While there are many steps to take, one of the best things you can do is request a whole life insurance quote. Once you have this in hand, everything will come together.

What Are You Looking At?

We will use whole life insurance as it's a more complex illustration. But if you can read a whole life, you will be able to read any type of life insurance illustration very easily.There is a big difference between receiving a whole life insurance quote and understanding what you are looking at. If you don't understand the finer details, it can be difficult to decide what to buy.

Fortunately, whole life insurance illustrations are simple to review and understand. There is not much to this as long as you know the basics and remain patient during the search process.

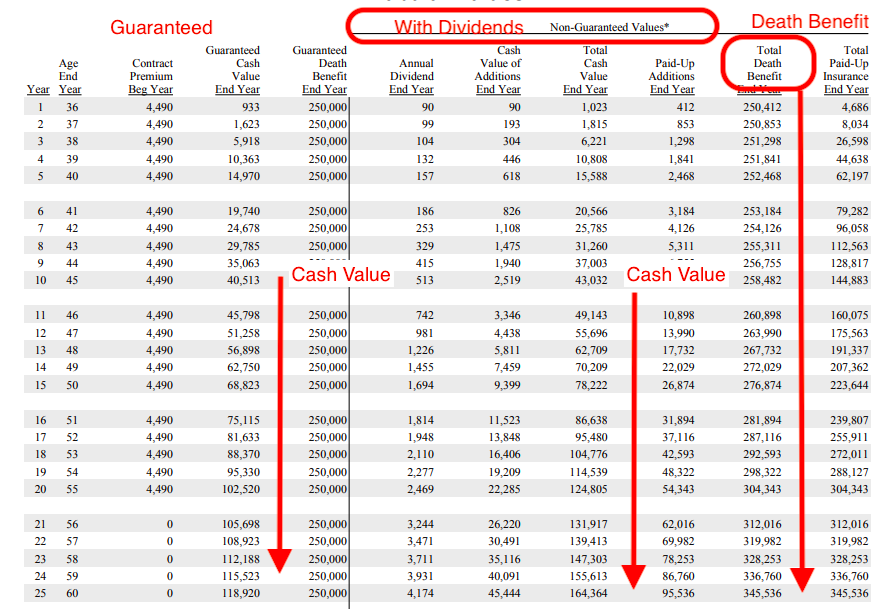

The following is an actual whole life insurance illustration:

Here are the details that deserve the most time and attention:

Here are the details that deserve the most time and attention: -

Cost

For most, there is nothing more important than the cost. It would be nice if this weren't a concern, but most people realize that it is.

How much can you afford to spend each month on a whole life insurance policy? Once you know the answer, you can use this information to understand a quote better.

The premium rate is what you are expected to pay for coverage. As long as you are comfortable with this number, you can avoid a situation in which you can't afford or don't want to pay for the future policy.

-

Death Benefit

It's important to understand the cost of whole life insurance coverage, but you need to know what you are getting in return.

What is the death benefit? This is the amount of money your beneficiary will receive when you pass on.

As long as you continue to make your premium payment in full and on time, you can be guaranteed that your death benefit will be paid. This is the primary benefit of whole life insurance, as opposed to term coverage.

As a general rule of thumb, the more you pay for coverage, the higher the death benefit. If $100/month gets you a death benefit of $100,000, $200/month could push this closer towards $200,000 in coverage.

-

Age and Sex

Your sex will never change; however, you will soon realize that the cost of coverage for a male and female is not the same. This is particularly easy to see if you are buying a policy for you and your spouse.

If all else is equal, females almost always pay less for life insurance than their male counterparts.

Age also comes into play when buying whole life insurance. Your quote is for the cost of coverage at present. If you wait five years to make a purchase, don't expect your rate to be the same.

Age and sex details are often included in a whole life insurance quote. This gives you a clear idea of your cost now and in the future.

4. Guaranteed Rates vs. Non-Guaranteed

Whole life insurance has two main rates: Guaranteed and Non-Guaranteed. The non-guaranteed rate is the one that includes a dividend. Many participating companies offer a dividend on top of their guaranteed rate. They do not guarantee this dividend as it is based on the performance of the company. So that's why they call it the non-guaranteed rate.

Final Thoughts

Once you request several whole life insurance quotes, it is time to compare each one. Doing so with an understanding of the coverage is of utmost importance.When you break down a quote, you can rest assured that you can make an informed buying decision when you know what you are looking at.

Do you have questions or concerns? Don't make a purchase just yet. Instead, request more information from your broker or directly from the insurance company. This will ensure that you only make a purchase when you are ready to do so.

What other advice would you give somebody who is in the process of reviewing whole life insurance?