AIG Whole Life Insurance Review dives into the good, bad, and everything in between. Learn more about this company before you buy it.

AIG Whole Life Insurance Review

American General Life is part of the American International Group, better known as AIG to many people. Also, they are one of the largest insurance companies in the world and have been in business since the 1960s. AIG offers Americans several insurance solutions, including term insurance, guaranteed issue whole life, universal life, variable universal life, and accidental death and dismemberment insurance. The company covers more than 90 million people all over the world. Today, we will dig deep into AIG's permanent life insurance offers.

In this review, we will cover the following topics:

So let's get started.

The Good

Several Permanent Life Insurance Options.

AIG offers several great policy options for consumers looking for a permanent policy. These permanent policies include Universal Life, Whole Life, and Guaranteed Issue Whole Life. Policies.

Application Process

In an industry that still loves to waste time and paper, AIG is at the forefront, offering a streamlined application process for you. Also, they have great options for the consumer who needs help getting covered fast. They offer several options for whole life and even universal life where you can apply and lock in coverage without going through full underwriting entirely online.

Convertible Term Options

This review is intended to focus on whole life and permanent insurance options by AIG. However, AIG offers excellent term life insurance at an affordable price. The essential part that we always consider when looking into term insurance is if the policy has a convertibility option.

What does convertibility mean? Convertibility is the option to change your term policy into a whole life policy without showing any proof of health changes. Being able to convert your term insurance policy is valuable if your health changes and you cannot qualify for insurance anymore.

The Bad

Customer Service

AIG seems to have mixed reviews. Overall we would say that the company takes care of its customers. The Better Business Bureau gives the company an A+; however, after analyzing the most recent data from the National Association of Insurance Commissioners, AIG is below average from a customer service standpoint.

Confusing Brand

The company American International Group (AIG) has many counterparts and affiliates that can make understanding where your insurance policy is coming from impossible. Here are a few names you will come across. AIG Direct, AIG 100, American General Life, and United States Life Insurance of NY. When you are searching online, we believe it is helpful to present a simple, precise webpage for the consumer. AIG, due to its size, can easily be confusing due to the many company names they do business as.

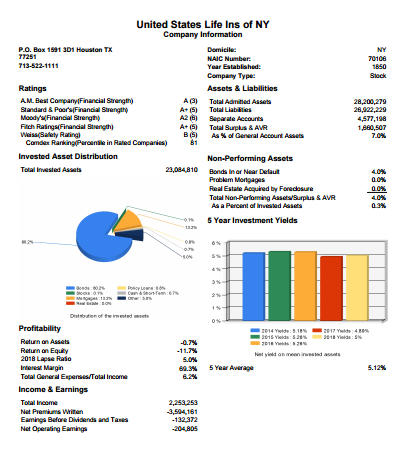

Companies History

AIG is a nationally recognized brand. However, you mostly did not know that it has a dark past. The company in 2008 during the financial required a bailout to the tune of $182 Billion! After the government granted the loan, AIG got to work and changed the structure of the failing business model. As a result, they could turn the company back around and repay all money plus interest to the government in 2012.

Finances

"The insurance behemoth's turnaround plan is still a work in progress. AIG falls again to #72 on the Fortune 500 after its revenues shrank more than 4% in 2018, in part because it made less money from investing as the stock market swooned late in the year. While the insurer still took a $6 million overall loss last year, that figure was minor compared to its losses in previous years, and the company is moving closer to profitability. Still, a string of catastrophic events, from Japanese typhoons and hurricanes Michael and Florence to California's fires and mudslides, helped push AIG into the red."

Source:https://fortune.com/company/aig/fortune500/ https://fortune.com/fortune500/aig/

