Guardian, one of the well known mutual companies has released its 2020 dividend and dividend interest rate. The company is proud to be one of the top 250 on the fortune 500 list and serves almost 30 million customers.

For customers who have purchased a Guardian whole life policy, they will have the privileged to receive the Guardian 2020 dividend payout.

How is the Guardian 2020 Dividend Calculated?

Guardian's Dividend payout is the calculated from financial performance of the company in three key areas. It is important to note that Guardian does not guarantee its dividend payout to its policyholders. A dividend would be paid out to policyholders if the company is profitable enough to do so.

Three key financial areas for Guardians dividend calculation:

- Investment Results

- Mortality experience

- Expense Management

Guardians Financials

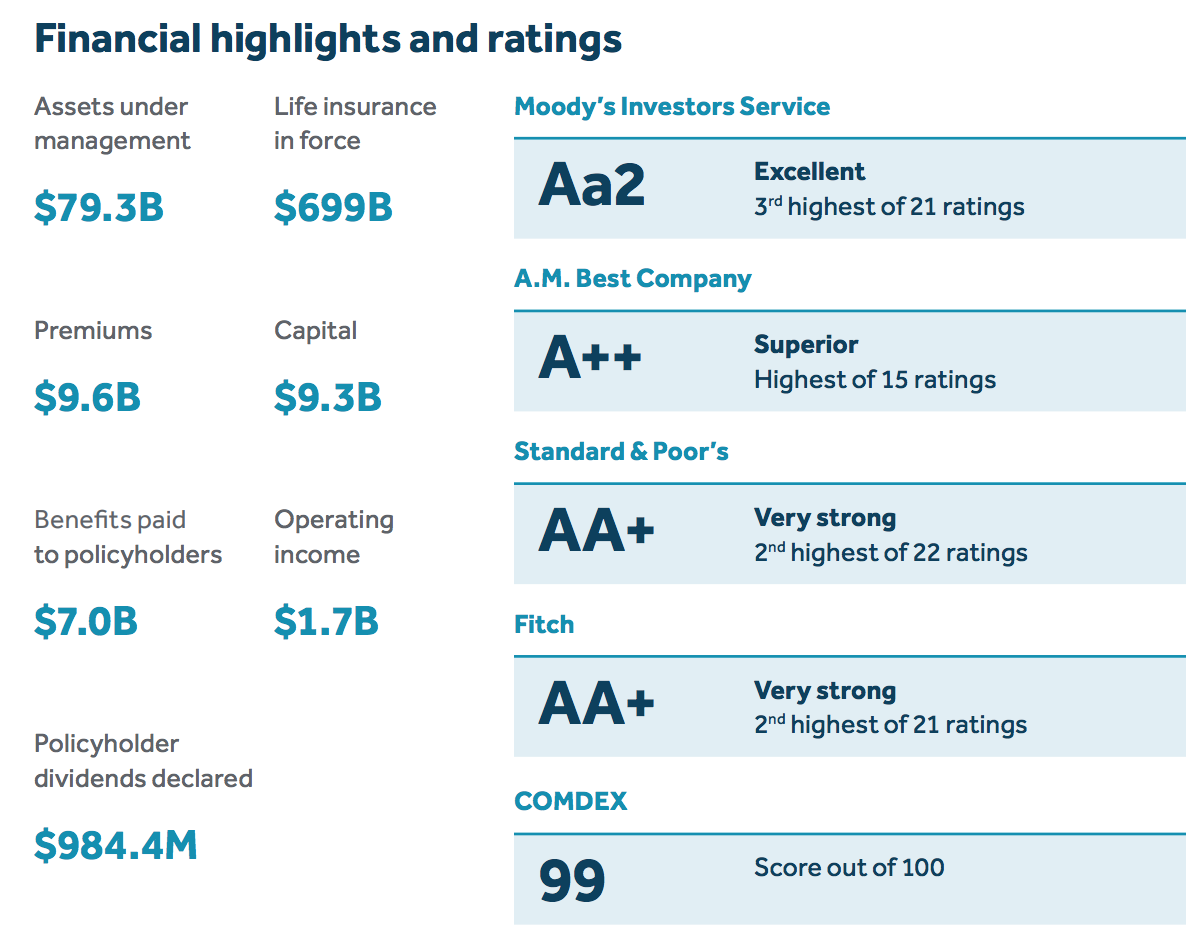

Assets under Management: $79.3 Billion

Life Insurance Inforce: $699 Billion

Premiums: $9.6 Billion

Capital: 9.3 Billion

Benefits Paid to Policy Holders: $7.0 Billion

Operating Income: $1.7 Billion

Policy Dividend Declared: $984.4 Million

Guardian 2020 Divided Announcement

The company will pay out $982 Million to policy owners in 2020. Guardian 2020 dividend payout is the largest payout in the company's history.

The Guardian 2020 Divided interest rate is 5.65%.

Guardian, unfortunately, has been on a steady decline since 2020. It is important to take note of this decline over the years. If you are considering buying whole life this dividend interest rate would affect the performance of your policy. We would recommend reviewing several companies' dividend rate history as a part of your research when considering buying whole life insurance.

Guardian Review

Interested in learning more about Guardian? Our Top Whole Life Guardian review will cover the company's overview, the good, the bad, financials, ratings, products, and much more.

Read the full Guardian Whole Life Review