Get Me A Quote MassMutual has had another successful year. Going into the year 2020 the company is announcing its 152nd consecutive dividend payout.

The MassMutual's Board of Directors approved an estimated dividend payout of $1.7 billion.

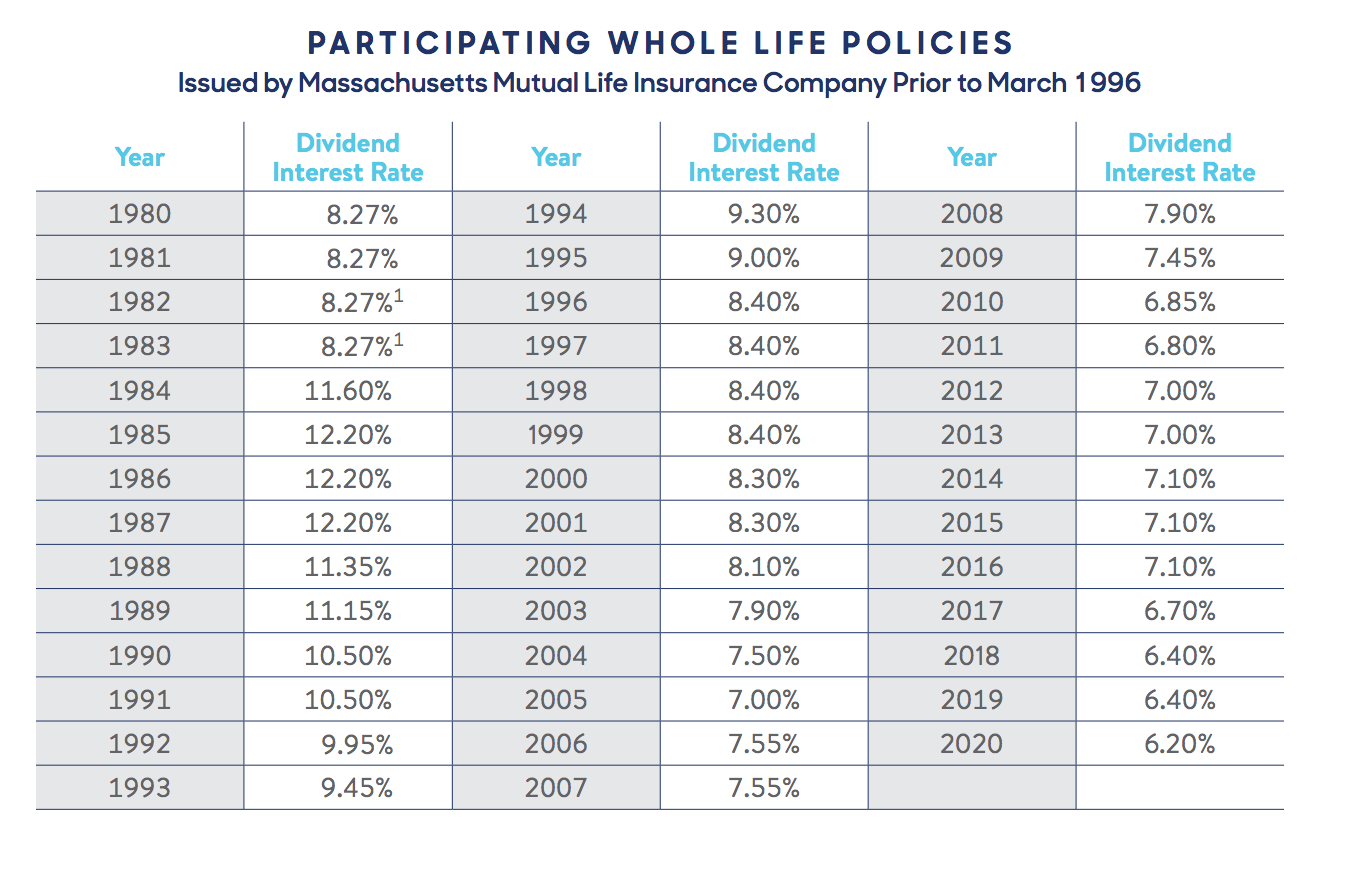

This 2020 Massmutual dividend payout correlates to a 6.20% dividend interest rate.

Ready the full MassMutual Review

Historical Dividends

Why do we update you each year abut dividends? Looking back as historical dividends is a way to see how the company has performed in good years and in bad. All insurance companies that have been around for 100+ years have their own way of doing business and the dividend payout is the proof of what worked and what didn't work.

Where some insurance companies did not do well there is less profit to distribute to policy owners. In MassMutual's case, they have been consistently able to distribute profits for over 152 years. This is an indication that they should be on your list of companies to consider when buying whole life.

Why did MassMutuals Dividend Change in 2020?

Insurance companies and the entire economy across the board have seen a prolonged low-interest-rate environment. MassMutual Dividend rates are not directly correlated to the market however they do track with interest rate benchmarks like the 10 year US treasury yield. The entire insurance industry is reacting in a similar manner and sees a reduction in dividend rates.

Even with this 20 basis point reduction from 6.40% in 2019 to 6.20% in 2020 MassMutual is still an industry leader. Ahead of companies like New York Life with a 6.00% dividend and Northwestermutual 5.00%

Dividends and Performance

Participating policies get paid a dividend and it is one of the major factors on how whole life insurance performs. There are many other things to consider:

- Cost

- Type Of Policy

- Overfunding For More Cash

- Underwriting

- Company Strength

To compare MassMutual's dividend to the competition, you should read our analysis: Whole Life Dividend Rate History.