Ratings

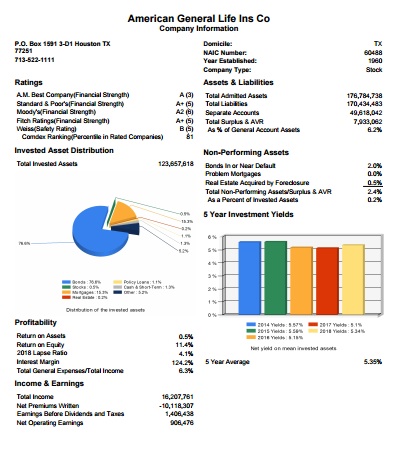

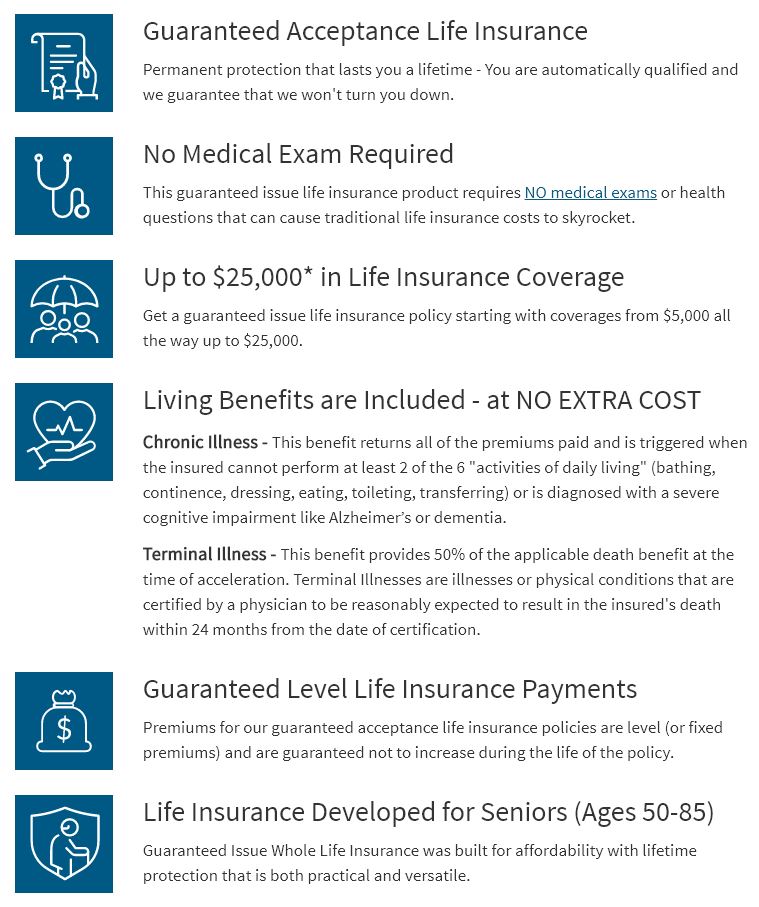

Ratings

If you look at the company's overall rating snapshot, you can see that they are a reliable company regardless of what the reviews may state.

- A.M. Best: A (Excellent)

- Standard & Poor's : A+ (Strong)

- Moody's Investor Services: A2 (Good)

- Fitch: A+ (Strong)

Products

- Term Life Insurance:

Description: Term Life Insurance is an affordable coverage option that is created to cover you for a fixed price over a set period. Image Source

Image Source

-

- Universal Life Insurance:

- Description: This is a type of permanent life insurance. It lets you make changes to your death benefit amount, and you do not need to get a new policy when you do this.

- Description: This is a type of permanent life insurance. It lets you make changes to your death benefit amount, and you do not need to get a new policy when you do this.

- Universal Life Insurance:

Image Source

-

- Whole Life Insurance:

-

- Description: A more traditional style of permanent life insurance is Whole Life. This type of policy is designed to have consistency. Consistent and unchanging premiums, consistent guaranteed death benefit, and potentially constant cash values.

- Description: A more traditional style of permanent life insurance is Whole Life. This type of policy is designed to have consistency. Consistent and unchanging premiums, consistent guaranteed death benefit, and potentially constant cash values.

-

- Whole Life Insurance:

