coverage.- Advantage Elite Select: A level term product available in four durations 10, 15, 20 and 30 year durations.

Variable Universal Life

A variable universal life is a semi-permanent product. It builds cash value, and the cash is tied to stock market performance.- Premier VUL: A Variable Universal Life product with index-linked interest features.

- Secure Care UL: A linked benefit UL product with cash indemnity long-term care benefits.

- VUL Defender is a protection focused Variable Universal Life product.

Indexed Universal Life

Indexed Universal Life or IUL is a permanent life insurance that builds cash value. The performance of the cash value is based on indexes (like the S&P 500). Also, you have to be careful, these products are complex and you should talk to an expert to pick the right ones.- Eclipse Accumulator Indexed Universal Life is an accumulation focused Equity Indexed Universal Life product.

- Eclipse Protector II Indexed Universal Life is a protection focused Equity Indexed Universal Life product.

- Eclipse Survivor Indexed Life is a joint accumulation focused equity indexed universal life product.

- Eclipse Survivor Pro Indexed Life is a Joint protection focused equity indexed universal life product.

- Value Protection Indexed Universal Life is a protection focused equity indexed universal life product.

We have a complete review on Securian IUL options.

Final Word

Finally, Minnesota Life has a lot to offer in regards to whole life insurance. While it never hurts to obtain a quote for coverage, most people find that they are better off buying from any one of the mutual companies.Other great Reviews:

Nationwide Whole Life Review

Oneamerica Whole Life Review

Farmers Whole Life Review

Whole Life vs IUL