Final Expense Life Insurance FAQ

Top 12 Questions for Final Expense InsuranceYou may be looking for a final expense whole life insurance to cover your expenses when you at death. In reality, it is straightforward to get a final expense policy, but you may have some questions before you are ready to buy. Check out these top 12 Final Expense Life Insurance FAQ.

Top 12 Questions for Final Expense InsuranceYou may be looking for a final expense whole life insurance to cover your expenses when you at death. In reality, it is straightforward to get a final expense policy, but you may have some questions before you are ready to buy. Check out these top 12 Final Expense Life Insurance FAQ.Here we list some of the most common Final Expense Life Insurance FAQ we get:

- What is Final Expense Life Insurance?

- What Final Expenses Should I Plan For?

- How Much Final Expense Coverage Do I Need?

- What Will A Final Expense Insurance Policy Cost?

- When Should I Purchase Final Expense Life Insurance?

- Will My Final Expense Premiums Change?

- How Long Will My Final Expense Life Insurance Policy Last?

- Do I Have Qualify For A Policy?

- How Do I Apply For A Policy?

- What Is The Difference Between Final Expense and Whole Life Insurance?

- Should I Buy a Final Expense Life Insurance Policy Online?

- Why Should I Buy My Policy From TopWholeLife.com?

1) What is Final Expense Life Insurance?

Final Expense Life Insurance is a specific type of whole life insurance. It provides a death benefit to help with costs associated with burial and other lasting expenses after death.These policies are also known as burial insurance.

Here are some of the common features of final expense life insurance:

- Level premiums for life

- The death benefit is paid to the beneficiaries tax-free

- Policies typically have a level death benefit

- No medicals needed for approval

- Simple & quick process

- Death benefits of $2,000 to $15,000

2) What Final Expenses Should I Plan For?

There are a few things you should consider when purchasing a final expense policy.Here is a quick list of things to plan for:

- Burial Expenses

- Medical Bills

- Loss of income for the family

- Bills left unpaid and other debts

- Educational expenses

- Passing on an inheritance

3) How Much Final Expense Coverage Do I Need?

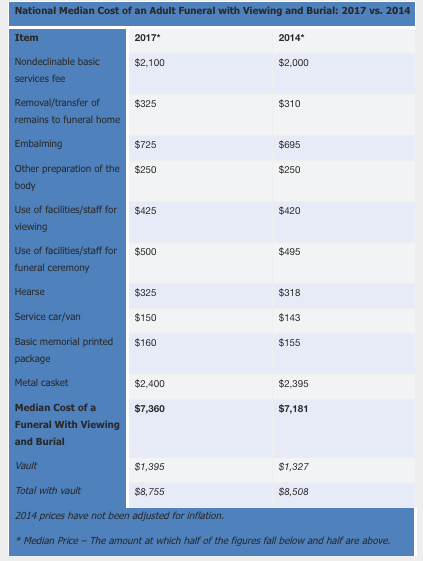

The number we are going to show you is only a guide, as we mentioned before, everyone has different needs. You should get as much coverage as you require.That being said, the National Funeral Directors Association estimates the average funeral cost close to $9,000.

If you would like to cover any debts and leave a legacy, you can add coverage from there.

Photo Reference: //www.nfda.org/news/statistics

From our experience coverage between $10,000 and $15,000 should be enough to cover your basic expenses.

4) What Will A Final Expense Insurance Policy Cost?

4) What Will A Final Expense Insurance Policy Cost?

The cost of a final expense policy depends on many factors such as age, health, and the company you pick.The best way to find out is to get a quote.

The average cost for a $10,000 final expense policy can be around $80/month.

5) When Should I Purchase Final Expense Life Insurance?

You should get a final expense life insurance as soon as you can. The costs only go up the older you get.Apply Now

Typically final expense policies are for people between the ages of 50 and 85.

Some companies will offer coverage to customers over age 85.

6) Will My Final Expense Premiums Change?

Nope! Your premiums will not change.Premiums are guaranteed to stay level regardless of your age, increasing or any changes in your health. This is one of the most appealing features of whole life insurance.

So, whatever happens, you know that you will keep all of your premiums the same for the rest of your life.

7) How Long Will My Final Expense Life Insurance Policy Last?

A final expense policy is designed to last until the passing of the insured.The policy will not be canceled and is guaranteed to pay a death benefit as long as you do not stop paying your premiums.

It is a straightforward type of life insurance, and it does what you would expect it to do.

8) Do I Have Qualify For A Policy?

This is up to you as you have many choices.You can be fully underwritten, sometimes referred to as medically underwritten for a policy. A fully underwritten policy means you can get better pricing if you are healthy, but you will have to go through a medical exam.

However, the difference in small policies is not that great, as most people purchase a final expense policy when they are older. This means that your health is probably standard, or not perfect.

There are simplified issue policies that only require a questionnaire. The insurance company still looks at your medical history, but there is no medical exam.

You can also choose to purchase a guaranteed issue policy with no health underwriting. This is the best option if you are unhealthy or do not want a medical exam.

9) How Do I Apply For A Policy?

First, you will need to obtain quotes: Click here for your Final Expense QuoteIf you apply for coverage with a medical exam, you will need to complete an application and schedule a meeting with a nurse. They will take a blood sample and a urine specimen.

If you choose the guaranteed issue option, you will need to complete an application.

10) What Is The Difference Between Final Expense and Whole Life Insurance?

There is no difference between a final expense policy and a whole life. Final Expense is a type of whole life insurance.Typically final expense coverage is a lower death benefit amount; $5,000 - $25,000.

Whole Life Insurance benefits can go up to millions of dollars, and it focuses on cash value accumulation. In reality, a final expense whole life is a type of whole life that is focused more on getting you a more affordable, guaranteed death benefit.

11) Should I Buy a Final Expense Life Insurance Policy Online?

Buying online is now the new normal. In the past, you would only buy a life insurance policy face to face, but technology allows us to do this from home now.In the past, it was much harder to find information online. Now with the help of sites like www.topwholelife.com, you can find the top final expense quotes.

Buying whole life insurance online also gives you the buyer a lot of power to compare quotes and think about what is best for you. Now you are not being sold a policy.

12) Why Should I Buy My Policy From TopWholeLife.com?

Getting whole life insurance quotes to be tedious and inefficient.We strive to make the process very easy for you to compare only the best companies available. With us, you will:

- You will get the best prices.

- You will get the best service.

- Your buying experience will be the most convenient.

Final Word

As you can see, final expense whole life insurance has great benefits, and it's a straightforward product that will do what it promises. To cover your final expenses guaranteed.Did we miss any important questions?

4) What Will A Final Expense Insurance Policy Cost?

4) What Will A Final Expense Insurance Policy Cost?