How To Change Your Life Insurance Beneficiary And Why You Should

Times have started to shift as the internet has empowered you to research and decide what you need for life insurance.You can now run quotes and even apply for life insurance entirely online.This process is excellent and makes purchasing life insurance much easier, but you will want to make sure that you are correctly outlining your beneficiaries when you buy your policy.In this article, we will review the steps on how correctly choose and also change the beneficiary on your life insurance policy. We will also review WHY this is such an essential item to address and not overlook.How to Change the Beneficiary on your Life Insurance?

Step 1: Annual Review

Step 1: Annual Review

For years life insurance has been sold in person by an insurance sales agent or a financial advisor who has some personal connection to you.If your agents are doing their job, they would reach out and check in at least once a year to see how you are doing and complete an annual review.This annual review should cover several items, and reviewing your beneficiary designation should an important one.If you do not have an agent who is reaching out on an annual basis, make sure you take the initiative and review your policy's beneficiaries annually.You can check your beneficiaries in a few ways.- You can call your life insurance company directly. The number to call will be listed on your billing statement you receive each month.

- You can see if your insurance carrier has an online portal. You can set up a login and password and manage your insurance policy on your computer.

- Call the advisor assigned to your policy. All policies will have a "servicing" advisor assigned to your account. This may not be the person who sold you the plan, but they will most commonly have the ability to answer your questions.

Step 2: What Has Changed?

Step 2: What Has Changed?

During your annual review, you will want to consider: What has changed?Life gets the best of us, and we can become so busy that we forget how quickly things can change in our lives.If I were to take a guess, I am sure that your life insurance policy is not something you think about daily.I guess that you have not thought about your life insurance policy since the day you purchased it. Don't worry; you're not alone!You do not need to become overly concerned with your insurance policy, nor do you need to become a life insurance expert BUT, you do want to keep an eye on your plans.The reason why is that a simple name change to your policy's beneficiaries can drastically change the outcome you had planned for when you purchased your policy.Top items to consider when reviewing: What has changed?

- Were you recently married?

- Did you have a name change?

- Did you just have a new child?

- Was there a death in the family?

- Were you recently divorced?

- Did you recently receive an inheritance?

Step 3: Tax-Free Benefit?

Step 3: Tax-Free Benefit?

Life insurance is designed to ideally provide a tax-free benefit to the beneficiary of your policy.BUT, are you sure this will happen?To ensure this happens, you will want to take into consideration "What Has Changed" each year and update your beneficiary designation properly. (If you are unsure what to do make sure to consult an advisor.)Here is an example we have run into before:If you are married and just had a new baby it is very important to review your beneficiary. Unfortunately, many new parents are so busy taking care of their new baby that they forget to review their life insurance policy. This is assuming that the new parents have life insurance.If you are a new parent and do not have life insurance make sure to get some right away now. You can get a quote here. Let's assume the above couple did have life insurance. Before the baby was born, they selected their spouse as the primary beneficiary, and that was it. Let's follow this example and see what they should do.Before Baby:John is married to Marry.They both have a 1,000,000 life insurance policy.- John is listing Marry as his primary beneficiary for his policy.

- Marry listing John as her primary beneficiary for her policy.

Which option is better?

Both options would not be advised to do. Here is why:- If John and Marry never add a secondary beneficiary, they are risking exposure if they both were to pass away at the same time. In this scenario, John and Marry's death benefit will not transfer to anyone tax-free. It will default to their estate and then will pass through probate risking additional tax exposure.

- If John and Marry were to add the new baby as their secondary beneficiary, unfortunately, this also not be a great solution.

- The reason why is that children under the age of 18 cannot receive a death benefit from a life insurance policy. If the secondary beneficiary is a minor, the death benefit would be held until the minor is of age.