Image Source

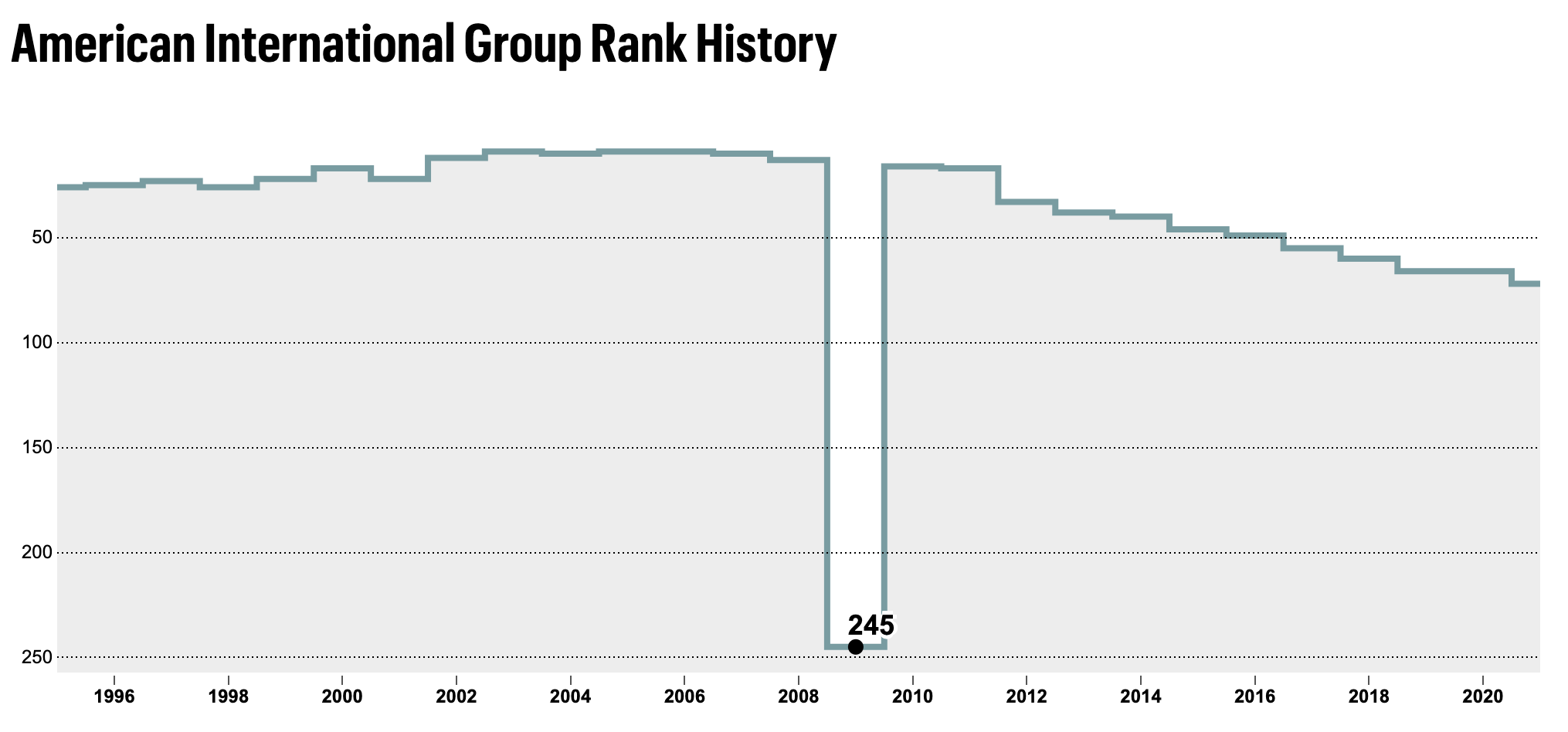

- Guaranteed Issue Whole Life Insurance:

- Description: This policy is very similar to the above Whole Life policy; however, much more straightforward. The ideal target for this policy is people who are ages 50 - 85 and are not insurable or do not want to take a medical exam to qualify. These types of plans are used for medical bills or funeral costs.

- Description: This policy is very similar to the above Whole Life policy; however, much more straightforward. The ideal target for this policy is people who are ages 50 - 85 and are not insurable or do not want to take a medical exam to qualify. These types of plans are used for medical bills or funeral costs.

Image Source

- Accidental Death Insurance:

- Description: AD&D insurance is a coverage that can be purchased to help cover if you are killed or seriously injured in an unexpected accident.

Riders

AIG offers a wide range of riders. A rider is a policy add-on for an additional cost. These riders allow you to customize a plan to meet your needs adequately. Check out AIG options:

- Child Protection Rider

- This Rider covers your kids with life insurance (ages 15 days - 19 years old). The amount offered is $500 - $25,000.

- Disability Waiver of Premium Rider

- This Rider is disability insurance for your life insurance premium. If you become disabled, premiums could be waived.

- Accelerated Death Benefit Rider

- Need your life insurance death benefit early? This Rider provides access to 50% of your death benefit or a max of $250K. The acceleration benefit offers this to clients with a terminal illness and life expectancy of 12 months or less.

- Accidental Death Benefit Rider

- This Rider would give you additional coverage if your death resulted from an accidental injury.

Dividend Rate

AIG is not a participating company and does not pay dividends.

Final Word

AIG has great permanent insurance options to consider. The company also has a great term insurance lineup where you can lock in your coverage and then decide to convert the policy later in life. If you are looking to place your insurance with a strong-rated company that helps out millions, then AIG is a good choice. Keep in mind their customer service will be spotty, and you may have issues connecting with someone if you need help with your policy. The best thing to do is compare AIG to other highly rated companies and decide then.