Step 4: Beneficiary Change Form

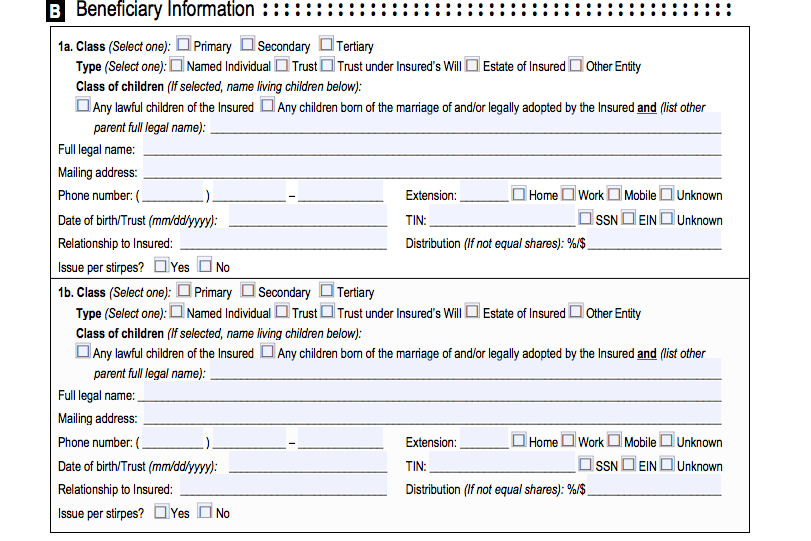

Filling out a new beneficiary form can be somewhat confusing. Don't be stressed when reviewing these documents. Below is an example of a standard beneficiary form. Many of these forms will be similar, so this will be a great help to anyone looking to make a change.Let review how to change the beneficiary on your life insurance. We will walk through this form stem by step. We will continue to use John and Marry's example to help us illustrate how to fill out your beneficiary forms Starting at the top of the page, you will see the section 1a.

Starting at the top of the page, you will see the section 1a.Class:

- Primary

- Secondary

- Tertiary

Type:

- Named Individual

- Trust

- Trust under Insured's Will

- Estate of Insured

- Other Entity

Class of Children:

This section may not be something that is on every beneficiary form. Each form may have slight differences and options depending on what company you are working with. For this form, the company is giving the owner of the policy a pre-selected option for children as a designation.Since we are currently designating Marry as the "Primary" beneficiary in section 1a, we will not check any of these boxes.Next StepContact Information:

You will now fill out all the necessary personal information and mailing address. This will be very important to have correct and update. If an insured were to die, the information listed on the policies beneficiary documents would be the only way the insurance company or agent can contact the beneficiary.Distribution:

As a part of this section, you will have the opportunity to designate "Distribution" amounts. This is done as a percentage of the death benefit or as a cash amount. For example, John can list that he wants 100% of the benefit to go to Marry, or he can list that he wants $1,000,000 to go to her. The distribution section is most important when there is more than one beneficiary.Next StepSection 1b

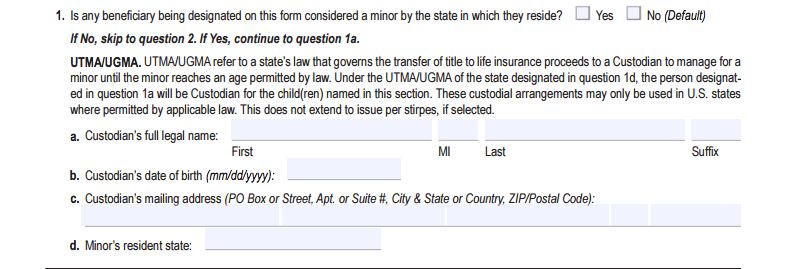

Section 1b is a replica of section 1a. In this section, you will want to designate a secondary beneficiary. You will do this by selecting "secondary" in the type section. If you are listing an adult, then you will then follow the same instructions we reviewed above for section 1a. If you are listing a minor, then you will want to make sure to do so correctly.Designating a Minor as your secondary or third beneficiary:

In John and Marry's scenario, they just had a new baby. They want to add the baby as the secondary beneficiary. Adding the baby as a secondary is fine; however, they will want to ensure that they set up a UTMA/UGMA.This is a trust account to accept a death benefit payout since the beneficiary is a minor. When setting your UTMA/UGMA up, you will designate a custodian of the account. We understand it is not a pleasant thing to think about; however, it is best to be prepared. To ease your stress when you think about this, remember that this type of beneficiary designation would be needed if both parents were to pass at the same time. The chances of this are very low, but they are a possibility that you will want to plan for.So in John and Marry's scenario, they will want to select a UTMA/UGMA list their child and a custodian as the secondary beneficiary of both their policies.Lastly

We understand it is not a pleasant thing to think about; however, it is best to be prepared. To ease your stress when you think about this, remember that this type of beneficiary designation would be needed if both parents were to pass at the same time. The chances of this are very low, but they are a possibility that you will want to plan for.So in John and Marry's scenario, they will want to select a UTMA/UGMA list their child and a custodian as the secondary beneficiary of both their policies.Lastly

Step 1: Annual Review

Step 1: Annual Review Step 2: What Has Changed?

Step 2: What Has Changed? Step 3: Tax-Free Benefit?

Step 3: Tax-Free Benefit?